Many of us have been working from home recently and are continuing to adopt hybrid versions of working between the office and the home.

It is therefore timely to remind people of what they are eligible to claim – particularly given recent findings in McAteer and FCT [2020] AATA 1795 which have given rise to what is being dubbed the case for “home office with a twist”.

Working from home deductible expenses in respect of a home office can be divided into two broad categories:

- Occupancy expenses: expenses relating to ownership or use of a home which is not affected by the taxpayer's income earning activities. These include rent, mortgage interest, municipal and water rates, land taxes and house insurance premiums.

-

Running expenses: expenses relating to the use of facilities within the home. These include electricity charges for heating/cooling, lighting, cleaning costs, depreciation, leasing charges and the cost of repairs on items of furniture and furnishings in the office.

In deciding cases concerning working from home office expenses, courts and tribunals have consistently drawn a distinction between:

- where part of a home can be characterised as a place of business; and

- where a room is used as a study or home office merely as a matter of convenience.

Mr McAteer was required by his employment contract to be able to work from home when rostered on duty after hours. For one week in every four weeks he was required to be available 24 hours a day to provide on-call support in his IT role at Westpac.

His employer assisted by supplying office equipment for his home, checking the safety of his home workspace and granting time off in lieu of out of hours work.

Mr McAteer’s home had four levels; at the top were family bedrooms and bathroom; in the middle were the kitchen, a family room, and a dining room; at the bottom was a garage; and a storage space and a ‘’study’’ or ‘’lab’’ half above the garage, which was also an entry to the upper levels.

The ATO disallowed some of Mr McAteer’s deductions for occupancy expenses and allowed certain running expenses relating to electricity, broadband and similar.

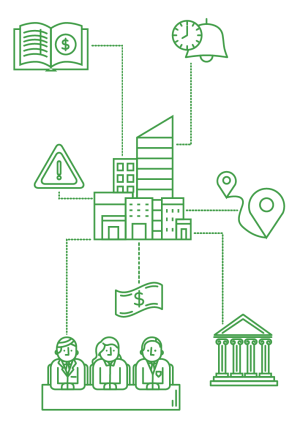

To be able to claim a deduction for occupancy expenses a taxpayer needs to show that:

- The outgoing was incurred in gaining or producing assessable income and;

- That working from home is not simply as a matter of mere convenience and;

- That the area subject to the claim was a dedicated work area, and only available incidentally for domestic use.

In this case, Mr McAteer was required to work from home during the out of hours period and provided evidence that substantiated the difficulties accessing his employers premises during this time. This key factor was relied upon by the Administrative Appeals Tribunal (AAT) to rule that Mr McAteer was not working from home out of convenience during this on-call period.

Accordingly, he was entitled to a deduction for occupancy expenses that related to his use of a study/laboratory which was used exclusively for work purposes during the out of hours rostered weekend time.

Mr McAteer was unsuccessful in his claim for occupancy expenses related to use of his family room and dining room.

In this regard, the Tribunal noted that the taxpayer did not meet the onus of proof of showing that this space was dedicated exclusively to his work as they were readily available for family or domestic purposes.

This case shows that taxpayers who have a dedicated study that they have used during lockdown are able to claim not only running costs but also occupancy costs if they have been required to work from home because their office is not available.

Given many offices in capital cities have been in lockdown at some point since March 2020 it means taxpayers could claim more than the 80 cents per hour allowed by the ATO under the “shortcut method” announced as a Covid-19 concession.

Capital Gains implications

Taxpayers need to consider the Capital Gains tax implications of claiming such occupancy costs as capital gains tax generally does not apply to a person's main residence.

However when the main residence disposed of was also used for the purpose of gaining or producing assessable income during the period of ownership, for example, where an area of a home is set aside and used as a place of business, the capital gains provisions may apply.

This of course would not apply to taxpayers who are renting their home as there would be no capital gains tax exposure.

For further guidance on capital gains implications on claiming occupancy expenses please contact your local RSM office.