A Registered Liquidator: your best ally in the worst times

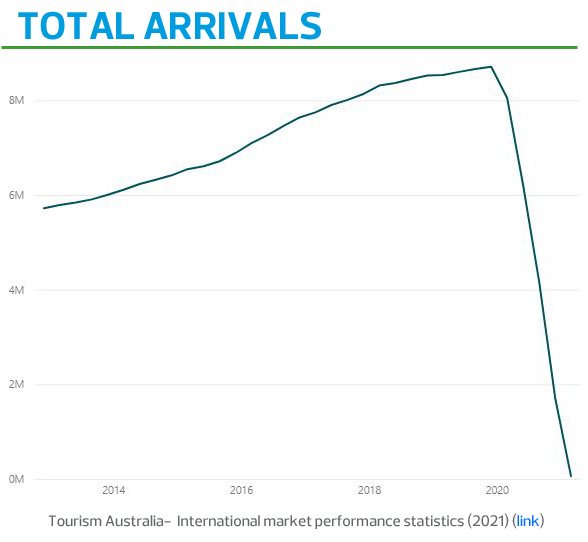

The Tourism Australia graph below is a stark reminder that international arrival numbers to Australia year-on-year, literally fell off a cliff in 2020 and haven’t recovered since.

A Q&A with Mitchell Herrett, RSM Partner and Registered Liquidator

This month, The Restructuring and Recovery team had a Q&A session with Mitch, who is based in Queensland and has over 20 years of experience in the insolvency profession. He is a straight-shooter; an honest and upfront professional who is helping business owners, many of whom are facing their worst times in business. Ever.

Q: What are you seeing in recent months in your day-to-day role as an insolvency professional?

Q: What are you seeing in recent months in your day-to-day role as an insolvency professional?

A: I’m seeing plenty of business owners doing their absolute best to hang in there, this tends to be the Australian way; to battle on. In my 20 years of experience though, I have to say that in the world of business, battling on isn’t always the best thing to do.

Getting advice and developing a plan of action earlier, rather than later, tends to mean there may be more options available. For example, you may be able to save your family home or stop the accumulation of more debt.

Q: What’s an example, sharing generally, of a client who you personally assisted in a Registered Liquidation capacity?

A: I was appointed to work with a big, burly guy who was aged around 45 and had a team of 20 people. He had a business with a multi-million dollar turnover at one stage, providing services. It turned out though, he was consistently underquoting to win work and over-time, getting deeper and deeper into debt. In the end, there was no other option for him but to declare bankruptcy.

It was definitely a tough time for this client - he was a hard-working, honest person, who also happened to have a failing business.

The good news is, he is now employed by someone else and isn’t feeling the stress and burden he was while running his own business, losing money, and being chased by creditors. He sold his assets, paid off his suppliers and employees, and has made a new start.

The good news is, he is now employed by someone else and isn’t feeling the stress and burden he was while running his own business, losing money, and being chased by creditors. He sold his assets, paid off his suppliers and employees, and has made a new start.

Q: In your experience what prompts people to put their hand up and ask for some debt management or insolvency support?

A: It tends to be some sort of trigger. A marriage breakdown, sometimes caused by ongoing financial stress, the inability to borrow any more money, or mental health concerns that arise due to working really long hours and still getting further into debt.

A blinding ambition to continue on in business, may actually end up costing people much more in the short and longer-term.

I see lots of dedicated business owners pushing themselves to work harder, to try to find a way out. I just really want to encourage people to seek support earlier. There is absolutely no shame in having a confidential conversation with an experienced Debt Manager or Registered Liquidator. Your options will become much clearer, usually pretty quickly.

Q: What signs are there that battling business owners may benefit from speaking with a Restructuring and Recovery team member?

A: Common signs that a business may be in financial distress can include delaying paying GST or employees’ Super and seeking out additional loans with no clear plan of how to pay the loan back. Other simple cues maybe that cash flow is a real issue - the phone is always ringing and people are always chasing payment.

Our team never judges anyone. We just get to the bottom of the situation as quickly as possible, and work out what the available options are from there.

Do you need some debt management or insolvency advice?

The Australian Federal Government introduced new Insolvency reforms that came into effect on 1 January 2021. They apply to incorporated small businesses with liabilities of less than $1 million. The reforms include new debt restructuring and simplified liquidation processes.