Your business may be worth more than you think

A business with an in-depth understanding of its value could exploit value-adding opportunities and maximise its economic potential. Value lies in different assets and investments and could vary considerably in this ever-changing business and regulatory landscape.

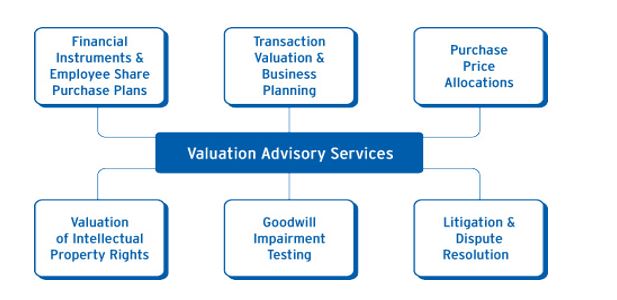

Our professional valuation services help your business to keep abreast of changes in accounting standards, establish its value for commercial purposes such as buy / sell transaction pricing, as well as handle internal management information and planning, litigation support and dispute resolution.

Financial Instruments

The recognition and measurement of financial instruments require a high level of up-to-date technical knowledge in both commercial and accounting aspects. We provide expertise in fair valuing financial instruments such as loans, convertible bonds, financial guarantees and derivatives.

Employee Share Purchase and Option Plans

Financial Reporting Standards require that costs relating to share-based payments be accounted for in their financial statements. We are able to estimate share-based expenses through the use of option valuation models.

Transaction Valuation

We help to derive an indicative price before an acquisition strategy is developed. We also perform valuation of companies which measures potential synergies and highlights business risks and opportunities.

Business Planning

We provide professional assistance in developing business plans which may include an objective valuation of the company.

Purchase Price Allocations & Valuation of Intellectual Property Rights

Financial Reporting Standards require the purchase price of an acquired company (or group of assets) to be allocated among identifiable assets and liabilities to derive the resulting goodwill. We provide expertise in fair valuing various classes of assets and liabilities, including intangible assets.

Goodwill Impairment Testing

Financial Reporting Standards require goodwill and other intangible assets with indefinite useful lives to be tested for impairment. We are able to assess the reasonableness of the basis and assumptions underlying the valuation models through an analysis of both external and internal factors.

Litigation & Dispute Resolution

Businesses engage us to assist with legal and dispute resolution relating to business, commercial and family disputes. We provide services such as fact-finding and modelling, quantification, valuation of shares / business, trial preparation and expert testimony.