Lokalisierung für Microsoft Dynamics 365 Business Central ist eine umfassende Anwendung, die die Standard-Funktionen dieser ERP-Software um Lösungen erweitert, die das System an die polnischen rechtlichen, buchhalterischen und steuerlichen Anforderungen anpassen.

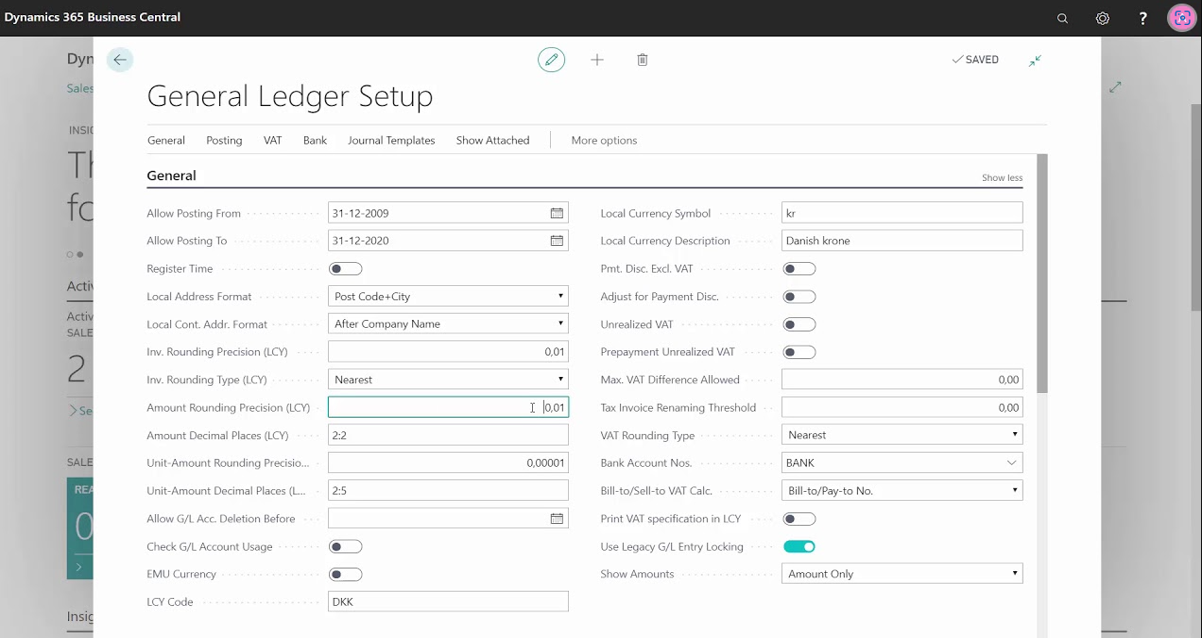

Polish Localization App basiert auf der Technologie und den Funktionen von Microsoft Dynamics 365 Business Central – einer modernen ERP-Lösung, die das tägliche Management kleiner und mittlerer Unternehmen unterstützt. Business Central ermöglicht es Ihnen, die Geschäftsprozesse in Schlüsselbereichen Ihres Unternehmens zu automatisieren und zu optimieren, wodurch eine höhere Effizienz und eine bessere betriebliche Kontrolle gewährleistet wird. Die Lokalisierung wurde für polnische Benutzer von Dynamics 365 Business Central und in Polen tätige Unternehmen entwickelt, die in Übereinstimmung mit den gesetzlichen und buchhalterischen Anforderungen gemäß den polnischen Rechtsvorschriften handeln möchten.

Verzeichnis der Funktionen von Polish Localization for Microsoft Dynamics 365 Business Central

FUNKTIONALITÄT

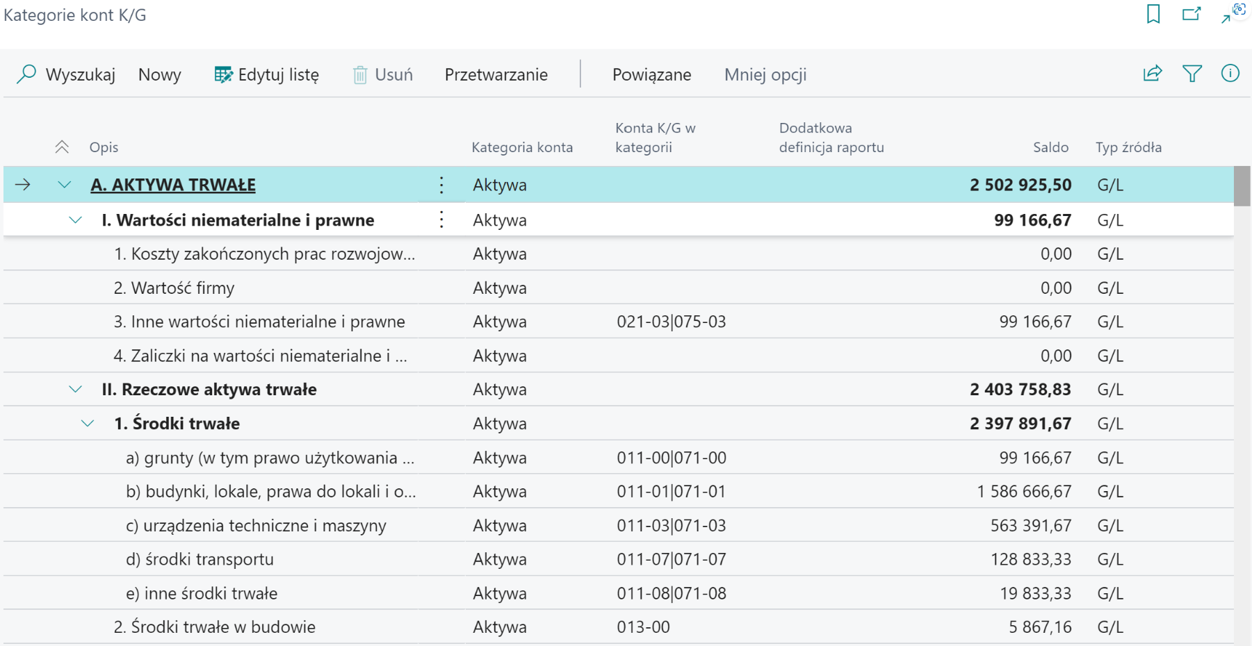

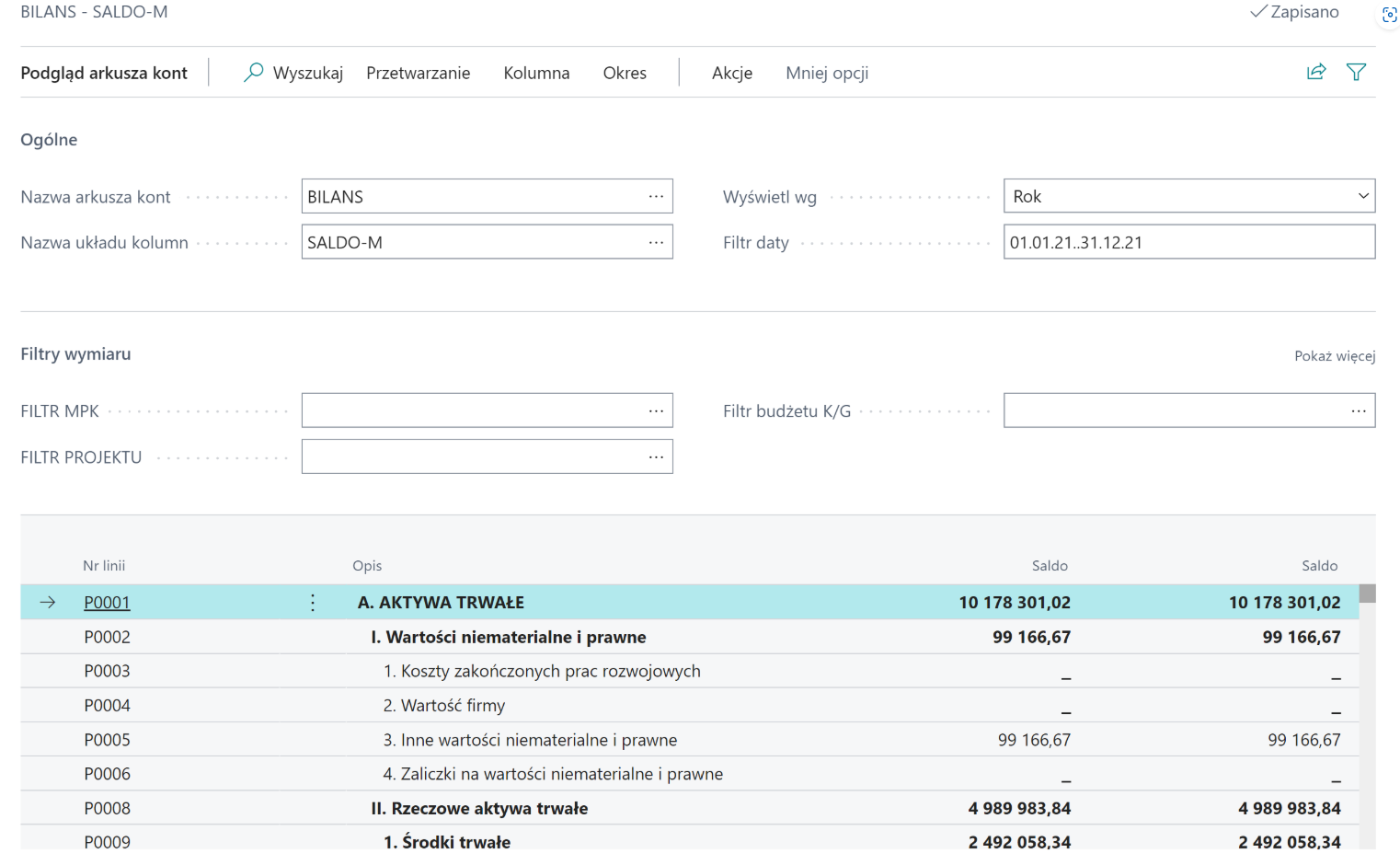

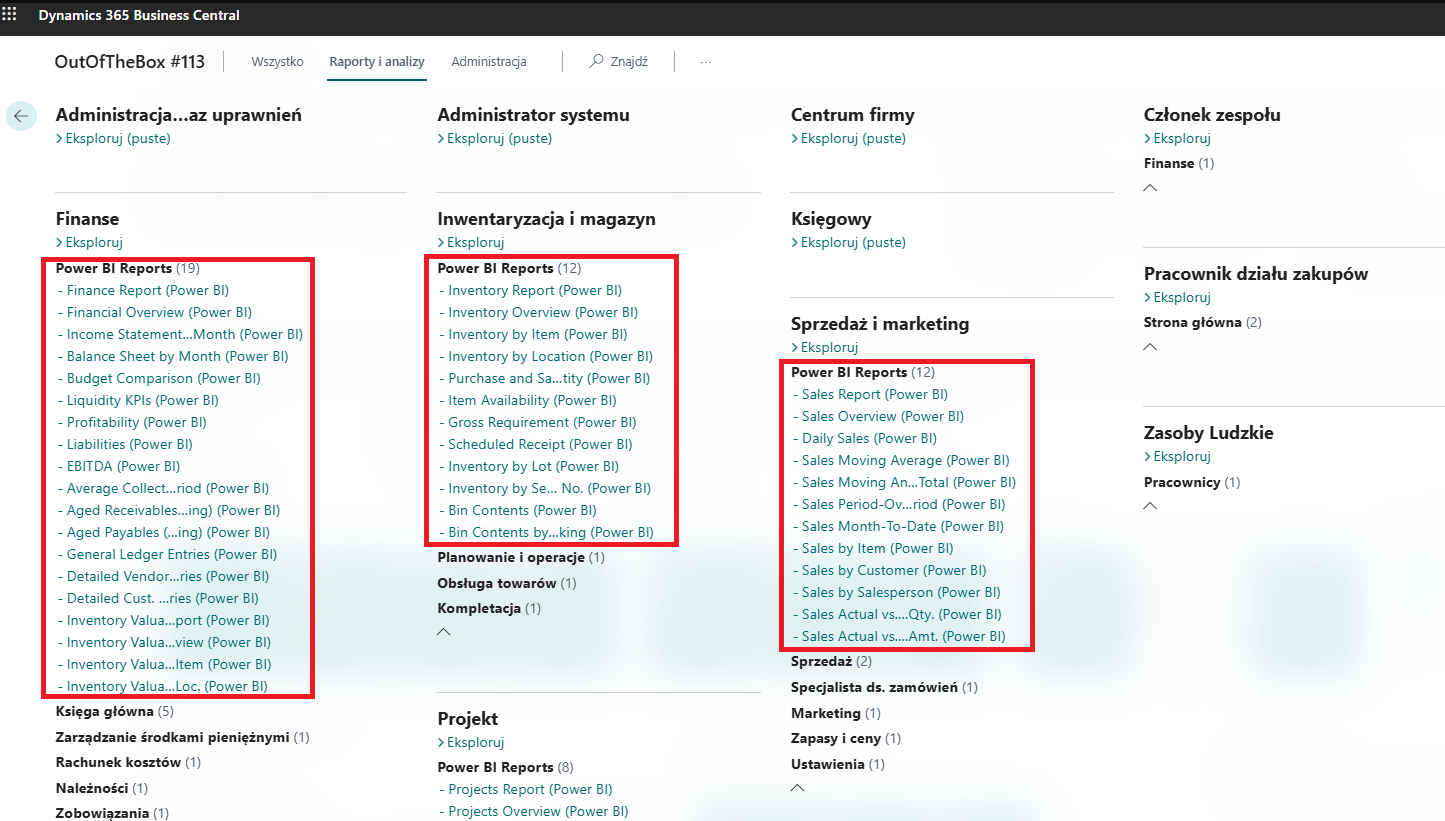

- Generieren der Bilanz und der Gewinn- und Verlustrechnung

- Erstellen von Kontenkategorien

- Nummerierungsvorlagen

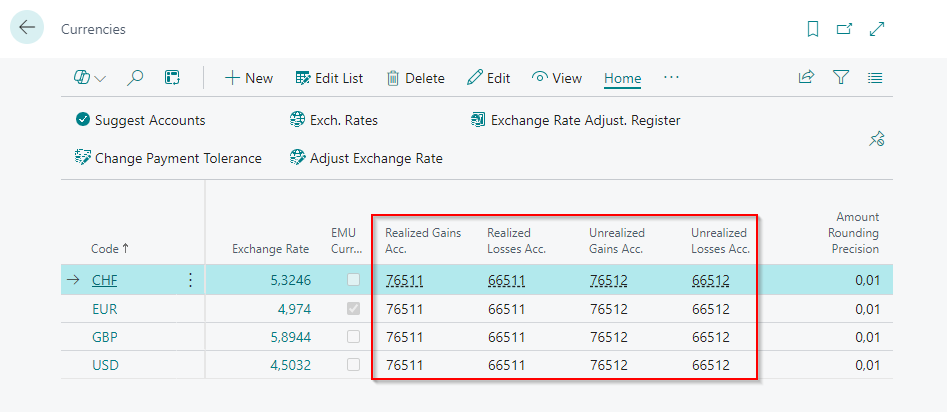

- bilanzielle Bewertung von Wechselkursdifferenzen für Bankkonten, Kasse, Verbindlichkeiten und Forderungen

- Berechnung von Wechselkursdifferenzen, auch im Testmodus

- Integration mit NBP-Wechselkursen

- Korrektur des Eintrags über ein rotes Storno oder ein schwarzes Storno

FUNKTIONALITÄT

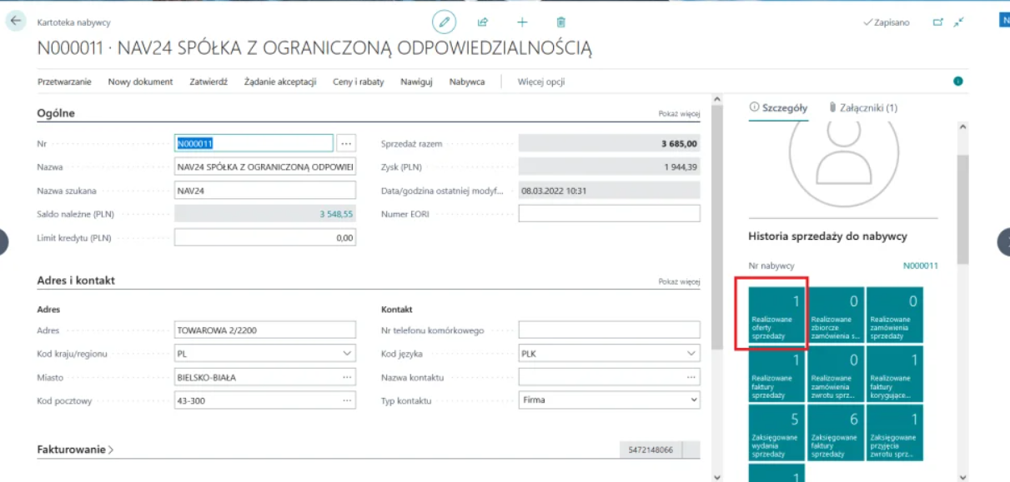

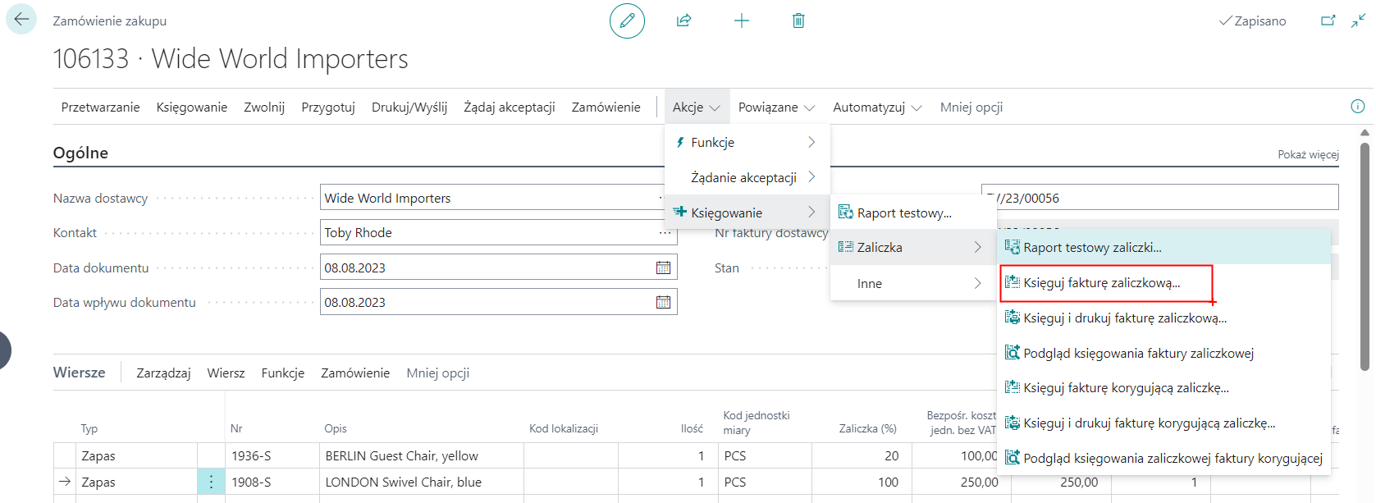

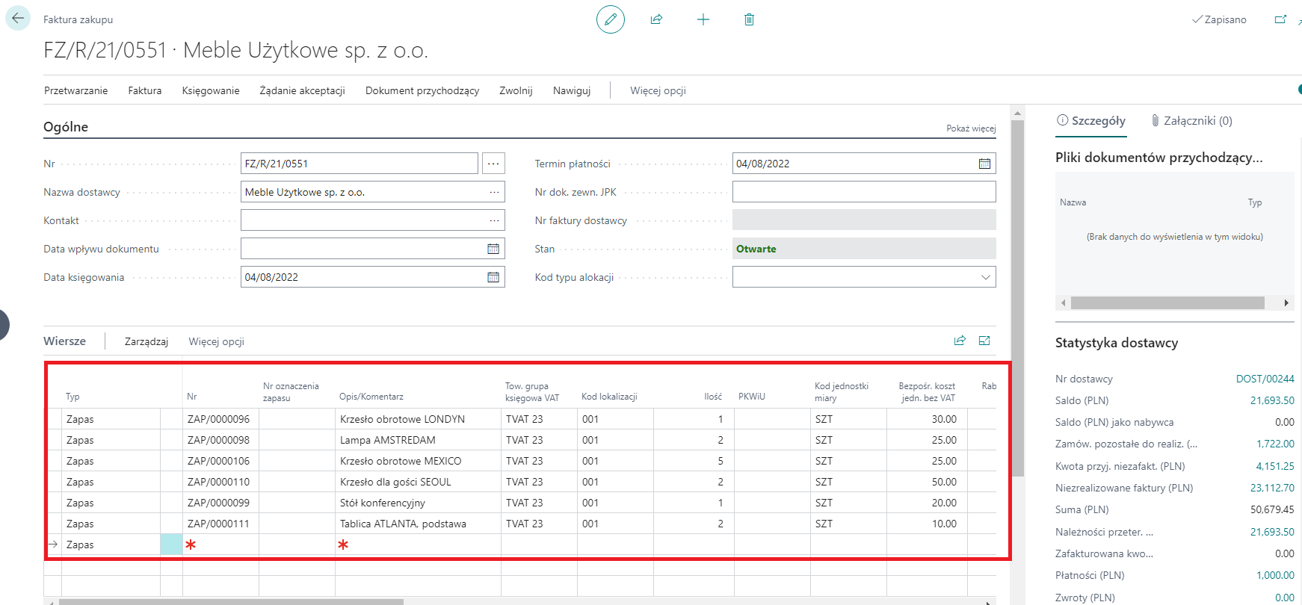

- Ausstellen von Ausgangsrechnungen, Ausgangskorrekturrechnungen, Proforma-Rechnungen und Anzahlungsrechnungen

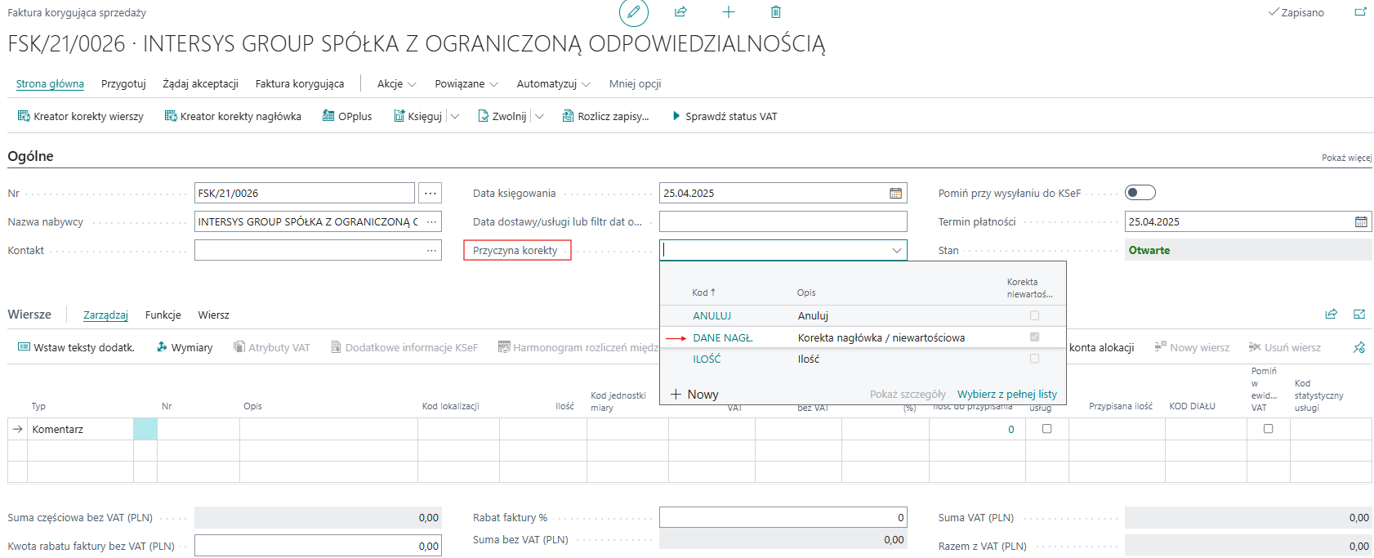

- Möglichkeit, eine Ausgangskorrekturrechnung für mehrere Ausgangsrechnungen auszustellen

- Erfassung der Vorher- und Nachher-Werte und Ermittlung des Grundes für die Korrektur

- Nummerierungsserien für Kreditoren und Debitoren

- Saldenbestätigungen für Kreditoren und Debitoren

- Integration mit der Regon-Datenbank

FUNKTIONALITÄT

- eingebaute Polnische Klassifikation der Wirtschaftszweige PKWiU 2016

- Generieren von Intrastat-Meldungen mit zusätzlichen Feldern in Abhängigkeit von den statistischen Anforderungen und Export von Meldungen im XML-Format

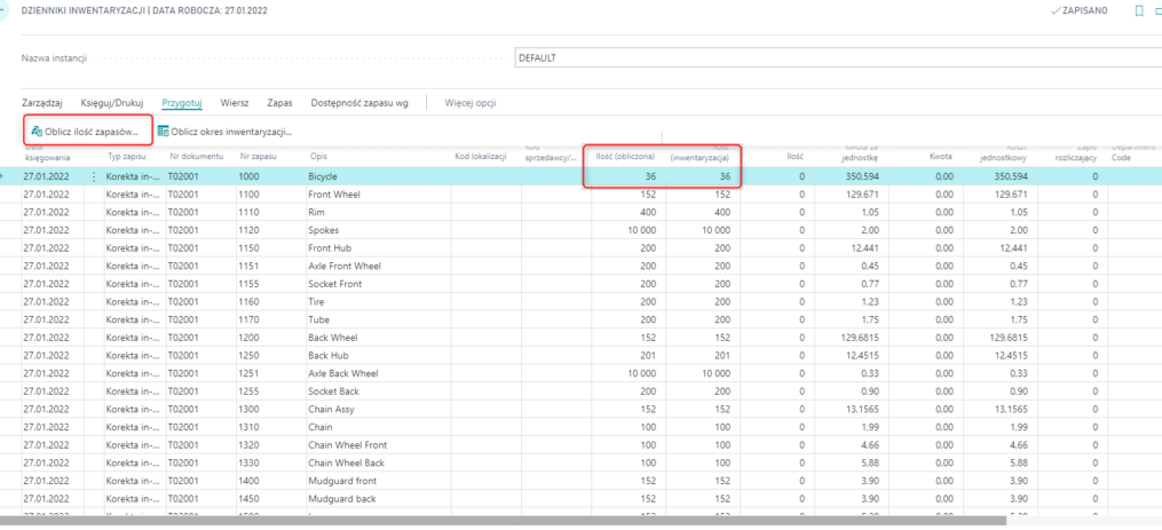

- Generieren einer Inventurunterlage mit der Menge und dem Wert der aufgenommenen Bestände und den Unterschriften von verantwortlichen Personen als Bestätigung für die Beendigung der Inventur

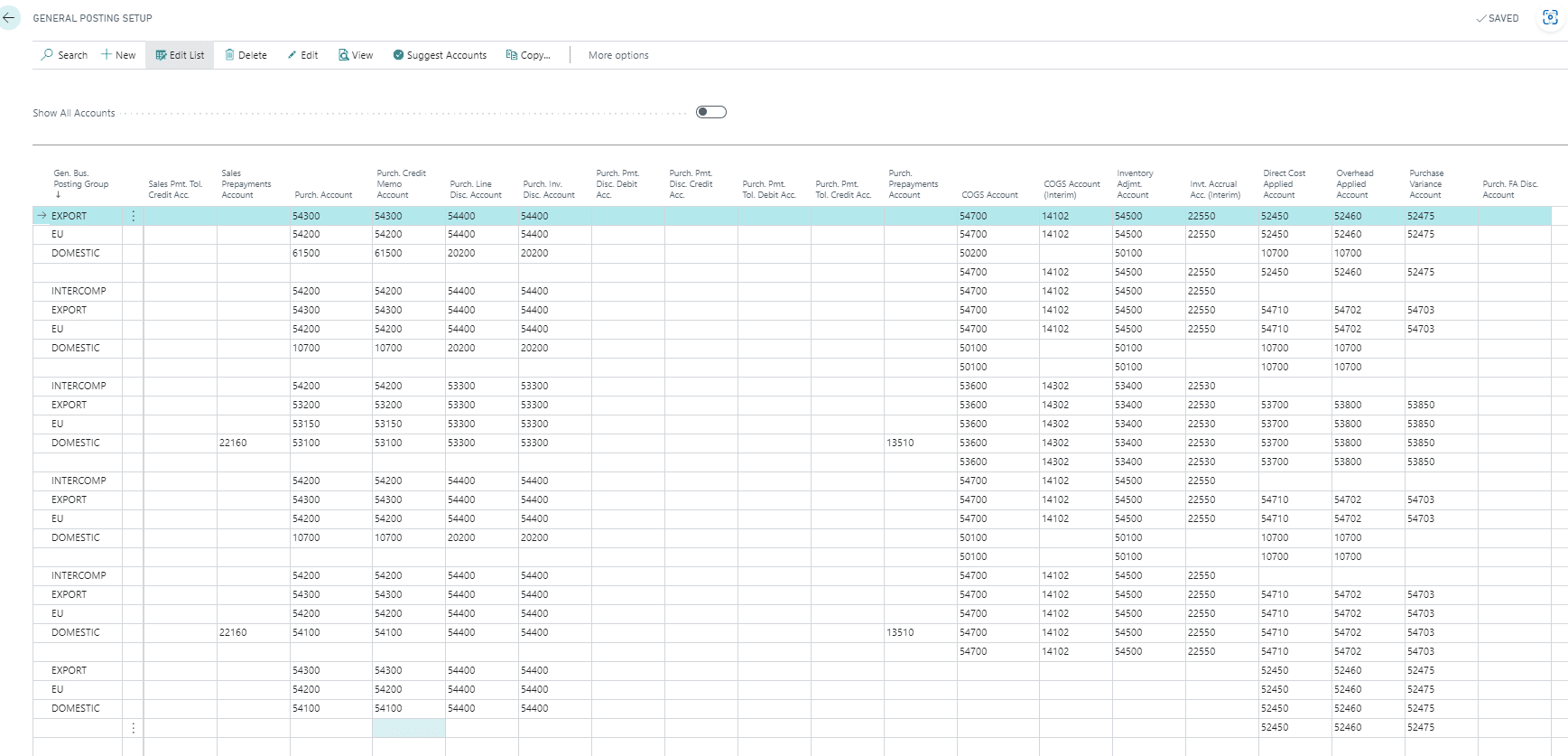

- Bestimmung von Standardcodes für die allgemeine Geschäftsbuchungsgruppe für Bestandsüberschüsse und Bestandsmängel, die sich aus der Bestandsaufnahme ergeben

FUNKTIONALITÄT

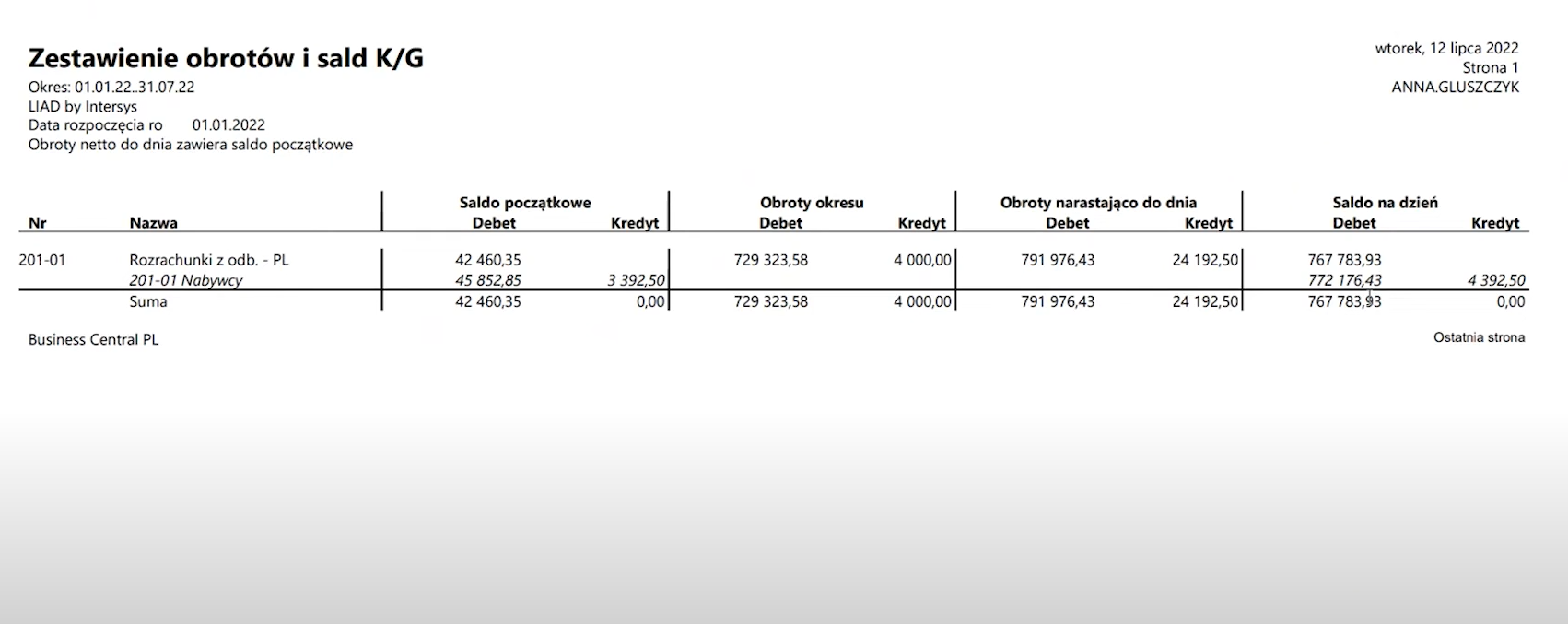

- Summen- und Saldenliste

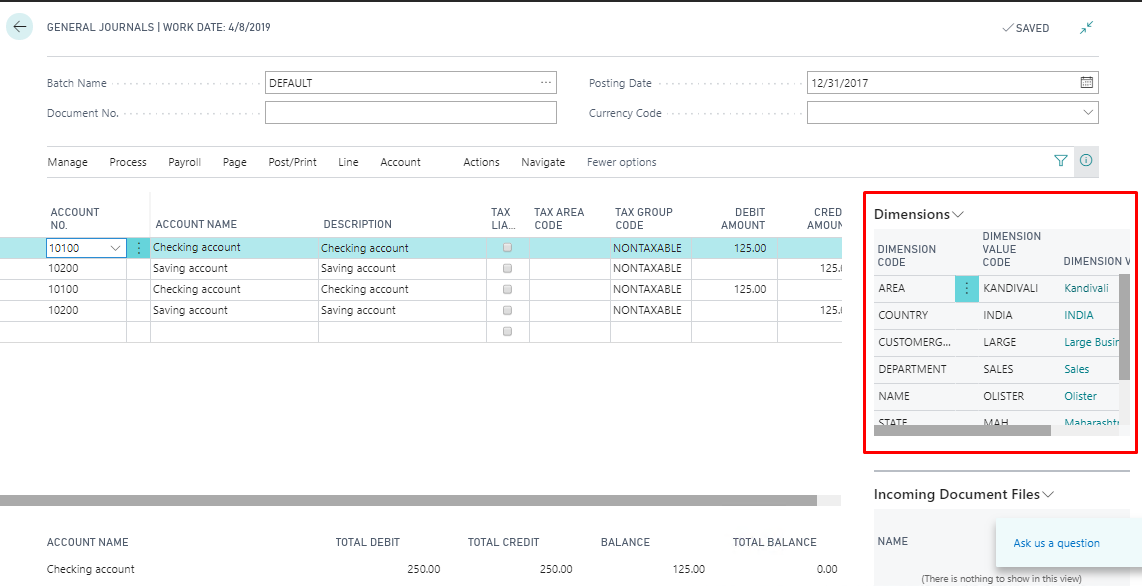

- Journale des Hauptbuches, Debitoren- und Kreditorenjournale – chronologische Reihenfolge von Geschäftsvorfällen

- Haupt- und Nebenbuchberichte

- Hauptbuchbericht – Drucken der Kontierung für gebuchten Beleg

- Hauptbuchbericht Einkauf und Verkauf – zeigt gebuchte Verkaufs-/Kauftransaktionen mit detaillierten Informationen an

- Analyse der Altersstruktur von Forderungen/Verbindlichkeiten – in tabellarischer Form, mit der Möglichkeit der Filterung

- Analyse der Bestandsalterung – wert- und mengenmäßig in vier beliebig ausgewählten Perioden

FUNKTIONALITÄT

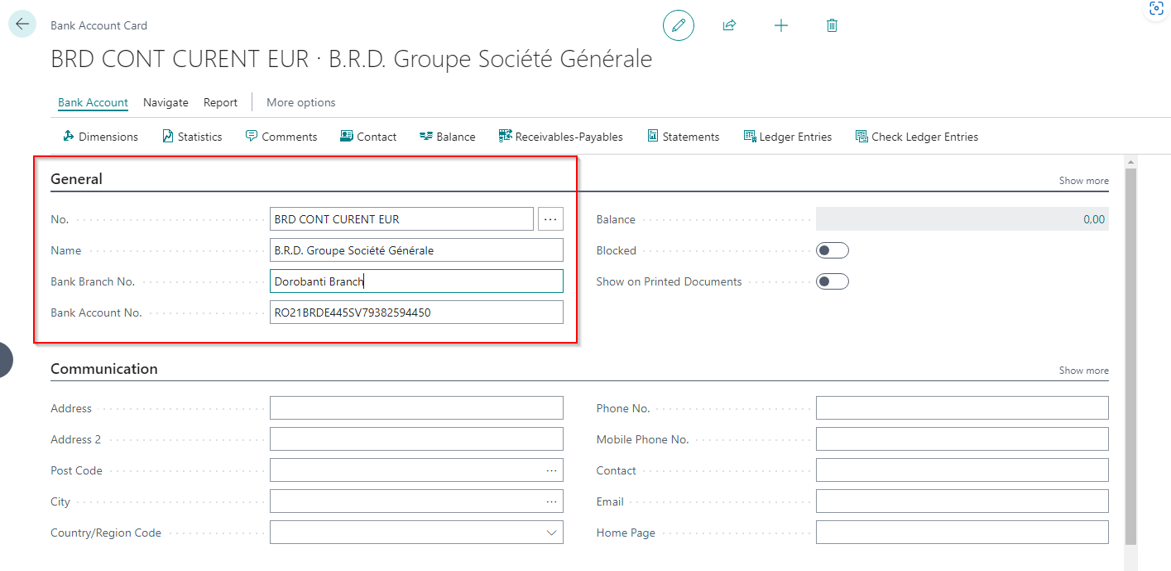

- Buchung von Bargeld- und Bankgeschäften in Eigenwährung und in Fremdwährung

- Berechnung von Wechselkursdifferenzen nach FIFO, LIFO, gewichtetem Durchschnitt

- Export von Überweisungsaufträgen an die Bank und Import von Kontoauszügen in das System nach der Installation der Electronic Banking App

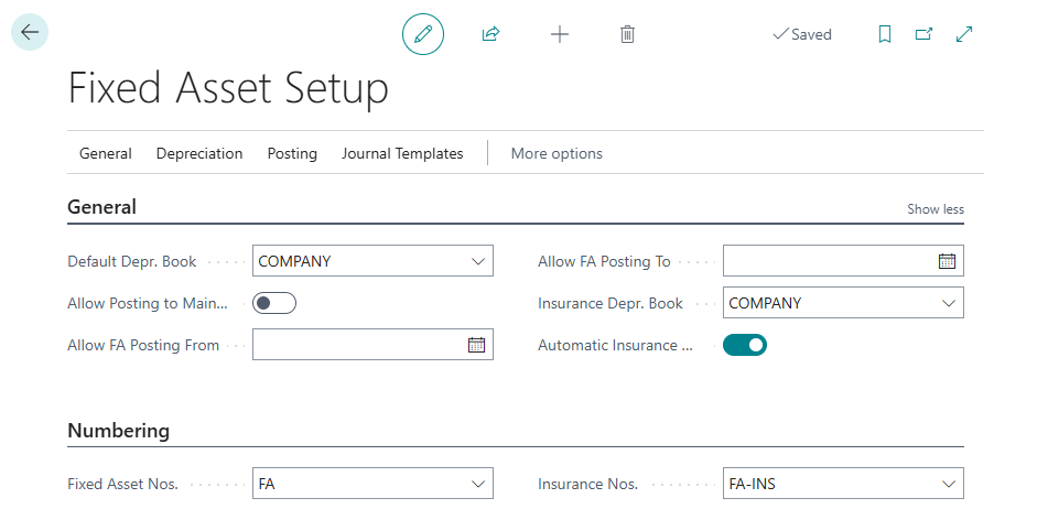

FUNKTIONALITÄT

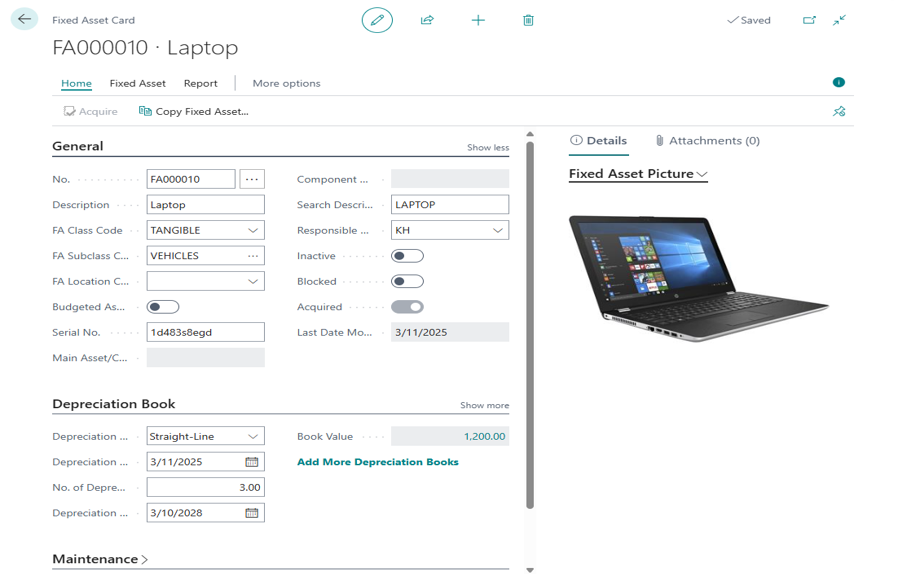

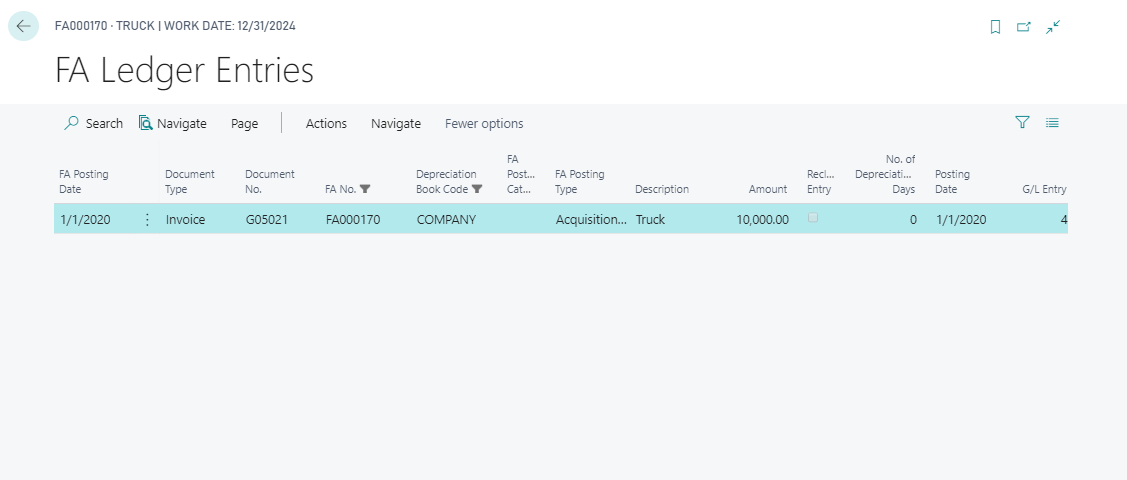

- Berichte über das Anlagevermögen: Anlagenkarteien mit detaillierten Daten, OT-Bericht über Abnahme des AV zur Nutzung, Abschreibungstabellen nach Anlagengruppen, Bericht über verkauftes / liquidiertes Anlagevermögen, Liste der Anlageninventuren, Bericht nach der Bewertung des Anlagevermögens für die Zwecke des Jahresabschlusses

- Statistische Berichte DNU-K/DNU-R mit statistischen Codes für Zwecke des Berichts über den internationalen Dienstleistungsaustausch

FUNKTIONALITÄT

- Support von Split Payment für Eingangs- und Ausgangsrechnungen

- Support auf Basis von PKWiU-Codes und USt-Klauseln

- Möglichkeit, die Split Payment-Verpflichtung ab einem bestimmten Betrag standardmäßig zu definieren

- Das System selbst teilt den Betrag aus Ausgangs- und Eingangsrechnungen (sowie Korrekturrechnungen und Aufträgen), die bei Erfüllung der gesetzlichen Voraussetzungen obligatorisch der Split Payment-Pflicht unterliegen, in Nettobetrag und Umsatzsteuer auf

FUNKTIONALITÄT

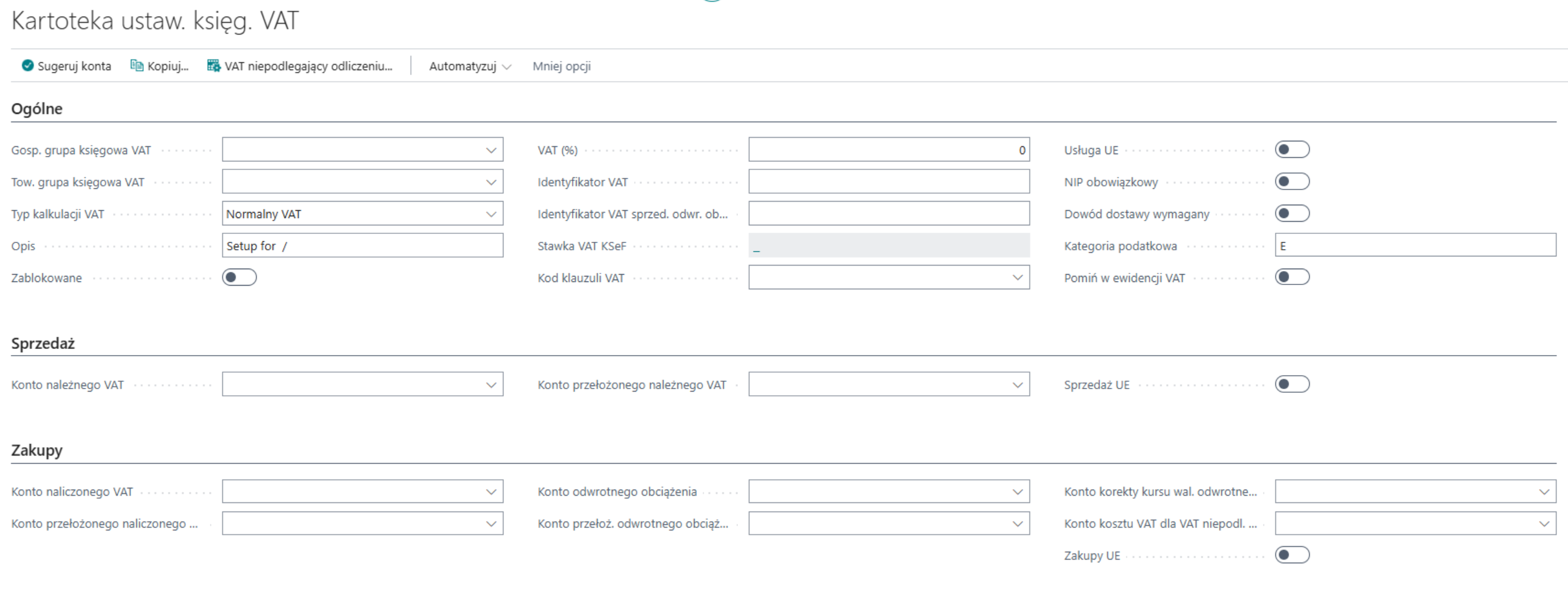

- voller Support für zu zahlende Steuer und Vorsteuer, igE und igL, nicht abzugsfähige Umsatzsteuer, Umsatzsteuer mit Teilabzug, Umsatzsteuer mit Umkehrung der Steuerschuldnerschaft und Umsatzsteuer auf unentgeltliche Überlassung

- Generieren von VAT-Registern

- Umsatzsteuerabrechnungsblatt, dank dem der Benutzer die Kontrolle über Steuerstundung, Steuerzahlung, Änderung des Verpflichtungsdatums, Weglassen der Umsatzsteuer in den Aufzeichnungen und Änderung des Wechselkurses für die Umkehrung der Steuerschuldnerschaft hat

- eine Reihe von USt-Attributen, die vom Finanzministerium benötigt werden - das System ermöglicht es Ihnen, USt-Attribute auf gebuchten Belegen zu ändern

- Bericht über Umsätze, für die in einem bestimmten Zeitraum kein Recht auf Vorsteuerabzug bestand

- Prüfung, ob das Bankkonto auf der Weißen Liste der Umsatzsteuerpflichtigen steht sowie Prüfung des Status des Umsatzsteuerpflichtigen

- Generieren von Zusammenfassenden Meldungen im XML-Format für bestimmte Umsatzsteuerzeiträume unter Berücksichtigung von Dreiecksgeschäften

FUNKTIONALITÄT

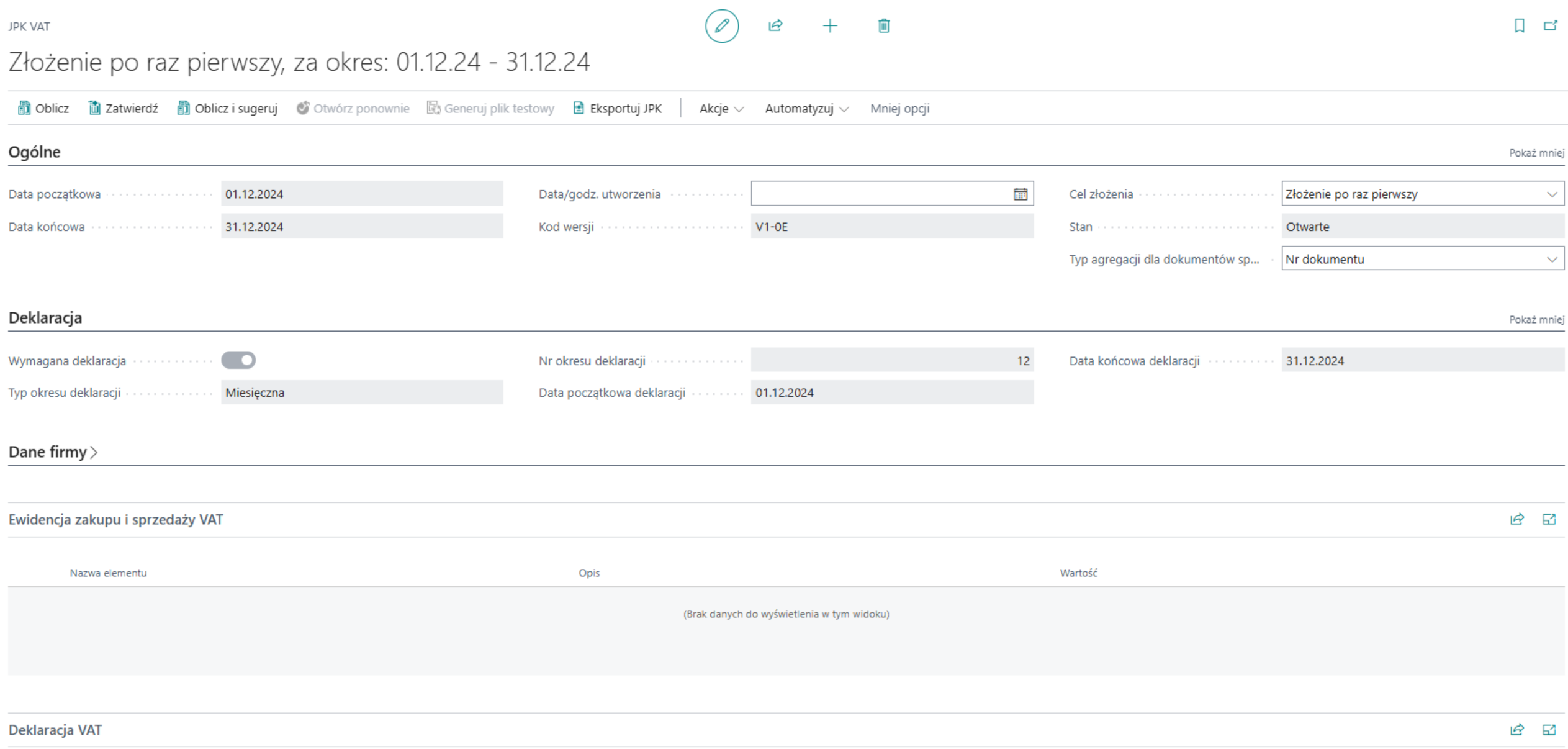

- Generieren von SAF-T-Berichten wie JPK_VAT (JPK_7M/ JPK_7K), JPK_FA, JPK_WB, JPK_KR, JPK_MAG, JPK_KR_PD JPK_ST_KR im XML-Format

- Einstellungen nach Leitlinien des Finanzministeriums

- Möglichkeit, das automatische Generieren von SAF-T-Berichten zu definieren

- Möglichkeit, Hauptbuchkonten mit einem Attribut für Zwecke von JPK_KR_PD zu markieren

- Auswahl der JPK-Version beim Generieren des Berichts

- Versand an das Finanzamt mit einer Anwendung des Finanzministeriums (JPK Client WEB) oder mit einer anderen externen Software

- Das System speichert historische JPK_VAT mit Voranmeldungen und ermöglicht bei Bedarf den erneuten Versand

FUNKTIONALITÄT

- unterstützt den Versand von Ausgangsrechnungen und das Abrufen von Eingangsrechnungen

- ermöglicht die Kommunikation mit dem KSEF-System über interaktive Sitzungen

- tokenbasierte Authentifizierung

- Unterstützung der aktuellen logischen Struktur

- optionale Daten können manuell hinzugefügt werden

- Überprüfung von Ausgangsrechnungen während der Buchung im Hinblick auf die Übereinstimmung der XML-Datei mit der vorbildlichen logischen Struktur von E- Rechnungen im XML-Format

- Möglichkeit, bestimmte Belege oder Käufer zu überspringen

- Versand beschränkt auf die im System gebuchten Rechnungen

- Import von strukturierten Eingangsrechnungen

- Einstellen von heruntergeladenen Rechnungen ins Import-Register

- Download und Lesen der amtlichen Empfangsbestätigung (UPO)

Optionale Anwendungen

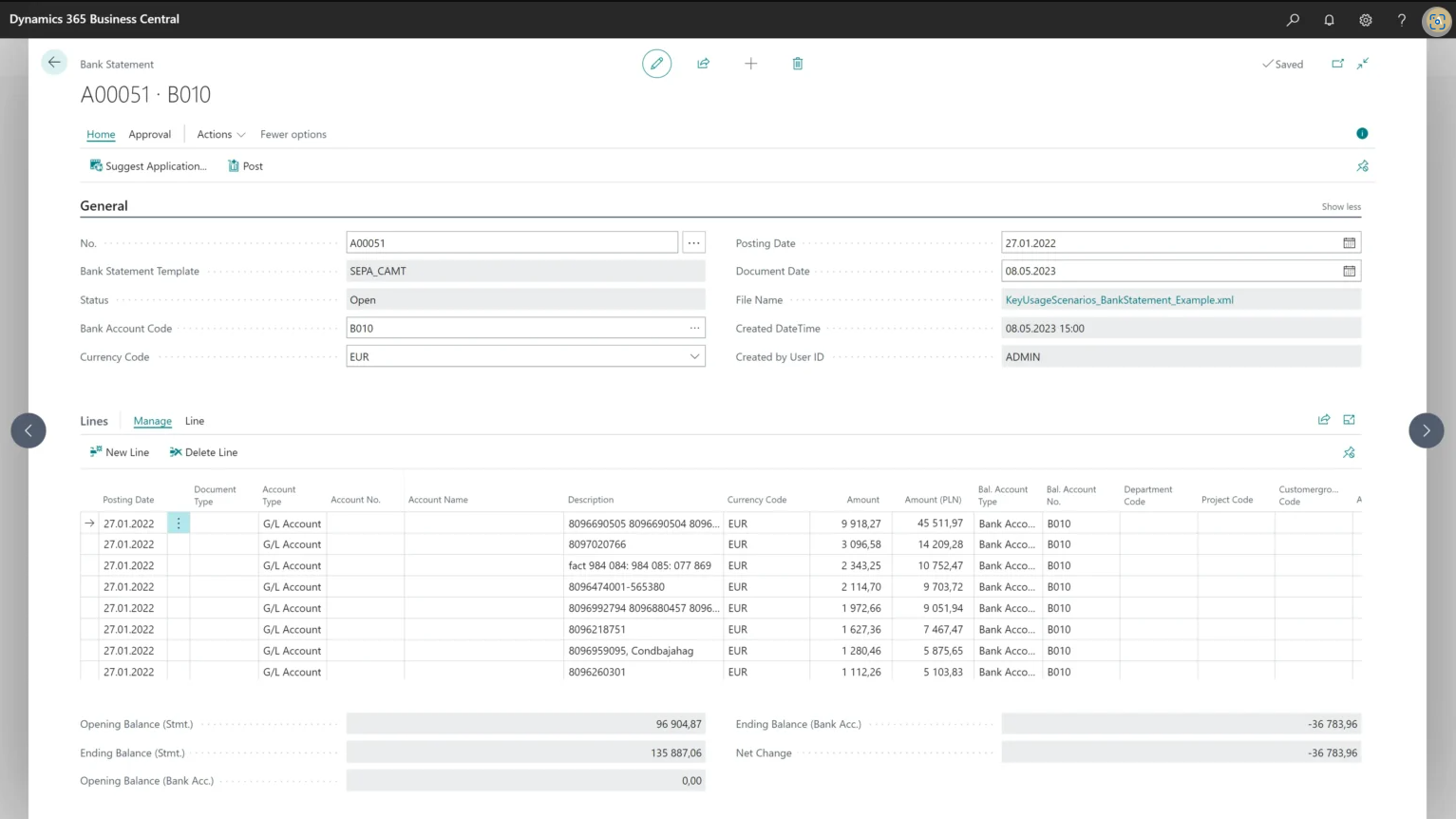

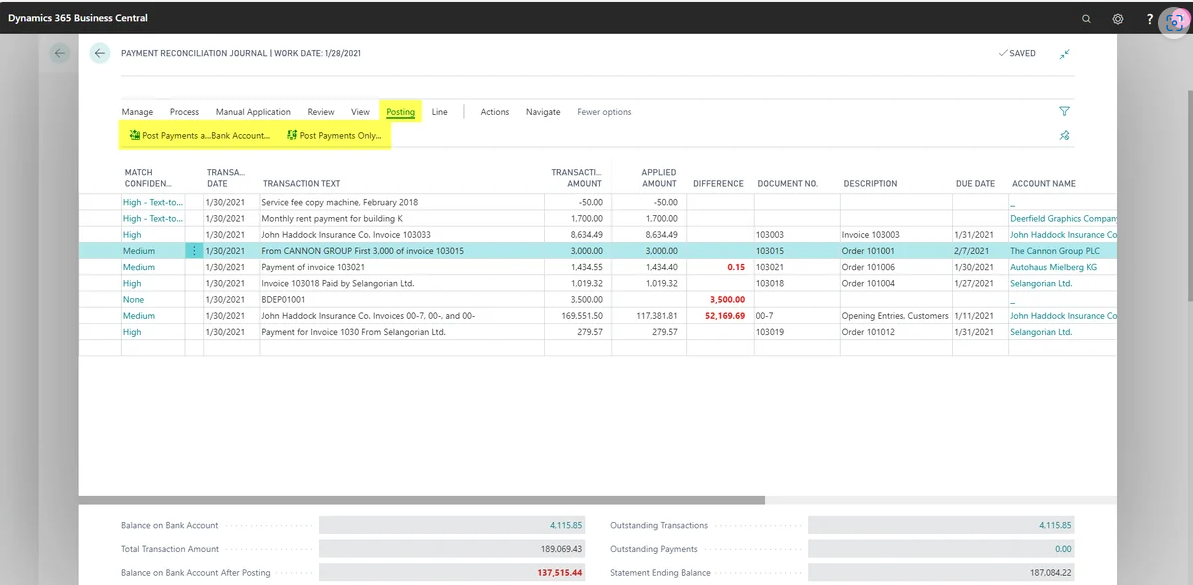

Diese App ist eine Erweiterung der Standardfunktionen des Online-Banking im ERP-System Microsoft Dynamics 365 Business Central. Das Modul ermöglicht die Integration des Systems mit Banken und erleichtert die täglichen Finanzvorgänge in Business Central dank der Verbesserung der Abwicklung von Überweisungen an Banken und des Imports von Kontoauszügen sowie der Abrechnung von Zahlungen in Business Central.

Das Electronic Banking-Modul richtet sich sowohl an Unternehmen, die in einem Land tätig sind, als auch an global agierende Unternehmen. Diese Erweiterung ist so konzipiert, dass sie vollständig in die Lokalisierung für D365 Business Central integriert werden kann.

Die Electronic Banking App ist in zwei Versionen verfügbar:

- Electronic Banking Base App – unterstützt das Senden von Überweisungsaufträgen an die Bank und das anschließende Herunterladen von Kontoauszügen und deren Zuordnung im System

- Electronic Banking Extension – empfohlene Option, wenn Banken aus verschiedenen Ländern mit unterschiedlichen Schnittstellen unterstützt werden, einschließlich Split-Payment-Support

Verfügbare Funktionen in der Electronic Banking App:

- Support für polnische Banken (MT940, SEPA)

- Zusammenarbeit mit den meisten globalen Banken

- Split-Payment-Support

- Validierung mit dem Register der aktiven Umsatzsteuerpflichtigen

- einfache Integration mit der polnischen Lokalisierung

- unterstützte Formate: SEPA, XML, MT, CSV

- direkte Kommunikation über Webdienste

- direkte Kommunikation mit SFTP

- einfacherer Banking-Support: Export von Zahlungsvorschlägen an die Bank, Import von Kontoauszügen mit automatischer Zuordnung, Register der Bankgeschäfte, die Möglichkeit, weitere zu unterstützende Banken hinzuzufügen

- verfügbare Schnittstellen für folgende Banken: Alior, BGK, BNP Paribas, Citi Handlowy, Credit Agricole, Danske Bank, Deutsche Bank, HSBC, ING, Millennium, mBank, Nest Bank, Pekao SA, PKO BP, Santander, SEB, Societe Generale, Bank of America, Bank Spółdzielczy Krokowa

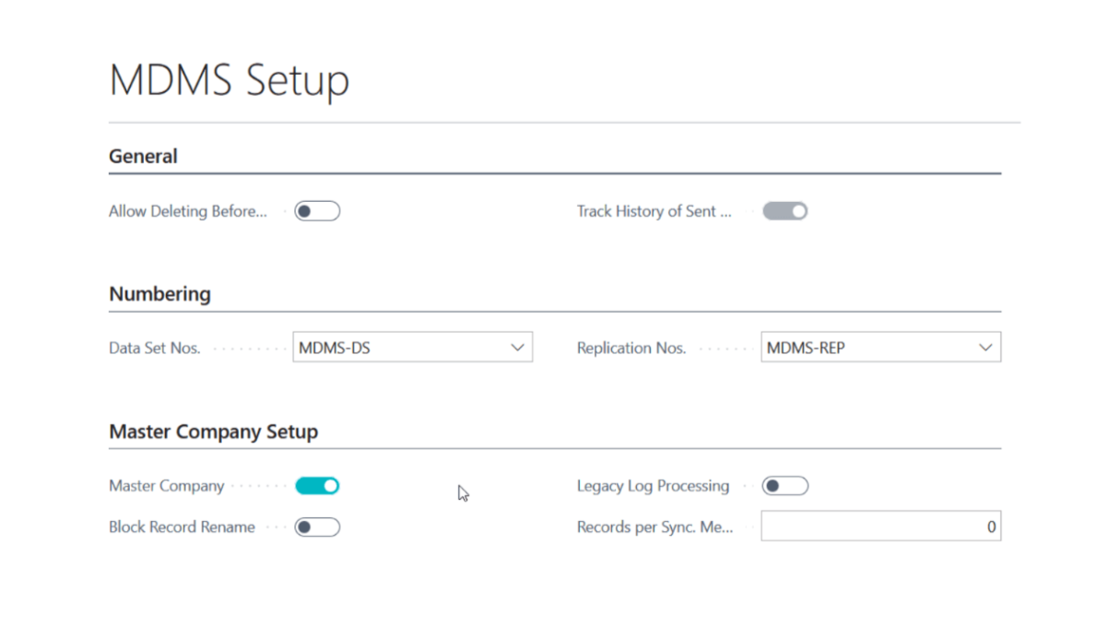

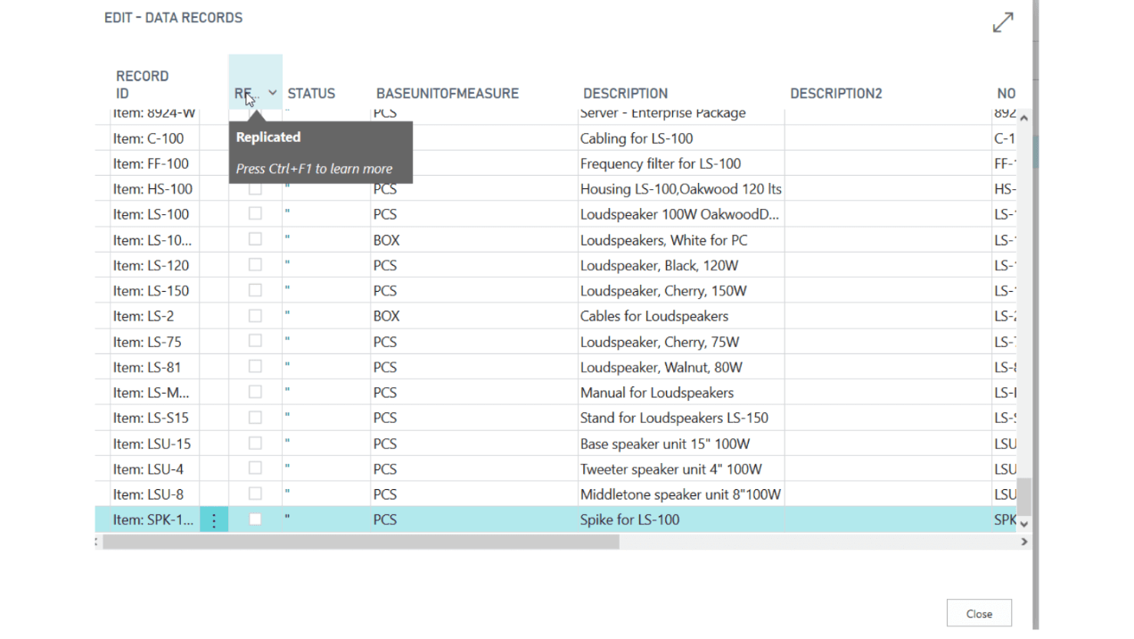

Das Master Data Management System ist eine Erweiterung von Microsoft Dynamics 365 Business Central, die für multinationale Unternehmen mit mehreren Niederlassungen entwickelt wurde. Die Anwendung ermöglicht die zentrale Verwaltung und Synchronisierung von Schlüsseldaten zwischen den Tochtergesellschaften, wodurch Inkonsistenzen beseitigt und eine einheitliche Betriebspolitik unterstützt wird. Durch die Standardisierung von Daten erhalten Unternehmen eine bessere Kontrolle über Prozesse, eine höhere betriebliche Effizienz und eine solide Grundlage für die weitere digitale Transformation.

Funktionen, die im Master Data Management System verfügbar sind:

- Stammdatenmanagement innerhalb verschmolzener Unternehmen einer Organisation

- einfaches Kopieren von Kreditoren/Debitoren/Konten/Dimensionen/Benutzerrollen zwischen Unternehmen

- einfache Gründung eines weiteren Unternehmens

- bessere Kommunikation zwischen Unternehmen

- Standardisierung von Prozessen in der gesamten Organisation

- schnelles und standardisiertes Reporting in allen Unternehmen

- einfaches Service-Management

- zentrale Beschaffung umsetzbar

Warum ist RSM Poland die richtige Wahl für Ihr Unternehmen?

RSM Poland ist einer der führenden Microsoft Dynamics 365 Business Central Partner in Polen. Unser Team besteht aus qualifizierten Spezialisten – zertifizierten Business Central Consultants und Developern sowie erfahrenen Steuerberatern, Buchhaltern und Wirtschaftsprüfern, die die Komplexität der polnischen Vorschriften perfekt verstehen.

Wir bieten umfassende Unterstützung bei der Implementierung der Lokalisierung für Dynamics 365 Business Central und Hilfestellung nach Abschluss des Projekts. Unsere Experten haben bereits vielen Unternehmen geholfen, ihre wichtigsten Geschäftsprozesse zu verbessern und ihre Ziele zu erreichen. Wir unterstützen Unternehmen aller Branchen und Sektoren, indem wir unsere Lösungen an ihre individuellen Bedürfnisse anpassen.

Get a 100% free customized demo from a Microsoft expert at RSM Poland

Complete this form and an RSM representative will be in touch.