This month Jonathan Colbran, one of our Restructuring & Insolvency Experts and a Registered Liquidator, shares his insights around:

- The number one thing we should all be doing to support small businesses

- The natural cycle of business openings and closures

- Why the timing of exploring business options is critical

- The value of trust, confidentiality, and impartiality

Jono, as he is often referred to by our team and many of his clients and referrers, has been with RSM for nearly 20 years, specialising in insolvency. He has worked with all types of business owners, from the local fish and chip shop owner who needs to close their business after 30 years in operation to property developers who have assets worth over $200M +.

Here are four tips from Jono to support small business owners, today.

Here are four tips from Jono to support small business owners, today.

Pay your bills on time

Pay your bills on time

“It’s pretty simple, if we all pay our bills on time small businesses can maintain their cash flow. Recent SME growth index statistics show that over 70% of business owners reported they experienced cash flow difficulties last year. That’s a staggering statistic to me.

Small business owners commonly have to chase payments and are often met with excuses such as ‘it must have got lost in the system’, ‘it’s being reviewed internally,’ or ‘I’ll have to get back to you on that later.’

I think in 2021 and beyond if we all process payments in a timely manner a great deal of pressure will be eased for SMEs and their whole supply chain. Let’s get the goodwill happening.”

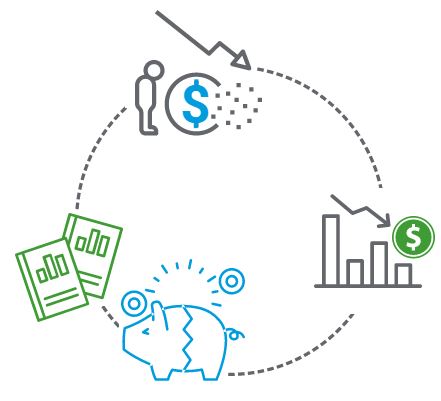

Recognise that closing a business does not always mean failure

Recognise that closing a business does not always mean failure

“There can be a stigma around a business closing, but closing the doors isn’t always bad news."

“There can be a stigma around a business closing, but closing the doors isn’t always bad news."

I have had clients who have run successful businesses, but due to a change in their personal circumstances, such as a family illness, it may not be in their best interests to keep working 70+ hours a week. They may opt to close their business because they want to spend more time with their family and we can help them achieve that personal goal.

Businesses also have a natural attrition cycle, and that’s not all bad news either. I read a recent Canberra Times article that made the point that before the pandemic set in, about 67,800 Australian businesses that employed people failed each year, but that we typically saw another 93,500 businesses created. This turnover of businesses can be a good thing for our economy on a broader scale.

To give this some national context, data from the Australian Bureau of Statistics show that in the period 2019- 2020, across Australia, 344,472 businesses were created with 297,821 exiting the market.

"It’s a reality that businesses will always come and go - but sometimes those businesses that are forced to close could have been saved if available options had been explored earlier.”

Encourage businesses owners to get ahead of the game: explore options early

Encourage businesses owners to get ahead of the game: explore options early

“I have had some people that contact me saying they need to declare bankruptcy or appoint a liquidator, but they are usually the last options on the table. There are often three or four other options available for them to consider."

I know that when business owners are stressed and exhausted from day-to-day operations and struggling with issues such as cash flow, they can assume there is no way out - but that’s often not the case. Timing does count for a lot though. Typically if we are contacted by business owners earlier in the process, when they are starting to worry and feel the pinch, we can put more options on the table for them to consider.

Sometimes I think businesses in financial distress delay getting in touch because they think they may lose their family home or are even scared of going to jail. The best way to reduce the risk of personal liability and any risk of losing the family home is to be proactive and get help as early as possible. It’s extremely rare that someone would ever be charged with a criminal offence and find themselves going to jail. Typically for this to happen, someone really needs to be deliberately breaking the law and the vast majority of business owners that we work with aren’t in this category.

"People understandably fear the worst-case scenarios, but our team can often, very quickly, put their mind at ease that these scenarios won’t become a reality for them and their families.”

Always act in their best interests

Always act in their best interests

“Unfortunately business owners can sometimes fall prey to people who want to push products or services that aren’t always in their best interests or with terms that aren’t commercially attractive."

I came from humble beginnings and I often think of my Mum and Dad when I’m working with clients who may be hard-working, small business owners who have found themselves in financial distress. I take pride in working with them to provide impartial advice that can often save them time, money and reduce their stress levels.

We have a strong base of referrers from legal and accounting firms who send us their clients who need restructuring, recovery or bankruptcy, and liquidation assistance. They know our team will act ethically and honestly to support their clients.

Stop that horrible feeling of uncertainty

Often within a 20-minute call, our Restructuring and Recovery team will be able to confirm if we can help you.

We are solutions-focused. If we can’t be of assistance with your specific situation, we will do our best to refer you to the right place, for example, a free, local Debt Counselling service.