Greenwashing is the practice of making misleading claims regarding the sustainability credentials of products and services offered by businesses, and has become a key concern for businesses and their stakeholders worldwide. As climate consciousness in society deepens, businesses should pay heightened attention to the sustainability claims they make.

The SGX RegCo in Singapore has outlined various steps to tackle greenwashing by publicly-listed companies. The issue has also been debated in the Singapore Parliament, with the Government studying developments on greenwashing regulations in other developed countries.

Given the perceived prevalence of greenwashing and increasingly stringent regulations to deter this, it is critical for corporations to understand how to reduce the risk of greenwashing.

WHY DO COMPANIES GREENWASH?

There are undoubtedly benefits to being perceived as a “green” company. Companies that are perceived to be genuinely committed to sustainability are likely to be rewarded with greater investor confidence and financial returns over the long term. For instance, global conglomerates such as Tata Group and Unilever have aligned ESG (Environmental, Social, and Governance) strategies with the core of their businesses. Along with commitments to maintaining reliable and objective ESG disclosures, these businesses have enjoyed strong returns and performance over the past decade.

However, greenwashing is a complex and multi-faceted issue. It can result from an honest mistake or even initiated by deliberately fraudulent misrepresentation.

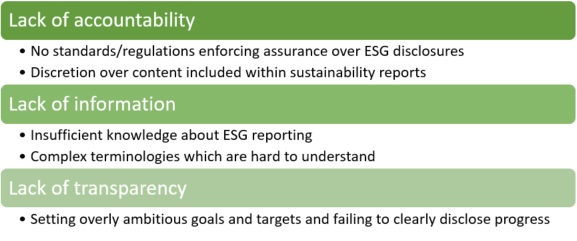

For instance, a “greenwashed” claim could have been initiated due to a lack of ESG domain knowledge within the organisation. Other scenarios include unscrupulous engagements in market manipulation, or even attempts to manipulate reported metrics to qualify for green loans. There are 3 broad reasons why companies engage in greenwashing:

THE RISKS OF GREENWASHING

Greenwashing is clearly unethical and can mislead users of ESG information. Not only does greenwashing pose reputational risks for corporations that engage in it, but it also exposes business leaders to possible litigation risks. The costs of greenwashing can, therefore, be financially damaging.

For example, in the case of Volkswagen, public backlash and fallout from the emissions scandal in 2016 resulted in hefty fines, a sharp fall in share price and dismissal of members from their leadership team. This also impacts their ability to attract/retain talent and maintain the confidence of stakeholders, regulators and supply chain partners.

Business owners and key management personnel must therefore understand the various risks of greenwashing and take progressive measures to safeguard themselves.

WHAT IS CURRENTLY BEING DONE?

At present, the regulations governing ESG reporting differ from country to country. To tackle this, the International Sustainability Standards Board is developing a set of standards for ESG reporting to be released by the second half of 2023.

The new ISSB standards will provide consistent guidelines for companies to measure, report, and disclose ESG information. This will help to ensure a degree of consistency and comparability in the ESG information being reported, which will, in turn, promote greater reliability and comparability of ESG disclosures.

Closer to home, the Singapore Exchange Regulation (SGX RegCo) has mandated listed issuers to subject their sustainability reporting process to internal review and may additionally commission an independent external assurance on the sustainability report. Together with the Accounting and Corporate Reporting Authority, SGX Regco is also working towards issuing a public consultation in mid-2023, covering areas such as:

a. Scope of companies required to report;

b. Mandatory reporting framework;

c. Assurance requirements; and

d. Legal responsibilities and offences.

With the harmonisation of ESG reporting standards and the increasing pressure placed on Singapore businesses to report their ESG practices, it is clear that the economy will place great importance on the reliability of ESG information to drive consumer, business and investment decisions.

RESPONSIBILITIES OF THE BOARD

Business leaders need to be well-equipped with the necessary skills to set and provide oversight of their business goals and ESG targets. Company directors are required to act honestly and in good faith. They can be held liable under securities regulations for false or misleading statements. The SGX has mandated that directors of issuers are to attend sustainability-related training to enhance their understanding and capabilities in the area of ESG.

Board members who play a critical role in advising and setting ESG priorities for companies, should therefore ask themselves whether they have:

- The right capabilities, qualifications and relevant experience to support the Company in its ESG journey.

- A clear alignment of ESG strategy and the Business mission and objectives.

- Realistic ESG targets and the means to address the impact from climate change risk.

- Prioritised efforts to support ESG initiatives and related business transformational plans.

- Regular means of benchmarking ESG performance against comparable market players.

- A sound framework to provide assurance over ESG matters reported.

In conclusion, business leaders have come to understand the importance of putting ‘Planet before Profits’. As ESG awareness continues to grow across the corporate community, the risks and detrimental impact of greenwashing will also continue to escalate. Therefore, business leaders need to set the right ‘tone at the top’ and emphasise the governance and principles that drive reliable and accurate ESG reporting.