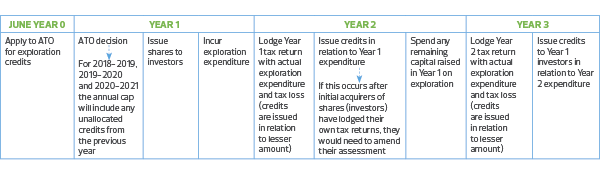

The Junior Minerals Exploration Incentive (JMEI) was introduced in 2018 to allow junior mining exploration companies (JMEC) that are undertaking greenfield exploration in Australia, to convert tax losses into exploration credits for investors. The exploration credits provide a tax offset for investors that incentivises them to contribute new capital to a JMEC. Applications for the 2020-21 JMEI must be submitted electronically between 1 June and 30 June 2020.

The Income Tax Assessment Amendment (Exploration for Minerals) Regulations 2020 has prescribed an additional $5m in unused exploration credits, from the 2017-18 income year to the exploration credits available for the 2020–21 income year, increasing the available cap of credits for this year to $35m.

Investors that purchase newly issued shares in a JMEC will be able to access the JMEI credits, allocated to eligible JMEC's, on ‘a first-come, first-served basis’. JMEC's that qualify for the JMEI will be allowed to apply for the scheme before they undergo capital raisings, meaning that investors will be able to take into consideration the credits they are likely to receive in advance of their share investment.

Eligibility requirements

A JMEC will be able to create JMEI credits where:

- It incurs exploration expenditure for minerals exploration (not petroleum or feasibility studies), or alternatively, is a transferee under a farm-in farm-out arrangement;

- The exploration expenditure relates to an area that is in Australia, over which the JMEC holds a mining, quarrying or prospecting right and that area does not contain an inferred mineral resource in a JORC Code; and

- Neither the JMEC, its affiliate, or a connected entity, carried on mining operations for the previous two income years.

The JMEC must apply for and obtain an allocation of the credits from the Commissioner by electronically submitting the JMEI Participation Form between 1 June and 30 June (including those applicants with substituted accounting periods) in the proceeding financial year that corresponds to the income year for which the allocation is requested.

The Form requires details about the JMEC’s:

- Estimated greenfields exploration expenditure for the income year;

- Estimated tax losses for the income year;

- Applicable corporate tax rate; and

- Estimated capital to be raised for the income year.

The exploration credits can only be issued to investors that participate in new capital raisings in the income year, or the immediately preceding income year, rather than to all shareholders in the company. JMEI credits are received by the investor irrespective of whether or not they continue to hold the shares. Investors who invested in the JMEC in the immediately preceding year must be issued with the credits first, and in priority to, those investors in the later income year.

A minerals exploration company will create exploration credits after its tax return has been lodged and its tax loss for a year of income is known.

Limitations of the Incentive

The Commissioner will not grant JMEI credits to a JMEC that is greater than the value of the following:

- The JMEC’s total expenditure on greenfield exploration for the relevant tax year, multiplied by its applicable corporate tax rate for the 2020-21 financial year.

- 5% of the total annual exploration cap of the JMEI, which for 2020-21 income tax year is $1.75m.

- The JMEC’s estimated tax loss for the income year, multiplied by its applicable corporate tax rate for the 2020-21 financial year

Example

Greenfield Exploration Limited (GML) makes an application to the Commissioner for an allocation of JMEI credits on 1 June 2020 for $1m. In September 2021, the Commissioner notifies GML that its allocation has been successful. GML raises $6m of new capital in October 2021 to fund an exploration program in Australia on a previously unexplored tenement. GML incurs $4m of greenfield exploration expenditure in the 2020-21 year. GML lodges its June 2021 income tax return in May 2022 which reflects a tax loss of $5m. GML issues credits of $1m to its 2021 investors. Click on the below image to enlarge.

How can RSM help?

RSM will be able to assist exploration companies looking to take advantage of the JMEI by:

- Assessing eligibility

- Drafting relevant clauses for public company share offer documents explaining the potential flow of exploration credits to an investor

- Completing the JMEI Participation Form and lodging it with the ATO

- Advising of the proper allocation of exploration credits to investors

As the JMEI runs on a ‘first-come-first-served basis’ it is paramount to complete the application accurately and in a timely basis, to ensure the best outcome. RSM is also able to mitigate the risk of a breach in the JMEI rules, which can lead to explorers being liable to pay back excess exploration credits.

For further information

If you require any further information on Junior Minerals Exploration Incentive, please contact your local RSM office.