Payments that are long (after 30 days) or are late, have significant impacts on small businesses and, more broadly, the economy.

A 2019 study by AlphaBeta highlighted that normalising a 30-day payment time from large business to small business would have an estimated net benefit to the Australian economy of $313m per year.

We focus on linking analytics directly to decision making, taking the necessary actions, and measuring the outcome in order to deliver incremental value to your business.

Businesses required to report are those that are:

- Constitutionally-covered;

- Carry on an enterprise in Australia;

- Meet the income threshold of over $100m in total annual income; andCommonwealth corporate entities and Commonwealth companies that meet the income threshold; or

- Entities with a total income of over $10m that are members of a controlling corporation with a combined income of over $100m.

For all arrangements where a large business and a small business supplier agree that payment is to be delayed to atime after the supply, the reporting requirements include:

- Standard payment periods;

- Proportion of invoice paid across time based categories;

- Proportion of business procurement from Australian small business suppliers;

- Details of the use of supply chain finance; and

- Notifiable events.

The first reporting period will be 1 January 2021 to 30 June 2021 with each subsequent period covering the following 6months, e.g. 31 July 2021 to 31 December 2021.

The reports will be due to the payment times reporting regulator within 3 months of the end of each reporting period, being 30 September 2021 for the first.

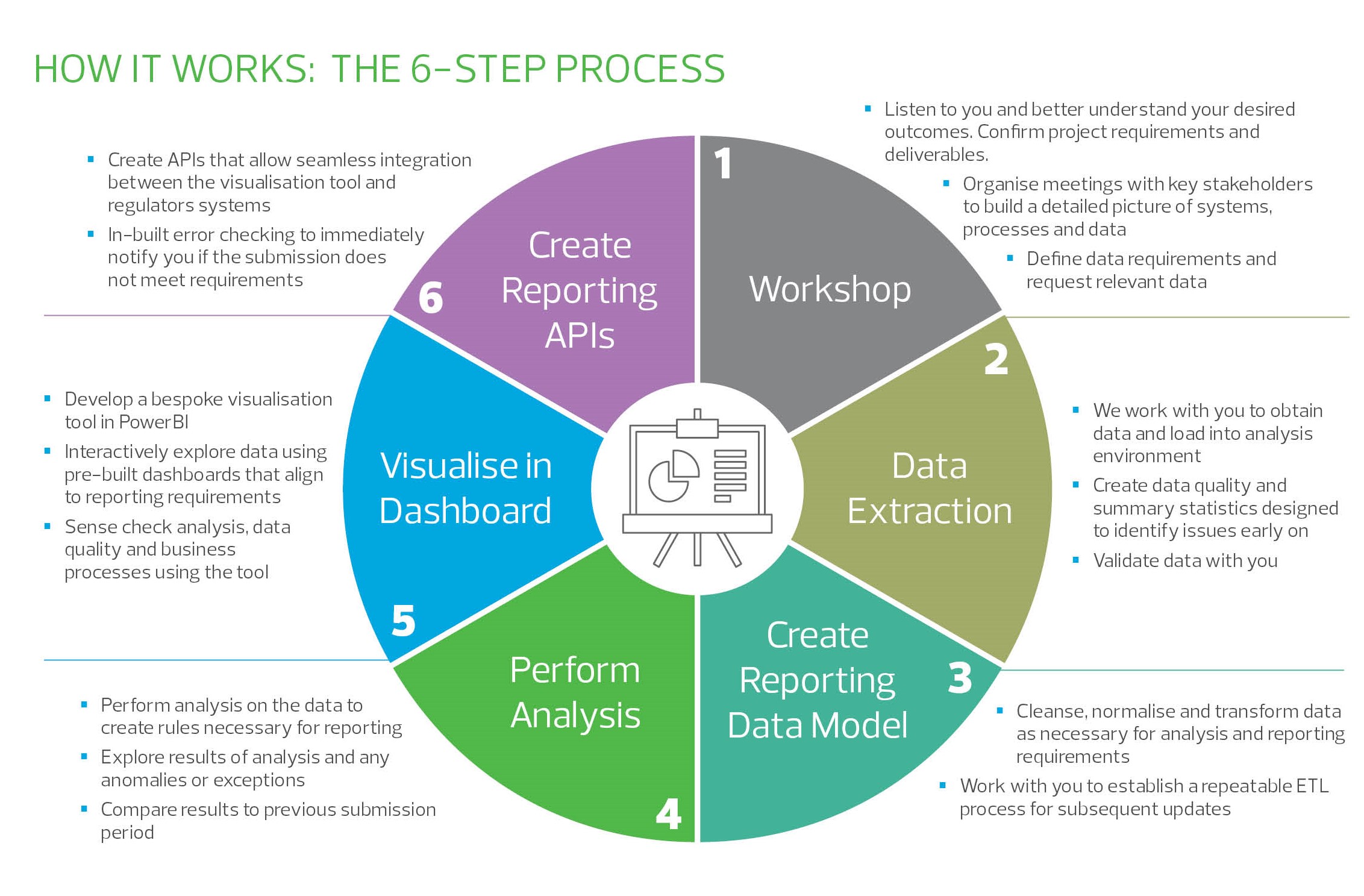

We have developed a 6-step process to deliver our Payment Times Reporting (PTR) solution to ensure your business meet its obligations quickly and easily, without being a burden to you.

RSM’s PTR solution uses the latest statistical tools and data visualisation software to prepare and structure your data, before interrogating and summarising in precisely the way required for reporting obligations. This tool provides operational efficiencies and enables you to uncover additional business insights through the analysis and visualisation of your data.