Do the latest changes to Super present the last opportunity for former WA State Government employees, to capitalise on their West State Super before retiring?

We have been working with numerous self-employed people, including former employees of the WA State Government, to help them maximise the Super Fund balances for retirement.

A strategy for high income earners, like doctors and engineers, has been working exceptionally well at improving both their retirement and personal income positions, as we discussed in our previous article .. 'Last chance for self-employed to maximise Super Contributions to GESB'

The problem for a majority of people, is that they didn’t have the high income, or surplus capital, for this strategy to be appropriate for them. So they haven’t been able to benefit from the very generous contribution rules.

However, with a generation of self-employed West Australian workers ‘The Baby Boomers’, now looking towards retirement, this strategy may in fact become appropriate. It could even provide a number of benefits particularly if you are planning to fund your retirement from the sale of a high value asset like a farm, business or investment property.

This opportunity could still be appropriate even if the sale of the asset could potentially create a Capital Gains Tax liability.

Under current rules, self-employed people, who have a GESB West State Super Fund have been able to make tax deductible contributions in excess of the current caps, significantly boosting their retirement savings.

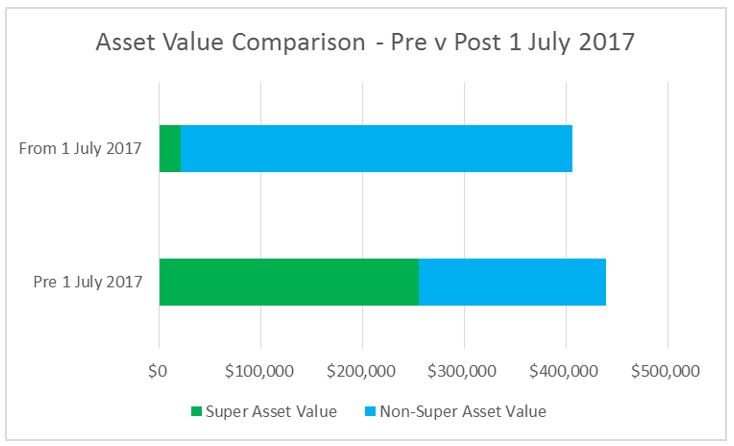

For example if a person earning $100,000 a year with a cost of living of $65,000, wanted to sell an investment property with a net worth of $450,000 and a $150,000 capital gain, to fund and start their retirement in the 2017 /18 financial year, they could sell the property this financial year and make a contribution of say $300,000 to the GESB West State Super Fund before 30 June 2017, retaining the balance outside of Super.

Or

They could choose to sell the property after 1 July 2017 and make only a $25,000 contribution to a different Super Fund, after the GESB West State Super strategy closes, retaining the balance outside of Super.

The difference between these two scenarios is illustrated below.

As you can see, the benefit could be substantial. Over $233,000 additional invested into the lower tax environment of GESB West State Super and over $33,000 in tax saved.

This includes the assumption that the investor was able to claim a tax deduction for the contributed amount which can help to reduce their personal taxable income, or potentially any capital gains tax liability realised from the sale of the asset.

There is also the potential opportunity for this strategy to be further enhanced if you have pre-1983 service. This is explained further in our article about the Crystalisation of Benefits in GESB West State.

A key point to note is that the timing of this strategy is vital to ensure that the optimal outcome is achieved, as there is only a short time to act.

A word of caution!

Getting this wrong, by not having the contributions classified correctly by your Super Fund, not claiming the deductions correctly through your tax, or worse breaching your Superannuation Lifetime Limit, can be costly and cause massive headaches.

As too could failing to get the asset sale settled in time.

Given the complexity plus the looming 30 June 2017 deadline, to take advantage of this opportunity you should consider seeking help from our GESB Specialist Team.

In addition, if you are planning to retire soon we’ll ensure that the strategy for your Super and pension fund is optimised to take into consideration the new change to pension fund account balance caps which also commence on 1 July 2017.

For more information just leave your details here and we’ll have a GESB wealth specialist contact you.

This page has been prepared by RSM Financial Services Australia Pty Ltd ABN 22 009 176 354, AFS Licence No. 238282.

As everyone's circumstances are different and this article doesn't take into account your personal situation, it is important that you consider the above in light of your financial situation, needs and objectives, and seek financial advice before implementing a strategy.

View the Financial Services Privacy Statement and Policy, Complaints Policy, Financial Services Guide and RSM Privacy Policy.