“Planning is bringing the future into the present so that you can do something about it now.”

- Alan Lakein

Time flies when you’re running a business. Days turn into weeks, which turn into months, and before you know it…years have passed.

Focussed on building momentum and keeping the cogs turning, it’s easy to direct all of your energy into the daily grind and leave business administration for a rainy day.

But there comes a point in every established business where you need to stop, look around, and evaluate how far you’ve come: every business system, and every asset you’ve acquired to make those systems work.

Consider what would happen if an unexpected event occurred, such as:

- you got sued

- a significant invoice went unpaid

- a major supplier went broke

In deep financial trouble, your assets could be repossessed leaving you with nothing but the debt you still owe for them.

And while you may quickly shake your head and attempt to banish the thought from your mind, the unfortunate truth is that these situations do happen. History is full of entrepreneurs who poured their hearts and souls into developing a business from grassroots before an unfortunate incident took it all away (including their personal assets).

You can do everything by the book – serve your clients well, value your customers, pay your taxes, have insurance, and stick to a solid 5-year plan. But this is not the type of diligence that will serve you if something completely unplanned and undeserved happens.

Asset protection is perhaps one of the best measures you can take to ensure the longevity of your business (and potentially your livelihood).

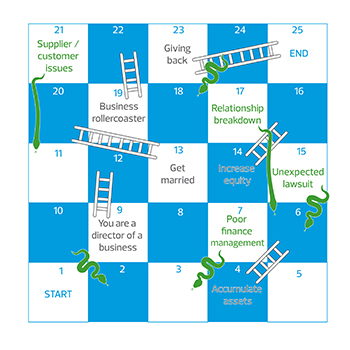

Business lifecycle

Deciding when to implement asset protection depends on where you are in the business lifecycle.

Which of these phases resonates with you?

Start-up phase

You’ve just launched your business and have more in the way of liabilities than assets. Attempting to establish strong foundations, you may be taking out loans and signing credit contracts.

Unless you’ve put up your house as collateral, asset protection is probably the furthest thing from your mind.

If you’re committed to starting on the right foot, you may direct some of your funds to setting up a smart business structure. This will serve you well in the future, and could save you from heartbreak if plans don’t go according to plan!

Success phase

Your business is going well and you’re accumulating assets. They may not seem like much now, but you’ve come a long way from when you first started.

Recognition Phase

Business is running smoothly, and your asset list is growing.

This is the ideal time to consider asset protection and have a qualified expert assess your structure with you. If you wait for an unexpected event, your options become limited and your risk increases significantly.

You should consider:

- Am I personally protected from claims against the business?

- Are assets in one business protected from claims against another business?

- How much risk am I willing to accept?

- Am I confident that my business structure will see me through unexpected events or tough times?

An asset protection specialist can work with you to examine your assets and set up and find valuable ways to reduce exposure and risk.

Continual Assessment

Life and business is dynamic. Over time you will purchase new assets and your business will evolve. As your business changes, so too should your asset protection plan.

Restructuring your assets is an essential element of effective asset protection, and involves a commitment from you. Once a year, or whenever you purchase a major asset, is a good rule of thumb.

How we work with business owners

There is no “perfect” business structure that suits all businesses.

We know that every business is different, so we work with you and other key stakeholders to develop a tailored solution, based on a holistic picture of your:

- business assets

- personal assets

- business structure

- business goals

- appetite for risk

Working alongside our taxation specialists, we offer a comprehensive asset protection plan that benefits your entire business and gives you peace of mind.

To learn more about asset protection or speak with a specialist, contact your local RSM office.