Moving into 2026, the European mid-market mergers and acquisitions landscape continues to reflect a market characterised by resilience and adaptability against an evolving backdrop of uncertainties. Despite a range of external pressures, deal activity remained solid with volumes increasing throughout 2025.

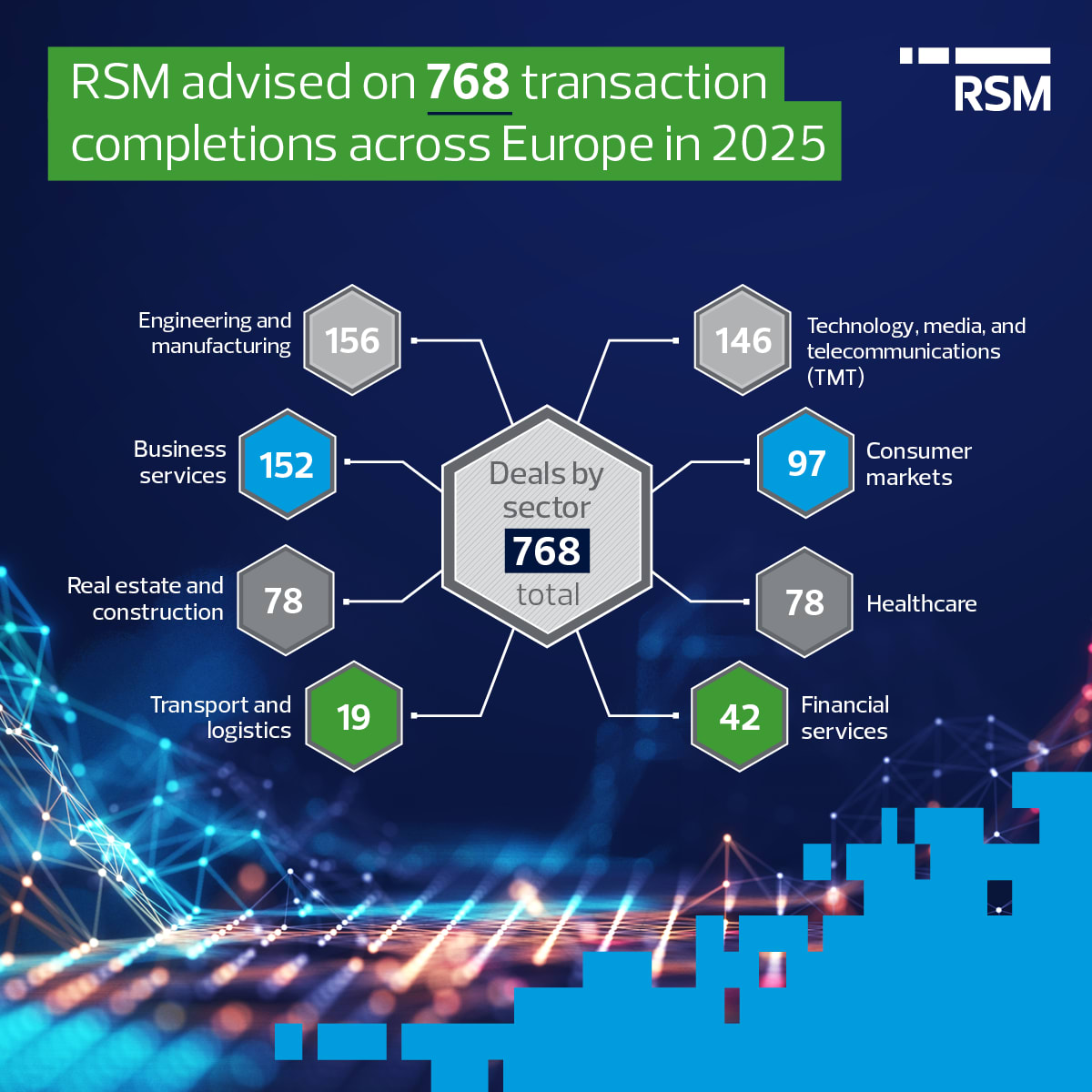

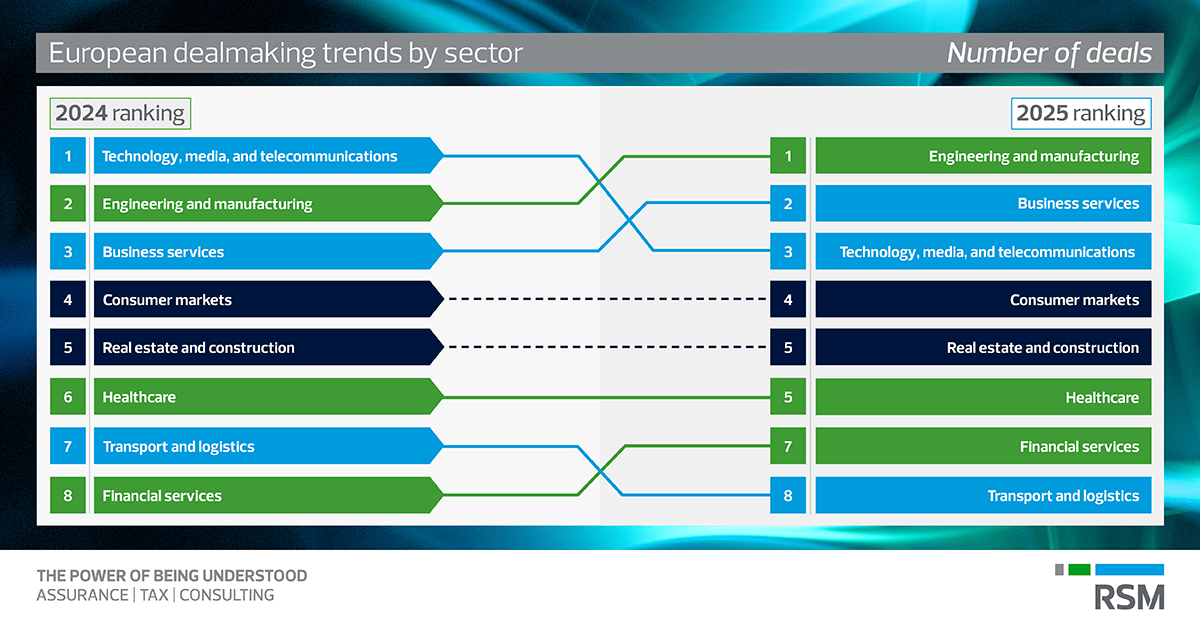

Across Europe, RSM advised on 768 completed deals in 2025, representing an increase of 7.8% over 2024’s total deal completions, highlighting the market's sustained momentum and our teams' strong engagement with clients across the continent. Engineering and manufacturing was particularly notable, with 156 transactions completed. This was followed closely by business services with 152 deals, and technology, media, and telecommunications (TMT) with 146 completed deals. This activity underscored continued investor interest in high-quality, resilient businesses with strong technological foundations and recurring revenues.

While the general environment remained complex, the gradual easing of inflation and a more stable economic outlook made pricing and risk assessment clearer, allowing deals to move forward. The availability of investment capital, especially from private equity, played a key role in keeping M&A activity strong.

This comprehensive 2025 report provides in-depth analysis from our experts across Europe. It delves into the key trends that shaped the M&A market, including insights into key industry sectors, the impacts of technology, and the rise of data analytics in building detailed value insights. By combining deep, industry-specific insights with our extensive cross-border capabilities, we help middle-market organisations navigate complexity and take charge of change, offering the understanding needed to move forward with confidence.

European M&A report: Trends and growth drivers

“The general environment remains complex while uncertainty continues to dampen investment decisions. Though volatility remains, the gradual easing of inflation and a more stable economic environment have made pricing and risk assessment clearer, allowing deals to move forward.”

Lee Castledine

Partner

RSM UK

European industries M&A snapshot

The future-driven nature of the engineering and manufacturing industry continues to drive investor confidence, allowing it to navigate external challenges through focused, strategic decision-making. While the broader M&A market has been tempered by economic uncertainty, the industry has demonstrated remarkable resilience.

Across Europe, RSM advised on 147 completed transactions in engineering and manufacturing in the year ending June 2025, underscoring the industry's sustained momentum. This strong performance is not driven by wide economic trends, but by precise strategic moves within high-growth subindustries like engineering services, healthcare, and energy transition.

Private equity remains a key driver, providing vital capital and fuelling buy-and-build strategies. This highlights the industry's adaptability as businesses respond to geopolitical shifts, supply chain disruptions, and evolving investor appetites. The focus has shifted to niche, high-value opportunities, positioning the industry for continued growth.

Amid evolving economic pressures, the technology, media, and telecommunications (TMT) industry has continued to show remarkable resilience and momentum, standing out as a key force in M&A activity. While many industries have navigated turbulent headwinds, TMT has leveraged its focus on subscription-based revenue models and the growing demand for essential digital services to sustain strong investor sentiment.

In the year ending June 2025, RSM advised on 139 completed transactions in the TMT industry across Europe—reflecting the industry’s distinctive stability and capacity for growth. This performance is supported by powerful innovation trends, with companies embracing digital transformation, artificial intelligence, and new media channels to adapt and thrive. As the industry continues to shape future business landscapes, its ability to deliver predictable returns and align with long-term growth drivers ensures it remains a destination for strategic investment and opportunity.

The business services industry has again demonstrated resilience and adaptability in the face of continuing global economic headwinds. Activity remained concentrated in the mid-market, particularly within professional services, staffing, and testing, inspection, compliance, and certification. Investors are increasingly prioritising businesses with robust, scalable operating models and recurring revenue. Private equity’s engagement continues to fuel transformation, with technology adoption, AI integration, and agile responses to shifting client expectations driving innovation.

Across Europe, RSM oversaw 135 completed deals in this sector, illustrating a market shaped by measured activity and strong interest from both strategic buyers and private equity investors. The industry is well-positioned to capture new opportunities, as those with a focus on data-driven insight and operational flexibility are best placed to deliver sustainable growth and long-term value.

The past year has tested the resilience of the consumer markets, yet it has also revealed significant opportunities for strategic growth. While the market has stabilised, M&A activity remains selective, demanding a new level of agility from businesses looking to thrive amidst ongoing economic and consumer shifts.

In the year ending June 2025, RSM oversaw 91 deals in Europe, a landscape defined not by volume but by strategic precision. This environment underscores a crucial lesson: readiness is paramount. Companies with a clear value proposition, robust operational efficiencies, and the foresight to anticipate consumer behaviour are positioning themselves for future success.

Buyers prioritised scalability, strong brand equity, and operational efficiency, while private equity cautiously pursued add-on acquisitions. Challenges such as valuation alignment, extended due diligence, and geopolitical uncertainty persist, alongside the cost-of-living crisis, which has driven growth in ‘accessible premium’ offerings. Consumer preferences for authenticity, experiential retail, and digital capabilities continue to shape the M&A landscape.

Despite a period of fluctuation and extended deal timelines, the M&A market is gathering momentum as buyers and sellers move closer on price expectations, signalling renewed confidence for the year ahead.

Across Europe, RSM advised on 84 completed real estate transactions in the year ending June 2025. This activity highlights the industry’s resilience and is driven by strong performances in key sub-sectors. Institutional investors like pension funds have become significant players, deploying capital into long-term assets, while high-net-worth family offices are also driving market activity.

The industry’s adaptability is evident as opportunities in commercial, logistics, and student accommodation gain traction. This comes as businesses capitalise on evolving market demands and position themselves for strategic growth in a landscape primed for a promising, albeit measured, recovery.

The healthcare industry has demonstrated remarkable fortitude, navigating global macroeconomic headwinds to maintain a dynamic M&A landscape. Despite challenges from fluctuating policies, elevated interest rates, and increased regulatory scrutiny, the industry has pushed forward, showcasing its inherent adaptability and capacity for strategic growth.

Across Europe, RSM advised on 73 completed healthcare transactions in the year ending June 2025, offering a glimpse at the sector's enduring investor appeal. This resilience has been fuelled by powerful macro drivers, including ageing populations and the hard push towards digitisation. Dealmakers are capitalising on this momentum, with private equity firms leveraging significant dry powder to invest in high-growth niches like healthcare technology, pharmaceutical services, and consumer-facing care models.

As businesses integrate transformative technologies like AI and automation to enhance efficiency, and as cross-border opportunities gain traction, the industry is primed for continued innovation.

While macroeconomic factors softened some of the initial optimism witnessed at the start of 2025, investors and businesses have shown both adaptability and determination, resulting in steady momentum across the M&A landscape.

In the year ending June 2025, RSM oversaw 34 completed transactions in the financial services industry across Europe—a clear demonstration of enduring investor confidence and a robust appetite for consolidation. Activity has been fuelled by strong performances in wealth management and asset management, as well as the persistent influence of private equity and private credit capital. In an increasingly competitive marketplace, dealmakers are targeting high-potential segments, seeking both operational synergy and strategic advantage.

Despite ongoing challenges, including elevated interest rates and evolving regulatory demands, the sector’s ability to adapt and innovate remains evident. As firms navigate new obstacles and seize emerging opportunities, financial services M&A stands poised for continued progress, shaped by bold decisions and future-focused strategies.

Despite a turbulent landscape, the transport and logistics industry continues to demonstrate remarkable resilience and adaptability. Over the past year, companies have faced ongoing restructuring, the rising demands of electrification, and fast-paced technological change—all against a backdrop of fluctuating demand and economic headwinds. Across Europe, RSM oversaw 28 completed transactions in the year ending June 2025.

While investment is being shaped by the need for consolidation and the capital intensity of fleet electrification, the industry has also seen strategic activity driven by advances in software, data, and route optimisation capabilities. Private equity interest remains focused on high-value niches, supporting targeted growth even as shifts in market conditions present new challenges.

Outlook for 2026

The European M&A landscape in 2026 is expected to demonstrate continued resilience, supported by strategic focus and targeted investment across key industries. Private equity is anticipated to remain a significant driver of activity, with substantial capital reserves being deployed into high-growth niches. The buy-and-build strategy is likely to retain its prominence, enabling investors to achieve scale and diversification across geographies and industry verticals. High-value subindustries, including energy transition, AI-driven technology, and healthcare services, are expected to continue attracting considerable interest, reflecting a broader emphasis on innovation and sustainability. Stabilising interest rates and easing inflation are projected to create a more predictable economic environment, fostering confidence among dealmakers.

Despite these positive indicators, challenges such as valuation gaps, regulatory complexities, and geopolitical uncertainties are expected to influence the pace of activity. Cross-border transactions are likely to gain momentum, particularly in less regulated sectors, as investors seek synergies and new market opportunities. The integration of transformative technologies, including AI and automation, is expected to play a pivotal role in shaping M&A activity, particularly within technology, media, and telecommunications (TMT) and business services. Overall, the European M&A market in 2026 is forecast to balance cautious optimism with strategic adaptability, as businesses and investors navigate an evolving and complex landscape.

Contact us

If you would like more information on any of the content featured in this series, please get in touch.