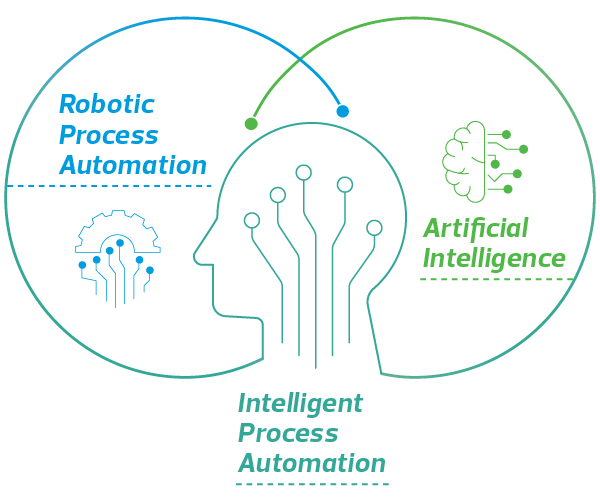

Robotic Process Automation (RPA)—the automation of repetitive, replicable and routine tasks through robots—has the potential to fully transform business processes, allowing the organisation to focus on strategic priorities. While RPA has been widely adopted by many businesses and delivered significant benefits, its evolved cousin, Intelligent Process Automation (IPA), has the potential to enhance business outcomes further. This requires the addition of an artificial intelligence (AI) dimension that allows RPA robots to sense, think and act as illustrated below.

With such potential, what role can IPA play to enhance the finance function?

Why IPA?

Data entry is one of the most common and time-consuming tasks in the finance function. Financial service professionals first need to read and extract key data from various documents such as invoices, bank statements, purchase orders, sales orders and bills of lading. Subsequently, they have to enter the data into a structured data file (such as Excel) and may also need to extract general ledger information from the accounting systems to perform data reconciliation and generate reports. IPA has the potential to transform this process for greater operational efficiency, allowing financial service professionals to focus on high value areas while the IPA bot is running.

How does IPA work in the finance function?

The IPA application can analyse soft copies of various financial documents, as well as apply computer vision (Optical Character Recognition, or OCR) and Natural Language Processing (NLP) techniques to read and extract relevant information. Once the data is collected, the IPA application will apply artificial intelligence components via machine learning (including deep learning) or machine reasoning to predict the document type and nature of the extracted fields (e.g. company name, dollar amount, currency, item type, etc.). Subsequently, the IPA application can input the processed data into a structured database and/or generate reports. A common workflow of an IPA application in the finance function is shown below.

|  |  |

| Read & Extract Information from Various Financial Documents | Prediction/ Classification | Data Entry & Report Generation |

|

| Robotic Process Automation |

How can IPA be applied to the finance function?

Account reconciliation

Account reconciliation is a tedious process involving the manual matching of bank statements with the accounting data. For instance, the IPA application can utilise OCR and NLP to extract data from bank transaction records, classify the transaction items and apply business logic to match them against general ledger entries and financial statements.

Financial analysis

Financial analysis is the analysis of a company’s past financial position and performance, and forecasts future financial performance. It requires the consolidation of multiple time periods’ financial statements before the analysis. The IPA application can easily extract relevant key fields from the financial statements, generate a consolidated data set, and directly link it to a business intelligence dashboard tool such as Power BI or Tableau.

Compliance reporting

One of the compliance reporting procedures requires the conversion of financial data into a standard report designed by the authority. Relevant information is extracted from the financial statements, and then classified into the desired report template. IPA can help the accountant to perform this process much faster.

The potential applications of IPA cover many business processes, such as finance, human resources, procurement, IT and audit. Businesses should keep abreast of such technological developments that could enhance the efficiency, accuracy and effectiveness of their processes.

This article was written by AI Engineer Steven Shi of our Technology, Media & Telecommunications practice.