As discussed in part one and two of the series The Six Fundamentals of a Strong Financial Plan, it's important to remember that there are always going to be events that are happening locally or internationally that will impact financial markets.

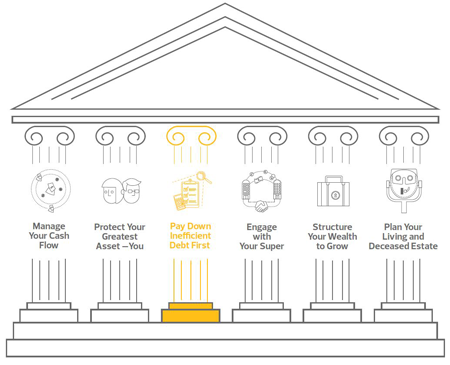

What's important is your view and plan for the long term ensuring that you have adequately prepared yourself across each of the financial pillars.

Previously we discussed the importance of 'managing your cash flow' and 'protecting your earning capacity' as core pillars to a strong financial plan. These two pillars deal with ensuring that you maintain the all-important flow of cash which is the lifeline to your personal finances.

The next two pillars are about how you can allocate this cash flow effectively to build strong net financial wealth.

#3 - Pay Down Inefficient Debt First

Inefficient debt is best described as a loan which you can’t claim a tax deduction for the costs and interest on the loan. These loans, referred to as non-deductible debt, generally include facilities such as credit cards, personal loans, store cards or a home mortgage.

Once you’ve established and implemented a cash flow and budget system, any surplus cash flow (net income) identified should be directed to pay down the highest cost non-deductible debt.

The reason being that non-deductible debt provides no tax benefits for any interest paid. It is literally just an ongoing cost to you increasing the overall purchase price of the whatever you have purchased.

The faster you pay down the capital of the loan, the less interest you will pay and the quicker you can free yourself of the burden.

If you have multiple non-deductible loans, then it’s worth speaking to each of your lenders to have them confirm for you the current interest rates on each of your loans, and then to target the highest cost loan first.

When non-deductible debts are paid off, you can then assess where your surplus income should now be directed to help achieve your financial objectives.

In some cases, you may have deductible debt, such as an investment loan over a property, which could be paid down in order to reduce your debt. Alternatively, you could also look to redirect your surplus income towards wealth creation vehicles like investment and superannuation portfolios.

This next step in directing surplus income will be very specific to your circumstances and will encourage you to become more involved with your financial objectives, and the strategies and tools you use to achieve them.

NOW available

pillar #4 - Engage with Your Super -

One of the key benefits of superannuation is that it’s a low tax environment to invest and...

For more information, contact your local Financial Services team today.