In diesem Beitrag erfahren Sie:

- welche neue Funktionalitäten in das Polnische Lokalisierungspaket Oracle NetSuite 2025.3 eingeführt wurden;

- welche neue Verbesserungen an dem Polnischen Lokalisierungspaket Oracle NetSuite 2025.3 vorgenommen wurden.

Das Polnische Lokalisierungspaket (Advanced PLP) führt eine Erweiterung der ursprünglichen Funktionalität von Oracle NetSuite ein. Es handelt sich um eine Reihe von Modulen, die entwickelt wurden, um Ihr NetSuite-Finanzsystem in Übereinstimmung mit den Anforderungen des polnischen Rechnungslegungsgesetzes vollständig zu unterstützen. Unser Team aktualisiert regelmäßig unser Lokalisierungspaket, daher präsentieren wir Ihnen die neuesten Funktionalitäten der Oracle NetSuite.

FUNKTIONALITÄTEN:

Wir haben die Funktionalitäten des Polnischen Lokalisierungspakets angepasst, um die NetSuite-Konfiguration zu unterstützen, bei der die Währung des Hauptbuches (Primary Book) eines polnischen Unternehmen nicht der polnische Zloty ist. Die vorgenommenen Änderungen ermöglichen die ordnungsgemäße Erfassung von Transaktionen und deren Abrechnung im Rahmen von Steuererklärungen. Die Änderungen betrafen folgende Bereiche:

- Erfassung von Umsätzen einschließlich Umsatzsteuer,

- Bearbeitung von Ausdrucken für Verkaufsbelege,

- Bearbeitung von VAT-Registern,

- Generieren von Steuererklärungen und SAF-T.

Diese Funktionalität ist im Rahmen des erweiterten Servicepakets verfügbar und erfordert separate Gebühr. Für detaillierte Informationen zu Kosten und Implementierung wenden Sie sich bitte an unser Team.

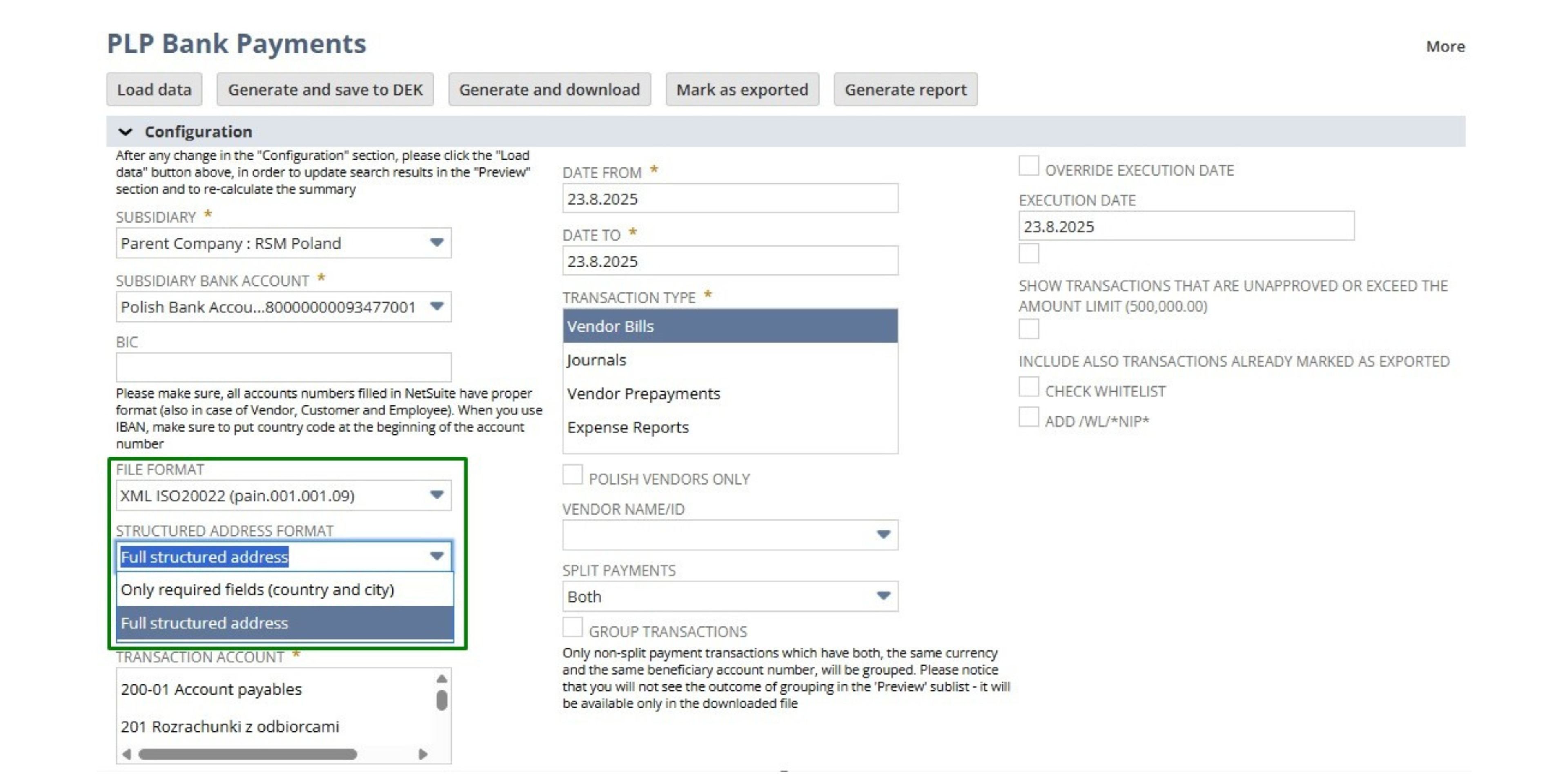

Im Modul Bankzahlungen des Polnischen Lokalisierungspakets Oracle NetSuite haben wir neue Ausgabeformate für generierte Zahlungsdateien bereitgestellt:

- Multicash PLI (Elixir 0) Credit Agricole – spezielles Format für Credit Agricole

- XML ISO Version 009 – eine Bankdatei im XML-Format Version ISO20022 (pain.001.001.09), die die Abwicklung von Auslandsüberweisungen und SEPA unterstützt. Die neue Struktur soll das derzeitige Format ISO20022 (pain.001.001.03) ersetzen. Darüber hinaus kann der Benutzer bei strukturierten Adressdaten eine der verfügbaren Optionen auswählen:

- vollständige Adressdaten – im Rahmen der verfügbaren und automatisch trennbaren Adressdaten aus der Lieferantenkartei in Datenfelder;

- nur erforderliche Adressdaten – unter Berücksichtigung nur der Pflichtfelder wie Land und Ort.

Das XML-Format ist im Rahmen des erweiterten Servicepakets verfügbar und erfordert separate Gebühr. Für detaillierte Informationen zu Kosten und Implementierung wenden Sie sich bitte an unser Team.

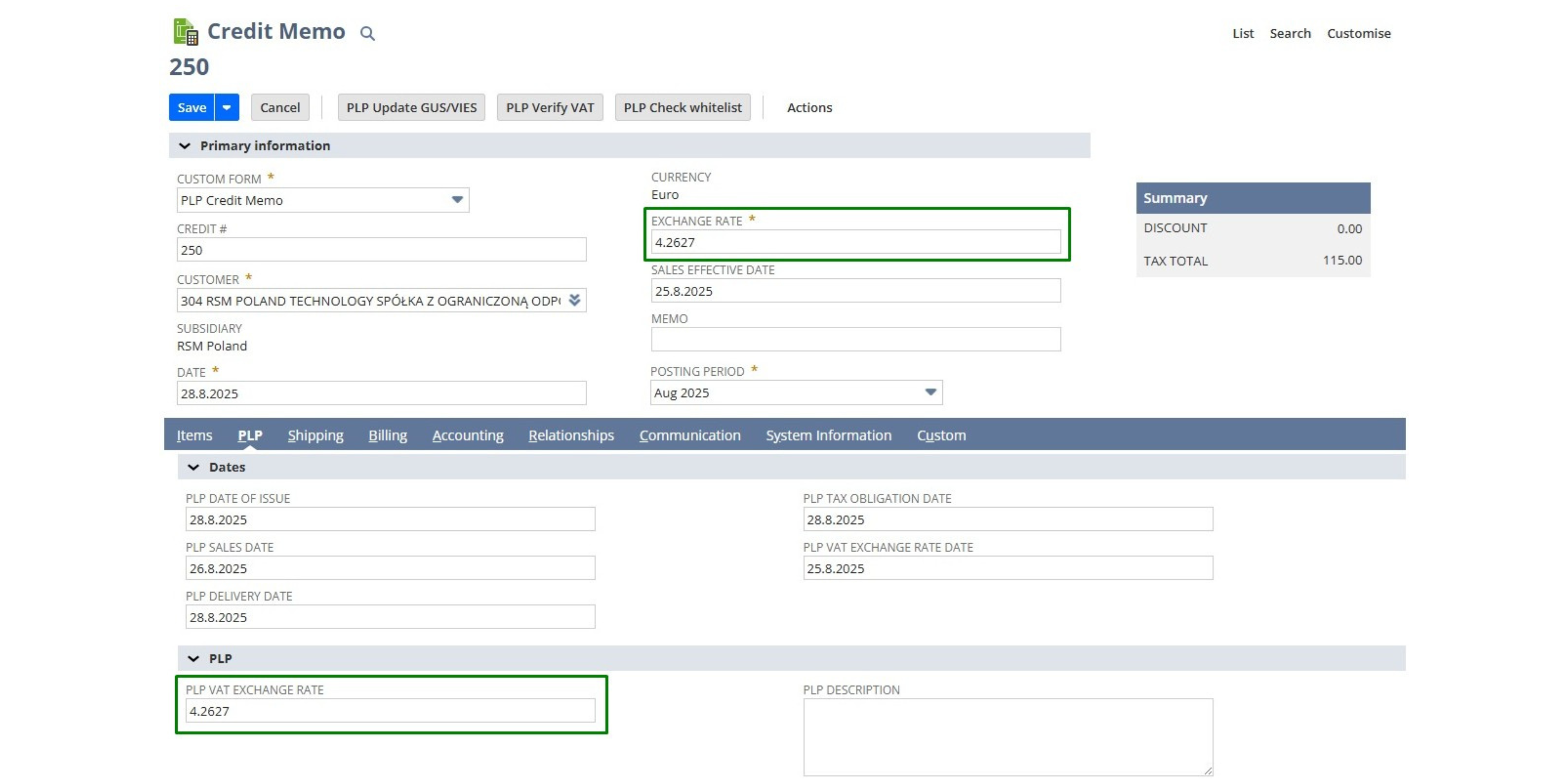

Wir haben eine Unterstützung im Bereich der Umsatzsteuer und Körperschaftsteuer gemäß den SLIM VAT-Regeln eingeführt, nach denen der Steuerpflichtige gemeinsame Umrechnungskurse für Umsatzsteuer und Körperschaftsteuer anwenden kann. Die Aktivierung der SLIM VAT-Unterstützung in Oracle NetSuite führt zu folgenden Ergebnissen:

- Einstellung des Körperschaftsteuer-Umrechnungskurses in Übereinstimmung mit dem Umsatzsteuer-Umrechnungskurs für Verkaufsumsätze;

- Einstellung des Körperschaftsteuer-Umrechnungskurses in Übereinstimmung mit dem zu korrigierenden Beleg für Korrekturbelege.

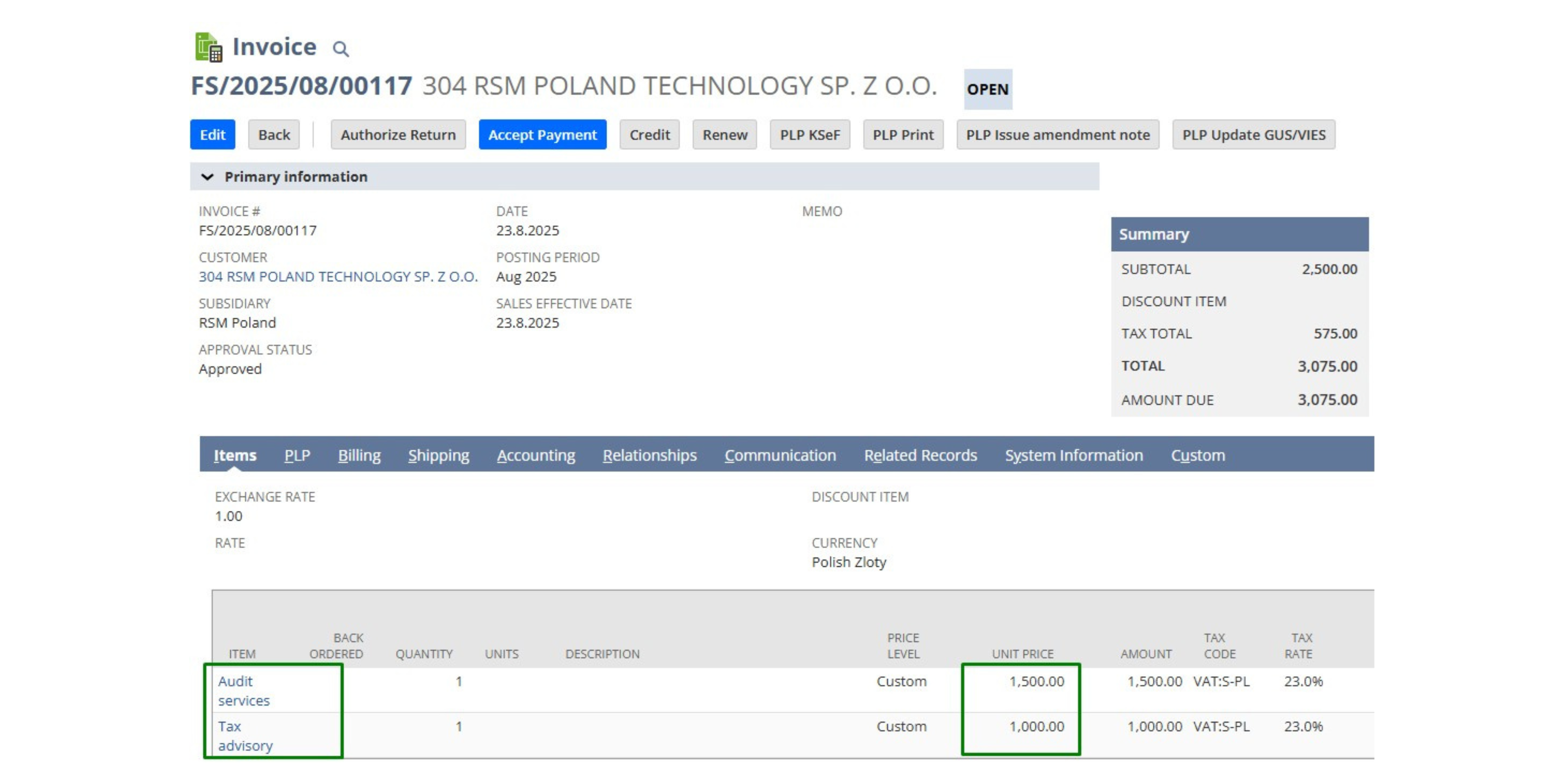

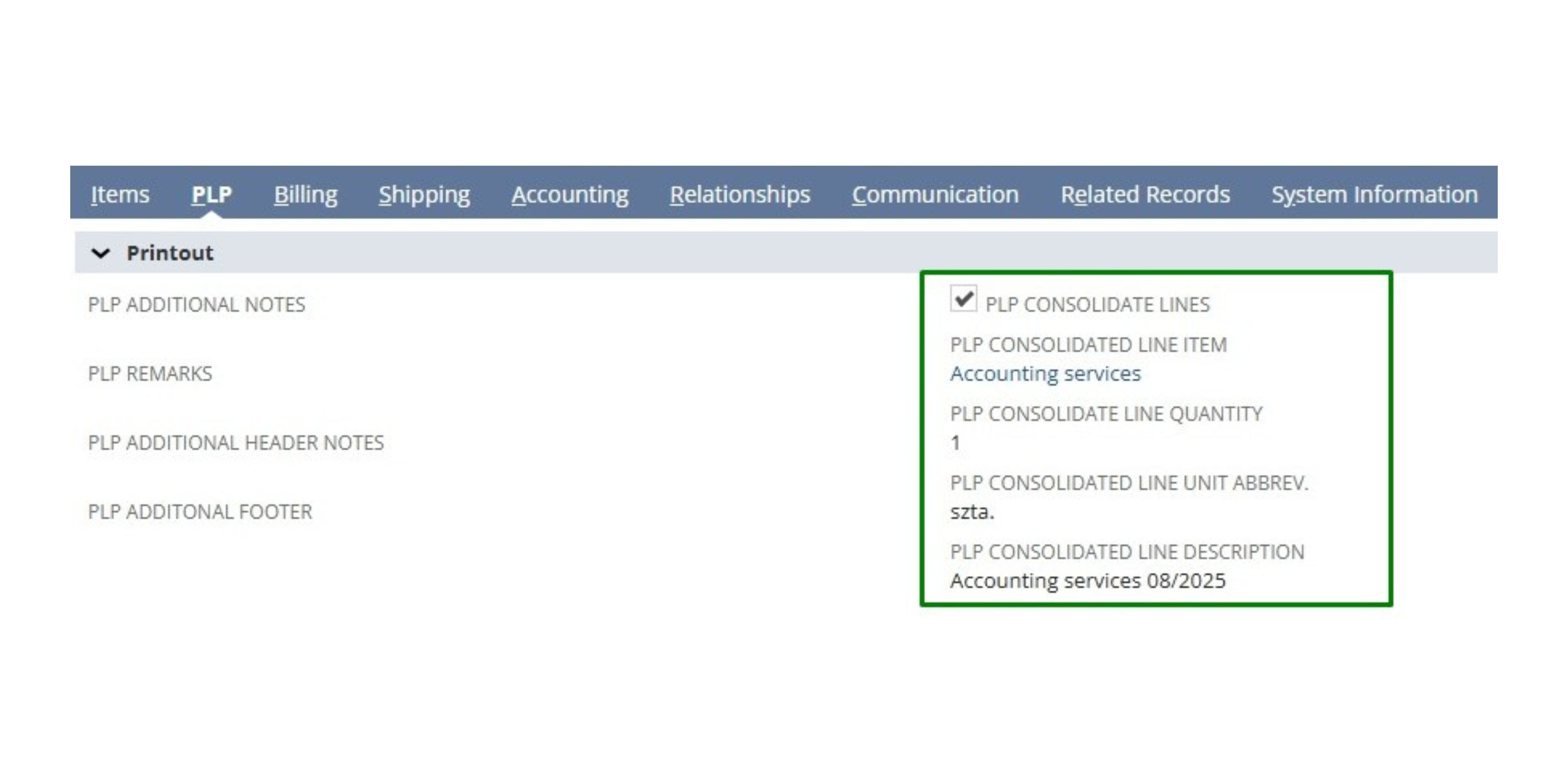

Wir haben eine Funktionalität eingeführt, dank der die Zeilen in Verkaufstransaktionen konsolidiert werden können und ein gruppierter Posten auf dem PLP-Ausdruck des Belegs, in Steuererklärungen, SAF-T (JPK) und der XML-Datei für das KSeF-System dargestellt werden kann.

Wir haben spezielle Felder bereitgestellt:

- PLP consolidate lines – ein Kontrollkästchen, das verwendet wird, um die Konsolidierung von Transaktionsposten zu aktivieren;

- PLP consolidate line item – Feld, in dem die Ware oder Dienstleistung anzugeben ist, die als gruppierter Posten dargestellt werden soll;

- PLP consolidate line quantity – konsolidierte Menge;

- PLP consolidated line unit abbrev. – Maßeinheit für gruppierten Posten;

- PLP consolidated line description – fakultative zusätzliche Beschreibung der Fertigware oder Dienstleistung.

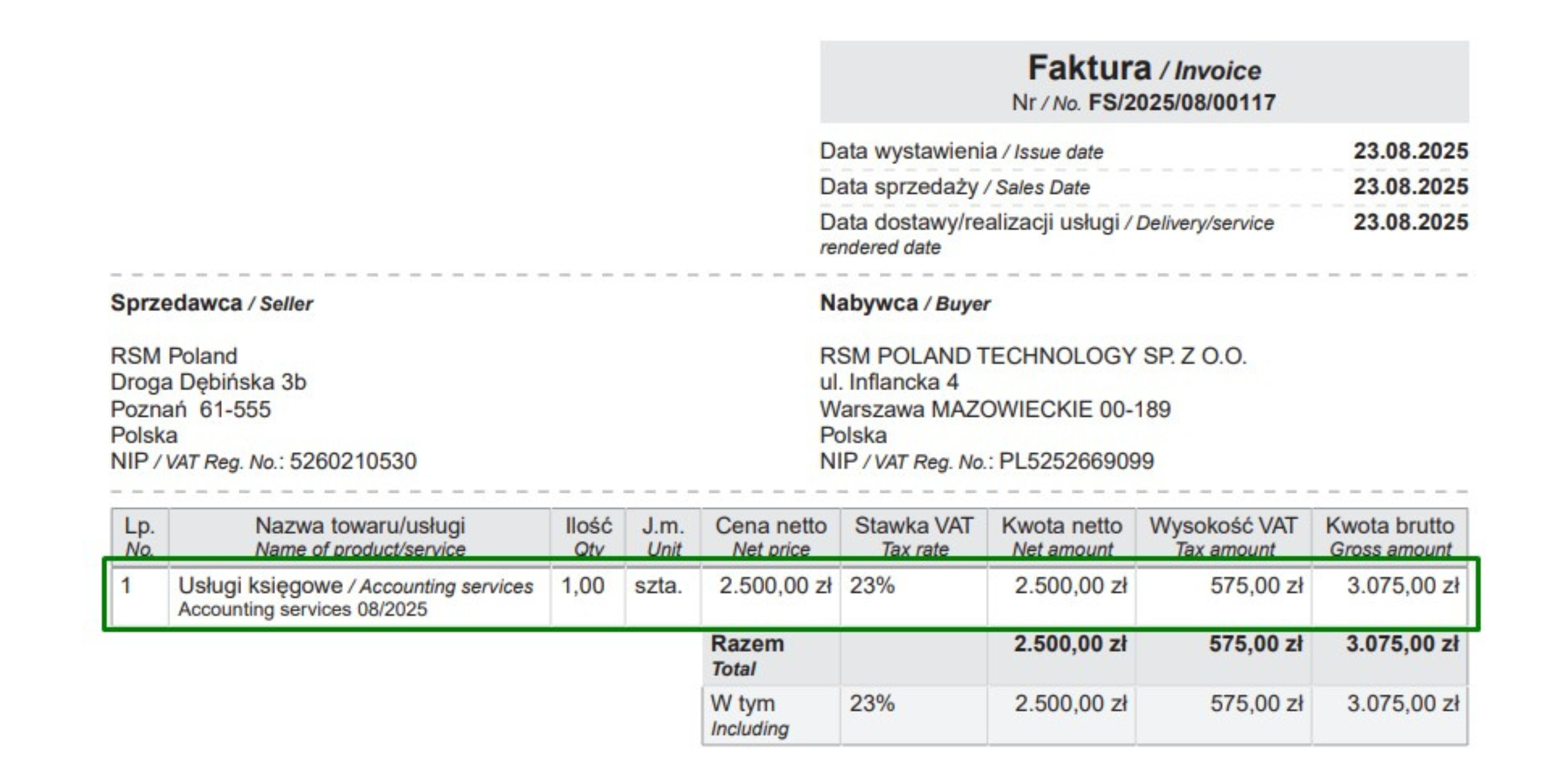

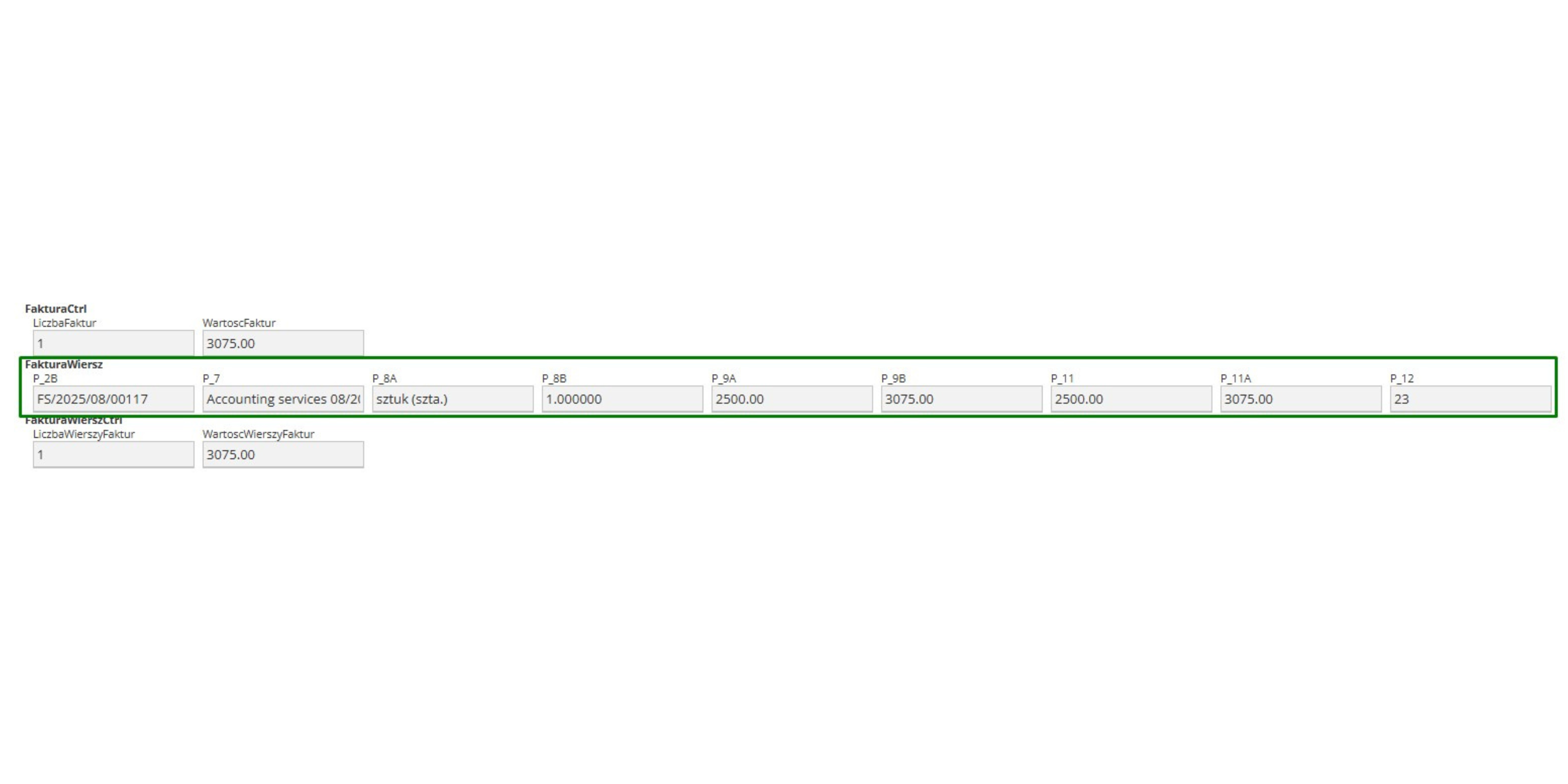

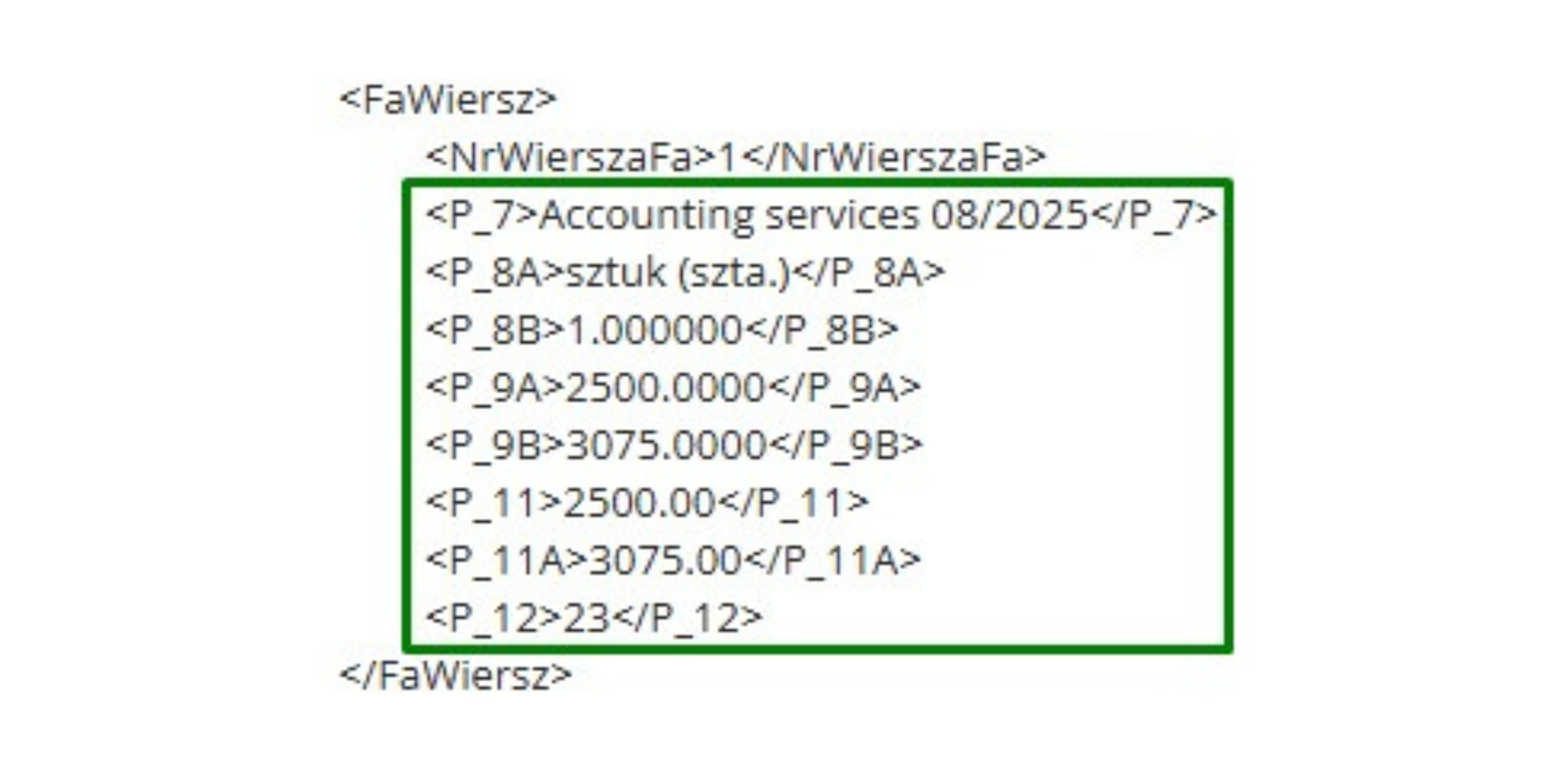

Durch die Ergänzung bestimmter Informationen können die Daten in gruppierter Form dargestellt werden:

- auf dem PLP-Ausdruck des Belegs:

- in der JPK_FA-Datei:

- in der KSEF-XML-Datei:

Zusammenhängende Dienstleistungen

VERBESSERUNGEN:

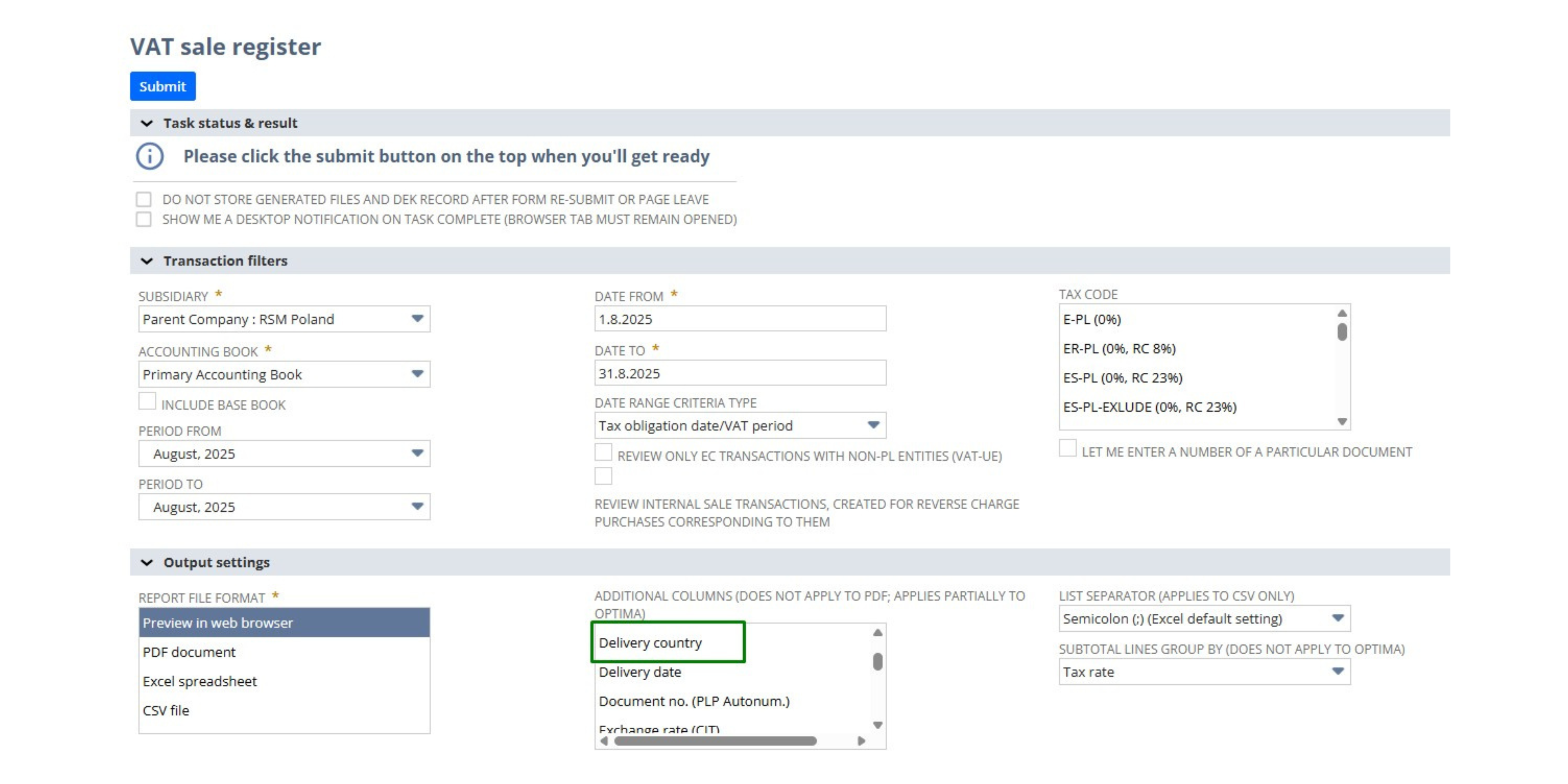

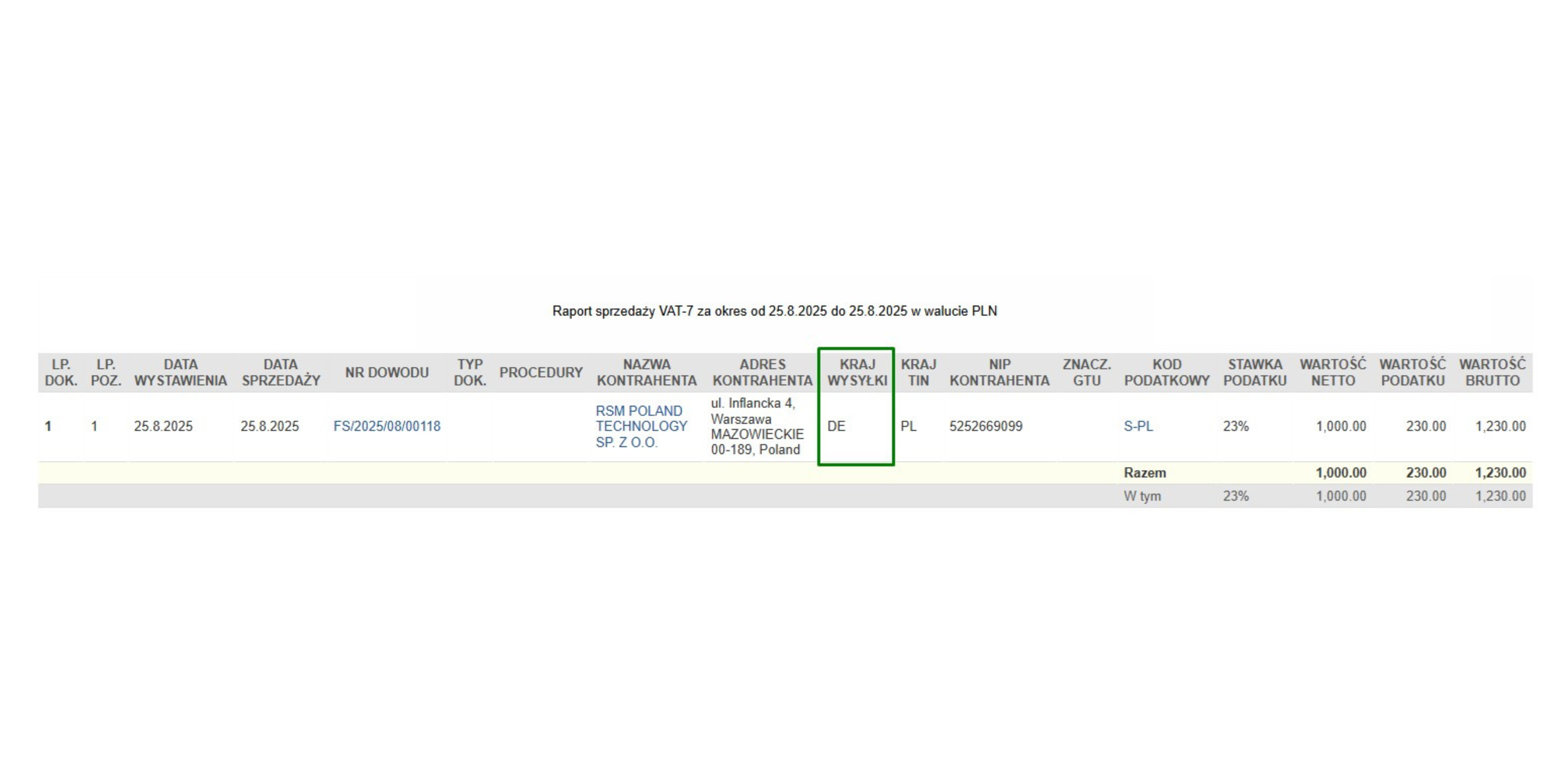

Wir haben eine zusätzliche Spalte im VAT-Register für Ausgangsumsätze bereitgestellt, in der der Leistungsort angegeben ist. Die Angabe wird aus dem Feld Land übernommen, das in der Transaktion im Abschnitt Shipping address angegeben ist.

Die zusätzliche Spalte wird in dem Bericht als Ländercode der Sendung angezeigt.

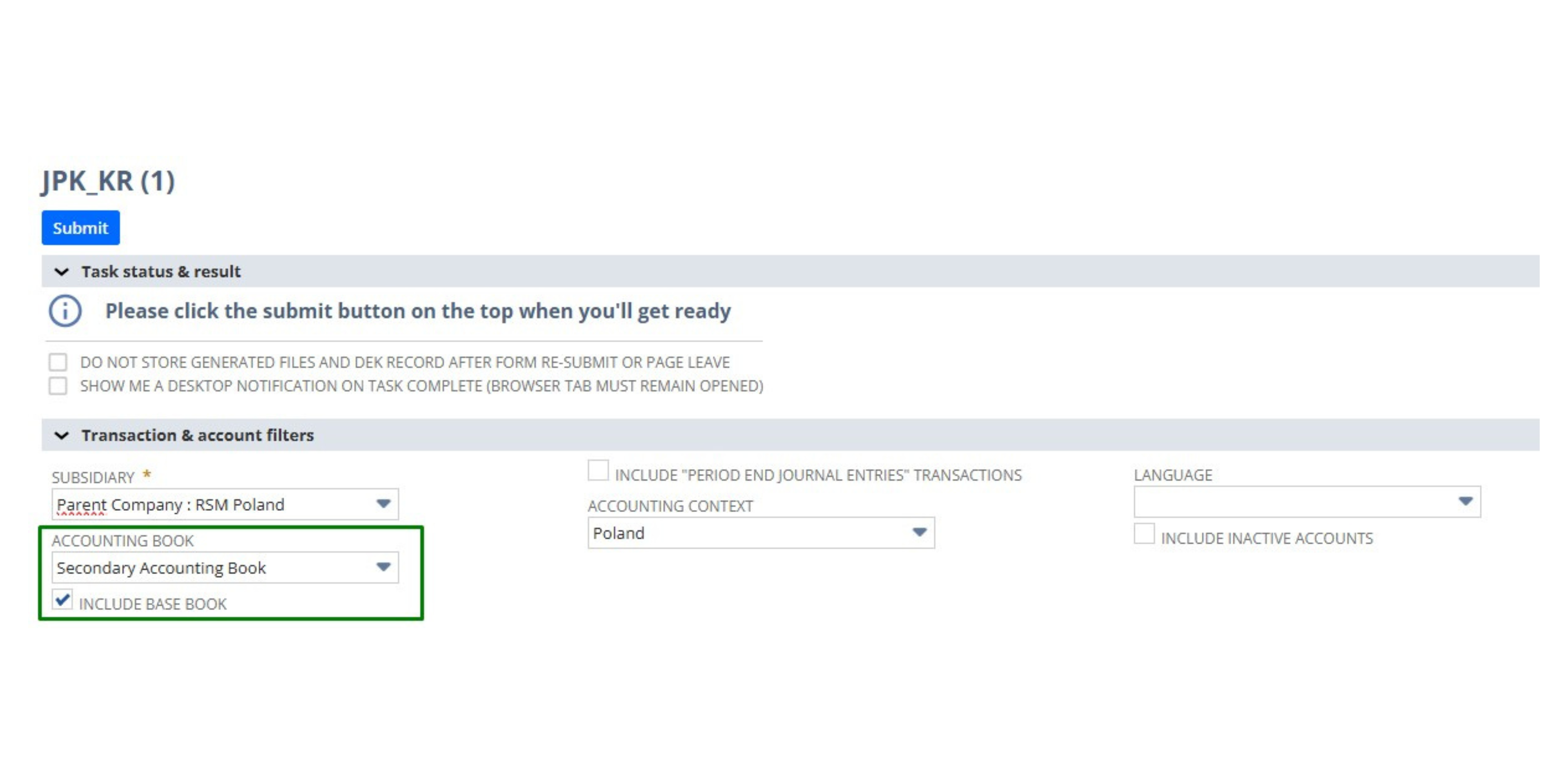

Wir haben den Mechanismus zur Generierung der Audit-Datei JPK KR um die Möglichkeit erweitert, das Hauptbuch einzubeziehen. Dadurch wird die Multibook-Funktion unterstützt.

Dank dieser Verbesserung ist es möglich, eine Audit-Datei für ein bestimmtes Buch oder mehrere Bücher (Adjustment Book und Primary Book) gleichzeitig zu generieren. Mit der eingeführten Änderung wurden die Funktionalitäten des Polnischen Lokalisierungspakets im Bereich der Finanzberichte vereinheitlicht.

Das Polnische Lokalisierungspaket wurde durch die Implementierung von Abfrage-Caching beim Import von Belegen optimiert. Diese Funktionalität bietet eine höhere Effizienz der Datenverarbeitung und reduziert die Zeit für die Erstellung von Belegen, indem Abfrageantworten im Systemcache gespeichert werden.

Beispiele für die Verwendung des Mechanismus:

- Beim Import mehrerer Fremdwährungsbelege wird der Wechselkurs für dasselbe Datum nur einmal durch das Tool abgefragt. Das Ergebnis wird im Cache gespeichert und für nachfolgende Belege verwendet.

- Bei mehrfacher Verwendung derselben Ware mit einem GTU-Code werden die Informationen über die Warenbezeichnung nur einmal heruntergeladen.