The potential applications of blockchain technology are numerous, but the technology is complex and difficult to wield. Indeed, truly taking advantage of blockchain not only requires businesses to adapt existing business models, but to reimagine them from scratch.

Unfortunately, full commercial exploitation of blockchain hinges on the resolution of certain regulatory and technological issues, such as configuring distributed ledgers to comply with the “Right to Be Forgotten” provisions of the European Union’s forthcoming General Data Protection Regulation. It therefore remains to be seen whether blockchain will grow in use as rapidly as Internet-enabled technologies did in the 1990s.

Despite these challenges there are many exciting potential applications of blockchain technology. By enabling direct exchanges on fully encrypted, self-governing networks, blockchain allows individual agents to circumvent traditional market intermediaries. This means that many services could become disintermediated by blockchains and that poses both a threat and an opportunity for companies.

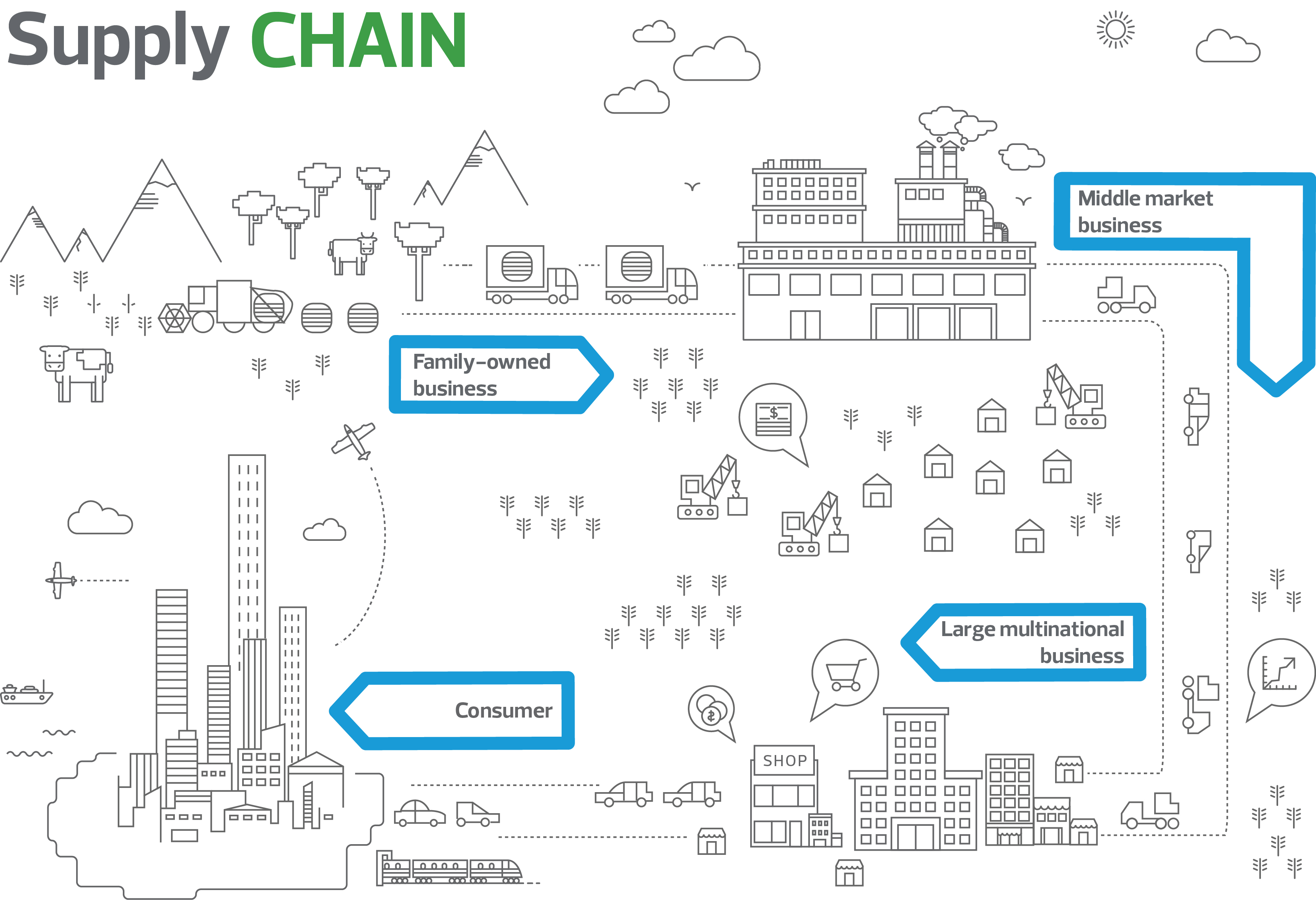

Blockchain technology promises to strengthen the competitiveness of middle market businesses active in global supply chains.

In 2016 the Linux Foundation’s, Hyperledger, was created - an open source, corporate collaboration to accelerate the deployment of blockchain technologies across multiple industries. The membership of Hyperledger includes major financial services firms such as ABN Amro, American Express, BNP Paribas, and JP Morgan as well as many others. Further signaling the corporate sector’s growing interest in blockchain, venture capital firms invested $1.2 billion in blockchain-related startups in 2013-16. McKinsey & Company estimates that annual investments in blockchain technology by the banking industry will reach $400 million in 2019.[1]

Middle market businesses should therefore take note of the corporate activity and act now if they don’t want to be left behind. Fortunately, while IBM and other large multinational companies are spearheading the development and commercialisation of blockchain, the technology holds substantial promise for smaller scale uses. For example, blockchain technology promises to strengthen the competitiveness of middle market businesses active in global supply chains. For mid-sized companies interacting with geographically remote buyers and suppliers, blockchain permits authentication of the origin and integrity of globally sourced primary materials. Blockchain also enables middle enterprises to attach unique “digital tokens” to products and services progressing through supply chains.

Other opportunities also align with middle market businesses that want to deploy advanced digital technologies across a range of areas.

Analogous to the Internet’s disruption of global communications in the 1990s, blockchain technology threatens to upend the institutional foundations of commercial transactions in the 2000s.

To understand the benefits of this technology, middle market businesses should look at a peer-to-peer business model. In this model, individual members of the chain interact directly without need of intermediaries. This exists in other forms already, such as financial platform, but the ability to verify transactions on a blockchain ledger has not been applied to that model.

Furthermore, advanced cryptography permits authentication of blockchain transactions and prevents unauthorised entry into the ledger. This ledger need not be a financially related ledger either, peer-to-peer is just an example. Companies could use the blockchain to exchange and log almost anything of value. This is because any asset (financial, physical, or virtual) can be digitized and secured on the ledger.

Analogous to the Internet’s disruption of global communications in the 1990s, blockchain technology threatens to upend the institutional foundations of commercial transactions in the 2000s. Just like email, this is technology that middle market businesses cannot afford to ignore.

David Bartlett

Economic Advisor

[1] (“Blockchain Technology in the Insurance Sector: Quarterly Meeting of the Federal Advisory Council on Insurance”, January 5, 2017).