What to consider when tax planning for End of Financial Year

With the end of the financial year looming, it’s time to think about your tax planning options before 30 June 2022 hits.

We’ve curated a list of top things to focus on when organising your tax affairs for the 2022 year-end, applicable to businesses, primary producers, trusts, and individuals.

BUSINESSES

The most commonly overlooked deductions that could reap big refund rewards.

When running a business, the payment of suppliers by the due date is a priority. While paying bills on time is always a primary concern, most businesses are unaware of the tax savings that can result from bringing forward the payment of certain expenses. Let’s look at the most overlooked deductions that can accelerate your cashflow by postponing your tax liability.

-

Paying superannuation on time and before year-end

Most businesses have payroll software  that enables posting payroll expenses into the general ledger by the click of a button. Employees are paid their net wage, but the superannuation contributions may be left in an unpaid superannuation account until the end of the month or quarter.

that enables posting payroll expenses into the general ledger by the click of a button. Employees are paid their net wage, but the superannuation contributions may be left in an unpaid superannuation account until the end of the month or quarter.

While most expenses are eligible for deduction when incurred, superannuation is only deductible when it is paid and received, on time, by a complying superannuation fund.

Superannuation contributions need to be received by the fund by the 28th day of each quarter (with significant penalties for late payment). The June quarter superannuation liability is only due by 28 July and is often not paid before year-end. However, by paying the June quarter liability before 30 June the amount is deductible in the year it is paid should the fund receive the amount by 30 June.

- Updated guidance on Family Trust Arrangements

On 23 February 2022, the Australian Taxation Office (ATO) issued long-awaited guidance on discretionary trusts and the application and operation of section 100A of the Income Tax Assessment Act 1936 (ITAA 1936).

The ATO simultaneously issued updated guidance setting out the ATO’s current view on Division 7A, trusts and unpaid present entitlements owing to corporate beneficiaries. The guidance is set to have a significant impact on discretionary trusts in Australia, particularly in familial arrangements where trusts are used for business and investment purposes and trustees have (or intend to) distribute income of the trust to adult beneficiaries over the age of 18 (adult child beneficiaries) or corporate beneficiaries.

Learn more on this topic here, or speak to your RSM adviser for more information.

- Temporary full expensing of depreciating assets

As a result of the continued impact of the COVID-19 pandemic on the Australian economy, the Federal Government announced as part of the 2020-21 Budget a major overhaul to depreciation tax concessions.

Previously, eligible businesses were able to deduct the cost of certain assets acquired, provided the asset cost was less than $150,000. Not only has the Government provided almost all businesses with access to such concession, but eligible businesses are now able to deduct the cost of eligible depreciating assets with no cost limit, provided the asset is acquired from 7:30pm AEDT on 6 October 2020 and first used or installed by 30 June 2023.

Read more information on the Temporary Full Expensing of Depreciating Assets.

- Writing-off bad debts before year-end

If you have a non-paying customer and there is a genuine concern regarding recovery of the debt, then some or all of the debt can be deducted in the current tax year provided it is written off before year-end and was included as income at an earlier time.

Keep in mind that you may be entitled to a reduction in GST for the bad debt written off. If you are registered for GST and have included the forgiven amount in a prior period Business Activity Statement, you are entitled to adjust down the GST payable in the period that you write off the bad debt.

- Scrapping/disposing of plant and equipment before year-end

Businesses should review their fixed asset registers to ensure that they are not holding plant or equipment that they no longer require due to obsolescence. Even checking for assets that your business no longer holds could save you at tax time.

Depending on the written down value of the assets, a deduction can be claimed should the asset be ‘scrapped’ or disposed of prior to year-end.

- Valuing closing stock at lowest value

It may be time to review how your business values stock on hand. Perhaps the value of closing stock used for tax purposes is based on your management accounts that uses the higher of net realisable value or cost.

The ATO allows a business to value its closing stock at any of the following values:

- Replacement value

- Cost

- Market selling value

Depending on the stock valuation under these three methods a business can obtain a significant reduction in its tax liability by adopting a method that results in the lowest value.

In certain circumstances, a taxpayer may also be entitled to a deduction for a write-down of obsolete stock where appropriate valuations and measures are taken.

- Committing to staff bonuses before year-end

It is common practice for a business to create  a provision for payment of staff bonuses. However, a tax deduction is only available for staff bonuses to the extent that the business is ‘definitively committed’ to paying the bonus. Therefore, a business looking to claim a deduction for current year bonuses should keep appropriate documentation to support approval of those bonuses prior to year-end.

a provision for payment of staff bonuses. However, a tax deduction is only available for staff bonuses to the extent that the business is ‘definitively committed’ to paying the bonus. Therefore, a business looking to claim a deduction for current year bonuses should keep appropriate documentation to support approval of those bonuses prior to year-end.

- Prepaying expenditure eligible for immediate deduction

Review any of your expenditure that is eligible for a discount if paid for the next year. Not only can you take advantage of this saving but depending on the expenditure it can also result in an immediate tax deduction.

From 1 July 2020, businesses with a turnover of less than $50 million are eligible to deduct any prepayment that has a service period of less than 12 months and all businesses can deduct prepayments that are either required under a Government law or cost less than $1,000.

- Accruing expenses paid after year-end

Just because you haven’t paid for goods or services until the following tax year, doesn’t mean you can’t take advantage of the deduction this year. To the extent that services are provided to you before year-end even though they are invoiced after year-end, and the cost can be reasonably estimated, the expenditure is deductible in the year in which the service was provided.

- Deducting ‘consumables’ contained within closing stock

If your business holds consumable stores or spare parts that are to be used within three months after year-end, the ATO’s view is that businesses can deduct the costs of consumables in the year acquired, as opposed to having to include the amount in closing stock. It can be beneficial for businesses to review their consumables and claim upfront where possible.

- Immediate deductibility of start-up costs

If you started your small business during the current year (or will do before year-end), the costs associated with starting the business will be deductible (e.g. accounting fees, legal costs, company incorporation costs and trust deed costs).

DIVISION 7A LOANS

- Company loan to shareholders

If you are a shareholder or a shareholder’s associate and you borrowed money from a company for personal use during the 2022 financial year, these loans need to be repaid or placed on a complying loan agreement by the lodgment due date of the company 2022 tax return. If not, there is a risk that the loan will potentially be treated as a deemed unfranked dividend and taxed in the shareholder/shareholder’s associate hands.

In respect to existing Division 7A loans, please ensure the minimum annual loan repayment is received by the company prior to 30 June 2022.

PRIMARY PRODUCERS

- Profit from forced disposal of livestock

With many areas around Australia being affected by adverse weather conditions, some farmers have been forced to destock pastures. Flood and drought affected areas may be eligible for tax relief in this situation.

This includes spreading the profit on disposal of livestock over a five-year period or electing to defer the profit to reduce the replacement cost of livestock. Any profit not used in the disposal year or any of the next five years would then form part of assessable income in the fifth income year.

- Primary production income averaging

Primary production averaging can be used to average the income of primary producers over a 5-year period. When a primary producer’s average income is less than their taxable income, they are entitled to an averaging tax offset. If their average income is more, than their taxable income will be subject to pay complementary tax.

Careful planning and review within a farming group could result in significant tax savings in minimising any complementary tax.

- Farming management deposits (FMD)

From 1 July 2018, the maximum amount of all deposits that can be held by an individual is $800,000, with a minimum amount remaining at $1,000.

If you are experiencing financial hardship and wish to access your FMD early, please contact our office to discuss what options may be available.

TRUSTS

- Trust distribution minutes

Ensure you speak to your tax adviser to ensure your trust distribution resolutions are in place by 30 June 2022.

Be aware that if you are planning to distribute to any new beneficiaries (e.g. adult children, corporate beneficiaries) for the 2022 year or beyond you need to ensure a Tax File Number (TFN) report has been lodged notifying the ATO of the beneficiaries’ TFN before the end of the financial year if not already done. This is to notify the ATO of any new beneficiaries as they have an obligation to provide their TFN to avoid having TFN withholding applied to payments at a hefty rate of 47%.

- Division 7A Loans – Trust distributing to a company

When deciding to distribute income from a Trust to a Company during the 2022 financial year to benefit from a lower company tax rate, ensure you have considered Division 7A consequences.

Where a Trust distributes income to a Company, the Unpaid Present Entitlement (UPE) may result in a deemed dividend if the UPE is not repaid by the lodgment due date of the Trust’s 2023 Income Tax Return or placed on a complying Division 7A loan agreement or Sub Trust Agreement.

INDIVIDUALS

- Bring forward deductions

Taxpayers who own an investment property or have an investment portfolio margin loan may consider prepaying interest up to 12 months in advance (service period ending prior to 30 June 2023) on investment loans and claiming a deduction in the 2022 year for the prepayment.

- Motor vehicle claims

If you frequently use your own vehicle for work related travel, a logbook may increase your motor vehicle deduction. A logbook must be kept for 12 consecutive weeks and must be updated every five years or whenever your vehicle use materially changes. In addition to maintaining a logbook ensure you keep written evidence of all motor vehicle expenses such as insurance, services, license and registration paid during the 2022 financial year.

If you do not maintain a logbook the maximum kilometres an employee will be entitled to claim is 5,000 kilometres at a rate of 72 cents for the 2021-22 financial year.

It is important to note, in most cases, home to work travel is not included as work related.

- Donations

A donation to a Deductible Gift Recipient (DGR) may be a great way to reduce your taxable income while contributing to a good cause.

If you intend to make a donation prior to 30 June 2022, ensure that the donation is made to a DGR and that you maintain the receipt. A list of DGRs are available on the ATO’s website.

- Income protection policy

If your income protection policy is owned by you personally it is an income tax deduction in your individual tax return. It may be wise talking to your financial adviser about your income protection policy being in your personal name instead of your superannuation fund to result in a personal tax deduction. In addition, to increase your deduction it may be beneficial to pay your policy annually prior to year-end instead of monthly.

- Managing capital gains exposure

You may consider reviewing any capital gains made during the financial year. If you have had a capital gains tax event during the year, evaluate any other assets you hold that are in a loss position and consider if it is an appropriate time to sell these to reduce your capital gains tax exposure.

Be aware that individuals have access to the 50% capital gain concession if they hold an asset for more than 12 months.

- Superannuation contributions – Concessional contributions

Just before the financial year-end is a great time to do a financial check of your funds and if you have any excess cash it might be worthwhile investing in your retirement and topping up your superannuation fund.

Any concessional contributions made into your superannuation fund up to the cap of $27,500 is an income tax deduction against your assessable income.

Since 1 July 2017, you are now able to make concessional contributions to your superannuation fund regardless of how your income was received.

This means even if you are not self-employed you can still make an eligible concessional contribution and have the amount deductible in your tax return.

However, if you are 67 or older you must still satisfy the “work test”. This requires that you are employed and undertaking paid work for a minimum of 40 hours in any 30 consecutive day period to make voluntary contributions.

The annual concessional contributions cap is now $27,500 for all individuals. For those with a super balance of less than $500,000 at the end of June 30 in the previous year, the new rules allow you to carry forward your unused concessional contributions cap amounts from 1 July 2018. The first year in which you can increase your concessional contributions cap by the amount of unused cap was 2019-20. Unused amounts are available for a maximum of five years and expire after this.

If you have had more than one job during the financial year you should make sure that you have not exceeded your concessional contribution cap as excess contribution amounts will be taxed at the marginal tax rate plus an excess concessional contributions charge.

To claim a deduction for superannuation contributions in your income tax return you must provide a signed notice (Section 290-170 notice) to your superannuation fund to notify them of your intention. You must receive an acknowledgement notice from the fund confirming your contribution, prior to the lodgement of your individual income tax return.

- Non-concessional contributions (after–tax contributions)

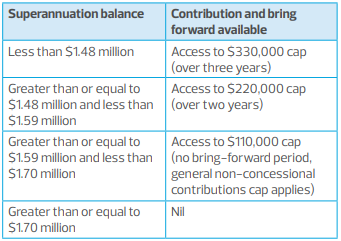

For members under 65, non-concessional contributions are subject to a yearly cap of $110,000 or up to $330,000 over a three-year period depending on their total superannuation balance.

Members over 65 but under 75 can still contribute up to $110,000 a year, however, are not eligible for the three year ‘bring forward’ non-concessional contribution.

Contribution and ‘bring forward’ available to members under 65:

Members are not eligible to make non-concessional contributions once they are 75 or older.

Due to the strict rules and regulations around superannuation funds and member contributions, we advise you to contact us prior to making any non-concessional contributions as excess contributions will be taxed at 47%.

- Division 293 tax on superannuation contributions

Individuals with an adjusted taxable income over $250,000 will be subject to an additional 15% tax on their taxable superannuation contributions.

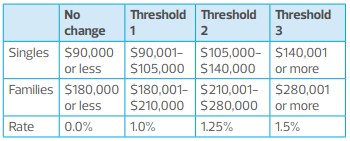

- Medicare levy surcharge

Singles and families who do not have adequate private health insurance cover will be liable for the Medicare levy surcharge.

This is determined by the income thresholds, set out below:

Note: The family income threshold is increased by $1,500 for each dependent child after the first child.

Ensure you have appropriate private health insurance going forward to avoid paying the Medicare levy surcharge.

For further information

If you require any assistance with tax planning for the end of financial year, contact your local RSM office.