The Exploration Development Incentive (EDI) was replaced by the Junior Minerals Exploration Incentive (JMEI) for the 2018 to 2021 years. JMEI applications for the 2019 year must be electronically submitted between 1 June and 30 June 2018.

$100m of JMEI credits will be available on a ‘first come first serve basis’ over the following annual exploration caps:

| 2017-2018 | 2018-2019 | 2019-2020 | 2020-2021 |

| $15m | $25m | $30m | $30m |

The JMEI will operate similarly to the EDI. A company will be able to create JMEI credits where:

- It incurs exploration expenditure for minerals (but not feasibility studies) or alternatively is a transferee under a farm-in farm-out arrangement;

- The expenditure relates to an area that is in Australia, over which the company holds a mining, quarrying or prospecting right and that area does not contain an inferred mineral resource; and

- Neither the company, its affiliate or a connected entity carried on mining operations.

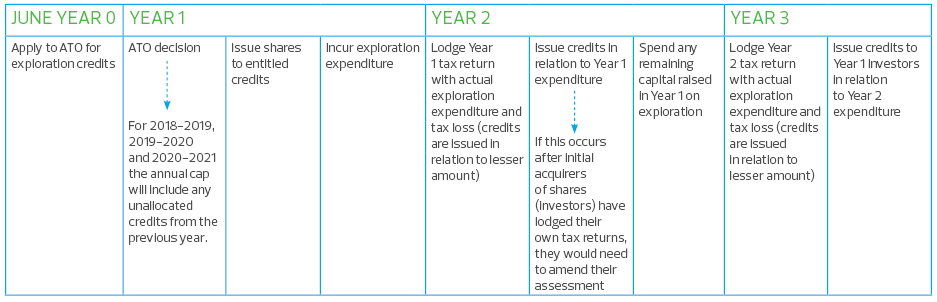

The company must apply for and obtain an allocation of the credits from the Commissioner. An application must be made between 1 June and 30 June (including those applicants with substituted accounting periods) in the proceeding financial year that corresponds to the income year for which the allocation is requested.

The amount of JMEI credits allocated to a company by the Commissioner for an income year will be the lesser of:

- The company’s estimated greensfield minerals expenditure multiplied by its corporate tax rate;

- The company’s estimated tax loss multiplied by the corporate tax rate; or

- 5% of the annual allocation cap.

The allocation is not subject to review or appeal.

An investor will make an exploration investment if it acquires shares in a minerals exploration company on or after the day the Commissioner makes a determination to allocate the company with JMEI credits.

A minerals exploration company will create exploration credits after its tax return has been lodged and its tax loss for a year of income is known.

JMEI credits can be issued to the investor for the year of the investment or the subsequent year. JMEI credits are received by the investor irrespective of whether or not they continue to hold the shares. Investors who invested in the immediately preceding year must be issued with the credits first, and in priority to, those investors in the later income year. The minerals exploration company must provide the investor with a statement in the approved form advising them of the allocated credits. The Commissioner also needs to be notified.

The JMEI credit will be received by the investor in the form of either a tax offset or in the case of an investor company, franking credits.

Example

Greenfield Exploration Limited (GML) makes an application to the Commissioner for an allocation of JMEI credits on 1 June 2018 for $1 million. In the September 2019, the Commissioner notifies GML that its allocation has been successful. GML raises $6m of new capital in October 2019 to fund an exploration program in Australia on a previously unexplored tenement. GML incurs $4m of greensfields exploration expenditure in the 2018-19 year. GML lodges its June 2019 income tax return in May 2020 which reflects a tax loss of $5m. GML issues credits of $1m to its 2019 investors.

Timeline for an exploration company participating in JMEI

Click the below image to enlarge

For further information

If you require any further information on Junior Minerals Exploration Incentive, please contact your local RSM office.