As discussed in part one to three of the series The Six Fundamentals of a Strong Financial Plan, it's important to remember that there are always going to be events that are happening locally or internationally that will impact financial markets.

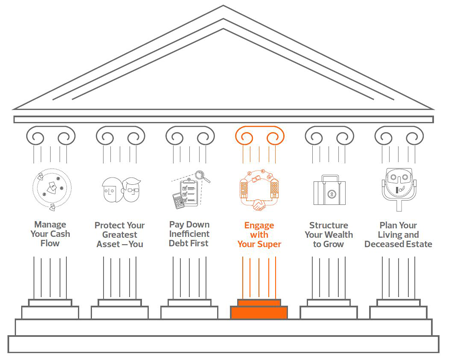

What's important is your view and plan for the long term ensuring that you have adequately prepared yourself across each of the financial pillars.

Previously we discussed the importance of 'managing your cash flow', 'protecting your earning capacity' and 'inefficient debt' as core pillars to a strong financial plan.

The next pillar is about how you can engage with your super effectively to build strong net financial wealth.

#4 - Engage with your Super

Employees in Australia earning over $450 per month, are entitled to Superannuation Guarantee (SG) Payment from their employer equal to 9.5% of their wages, which is paid directly into a superannuation fund.

Employees in Australia earning over $450 per month, are entitled to Superannuation Guarantee (SG) Payment from their employer equal to 9.5% of their wages, which is paid directly into a superannuation fund.

One of the key benefits of superannuation is that it’s a low tax environment to invest and grow your money for retirement. The key strategy to maximise the benefit of superannuation is to save more on a regular basis, to start as young as possible and to monitor it regularly with regard to your retirement goal...

By engaging with your superannuation early, setting a realistic longer term investment target and monitoring against short term investment targets, you will be able see how you are tracking towards your ultimate goal of retirement.

Although you cannot access superannuation until you meet a condition of release, superannuation offers a number of additional benefits to you now whilst in preparation for retirement.

These include:

- Insurance – you can utilise you superannuation fund to access life, disability and in some cases forms of income protection insurance. This means you can potentially pay for some of your insurance premiums using pre-tax income from your SG or salary sacrifice contributions, which can improve cash flow.

- Business Property – if you are a business owner and want to purchase your business property, you can structure the purchase through a Self Managed Superannuation Fund, which can provide business cash flow, tax and retirement savings benefits. You will need to engage a SMSF specialist.

- Estate Planning - Superannuation does not form part of your estate therefore you can use binding death nominations, to specifically distribute your superannuation to beneficiaries, bypassing your Will

What's really important point to remember is that within superannuation you can generally invest in a range of different assets including Australian shares, International shares, Property and Property Trusts, Corporate and Bank Bonds, Cash and Term Deposits.

Quite often superannuation funds will offer these assets in investment products known as managed funds, which simply manages one or more of these assets types in a single investment vehicle giving you greater access to more investment types plus the experience of specialist investment managers.

Some key questions you should be asking yourself regarding your superannuation include:

- How much income per year do I want or need to retire on?

- Am I contributing enough to achieve my retirement goals?

- Do I have any lost superannuation that is being held by the Australian Tax Office?

- Is my superannuation invested in a manner that suits my risk and financial objectives?

- Are the fees my superannuation fund charges competitive for the services they provide?

- Do I have multiple superannuation funds and is their benefit in bringing them together?

Superannuation is a powerful financial planning tool to get involved with early in your working career as it offers a number of key investment incentives plus the opportunity to also protect your wealth using pre-tax income providing increased support to your cash flow and debt reduction strategies.

available now

Pillar #5 - Structure your wealth to grow

Investing outside of superannuation can sometimes be slightly more complex due to the...

For more information, contact your local Financial Services team today.

This page has been prepared by RSM Financial Services Australia Pty Ltd ABN 22 009 176 354, AFS Licence No. 238282.

As everyone's circumstances are different and this article doesn't take into account your personal situation, it is important that you consider the above in light of your financial situation, needs and objectives, and seek financial advice before implementing a strategy.

View the Financial Services Privacy Statement and Policy, Complaints Policy, Financial Services Guide and RSM Privacy Policy.