One of the key changes to accounting treatment for many not-for-profit organisations is the change to accounting for investments. Caught under the rules for financial instruments under PBE standards, for Tier 1 and Tier 2 not-for-profit entities, the rules governing how to account for your investments are now complex.

And for entities that previously prepared in accordance with “Old GAAP” or prepared special purpose financial reports, there will potentially be some significant impacts.

The standard you need to understand: PBE IPSAS 29 Financial Instruments – Recognition and measurement

This standard draws on the requirements from IAS 39 – a standard widely regarded as one of the most complex to implement. Fortunately for most PBE’s the length and complexity of the standard is largely directed towards transaction types and classes that will not apply to most charities – derivatives and hedging arrangements and the like.

However care is required when complying with the standard to understand the differing requirements for different types of investment – and the impact these will have on your future reported results.

Financial assets

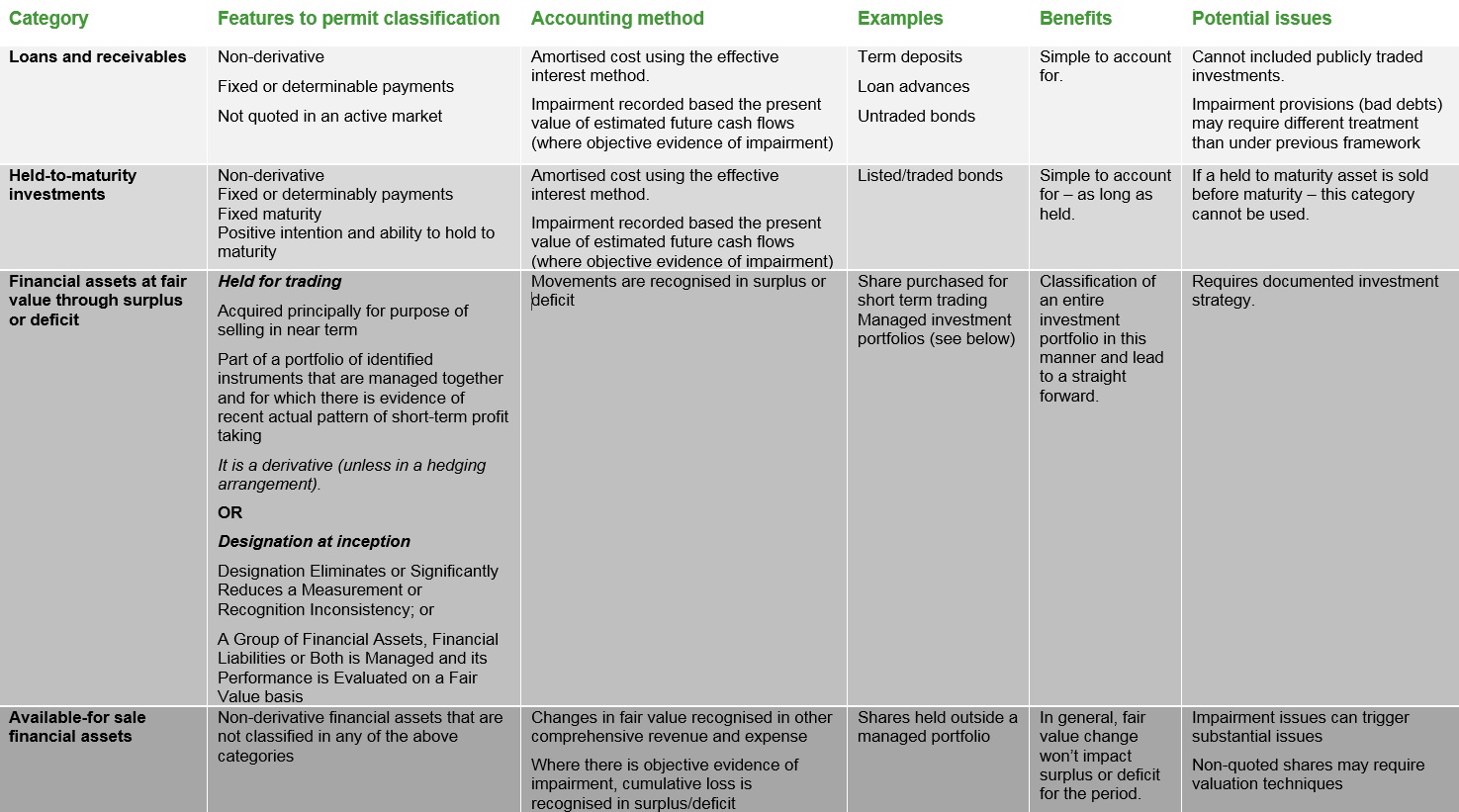

Investments will be considered financial assets under the standard and required accounting for in one of four categories. These categories are important as they determine:

- How the asset is measured (cost or fair value)

- Where movements in the assets value are recorded (Surplus or deficit for the period, or other comprehensive revenues or expenses)

The challenge is that this framework is a much more prescriptive set of rules than many entities have previously applied. And as a result there are differences in treatment. For instance, investments in quoted shares and managed funds will be required to be recorded at fair value. Previously many entities – particularly where there was a lack of formal structure around investments held – would have carried such investments at the lower of cost or market price.

The requirement for many investments to be booked at fair value will lead to a greater volatility in the assets presented.

How should we measure fair value?

For quoted investments appropriate source of fair value is current bid price. For unquoted investments, an estimate of fair value using a valuation technique will be required. (It should be noted that investment in subsidiaries, associates, and joint ventures are excluded from the requirement to measure at fair value.)

The four categories of financial asset

Generally, consideration will need to be applied as to which category each asset needs to be accounted for. A snap shot of the requirements are contained below.

Managed investment portfolio? Consider designation at fair value through surplus or deficit

Where a group of financial assets is managed and its performance is evaluated on a fair value basis, then the portfolio may be designated at its inception (see below regarding conversion). The logic is that an entity may manage and evaluate the performance of a group of financial assets in such a way that measuring that group of assets at fair value through surplus or deficit results in more relevant information than accounting for the portfolio’s separate components. The focus in this instance is on the way the entity manages and evaluates performance, rather than on the nature of its financial instruments. It is also a relatively straightforward manner of accounting – and potentially easier to explain to readers of financial statements compared to having some investments carried at cost, and others at fair value.

For this to apply, there must be a documented investment or risk management strategy. This may well be the case for many investment portfolios managed by external providers.

The downside is that it requires that “all eligible financial instruments that are managed and evaluated together” are designated the same. There is no ability to select individual investments from such a portfolio or investment sub-classes for recognition on a differing basis.

Generally, this designation is at the initial recognition of the financial assets. For entities that previously reported under Old GAAP or a special purpose framework it is PBE FRS 47 allows this designation to take place on transition.

Impairment (Bad and Doubtful debts)

Under IPSAS 29 where there is independent evidence of potential impairment of asset carried at amortised cost or held for maturity, and impairment loss is required to be recognised. For PBEs that have advanced loans to other parties they will need to assess such balances for indicators of impairment at the end of the reporting period and consider whether any existing provision comply with the requirements of IPSAS 29.

Transitioning to Tier 1 or Tier 2 rules in 2016?

If you hold investments in bonds, shares, or have made significant loan advances, we recommend early consideration of your adoption of the PBE accounting standards for these investments prior to year end.

|

Smaller charities: Whether to opt in?

|