With the new obligation for directors of a company to hold a Director Identification Number, it is important to understand if it applies and how it works to ensure your trades business is compliant.

As of 1 November 2021, if you are a director of an Australian registered company, registered foreign company or Aboriginal and Torres Strait Islander corporation it is mandatory to have a Director Identification Number (Director ID) registered through the Australian Business Registry Services (ABRS).

What is a Director ID?

A Director ID is a unique 15-digit identifier for an individual, that once applied for, will be kept for life, regardless of company changes, name changes, residency changes or directorship changes.

Do I need a Director ID?

More than 70% of tradies operate their business as a sole trader; so even if your trade or construction business does not operate day to day through a company, it is important to check if you are a director of a:

- Corporate trustee for a trust that operates a trades business or holds the business assets

- Corporate trustee for a Self-Managed Super Fund

- Land holding company

- Corporate beneficiary that receives profits from a trades business trust or partnership

Research has shown that the number of tradies operating their business as a sole trader is decreasing over time.

If you have recently restructured or looking to restructure you will need to check if a company is involved.

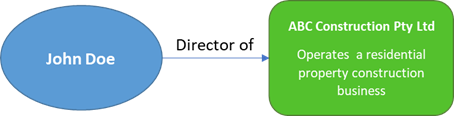

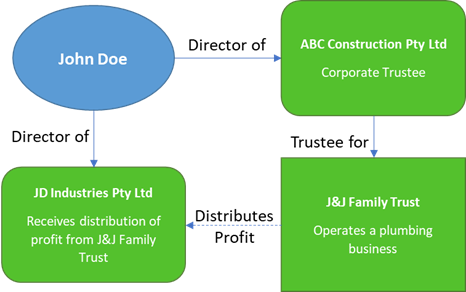

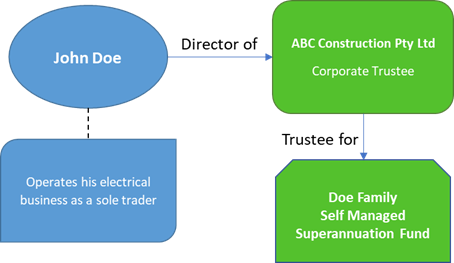

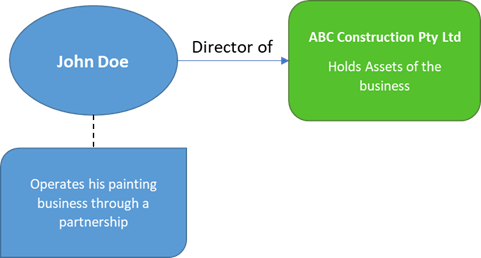

In each of the following scenarios John is required to have a Director ID and is only required to apply for one director ID regardless of how many companies he is a director of.

Scenario 1

Scenario 2

Scenario 3

Scenario 4

| Date you become a director | Date you must apply for a Director ID Number |

|---|---|

| On or before 31 October 2021 | By 30 November 2022 |

| Between 1 November 2021 and 4 April 2022 | Within 28 days of appointment |

| From 5 April 2022 | Before appointment |

When do I need to apply for a Director ID by?

If you were a director pre-November 2021 but have recently been appointed as a director of another company post 1 November 2021, you have the benefit of the 12 months grace period.

How can I apply for a Director ID?

Directors must apply for a Director ID themselves.

Tax agents are not able to apply on behalf of a director. They can however provide guidance on the verification and application process.

You can apply for a director ID in the following 3 ways:

- Online using your MyGov ID – This is the most popular way to apply. If not done so already, you are encouraged to set up your MyGov ID. You can do so by using the following link.

- Calling the ABRS – In Australia call 13 62 50 and outside Australia call +61 2 6216 3440.

- Using paper form – This can only be done within Australia. If you are applying via paper form, copies are not acceptable, original (wet) signatures are required. You can view the form online here.

Before applying, ensure that you have all the required proof of identity documents.

For more information on what documents are required, you can visit here.

What to do next?

Once applied, the Director ID will only be provided back to the director, so it is important to retain this number in a safe place and securely provide it to your ASIC agent or accountant for safe management.

For further information

If you have any questions or would like to speak to a business advisor, please contact your local RSM office.