CONTRIBUTOR

As Australia grapples with shifting fiscal tides, it's not just about numbers on spreadsheets but the lives of everyday Australians caught in the currents of economic change.

Financial uncertainties for an Australian, whether a consumer or a business, in the face of cost-of-living pressures and an elevated cost of operation, underscores the need for effective measures to alleviate burdens, illuminating yet again the human dimension of policy setting.

While the boost to public spending offers a glimmer of hope, we remain cautious, aware of the fragile balance between short-term relief and long-term sustainability.

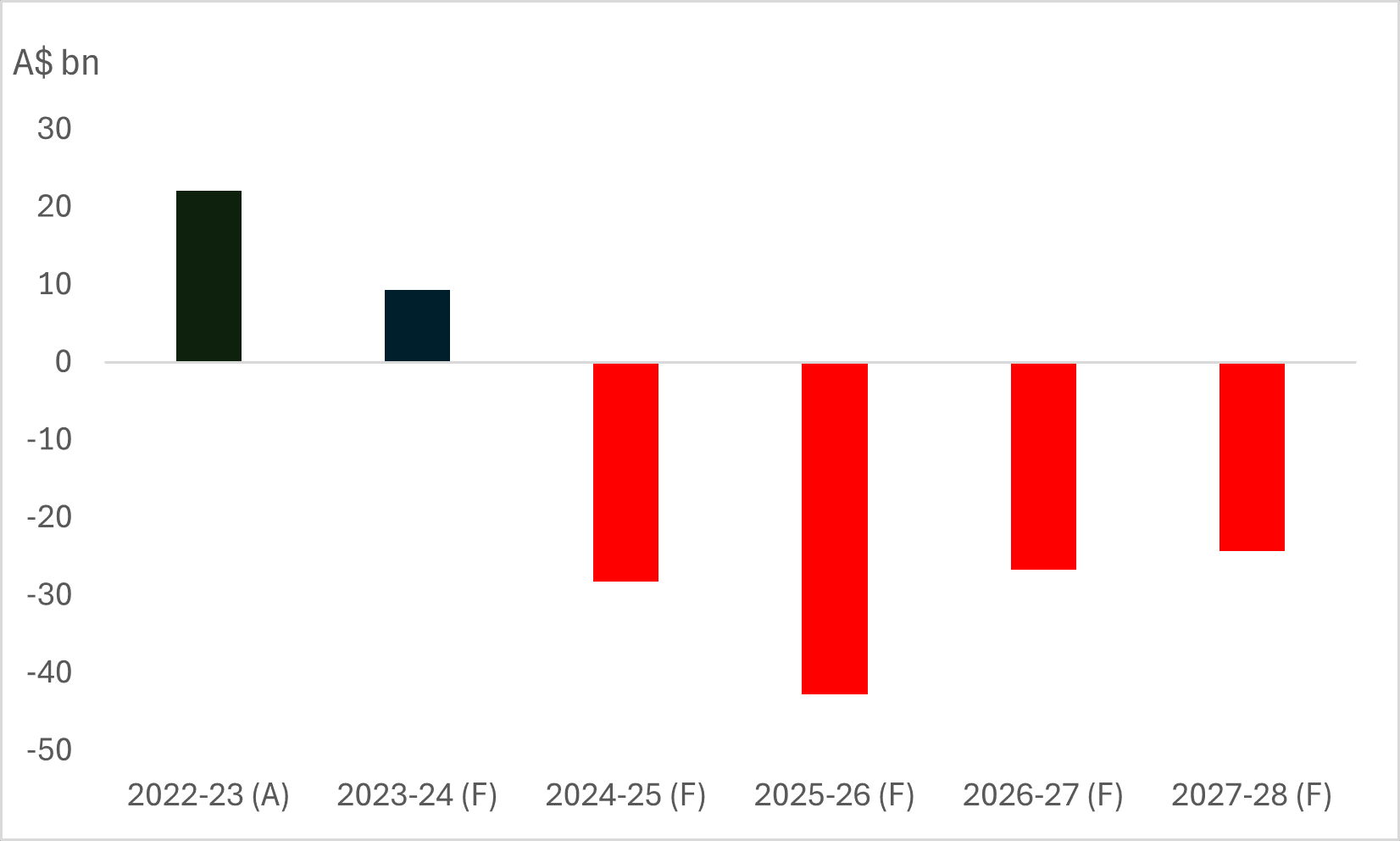

To date, commodity prices and a robust labour market have resulted in consecutive budget surpluses which are set to be reversed by projected deficits driven by increased spending and economic uncertainties. The Budget forecasts a surplus of $A9.3bn for 2023/-24 followed by significant deficits of $A28.3bn in 2024/-25 and $A42.8bn in 2025/-26.

Acknowledging the Treasury's typically conservative approach to forecasting commodity prices, it wouldn't come as a shock if the eventual fiscal position surpasses initial projections.

Source: Australian Treasury, Federal Budget 2024-25

Fiscal measures aimed to alleviate cost-of-living pressures begin with every Australian taxpayer set to receive tax cuts averaging $36 per week. Additionally, a significant allocation of $3.5bn has been earmarked to provide $300 in energy bill relief to all Australian households. Other measures include a waiver of $3bn in student debt and an increase in Commonwealth Rent Assistance by 10%. These initiatives collectively represent a comprehensive approach to address immediate financial burdens faced by individuals across the country.

In tandem with efforts to ease living expenses, substantial investments are being directed towards housing initiatives and infrastructure development. $6.2bn has been allocated for new housing investment with an additional $1bn set aside to assist states and territories in constructing more homes, aiming to alleviate housing shortages and facilitate affordable living options. Simultaneously, $16.5bn is aimed at infrastructure projects looking to connect cities and towns.

On the industry side, some key measures include a focus on renewable energy and healthcare enhancements, including an allocation of $22.7bn for renewable energy and $2.8bn and $3.4bn for Medicare services and pharmaceutical listings respectively. The budget also allocates $22.7bn over the coming decade for the Future Made in Australia initiative. Under this plan, the government will institute a National Interest Framework to define key industries and investment priorities.

What Lies Ahead

👉Concerns linger regarding the delicate balance between fiscal stimulus and inflationary pressures. The government's primary emphasis remains on addressing cost of living pressures but to say the Budget is not inflationary would be to deny the obvious.Today's Budget will likely make it harder for the Reserve Bank of Australia (RBA) to bring inflation down to target in the real sense. What we mean is, the measures, while targeted towards bringing down headline costs, risk stoking demand-driven inflation if Australian households do not show restraint in spending the extra cash. The proposed relief measures, some of which are neither targeted nor temporary, carry the risk of reversing the progress made on reducing inflation to date.

👉The contrasting perspectives on inflation and growth between the government and the central bank are starkly illustrated by the forecasts released by the Treasury today and the RBA in its recent Statement on Monetary Policy. Even if one were to entertain the notion that the RBA's inflation forecasts were adjusted upwards due to a lack of awareness regarding the subsidies outlined in today's Budget, we believe the RBA has demonstrated sufficient foresight in accounting for potential inflationary pressures within its economic outlook. Indeed, inflation is expected to decrease due to the subsidies; however, it's uncertain whether cost-cutting measures will result in sustained reductions in inflation over the long term.

👉It is unlikely the RBA will see the effects of this stimulus activity for another two quarterly CPI cycles, or until at least November 2024, at which point interest rates could go either way. Even if the RBA feels that the current 4.35% interest rate is sufficiently restrictive, it may be compelled to contemplate interest rate hikes, with the intention of directing the surplus funds toward mortgage repayments rather than discretionary expenditures.