Australia has shot to international prominence in the transfer pricing world following the Full Federal Court’s recent decision, dismissing the taxpayer’s appeal against the first instance decision in favour of the Australian Tax Office (ATO): Chevron Australia Holdings Pty Ltd v Commissioner of Taxation [2017] FCAFC 62

The decision has global significance for a number of reasons:

- The subject matter – a cross-border financing arrangement;

- The judicial reasoning – consideration is more than simply the interest rate;

- That it was litigated to a judicial conclusion, not settled; and

- The unequivocal result: a resounding victory for the ATO, at a time when other revenue authorities around the world are enjoying less judicial success.

The facts

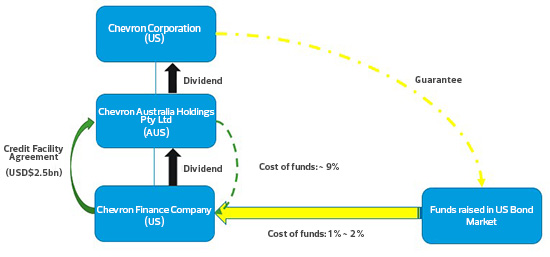

Chevron Australia Holdings Pty Ltd (CAHPL), an Australian company, borrowed $US 2.5bn from its US resident subsidiary, Chevron Texaco Funding Corporation (CFC). This was an internal group borrowing, with interest payable by CAHPL at around 9% pa. CFC had borrowed the money on the US commercial paper market (an external borrowing) paying interest of about 1.2%.

Figure 1 below provides a diagrammatical representation of the transaction flows.

Figure 1: Flow of transactions between CAHPL, CFC and Chevron US

Click here for detailed discussion of the facts

Issue in dispute and the result

The fundamental issue in dispute was whether the interest expense claimed as a tax deduction by CAHPL was excessive; in other words, whether the interest paid by CAHPL satisfied the arm’s length standard.

CAHPL, as the appellant, bore the burden of demonstrating the ATO assessments were excessive (i.e. the interest deduction allowed by the ATO was too little). At first instance, CAHPL failed to satisfy that burden, and the ATO assessments were upheld. On appeal, the Full Federal Court found no reason to overturn the lower court’s decision, so CAHPL failed again – the assessments remain standing.

Summary of the technical grounds

The issue was fought on a number of different grounds, which makes for some complexity in reading the judgements. The ATO originally supported the assessments on 3 grounds:

- the ‘old’ transfer pricing rules (Division 13);

- the temporary ‘new’ transfer pricing rules (Division 815-A); and

- Article 9 of the US double tax convention (not pursued on appeal).

Division 13 was held to apply, and the term ‘consideration’ was given a broad interpretation, extending to more than merely the ‘price’ (i.e. the interest rate) payable by CAHPL. (See comments below.)

The ATO acknowledged procedural invalidity in the making of the Division 13 determinations, but this was held not to be relevant in challenging the assessments; procedural failure is not a permissible ground for contesting the substantive issue, i.e. whether the tax liability assessed by the ATO was excessive.

Both the old and the new transfer pricing rules require a comparison to be made between the ‘actual transaction’ and an arm’s length ‘hypothetical transaction’. The hypothetical transaction is to be constructed on the terms of the actual transaction, absent only the non-arm’s length features or conditions. This approach rejects the so-called ‘orphan’ assumption, i.e. looking at a totally artificial stand-alone hypothetical borrower.

Division 815-A is not constitutionally invalid merely because it has a retrospective operation.

There was no conflict in the ATO basing the amended assessments on Determinations made under both Division 13 and Division 815; the same tax liability was supported on alternative technical grounds.

Click here for detailed discussion of the arguments and the Court’s reasons

Implications of the lack of security

CAHPL did not provide any security for the CFC loan, nor enter into any operational or financial covenants. The implications of this were hotly debated between the parties.

CAHPL argued that the “property” to be tested was the Credit Facility Agreement (CFA), including all its rights, benefits, privileges and facilities including access to the cash. As the CFA provided for no security or covenants, this was the nature of the property which had to be tested in setting the arm’s length price under the comparable hypothetical arrangement – and the expert evidence supported an interest rate on such an unsecured loan to be around 9%. The lack of security conditioned the property acquired, and did not go to the issue of consideration.

The ATO argued the opposite: the “property” acquired was limited primarily to the cash advanced, and the lack of security went to ‘consideration’. The consideration given by CAHPL was the interest payable, in combination with the absence of security or covenants. A hypothetical borrower in the circumstances of CAHPL would have to give security and/or covenants, and if it did, then it would pay a lower rate of interest.

The Court decisions have adopted the ATO view on this point. (And this point ties in with the proper construction of the hypothetical arrangement, i.e. the actual arrangement minus the non-arm’s length features, and not the ‘orphan’ assumption.)

Guarantee fee

CAHPL argued in the alternative that, if security was to be assumed in setting the arm’s length consideration, then that security could only have been provided by Chevron US, and on an arm’s length basis CAHPL would have had to pay a tax deductible guarantee fee.

The argument was accepted as correct but in the context of the hearing, it effectively came ‘too late’; there was insufficient evidence to safely determine the quantum of such a fee.

Observations

CAHPL failed to demonstrate the tax liabilities assessed on audit by the ATO were excessive.

Australia’s now superseded transfer pricing rules (Division 13) were found to have a far broader application than previously considered.

Given the inherently “grey” nature of transfer pricing, owing to the myriad of attendant legal and economic issues and concepts, transfer pricing cases settled in a Court of Law are a relative rarity and there is much excitement (and consternation) in the world of transfer pricing advisers and key stakeholders of Multinational Enterprises (MNE) following the decision.

The vast majority of contested assessments are settled between a taxpayer and a Revenue Authority well before expensive, lengthy and potentially PR costly legal proceedings are pursued.

Given Chevron’s financial clout, the dollars at stake, and a Revenue Authority’s doggedness to satiate a Government keen to demonstrate its ability to tackle perceived egregious MNE profit-shifting practices, the “Chevron case” was always destined to be a heavyweight contest bitterly fought until the end (although that “end” may yet have a final round left in it, should Chevron appeal to the High Court).

At present however, the ATO has landed what appears to be the knock-out blow.

Of relevance to taxpayers and advisers alike, the case elucidates key concepts upon which Australian (and OECD member country) transfer pricing laws are founded, in particular shedding light upon intercompany financing arrangements and the “orphan” or “standalone” assumption.

It should be noted that the case was fought on the validity of the application of Australia’s superseded transfer pricing rules under Division 13 of the Income Tax Assessment Act 1936, and the temporary rules under subdivision 815-A of the Income Tax Assessment Act 1997. However the concepts remain largely applicable under Australia’s new (and permanent) Division 815 rules which have a high correlation to the OECD Transfer Pricing Guidelines and should be construed as being of particular relevance going forward.

Takeaways for Taxpayers

Revenue Authorities and advisers the world over will be keen to determine the impact of the Chevron case, with a particularly lengthy judgment providing plenty to ponder.

Of particular relevance, the ‘separate entity approach’ has historically been taken in the transfer pricing world to require the contemplation of the taxpayer on a standalone basis (the extent however, has always been in contention and is the area of “grey” that underpins the art of transfer pricing).

Indeed the OECD Guidelines require the assessment of the arm’s length nature of a taxpayer’s intercompany dealings by reference to “independent” enterprises in comparable transactions and comparable circumstances, requiring the treatment of members of the MNE group as ‘operating as separate entities rather than as inseparable parts of a single unified business’ [Para 1.6 of the 2010 OECD Guidelines].

The Chevron decision suggests that greater weight be given to “group synergies” and that “independent” does not necessarily mean “standalone”, “orphan” or otherwise completely divorced from the reality of the multinational group. In this particular case, the credit standing, policies and principles of a significant Parent Company in the context of intercompany financing arrangements has direct bearing on the conditions and ultimate price of the tested dealings.

Whilst the facts and circumstances of this case are unique to Chevron, we can reasonably expect to see greater activity by the ATO in tackling perceived egregious profit-shifting measures at the top end of town.

Of relevance to our SME client base, the Commissioner’s powers to determine arm’s length conditions by looking through the mere legal form of arrangements entered into by related parties, has been ratified.

The OECD has long been headed this direction in any event, best demonstrated in its Base Erosion and Profit Shifting (BEPS) initiatives. However taxpayers will need to be more vigilant than ever in examining, in detail, their policies, procedures and supporting documents if they are to support the arm’s length nature of their intercompany dealings.

Performing comparability analyses will be inherently more important, yet more difficult going forward. Establishing a team of professionals with the appropriate mix of skills - transfer pricing professionals, international tax advisers, lawyers, accountants, economists, together with the company's commercial people – to deliver the documentation process, will be of critical importance. And this will extend to ensuring alignment between legal agreements, commercial reality and sound economic concepts if corporate taxpayers are to avoid being caught in the Commissioner’s cross-hairs.

One more step?

Having lost 4-0 to date (on the judges count), CAHPL must decide whether to appeal to the High Court. Any further appeal is not ‘as of right’ – the High Court must first decide that it will hear the appeal, and that would involve the hearing of an Application for Special Leave.

Everyone waits with baited breath to find out whether Chevron will roll the dice one more time. Given the quantum of tax in dispute in this specific matter, but with a view to the amount of tax potentially in dispute in later years if this decision stands, it seems likely that Chevron will have one more crack. Perhaps as a publicly listed company, governance demands such action.

At RSM we can help you stay on top of alerts and ensure you are kept up to date.

If you have any questions about this article, or any questions in relation to transfer pricing matters in general, contact your local RSM office.

If you have any other questions relating to tax, please contact Craig Cooper at [email protected].