Are you an Australian resident for income tax purposes?

The Australian Taxation Office (ATO) is concerned as foreign income and capital gains continue to be incorrectly classified as gifts or loans in a bid to avert or evade tax.

It doesn’t feel that long ago that the only thing stopping you from coming and going to Australia was the price of an airline ticket.

What ensued, was a level of international restriction that kept us within the confines of our country and even city borders that many of us have never experienced and hopefully never will again.

The rules surrounding residency from an income tax perspective are notably quite different from the rules around migration.

As an Australian resident, one is taxed on their worldwide income. This means that one must declare all income one has received from foreign sources in their income tax return.

The ATO always has its watchful eye on the activities of those who may seek to manipulate and exploit global situations and relationships for their own gain

In response to these actions, the ATO has released Taxpayer Alert – 2021/2 detailing their stance on taxpayers disguising foreign income as gifts or loans in a bid to avert or evade tax that they would otherwise have to pay.

Are you an Australian resident for income tax purposes?

It might sound like a simple question, but it can be surprisingly difficult to figure out the answer if you are newly arrived and working in Australia, or an Australian resident living overseas or even a foreign employee hired overseas by an Australian resident entity.

As a result of the border closures due to the ongoing pandemic, it may have an underlying impact for those within the community who may not even be aware that they are deemed Australian residents for tax purposes.

Knowing the answer to this question can make a huge difference to the amount of tax you need to pay – so it's important to stay informed and seek professional advice.

The ATO has been delving into the mass data of international transactions with the use of the sophisticated Australian Transaction Reports and Analysis Centre (AUSTRAC) in a bid to ensure that international transfers are conducted appropriately.

Is the ‘Gift’ or ‘Loan’ genuine?

The alert itself is fundamentally targeted at those taxpayers who indeed are aware of their residency status as well as the tax implications that apply to them yet still endeavour to avoid and evade tax.

Put simply, they seek to mask the true nature of funds that they deem are gifts or loans from a related overseas entity by concealing the true characteristics of the foreign income.

A ‘genuine’ gift or loan

- The characterisation of the gift and/or loan is supported by appropriate documentation.

- The parties’ behaviour is consistent with the characterisation of the gift and/or loan.

- The monies provided are sourced from funds genuinely independent of you.

Not a gift or loan

- Income from employment.

- Interest.

- Dividends or capital gains from shares held in a foreign company.

- Any amount deemed to be foreign assessable income under the controlled foreign company provisions.

- Amounts assessable as dividends or trust distributions.

Documentation is absolutely crucial and the larger the amount, the more substantiation is generally required.

How can it be ‘incorrectly’ classified?

Despite being aware of the foreign income provisions, taxpayers may conceal the true nature of foreign assessable income and in some cases, will prepare documentation that purports to show that the repatriated funds do in fact have the character of a gift or loan.

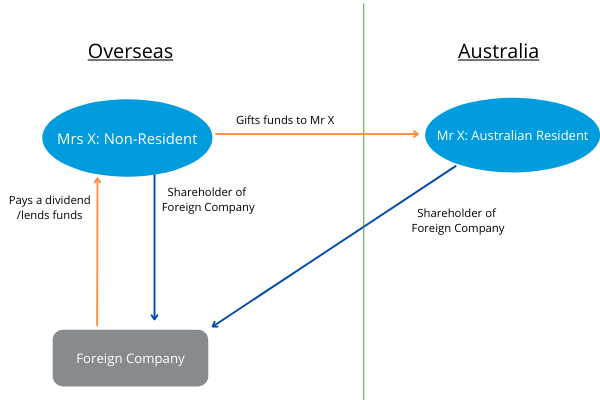

Below is an example of how this process may be carried out.

Profits from a foreign company disguised as a gift

Mr and Mrs X are both married and are the two sole shareholders of the Foreign Company. Mrs X draws profits from the company either by way of a loan or a dividend and simply transfers the funds to Mr X in Australia as a gift. Mr X uses the funds for private purposes and does not report any of the funds received in his income tax return.

NEXT STEPS

The ATO have made it clear that they are undertaking reviews and audits of international transactions and are engaging those taxpayers who have entered into such arrangements.

They are prepared to use their exchange of information powers to gather data from overseas nations if required.

They have warned that taxpayers and their advisers who knowingly pursue such arrangements will be subject to increased scrutiny and could face potential sanctions under criminal law.

We understand that during these challenging times, taxpayers who have loved ones overseas could be trying to source funds in order to get by until this storm passes.

Contact

If you feel that you may have incorrectly classified an overseas transaction or thinking of sourcing funds from overseas, reach out to your local RSM office and speak to one of your trusted tax advisers to ensure that such transactions are reviewed and disclosed correctly.