It is tempting to listen to widely held views that investing money is simple – you buy blue-chip stocks hold them over the long term and you’ll do well. The reality of a professional investment strategy that is formulated with your goals and objectives in mind though is much different.

Appropriate asset allocation

Asset allocation refers to the percentage of your portfolio to be invested in (or allocated to) each particular asset class. Broadly speaking, the available asset classes for investment are cash, fixed interest, property, and equities. Asset allocation determines the majority of your portfolio return based on the return characteristics of each individual asset class and the weight allocated to each asset class.

Asset allocation refers to the percentage of your portfolio to be invested in (or allocated to) each particular asset class. Broadly speaking, the available asset classes for investment are cash, fixed interest, property, and equities. Asset allocation determines the majority of your portfolio return based on the return characteristics of each individual asset class and the weight allocated to each asset class.

A financial adviser will go through a process known as risk profiling with you. Every firm’s process is different, but essentially it will involve providing you with some education around key investment concepts (a good adviser will tailor it to your existing knowledge level) and then asking you a series of questions with the aim of evaluating your willingness and ability to take investment risks. This then provides the adviser with a suggested asset allocation that matches your risk profile.

For example, a conservative investor will have a higher allocation to investments like cash, term deposits, and bonds. More aggressive investors will have a higher allocation to investments with more volatility, like shares.

Creating an investment portfolio that is tailored to your risk tolerance ensures you enter the world of investment with your eyes wide open and aware of the level of risk in your portfolio.

Your risk profile will also feed into the projections an adviser may complete for you and may provoke further conversations, including things such as based on the projections do you need to take on more or less risk to meet your objectives?

Behaviour

Psychology is a genuine factor in market movements. Markets move through cycles and in times of market downturn, it is imperative to remain focused on your strategy and avoid allowing emotions to cloud your judgement. Conversely, when markets are euphoric, overconfidence can take over and risk-taking can increase, potentially beyond where your actual risk tolerance lies.

Psychology is a genuine factor in market movements. Markets move through cycles and in times of market downturn, it is imperative to remain focused on your strategy and avoid allowing emotions to cloud your judgement. Conversely, when markets are euphoric, overconfidence can take over and risk-taking can increase, potentially beyond where your actual risk tolerance lies.

Research shows that advisers have a huge role to play in coaching clients through difficult times and ensuring they stay the course.

What damage does reacting to market conditions cause?

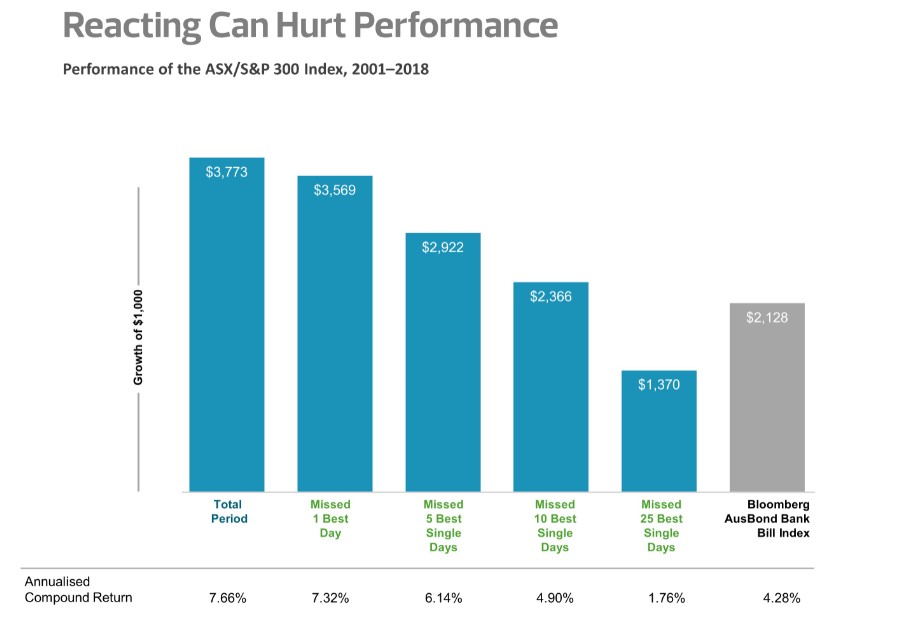

Being out of the market by attempting to market time can really hurt investment performance, as shown below:

In Australian dollars. For illustrative purposes. The missed best day(s) examples assume that the hypothetical portfolio fully divested its holdings at the end of the day before the missed best day(s), held cash for the missed best day(s), and reinvested the entire portfolio in the S&P/ASX 300 Index (total return) at the end of the missed best day(s). Annualised returns for the missed best day(s) were calculated by substituting actual returns for the missed best day(s) with zero. S&P/ASX data copyright 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Data provided by Bloomberg Finance L.P. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results.

Diversification

A well-diversified portfolio is imperative to successful investment outcomes. A very common issue with self-directed portfolios is overexposure to large-cap Australian shares, with a corresponding underexposure to International investments along with (quality) medium and small caps stocks. Similarly, self-directed investors often have too much exposure to cash and term deposits, creating a cash drag on returns. Diversified fixed interest investments can be explored as an alternative here.

A well-diversified portfolio is imperative to successful investment outcomes. A very common issue with self-directed portfolios is overexposure to large-cap Australian shares, with a corresponding underexposure to International investments along with (quality) medium and small caps stocks. Similarly, self-directed investors often have too much exposure to cash and term deposits, creating a cash drag on returns. Diversified fixed interest investments can be explored as an alternative here.

Understanding drivers of return

As noted above, the key driver of returns (over 90%) is asset allocation (as long as the portfolio is well diversified). Beyond this though, an educated, experienced adviser understands the longer-term drivers of investment alpha and can structure a portfolio with this in mind.

Tax optimisation

After-tax returns are the returns that matter and grow long-term wealth. An adviser can work with you to structure your affairs in a way that optimises after-tax investment returns, and also to understand the trade-offs that come with various structures, from tax and other perspectives.

HOW CAN RSM HELP?

If you have any questions regarding financial advice, get in touch with your local RSM financial adviser today.

This page has been prepared by RSM Financial Services Australia Pty Ltd ABN 22 009 176 354, AFS Licence No. 238282.

As everyone's circumstances are different and this article doesn't take into account your personal situation, it is important that you consider the above in light of your financial situation, needs and objectives, and seek financial advice before implementing a strategy.

View the Financial Services Privacy Statement and Policy, Complaints Policy and Financial Services Guide