Divorce among people over 50’s (commonly referred to as a “Grey Divorce”) is on the rise in Australia.

Currently, 27% of divorce applications are for couples who have been married for 20 years or longer.

While financial separation carries a heavy emotional burden at any age, the stakes for older divorcees can be greater, and the prospect of starting over is more daunting than for younger people.

The over 50s have often accumulated significant wealth and therefore have a larger pool of assets to split. These couples tend to be focused on preparing for retirement and may be at the peak of their earning powers. At all points along this path through later life, the financial consequences of divorce are substantial.

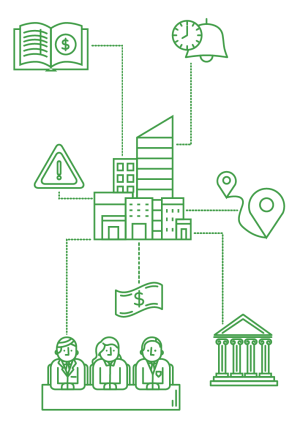

Given the major upheaval created by this event, it’s critical to obtain professional financial and legal advice right from the start. This will help to ensure the smooth separation of finances and a reduction in any unnecessary emotional pain.

The checklist – Items to sort out ASAP

At the end of a marriage or long-term relationship in your 50’s, some issues require immediate attention while others can be addressed at a later time.

Urgent items include:

- Opening individual bank accounts and giving new bank details to employers.

- Working out a budget based on new living expenses and securing an income which meets your new living costs.

- Changing life insurance and superannuation death benefit beneficiaries to reflect updated needs.

- Revising Wills and Powers of Attorney.

- Organising the living arrangements and financial needs of dependent children.

Once these important issues are addressed, attention can be given to:

- How will the superannuation balances be split? What super fund will best suit your needs?

- How will the division of personal property be managed? What assets in the pool would be most beneficial for you?

- What change in your retirement plans will you need to make based off the final property split?

While this can be a daunting prospect to face for many over 50’s, having the insight and guidance of a financial planning professional and a family lawyer can give you comfort and assistance in developing a plan to make the most of your new situation.

For more information

For more information on how RSM can help you, please contact your local RSM adviser.

This page has been prepared by RSM Financial Services Australia Pty Ltd ABN 22 009 176 354, AFS Licence No. 238282.

As everyone's circumstances are different and this article doesn't take into account your personal situation, it is important that you consider the above in light of your financial situation, needs and objectives, and seek financial advice before implementing a strategy.

View the Financial Services Privacy Statement and Policy, Complaints Policy and Financial Services Guide