The week ending 25 June 2023 was a significant one for the Federal Government’s so-called ‘multinational tax integrity package’, with a flurry of associated activity not unexpectedly observed.

The Australian Taxation Office (“ATO”) has issued new draft Practical Compliance Guideline PCG 2023/D2 for comment.

This replaces the earlier draft Practical Compliance Guidelines PCG 2021/D4 published two years ago regarding intangible arrangements between international related parties.

PCG 2023/D2 Overview

PCG 2023/D4 builds upon the previous PCG, with the most notable change being a quantitative risk assessment framework based on three compliance risk categories: high, medium or low.

Like other PCGs, the ATO has published recently, the risk categories will allow taxpayers to understand the ATO’s approach towards compliance resource allocations.

That is, the higher the risk rating, the more likely the ATO would initiate a compliance activity.

The ATO indicated that it might require taxpayers to disclose their self-assessed risk rating for their intangible arrangements in schedules such as the reportable tax position (“RTP”) – which is a common occurrence with many PCGs issued by the ATO. Further, the ATO also proposes to make the new PCG effective retrospectively.

The focus of PCG 2023/D2 and particularly the risk assessment framework is on transfer pricing issues, particularly :

- the migration of intangible assets (“IAs”) and

- the mischaracterisation or non-recognition of development, exploitation, maintenance, protection and enhancement (“DEMPE”).

However, its application is not confined to the transfer pricing provisions – it also touches on other tax risks such as the general anti-avoidance rule (“GAAR”), capital gain tax (“CGT”), capital allowance, withholding tax provisions, and diverted profits tax (“DPT’).

In addition to providing a risk assessment framework, the ATO provides extensive guidance regarding evidence taxpayers should assemble, to substantiate their self-assessed risk rating. There are also 13 examples to illustrate the application of the risk framework to various intangible arrangements.

Application of the risk assessment framework

Two separate risk assessment frameworks are provided for each of the above two areas, referred to as Table 1 (covering migration of IAs) and Table 2 (particularly covering the mischaracterisation or non-recognition of DEMPE).

However, prior to applying these risk factors, the ATO recommends a preliminary analysis to determine if the intangible arrangements exhibit the features listed in Taxpayer Alert TA 2020/1. In short, the ATO issued TA 2020/1 to address very specific examples of what it considered as non-arm's length arrangements or schemes connected with the DEMPE of IAs, such as the bifurcation of IAs and mischaracterisation or non-recognition of Australian DEMPE activities.

If a particular intangible arrangement meets those listed in TA 2020/1, the ATO does not consider it worthwhile to undertake a PCG2023/D2 risk assessment since such arrangements will automatically fall into the high-risk category.

Migration of intangible assets - Table 1 Risk assessment framework

The first risk assessment framework relates to the migration of IAs. The ATO refers to the migration of IAs as any restructure or change associated with IAs that allow another entity to access, hold, use, transfer, or benefit from the IAs. Most commonly, this would be a sale.

The ATO has regard to three elements: the presence of restructuring or changes associated with the IA, the substance of the international related party, and the tax outcome of the intangible arrangement.

These three risk assessment factors contain several criteria with a quantitative risk rating. The individual risk rating is aggregated to arrive at one of the three risk categories – high, medium or low.

The criteria for each of the three factors, including the risk rating, are provided below.

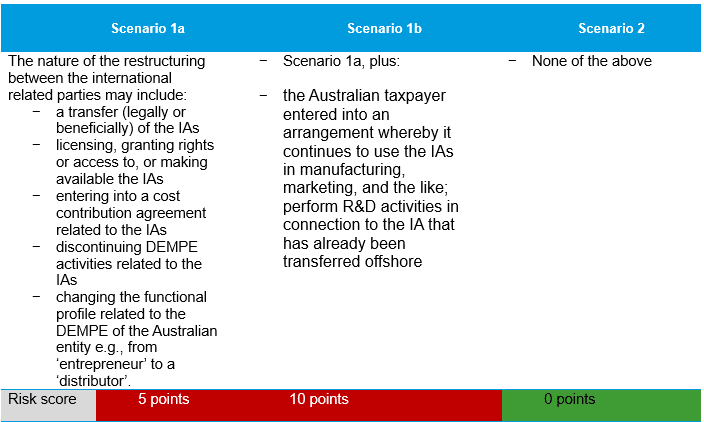

I. Restructure or changes associated with intangible assets

The risk criteria consider two aspects: the nature of the restructuring or change to the intangible arrangements and the post-structuring arrangements.

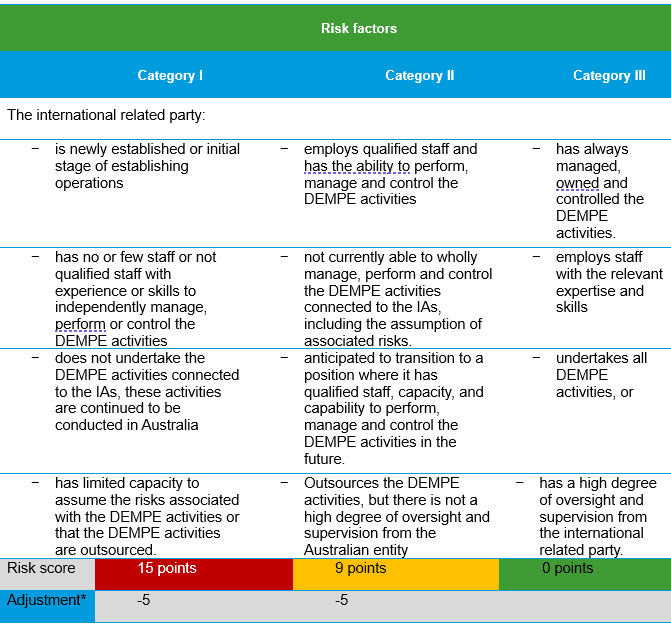

II. Substance of the international related parties

The substance of the international related party’s operations is the second element containing three categories of risk factors. The focus is the extent to which the international related party can undertake the DEMPE activities following the IAs migration.

The ATO allows the risk factor to be adjusted downward if the product or services in connection with the IAs are predominantly sold in the same jurisdiction as the international related party is a tax resident of.

The table below lists the risk factor, including the risk score for each category – noting that the most appropriate category must be chosen.

*If the associated products or services are predominantly sold in the jurisdiction where the international related party is a resident, take 5 points off the above score.

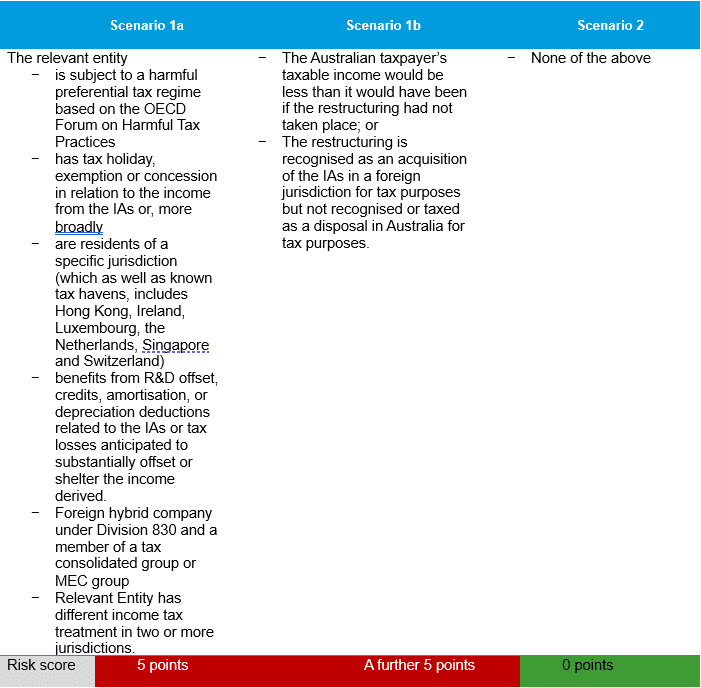

III. Tax outcome of the intangible arrangement

The tax outcomes the PCG takes into account are not limited to transfer pricing but include CGT, DPT and other direct tax consequences, as follows:

*For this table, Scenarios 1a and 1b are not mutually exclusive but may both be satisfied, either satisfied or neither satisfied at all.

Mischaracterisation of DEMPE activities – Table 2 risk assessment framework

Table 2 applies if a taxpayer had an “Intangibles Arrangement” connected with DEMPE of intangible assets, that did not involve a migration.

Similar to the migration of IAs risk assessment framework, three risk factors are relied upon to determine the compliance risk associated with mischaracterisation of DEMPE activities. While two of the three have similar effects, the restructuring/changes factor is replaced with an overall characterisation.

I. Overall characterisation

The overall characterisation factor considers the ownership of the IAs and the functional intensity of the Australian entity. The higher the functional intensity, such as undertaking parts of the DEMPE activities, the higher the risk score. The ATO considers the following with regard to the Australian taxpayer:

- does not own the IA, but it is owned by an international related party legally or beneficially, or

- owns the IAs and granted access to, or use of, the IAs to an international related party without entering into a legal agreement.

If the above is confirmed, then the following additional criteria would be relied upon to assign a risk score which ranges from 10 to 20 if all of the following three apply: - conducts or performs R&D activities in connection with those IAs in Australia.

- perform business activities (manufacturing, customisation, etc.) or functions which might reasonably be expected to enhance or add value to those IAs in Australia.

- Perform other development, enhancement, maintenance and protection activities with those IAs.

With regard to the substance of the international related party and the tax outcomes, the criteria are similar to those listed under the migration of IAs

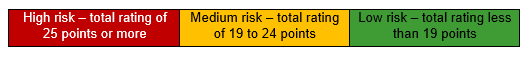

Determining a risk rating

The risk rating is determined having aggregated the individual criteria points for each of the three elements. The aggregated risk score is then used to categorise the intangible arrangements into one of the following three risk categories.

Evidence expectations

The ATO provides guidance in terms of the kinds of information and documents it considers relevant in determining the risk rating. The extensive list includes documents, such as valuations, financial modelling, and income tax return for offshore entities.

The ATO notes the compliance burden of the documentation listed and states that the complexity of the arrangement should be used as a guide in substantiating the arm’s length nature of the intangible arrangements.

Examples of intangible arrangements

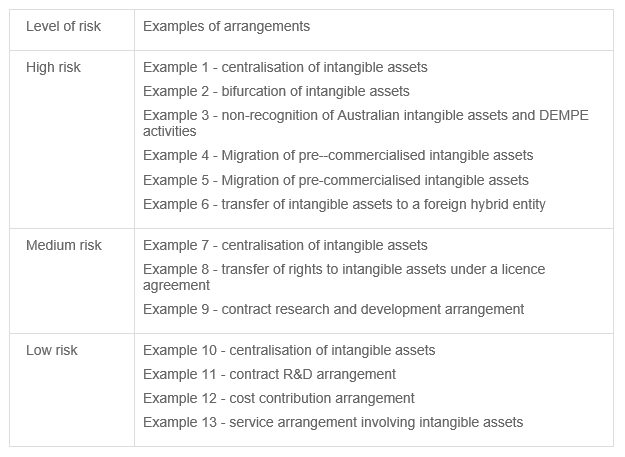

Similar to PCG2021/D4, the ATO provides examples to illustrate the application of the risk assessment framework, including the following:

RSM’s Insight

While PCG2013/D4 provides more pointed guidance regarding the type of information the ATO considers important to substantiate intangible arrangements' arm’s length nature, the lack of materiality threshold significantly impacts small and medium enterprises (“SMEs”).

Even for established businesses, particularly those completing RTP schedules, conducting a PCG analysis for disclosure adds to the ever-increasing compliance cost. The ATO, through the various information it collects, including the CbC reporting, has sufficient material to identify high-risk transactions. Thereby tailoring its risk assessment target more efficiently

Some of the risk assessment factors do not appear to be objective. For example, regardless of the arm’s length nature of the intangible arrangements, all else being equal would result in a lower tax outcome. Yet, the ATO assigns a higher risk score (10) to this meaningful outcome.

Our recommendation

The ATO continues to focus heavily on risks relating to intangible arrangements. Groups should be aware of this enhanced risk and should undertake a risk assessment prior to embarking on IP migration or making changes to DEMPE activities.

Such analysis would also be invariably be requested by the ATO in any Combined Assurance Review or by an adviser in any due diligence, and would also provide support for statutory audit purposes.

- Groups completing RTPs should have particular regard to this PCG – as it is almost inevitable that self-assessment and disclosure of the risk rating will be required shortly (or of a “high risk” rating in the absence of performing the self-assessment).

FOR MORE INFORMATION

To find out more, please get in touch with your local RSM office today.