Updated July 2016

Changes to the zone tax offset (ZTO)provisions will restrict access to the ZTO for fly in fly out (FIFO) workers in remote areas of Australia from 1 July 2015.

The purpose of the offset is to provide an income tax concession to individual residents of the prescribed zone areas for the disadvantages they are subject to because of the uncongenial climate conditions, isolation and the high cost of living in the zones. Presently, a remote zone offset is available to a taxpayer who resided or was actually in a specified remote area of Australia for more than 183 days in an income year. The zone rebates currently available are as follows:

|

Relationship Status |

Zone A |

Zone B |

Special Area |

|---|---|---|---|

|

Single |

$338 |

$57 |

$1,173 |

|

Relevant Rebate Amount increment |

50% |

20% |

50% |

The Relevant Rebate Amount increment is applied to the spouse, child-housekeeper, housekeeper, invalid relative, notional child and student and notional sole parent offsets.

* Some towns are eligible for a higher zone tax offset (called Special Areas) if the shortest land (or sea) route is more than 250km from the centre of any urban area with a 1981 census population of over 2,499. The urban centre does not have to be within Zone A or Zone B.

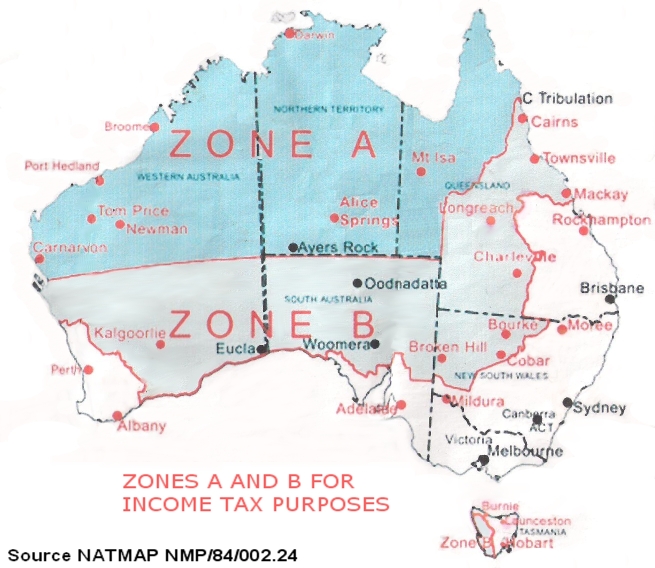

The zone’s eligible for the rebate are as follows:

Source: https://www.bantacs.com.au/topics/travelling-workers/

A full list of the eligible areas can be found here: https://www.ato.gov.au/Calculators-and-tools/Australian-zone-list/

The residency test does not require a zone tax offset recipient to spend 183 days continuously in either of the relevant zones. The 183 day test can straddle over two income years. Until 30 June 2015, the ZTO provisions do not require the taxpayer to reside in a zone provided they are actually in a zone for more than 183 days. FIFO workers are entitled to claim the zone tax offset if they spend 183 days or more in a zone in an income year (or straddled over the next year). This remains the case even though the taxpayer’s usual place of residence is not located within either of the zones.

From 1 July 2015, a taxpayer’s usual place of residence will need to be within the zone to qualify for the zone tax offset. This change to the law will affect fly in fly out workers of mining and resource projects in remote areas. Taxpayers with a usual place of residence within a zone that travel to a workplace outside of a zone, will retain their entitlement to the zone tax offset.

The summary of the changes are as follows:

|

New law |

Current law |

|

Where a person’s usual place of residence is not within a prescribed area, they will be unable to claim the ZTO. |

The ZTO does not require that a person’s usual place of residence is within a prescribed area. |