The oft-quoted maxim is that the art of tax is to pluck the goose so as to maximise the amount of feathers but minimise the amount of hissing.

To take the analogy further, sometimes governments realise that the best approach is to stop plucking in the short-term so as to maximise the quantum of feathers to be collected in the long-term.

With this in mind, all Australian states (other than Western Australia) have implemented some measures designed to ease the burden for individuals and businesses affected by bushfires, floods, cyclones and other natural disasters.

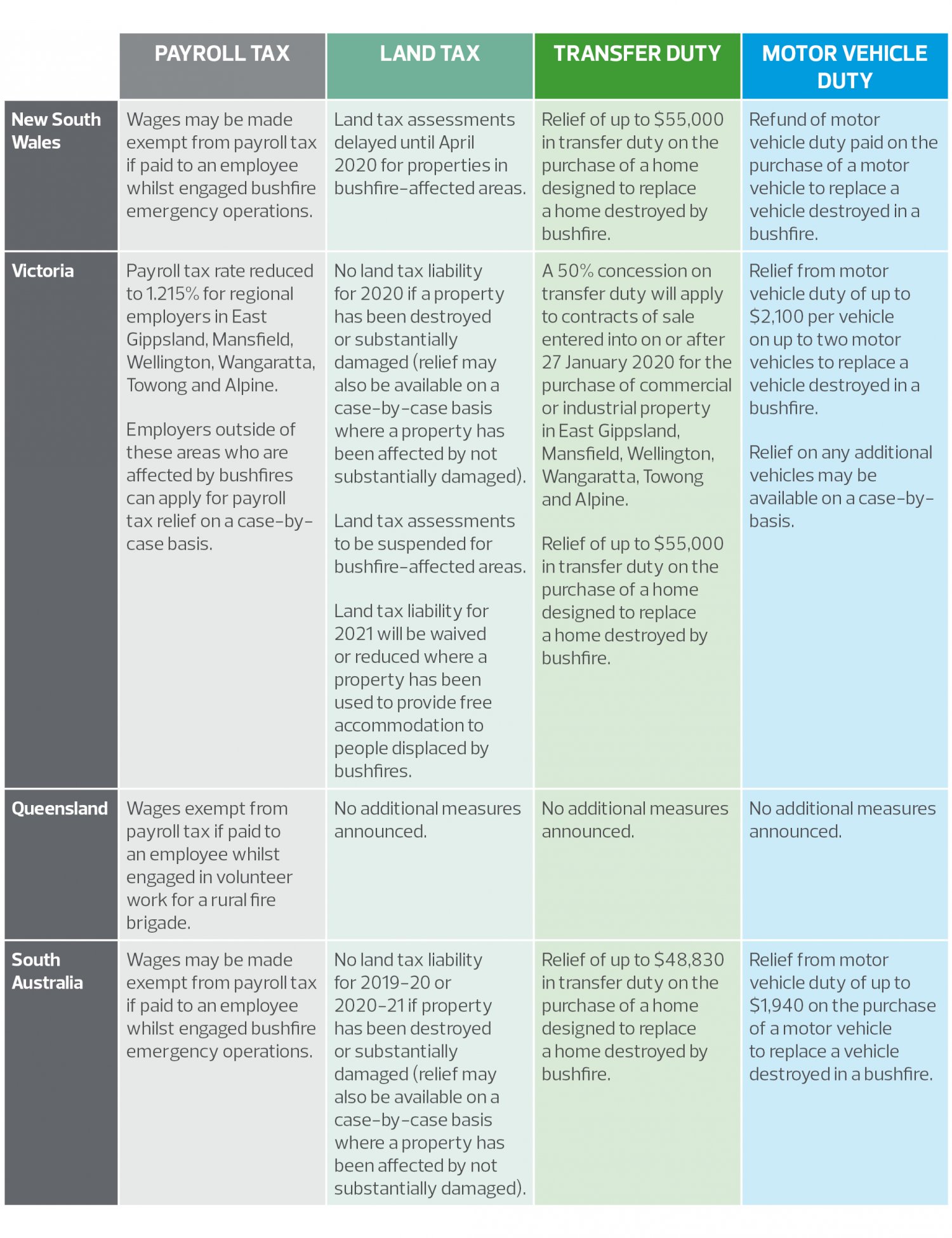

A summary of the relief measures across the states

The listing below covers specific measures that state governments have implemented or announced in the current financial year designed for those affected by natural disasters (click the below image to expand):

What should taxpayers do if they are affected by natural disasters?

- For those in affected areas or who may have suffered loss or damage as a result of natural disasters, it’s important to be aware of the tax-related measures that each state government has put in place and to ensure these are accessed within the limited time frames put in place for the measures.

- Even where a taxpayer’s circumstances do not fall within the temporary and targeted measures announced by a state government, it’s important to remember that a taxpayer can, at any time, seek any of or all of the following:

- extending the time to lodge documents or returns with the relevant OSR;

- extending the time for payments without charging the imposition of penalties or interest; and

- arranging a payment plan, allowing for tax debts to be paid over time and in agreed instalments.

For more information

If you have any questions or require further information regarding state government tax measures, please contact your local RSM office today.