The personal financial demands on you and other Australians are not getting any easier.

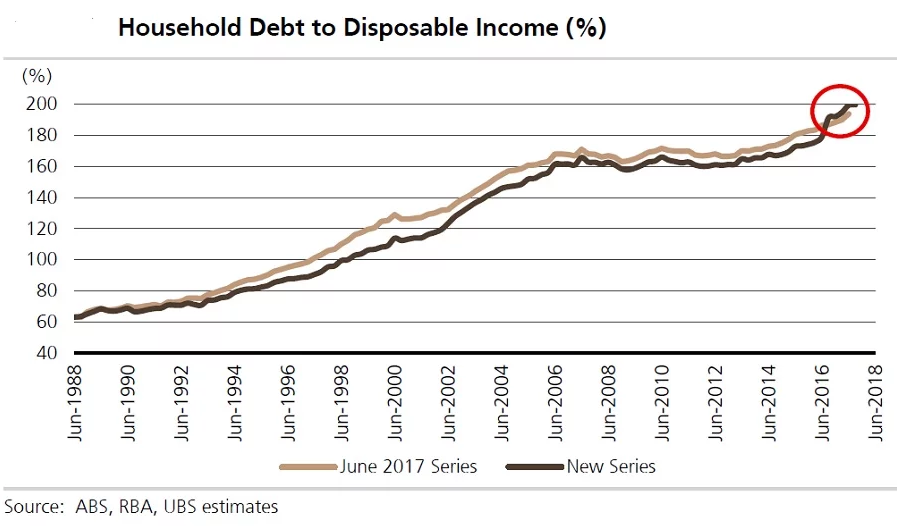

With continued record growth in the property market alone, Australians are having to live with the maintenance of some of the highest levels of household debt in the world.

With the rise in property prices there also tends to be a rise in household consumption, as increased property value can imply greater wealth.

This creates both greater demand and risk on the family’s income sources, to service rising debts and meet costs of living.

Logically, your main breadwinner’s income and their ability to earn a living becomes of paramount importance for the future livelihood of all in your household.

For this reason, you protect the primary breadwinner in case something happens to them, to ensure continuity of lifestyle for your family.

The primary caregiver incident

What is overlooked, however, is the impact on the household if the primary caregiver, often the mum, is the one that suffers a serious illness or worse.

I once heard the question...

“How do you replace the work of a person who has to be 100% available, working 25 hours a day, 8 days a week?”

The stark reality is that this unpaid role as the primary caregiver of the household is pivotal. If something should happen to them the very foundations and functions of the home can fall apart.

Just consider:

- Who will prepare breakfast, lunch and dinner and take your kids to school?

- Who will pick your kids up from school and take them to swimming, sports, music and more?

- Who will clean your home, wash your clothes and ensure there is food in the house to eat?

- Who will provide the nurturing love and care to your kids, especially when there is a sick parent also in need?

- Who will be caring for your sick spouse, who is trying to get well or coming to turns with a permanent change in their lifestyle?

The simple answer is YOU.

You'll need time off work or you'll have to obtain external assistance to help with these roles.

Not all employers, or business partners, will be as understanding as others, which means the challenges in your life might have a serious negative impact on your career or livelihood.

Protect the family by protecting your family’s carer

The situation above can be eased by ensuring you have considered the impact on your family and putting provisions in place.

By taking time to consider the personal and financial implications of something happening to your family’s primary caregiver, you can fully understand your risks and what you feel you need to put some protection in place for.

Nowadays you can protect a primary caregiver for the cost of replacing some of the home-based duties like cooking, cleaning, shopping etc, with something like an income (expense) protection.

Likewise, if something happened which resulted in a more permanent incapacity, then disability protection can be put in place for home-based duties which can assist with both the work to be carried out and also modifications to the house or medical treatments.

Ensuring that sufficient protection is in place will create financial security for your family. It will also help to reduce the personal stress of not knowing what could happen if the primary income earner has to become the primary caregiver.

To put these types of provisions in place only takes an hour or so of your time - this is spent establishing the level of risk and personal preferences you have, speaking with an adviser who can tailor a solution to your needs and circumstances.

For more information

To understand more about protecting the future care of your family and loves ones, please contact an RSM risk specialist, who will walk you through the steps.