The fundamental step in protecting an organisation and mitigating fraud and corruption control risks is understanding the type of fraud and corruption control risks that are prevalent to the organisation and assessing the counter measures currently in place to mitigate those risks.

This includes examining the controls or more specifically in the case of fraud and corruption the anti-fraud controls, which is the essence of fraud and corruption control pressure testing to reduce the fraud and / or corruption ‘surprises’.

The Association of Certified Fraud Examiners (ACFE) most recent 2020 Global Fraud Study or ‘Report to the Nations’ highlights that in the discussion of the effectiveness of Anti-Fraud Controls, that over the last ten years of their studies (every two years) there is a consistent and notable increase in implementation rates.

The ACFE study states that,

“proactive anti-fraud controls play a key role in an organisation’s fight against fraud. While the presence of these mechanisms alone does not ensure that all fraud will be prevented, management’s commitment to and investment in targeted prevention and detection measures send a clear message to employees, vendors, customers, and others about the organisation’s anti-fraud (and anti-corruption) stance.”

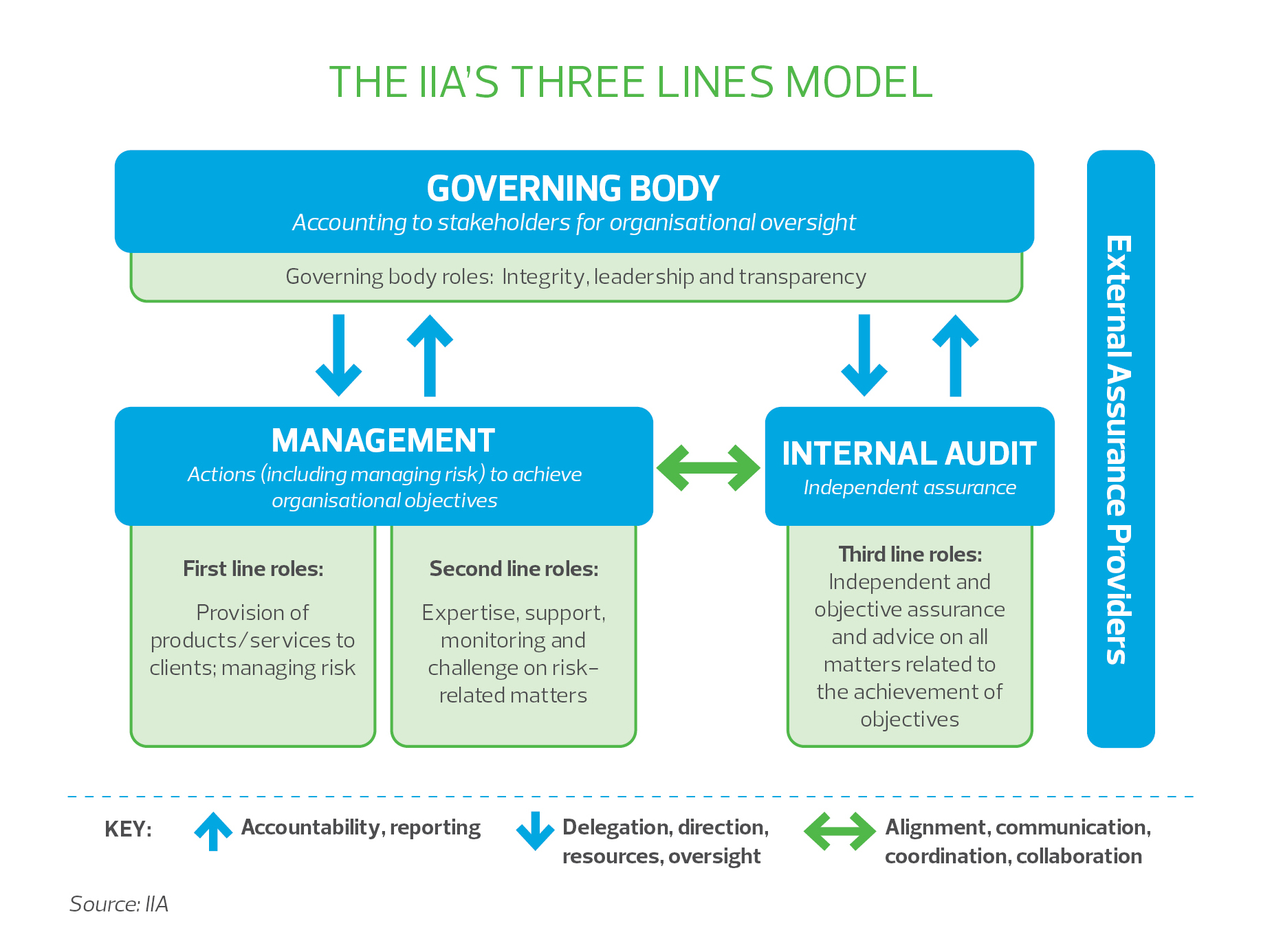

A key focus in examining the existing and operational effectiveness of the control environment will always be the roles of the following as depicted in various models of the 3 or 4 lines of defence.

These generally include:

- Firstly, an organisation’s front line management and their continual controls assessments

- Secondly, independent controls assessments such as with external audit for material financial misstatements or material fraud and the internal audit functions whether insourced or outsourced or a combination; and

- Thirdly enterprise controls including the Board, its Committees and Executive Management.

This is represented below in a recent global publication from the Institute of Internal Auditors (IIA), The IIA’s Three Lines Model: An Update of the Three Lines of Defence.

More locally in Australia, and focussing on controls assessment, there has been a recent innovation with what is called ‘pressure testing’ of controls.

In this article we are discussing specifically how this applies to ‘fraud / corruption pressure testing’. What is it? Where has it been discussed? This sort of focus on fraud and corruption controls testing is continually an ever-present need especially considering an ever-changing environment such as with COVID, and once in a lifetime risk events which ironically happen more regularly than that!

Fraud and corruption control resilience and adaptability is paramount in our current often continually changing and disruptive work environment.

To continue reading this article, please fill in your email address via the form below.

FOR MORE INFORMATION ON FRAUD AND CORRUPTION TESTING

Please contact Roger Darvall-Stevens, RSM Australia’s National Head of Fraud & Forensic Services, Senior Manager Milind Sheth or our RSM Fraud & Forensic Services team to discuss how your business can take advantage of fraud / corruption pressure testing for improvement, governance, risk and compliance to mitigate these risks .