Authors

As the end of financial year looms, everyone is thinking about tax.

That makes it a good time to examine the value of asset write-off rules. Temporary full expensing of depreciating assets has been extended, but do small businesses benefit?

Instant asset write-off rules have been around for longer than most think. They started on 1 July 2001 when eligible small business entities were able to claim an immediate tax deduction for items less than $1,000.

Over time, the rules for tax deductions for depreciating assets have evolved in response to economic changes.

After recent government announcements, eligible businesses can now claim an immediate tax deduction under the “Temporary Full Expensing” or TFE rules for assets purchased for business use and either used or installed ready for use before 30 June 2023.

But have we really benefited?

Who is eligible for Temporary Full Expensing of depreciating assets?

To be an eligible business, you need to have an aggregated turnover of less than $5 billion, and the amount you can claim as a tax deduction is unlimited.

You can purchase as many eligible assets, for whatever price. In certain circumstances, they can even be second-hand assets.

Has the TFE rules helped Small Businesses?

The question remains, has this extension and the current rule really benefited small businesses?

Let’s look at an example:

A farming business purchases a new tractor.

- Purchase Invoice date – 1st May 2022

- Purchase price - $500,000 GST Exclusive

- Delivery date to farm – 10th May 2022

- Sold 1st July 2028 for $100,000 GST Exclusive.

Tax Implications for the business

Without the TFE rules:

- The tractor would be depreciated over its useful life of 12 years (16.67% annually) under the rules of Division 40 of the Income Tax Assessment Act 1997.

- The depreciation would be calculated on a diminishing value basis each year.

- This means that the depreciation claim each year is based on the closing written down value after depreciation of the previous income years.

With the TFE rules:

- All the GST exclusive cost of the tractor is claimed as a tax deduction in the year that the tractor is purchased, being the year ended 30 June 2022.

- There are no further depreciation claims in future years for the tractor as it then has a nil written down value.

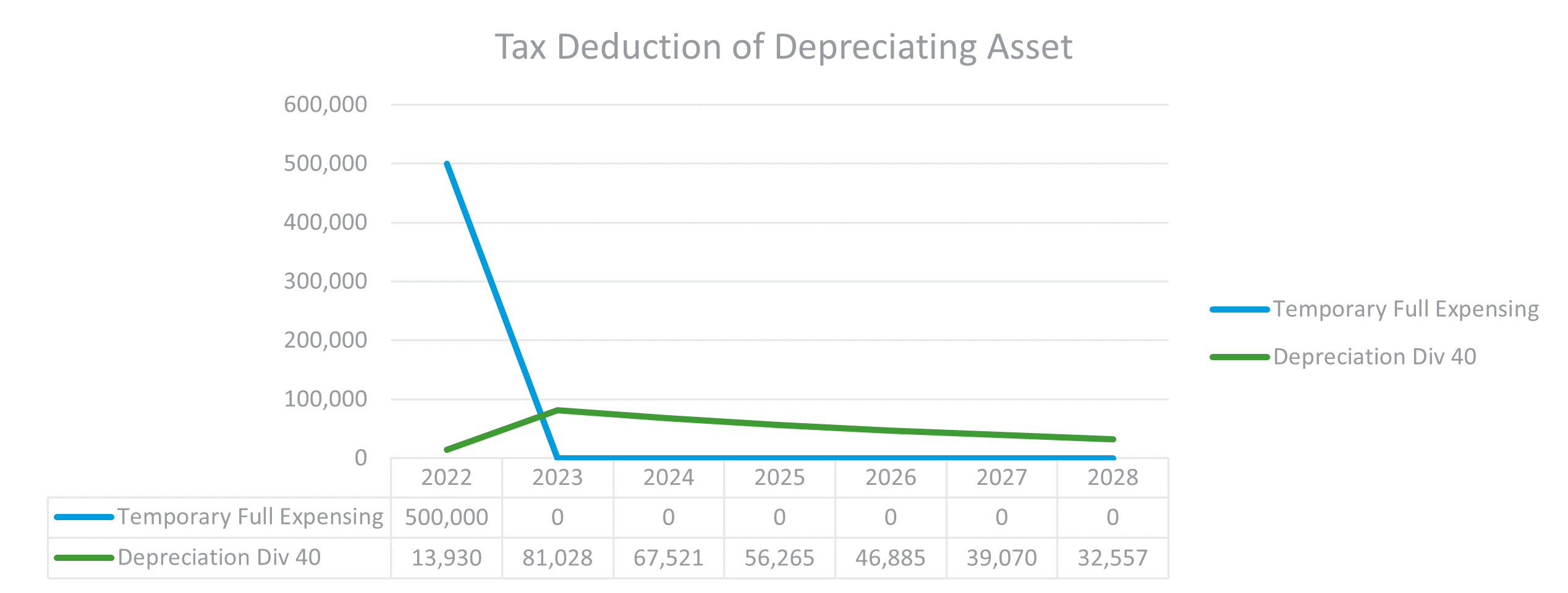

This table shows the difference in the amounts of depreciation claimable as a tax deduction.

Only a small amount of depreciation is claimed in the 2022 year under the Division 40 rules as the asset was only owned for 61 days of that financial year, versus being able to claim the full amount as a tax deduction under the TFE rules.

The tax deduction difference for the 2022 year under both rules is quite significant if we extend the example to the below table.

|

|

TFE |

Div 40 |

|

Gross Farm Income |

$1,000,000 |

$1,000,000 |

|

Less Cropping expenses |

($400,000) |

($400,000) |

|

Less Depreciation |

($500,000) |

($13,930) |

|

Taxable Farm Income |

$100,000 |

$586,070 |

It is not only in 2022 that there is a large difference. In the remaining years from 2023 – 2028, under the Division 40 rules, the business would benefit from continued depreciation whereas, under the current TFE rules, there is no further depreciation claimable.

Claiming the greater tax deductions now under the TFE rules has certainly been of benefit to many small businesses. Especially in recent years as many have struggled with the impacts of COVID-19.

Although this has been welcomed and is good news for many small businesses, it is also important to take into account what happens when the assets claimed are sold at a later date.

Extending the example further, if we assume that the tractor is then sold on 1 July 2028 for $100,000 GST Exclusive, the tax implications for the sale under both methods are outlined below:

|

|

TFE |

Div 40 |

|

Closing Written Down Value |

$0 |

$139,502 |

|

Sale price |

$100,000 |

$100,000 |

|

Taxable Income / (Deductible Loss) |

$100,000 |

($39,502) |

This shows, that although there are some tax benefits immediately from the TFE rules, you need to be aware that when you sell an asset in the future that has been claimed under these rules, there may be a possible tax consequence.

So, is it really all just a sugar hit now, with a sting in the tail coming in future years?

If you are considering purchasing an asset for your business that will fall under the TFE rules, you need to consider not just the short-term tax implications, but also the longer-term implications as well.

By claiming the larger tax deduction now are you deferring a larger tax bill to a future year where you may not have sufficient cashflow to manage it as you are making equipment repayments?

You may need to consider putting together a longer-term asset replacement plan that outlines both the cashflow and tax consequences of the changes.

Want to make sure that you're aware of the TFE rules and tax implications for your business? Contact your local RSM office to discuss.