Australia wins gold in the international transfer pricing games

The facts

Chevron Australia Holdings Pty Ltd (CAHPL), an Australian company, borrowed $US 2.5bn from its US resident subsidiary, Chevron Texaco Funding Corporation (CFC). This was an internal group borrowing, with interest payable by CAHPL at around 9% pa. CFC had borrowed the money on the US commercial paper market (an external borrowing) paying interest of about 1.2%.

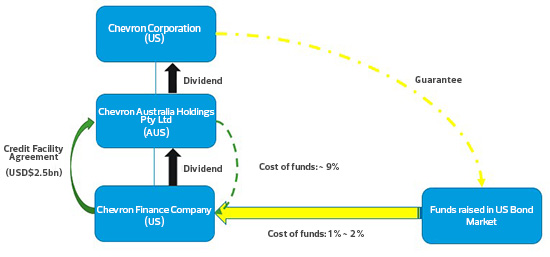

Figure 1 below provides a diagrammatical representation of the transaction flows.

Figure 1: Flow of transactions between CAHPL, CFC and Chevron US

The parties involved

- Chevron Australia Holdings Pty Ltd (‘CAHPL’) (Borrower) is a wholly owned subsidiary of the US-based Chevron Corporation (‘Chevron US’) (Parent); and

- Chevron Texaco Funding Corporation (‘CFC’) (Lender), a special purpose financing subsidiary established to raise funds in US bond markets (with the benefit of a guarantee from the Parent).

The arrangement

- The cost of funds to CFC was less than US LIBOR (approximately 1-2%).

- A Credit Facility Agreement (the Facility) was entered into in June 2003 between CAHPL and CFC

- The facility between CAHPL and CFC was set out as follows:

- the Borrower borrowed the AUD equivalent of US $2.5bn;

- interest at 1m AUD LIBOR + 4.14% p.a (approximately 9%);

- loan repayable in full after five years,

- not subject to financial covenants and no guarantee or security was provided by or on behalf of the Borrower

- Dividends were paid annually by CFC to CAHPL.