Das Polnische Lokalisierungspaket (Advanced PLP) erweitert die ursprüngliche Funktionalität in Oracle NetSuite.

Es handelt sich um eine Reihe von Modulen, die entwickelt wurden, um Ihr NetSuite-Finanzsystem in Übereinstimmung mit den Anforderungen des polnischen Rechnungslegungsgesetzes vollständig zu unterstützen. Nach der Installation des erweiterten Polnischen Lokalisierungspakets haben die Benutzer Zugriff auf eine ganze Reihe von Transaktionen, Belegen und Aufzeichnungen. Alle Bereiche des Polnischen Lokalisierungspakets enthalten speziell zugeschnittene Felder und Funktionalitäten, die es dem Benutzer ermöglichen, lokale Anforderungen zu definieren.

Nach der Installation von Advanced PLP erhalten Benutzer Zugriff auf eine breite Palette von Transaktionstypen, Unternehmensdateien und anpassbaren Finanzberichten. Die PLP-Module unterstützen alle Aspekte des Finanzmanagements in Übereinstimmung mit den polnischen Steuer- und Rechnungslegungsvorschriften und ermöglichen eine präzise Berichterstattung und die Einhaltung gesetzlicher Verpflichtungen.

Das IT-Consulting-Team von RSM Poland aktualisiert laufend das Polnische Lokalisierungspaket und passt es an die sich ändernden steuerrechtliche Vorschriften, Regelungen und Rechnungslegungspraktiken in Polen an. Wir stellen unseren Kunden regelmäßig release notes zur Verfügung, in denen neue Funktionalitäten und Verbesserungen vorgestellt werden, damit Systembenutzer Zugriff auf die neuesten Änderungen haben und die erweiterten Funktionen des Pakets in vollem Umfang nutzen können.

Auflistung der Module des polnischen Lokalisierungspakets

FUNKTIONALITÄT

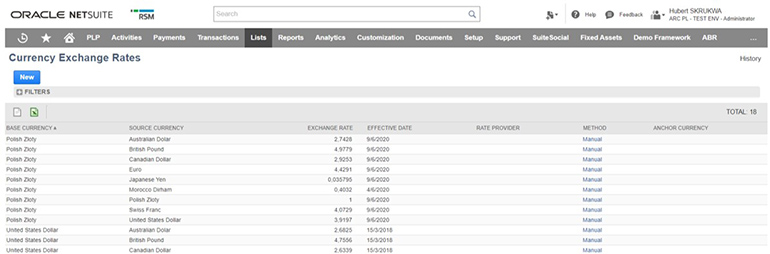

Jeden Tag veröffentlicht die NBP neue Tabellen mit Wechselkursen vom vorherigen Werktag. Dank dieser Funktionalität werden Wechselkursdaten täglich direkt auf NetSuite heruntergeladen, ohne dass zusätzliche Maßnahmen ergriffen werden müssen. Diese Funktionalität ist in das Tool zur Berechnung der Umsatzsteuer integriert und unterstützt sowohl die Erstellung von Umsatzsteuer-Voranmeldungen als auch die Angabe der erforderlichen Daten auf Rechnungen.

VORTEILE

- Die aktuellen Wechselkurse werden jeden Tag automatisch in NetSuite angezeigt (die Daten werden direkt von NBP heruntergeladen)

- Keine manuelle Dateneingabe notwendig

- Informationen, die zum Zwecke des Druckens einer Rechnung oder der Berechnungen im Rahmen von SAF-T- und KSeF heruntergeladen werden

- Zeitersparnis

- Zuverlässigkeit

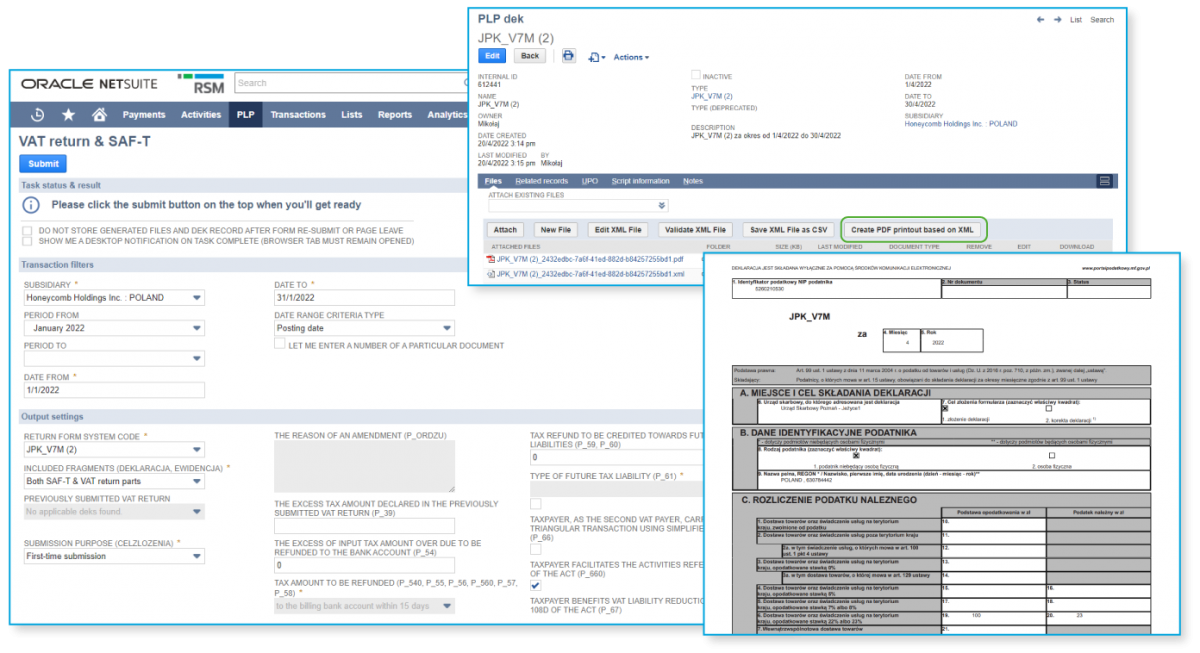

FUNKTIONALITÄT

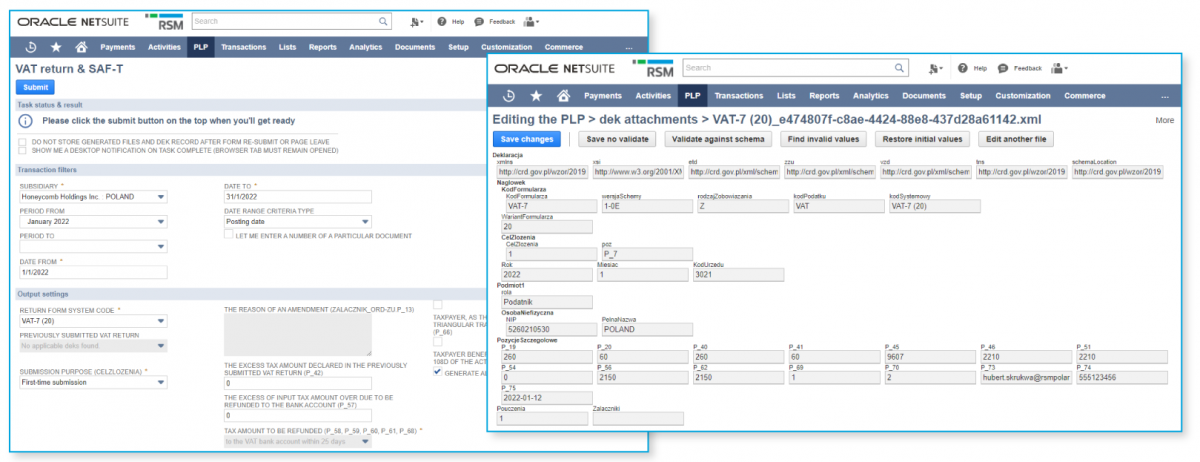

Ein Modul zur umfassenden Erstellung von USt-Voranmeldungen und Standard Audit File. Die Anwendung bietet Zugriff auf eine Ansicht der Dateien im PDF-Format sowie die Möglichkeit, Voranmeldungen zu unterzeichnen und sie direkt an das Finanzamt zu senden. Alle Vorfälle und Belege, die diesen Prozess begleiten, werden aufgezeichnet, gesichert und mit dem Voranmeldungsdatensatz verknüpft. Datenerfassung, Informationsverarbeitung und Erstellung von Abrechnungen sowie Bestätigung des Status der Voranmeldung erfolgen automatisch und zentralisiert.

VORTEILE

- Möglichkeit der Erstellung von SAF-T

- Möglichkeit der Visualisierung des Voranmeldungsteils als PDF-Datei

- Vollständiger Pfad zum Überprüfen des Status des hochgeladenen Belegs

- Übermittlung der Dateien direkt an das Finanzamt

- Elektronische Signatur integriert in NetSuite

- Speichern aller Vorfälle bei Erstellung einer Voranmeldung

- Minimiertes Risiko von Strafen und vollständige Log-Dateien über Vorfälle für Prüfungszwecke

- Verschlüsselter Versand, Sicherheit der Signatur, Daten- und Protokollspeicherung

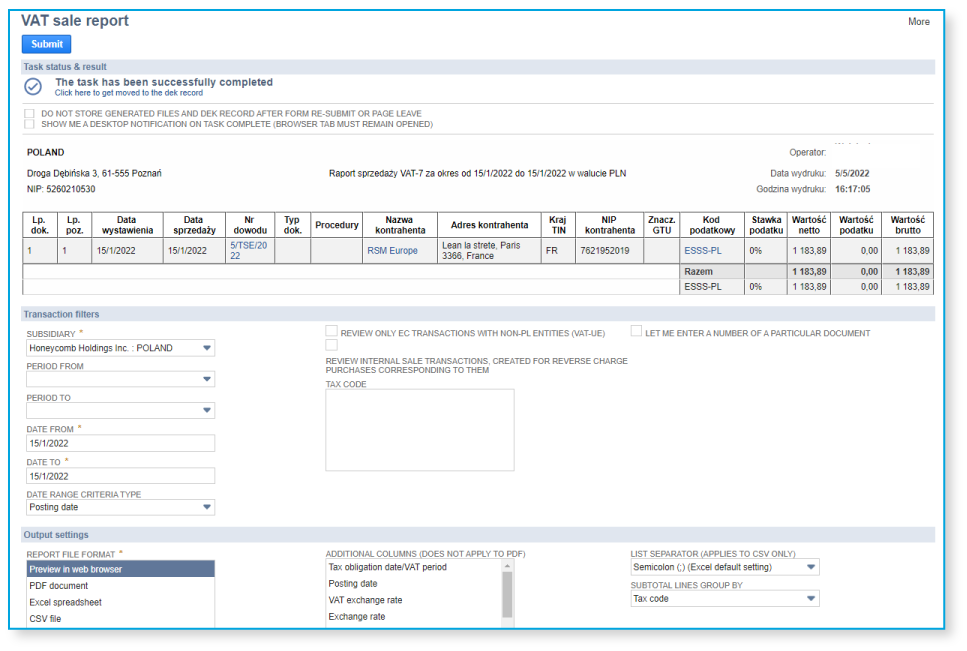

FUNKTIONALITÄT

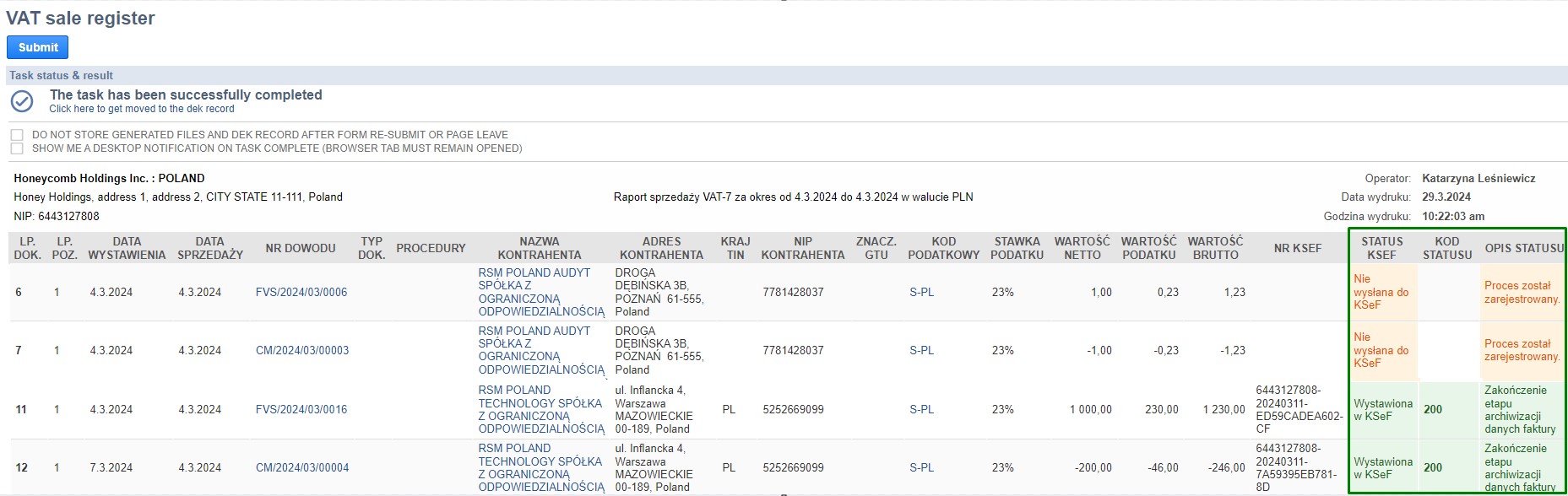

Das Polnische Lokalisierungspaket ermöglicht die Erstellung des VAT-Registers für Eingangs- und Ausgangsumsätze sowie Generierung einer zusammenfassenden Meldung. Dank dieser Funktionalität können Sie nicht nur Register erstellen, sondern auch Daten analysieren, den Bedarf an Korrekturen identifizieren und Teilregister für analytische Zwecke erstellen. Es stehen verschiedene Dateiformate zur Verfügung. Im Register werden Informationen im Zusammenhang mit dem KSeF und der Überprüfung der Steuerpflichtigen in verschiedenen Registern sowie andere Daten gespeichert, die zur Prüfung der Richtigkeit von Belegen erforderlich sind. Alle Register können zu Analyse- oder Prüfungszwecken gespeichert werden.

VORTEILE

- Berichte zur Bestätigung der Richtigkeit der Umsatzerfassung, nützlich für Analysen

- Berichte zur Bestätigung der Übereinstimmung von Daten in Voranmeldungen und auf den Konten

- Ein spezielles Toll zu Erhebung und Gruppieren von Daten für Zwecke der steuerlichen Überprüfung

- Einhaltung aller gesetzlichen Anforderungen

- Ein Tool zur Überwachung notwendiger Korrekturen

- Überwachung des Status von Rechnungen im KSeF

- Möglichkeit der Überprüfung der Umsatzsteuerpflichtigen und des angewandten Umsatzsteuersatzes für Verkauf

- Sicherheit und Zugang zu detaillierten Unterlagen für Prüfungszwecke

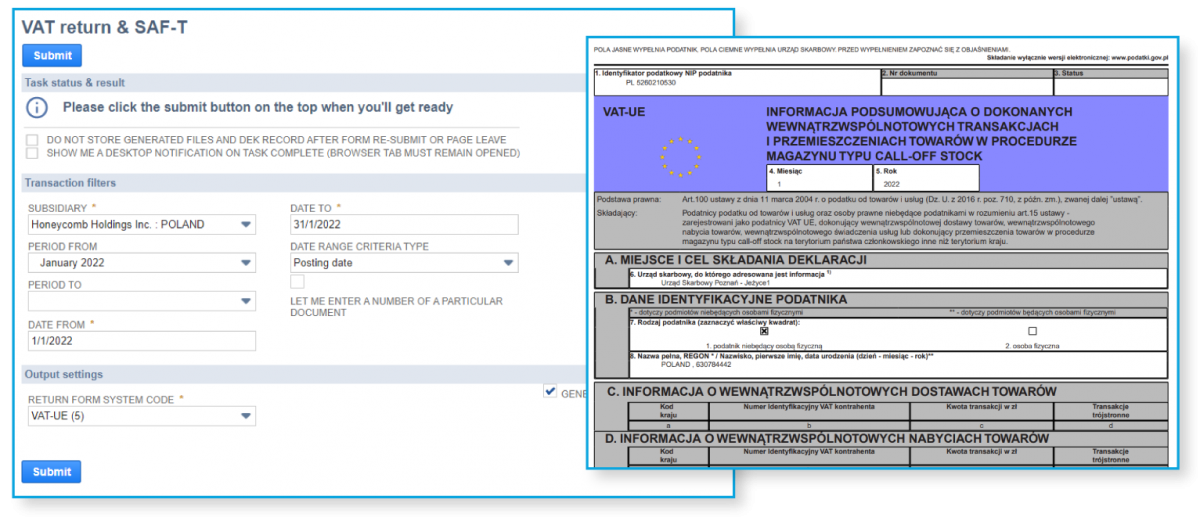

FUNKTIONALITÄT

Modul des Polnischen Lokalisierungspakets, das für Kunden entwickelt wurde, die Umsätze in der Europäischen Union tätigen. Die VAT-EU-Erklärung wird automatisch anhand von Daten generiert, die direkt im Rahmen des Polnischen NetSuite-Lokalisierungspakets vorbereitet wurden. Dank der Erweiterung der Standardfunktionalität ist es möglich, eine XML-Datei zu generieren, die an das Finanzministerium gesendet werden kann. Dieses Modul wurde um eine spezielle Methode zur Erstellung von Korrekturen für einen bestimmten Datenbereich erweitert.

VORTEILE

- Einhaltung der Vorgaben des Finanzministeriums und des Umsatzsteuergesetzes

- Möglichkeit der Visualisierung des Voranmeldungsteils als PDF-Datei

- Vollständiger Pfad zum Überprüfen des Status des hochgeladenen Belegs

- Übermittlung der Dateien direkt an das Finanzamt

- Elektronische Signatur integriert in NetSuite

- Speichern aller Vorgänge bei Erstellung einer Voranmeldung

- Minimiertes Risiko von Strafen und vollständige Log-Dateien über Vorgänge für Prüfungszwecke

- Verschlüsselter Versand, Sicherheit der Signatur, Daten- und Protokollspeicherung

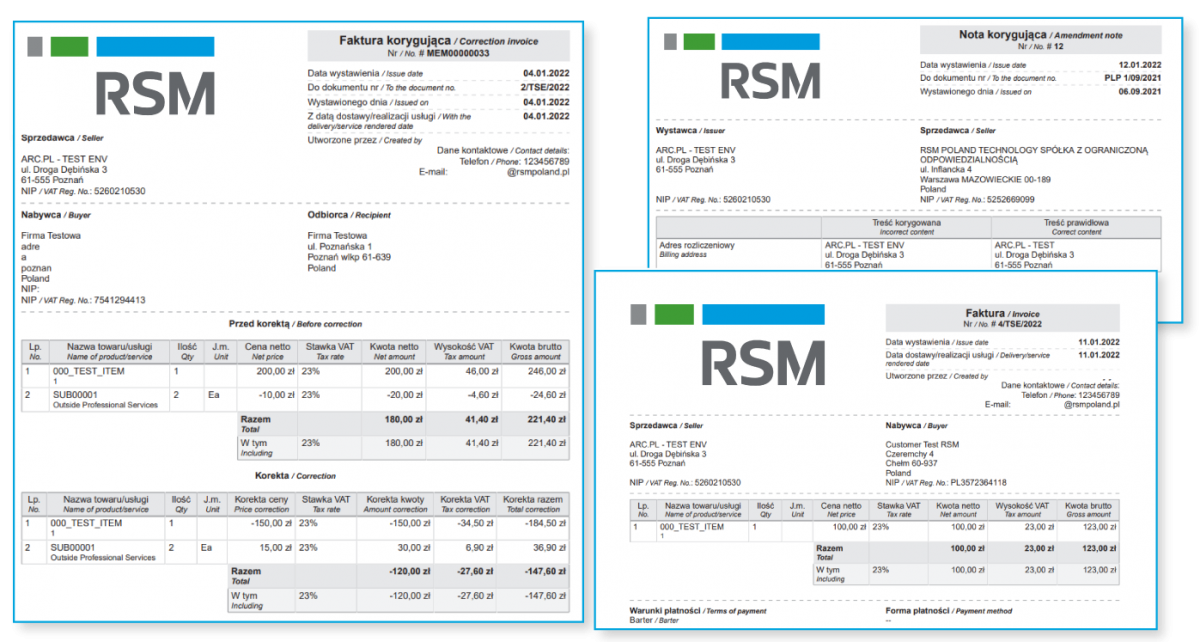

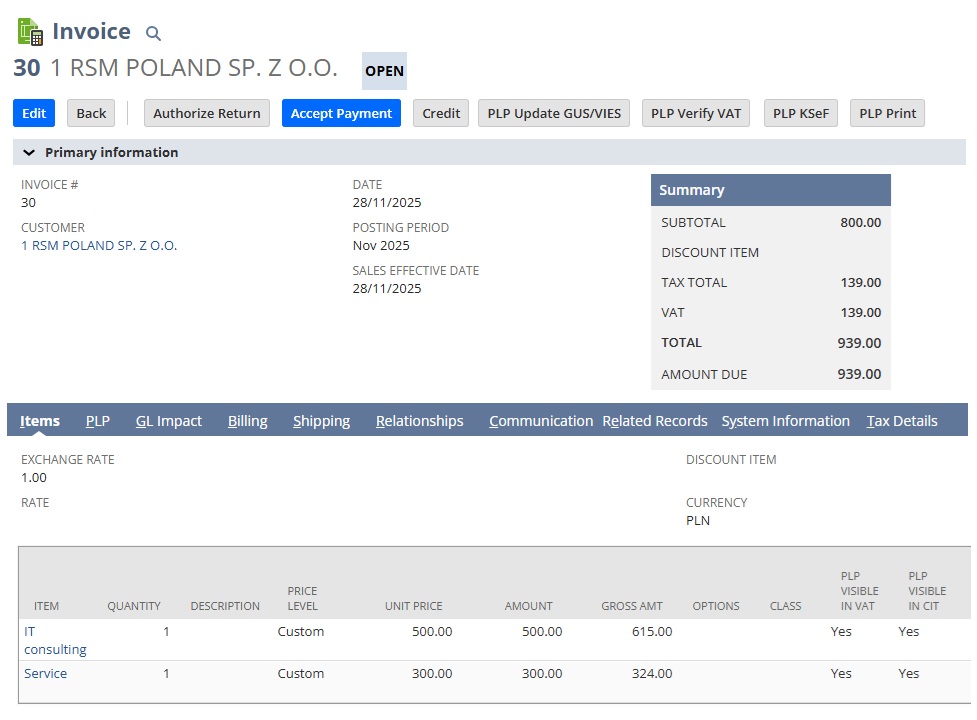

FUNKTIONALITÄT

Das Polnische Oracle NetSuite-Lokalisierungspaket bietet umfangreiche, vollständig konfigurierbare Funktionalität, die die Erstellung und den Versand von Belegen an einen Leistungsempfänger und leistenden Unternehmer ermöglicht, die Einhaltung der geltenden gesetzlichen Vorschriften gewährleistet und die Informationsbedürfnisse sowohl des Ausstellers als auch des Empfängers des Belegs erfüllt. Durch die Verwendung des Polnischen Lokalisierungspakets muss sich der Benutzer keine Gedanken über den Zugriff auf die erforderlichen Arten und Formate von Belegen, Korrekturen, Vermerke oder Berechnungen machen. Die Vorlagen bieten umfangreiche Einstellungen mit vielen Optionen, zusätzliche Felder in jedem Abschnitt und das Layout kann an individuelle Anforderungen angepasst werden. Die Funktionalität umfasst auch spezielle Ausdrucke von Anzahlungsrechnungen, Proformarechnungen und Noten.

VORTEILE

- Konformität mit den polnischen Rechnungslegungsstandards

- Automatische Generierung von Informationen basierend auf dem ausgewählten Transaktionstyp

- Alle Belege und Ausdrucke können mit NetSuite erstellt werden

- Umfangreiche Konfigurationsmöglichkeiten

- Bearbeitung aller Arten von Verkaufstransaktionen

- Volle Bearbeitung von Noten

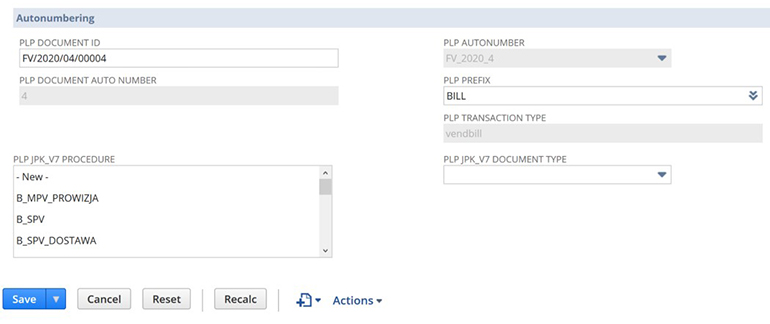

FUNKTIONALITÄT

Dokumentennummerierungssystem mit mehreren Varianten; ermöglicht die Aufrechterhaltung der fortlaufenden Nummerierung, die erforderlich ist, um die Anforderungen des Umsatzsteuergesetzes und Rechnungslegungsgesetzes zu erfüllen. Konfigurationsvarianten können auf die Erwartungen der anspruchsvollsten Kunden zugeschnitten werden.

VORTEILE

- Fortführung der Nummerierung für bestimmte Transaktionstypen

- Möglichkeit der Implementierung von unterschiedliche Sequenzen für dieselben Transaktionstypen

- Benutzerdefinierte Präfixe und Postfixe

- Jährliche und monatliche Nummerierung

- Transparenz der Buchführung

- Nummerierung gemäß den Anforderungen des Standard Audit File

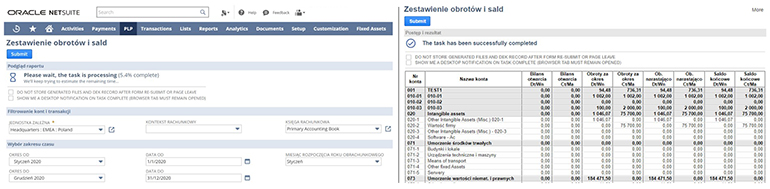

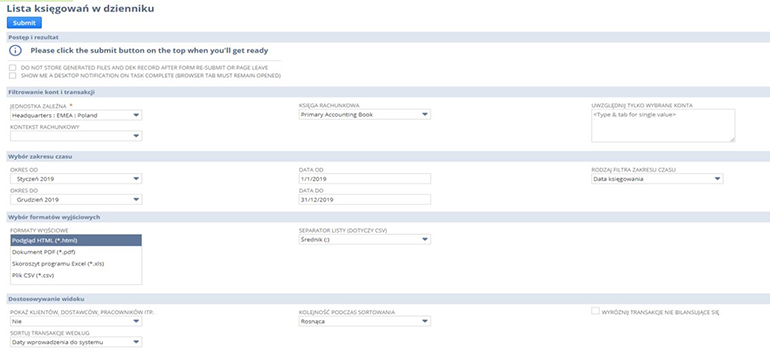

FUNKTIONALITÄT

Es wurde eine spezielle Vorlage für Summen- und Saldenliste mit der Druckmöglichkeit entwickelt, um den polnischen Kontenrahmen vollständig widerzuspiegeln und alle Kundenanforderungen zu erfüllen. Die Vorlage ist an die polnischen Anforderungen angepasst und bietet die Identifizierung der Eröffnungsbilanz, der Summen der Periode und der Schlussbilanz.

VORTEILE

- Die Vorlage spiegelt vollständig den polnischen Kontenrahmen wider

- Buchungen auf den Hauptbuch- und Nebenbuchkonten entsprechen den polnischen Rechnungslegungsstandards

- Verschiedene Exportformate verfügbar, einschließlich Druck

FUNKTIONALITÄT

Diese Zusammenstellung ermöglicht eine detaillierte Analyse der im System verfügbaren Daten dank einer Vielzahl verfügbarer Filteroptionen. Das Modul ermöglicht den Download der Daten von Standardtransaktionen und ihre Aufnahme in ausführliche Berichte für Geschäftsführung.

VORTEILE

- Automatische Übernahme der im System vorhandenen Daten

- Verschiedene Filteroptionen

- Möglichkeit der Speicherung von Ergebnissen in mehreren universellen Formaten

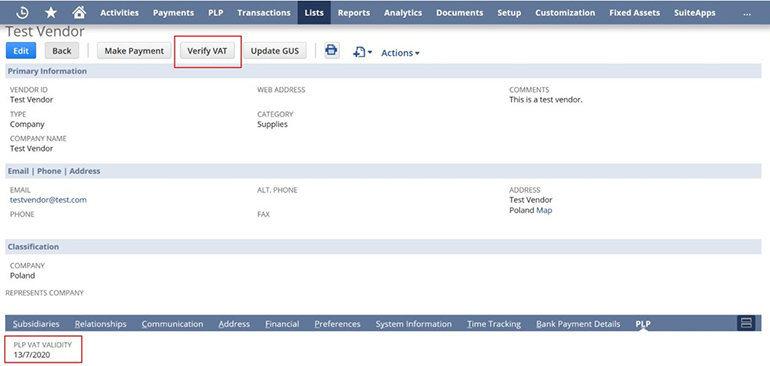

FUNKTIONALITÄT

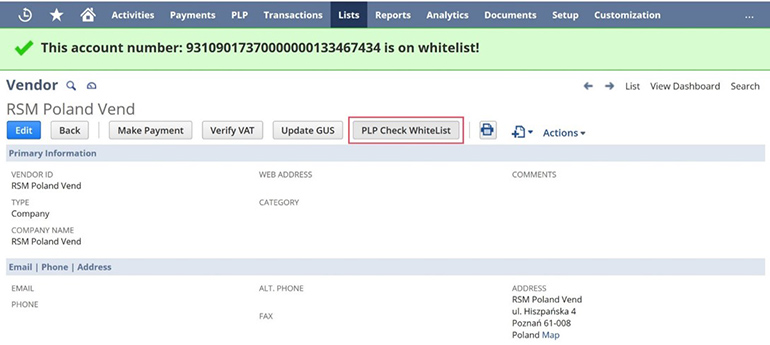

Im Rahmen des Polnischen Oracle NetSuite-Lokalisierungspakets wurde eine erweiterte Funktionalität implementiert, die eine umfassende Überprüfung der Daten von Geschäftspartnern in GUS-Register, VIAS und in der Datenbank der aktiven Umsatzsteuerpflichtigen ermöglicht. Dadurch kann der Benutzer bei der Eingabe eines neuen Geschäftspartners in das System oder bei der Aktualisierung seiner Daten die Informationen aus diesen Registern automatisch herunterladen und aktualisieren. Automatische Überprüfung erfolgt bei jedem Ablauf, für den dies notwendig ist. Zum Beispiel prüft das System bei einer Zahlung, ob das Konto des leistenden Unternehmers auf der weißen Liste steht, und beim Erstellen des Registers überprüft das System den Steuerpflichtigen in Bezug auf seinen Status als aktiver Umsatzsteuerpflichtiger nach dem polnischen Recht und Unionsrecht.

VORTEILE

- Überprüfung der Geschäftspartnerdaten

- Automatische Aktualisierung der Daten auf Basis von GUS-Register / VIES

- Überprüfung von Umsätzen in jeder Phase, von der Erstellung und Generierung von Registern bis hin zur Abwicklung von Zahlungen

- Sicherheit und Rechtskonformität

- Information über Überprüfung verfügbar für Prüfungszwecke

- Funktionsfähigkeit und Prüfung von Abläufen im Hintergrund

- Ein Tool, das in alle Steuerregister und Aufzeichnungen integriert ist

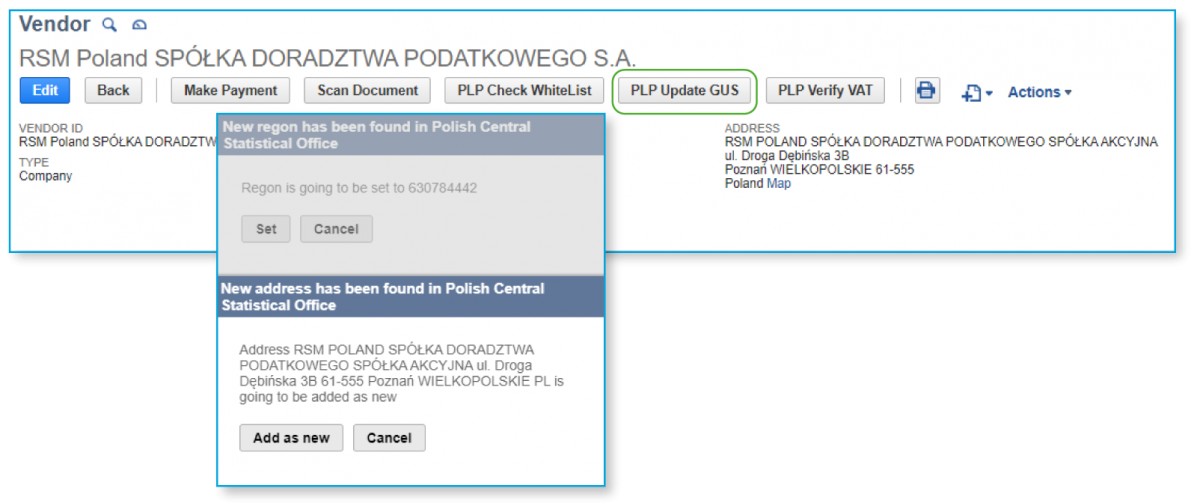

FUNKTIONALITÄT

Die Bewertung von Fremdwährungskonten nach der FIFO-Methode ermöglicht es, die Abflüsse vom Bankkonto in Fremdwährung in den aktuellen Wert eines bestimmten Tages nach dem FIFO-Prinzip in PLN umzurechnen (basierend auf chronologischen Ein- oder Ausgängen auf dem Konto). Die so durchgeführte Bewertung wird automatisch im System verbucht.

VORTEILE

- Automatisierter Prozess ohne Notwendigkeit der Verwendung von externen Tools

- Berechnungen auf Basis von Transaktionsdaten in NetSuite

- Verfügbar für alle Währungen

- Automatisches Generieren von Buchungsbelegen

- Speicherung von Berechnungen

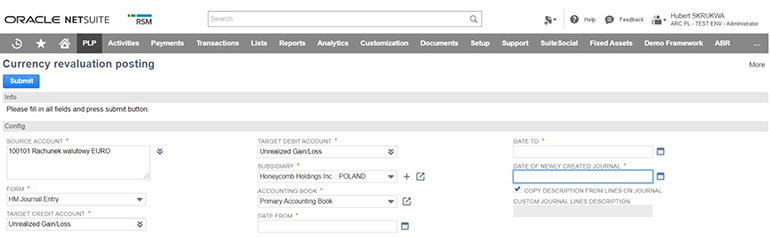

FUNKTIONALITÄT

Das spezielle Modul des Polnischen Lokalisierungspakets für Bankzahlungen berücksichtigt das Split-Payment-Verfahren. Diese Funktionalität ermöglicht die Vorbereitung einer Sammelüberweisung, Gruppieren von Einzelüberweisungen und Weiterleitung des Sammelüberweisungsauftrags an die Bank in verschiedenen Formaten, je nach den Anforderungen eines bestimmten Banksystems. Die erweiterten Funktionen des Moduls ermöglichen die automatische Markierung der Transaktion als bezahlt und Überprüfung der Bankkontonummern auf ihre Übereinstimmung mit der weißen Liste. Das Modul ist flexibel und kann an nahezu jede Online-Banking-Plattform angepasst werden.

VORTEILE

- Aktuelle Informationen über die Bankkontonummer des Geschäftspartners im Register

- Integriert in das Tool zur Erstellung von Zahlungs- und Abrechnungsbelegen in NetSuite

- Bequeme Zahlungsvorbereitung und -überprüfung

- Markierung der getätigten Zahlungen

- Automatische Validierung des Bankkontos

- Spezielles Modul zur Unterstützung der Sicherheit von Bankdaten

FUNKTIONALITÄT

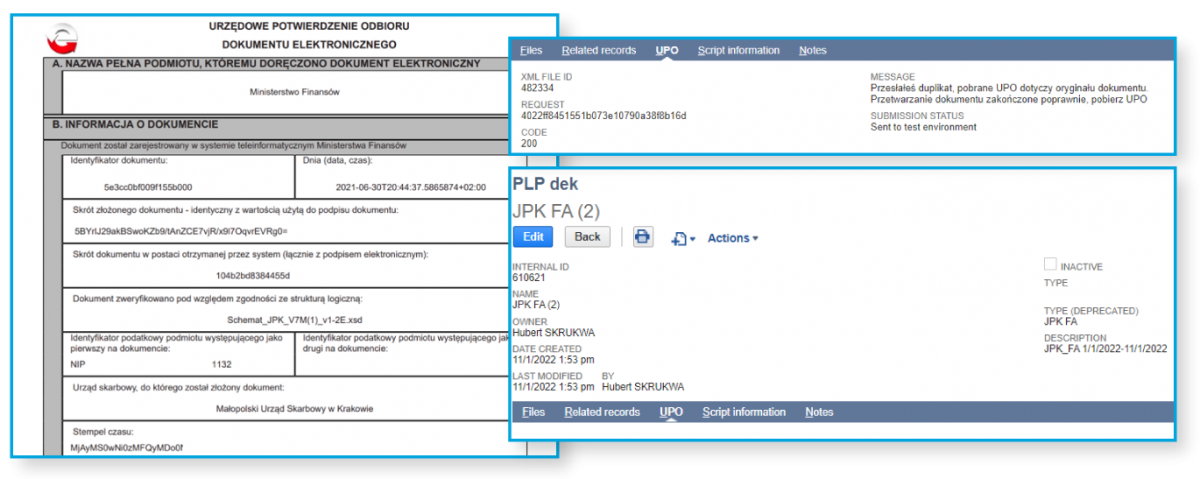

Möglichkeit, Voranmeldungen, Erklärungen und SAF-T, die mit den im polnischen Lokalisierungspaket verfügbaren Funktionen erstellt wurden, an den Server des Finanzministeriums zu senden. Das Modul ermöglicht die automatische Verwendung verfügbarer Signaturen und den Empfang von UPO.

VORTEILE

- Datenversand ohne Notwendigkeit der Verwendung anderer Software

- Empfang von UPO

- Die Möglichkeit der weiteren Bearbeitung von hochgeladenen Dateien, nachdem sie an die zuständigen Behörden übermittelt wurden, ist gesperrt

FUNKTIONALITÄT

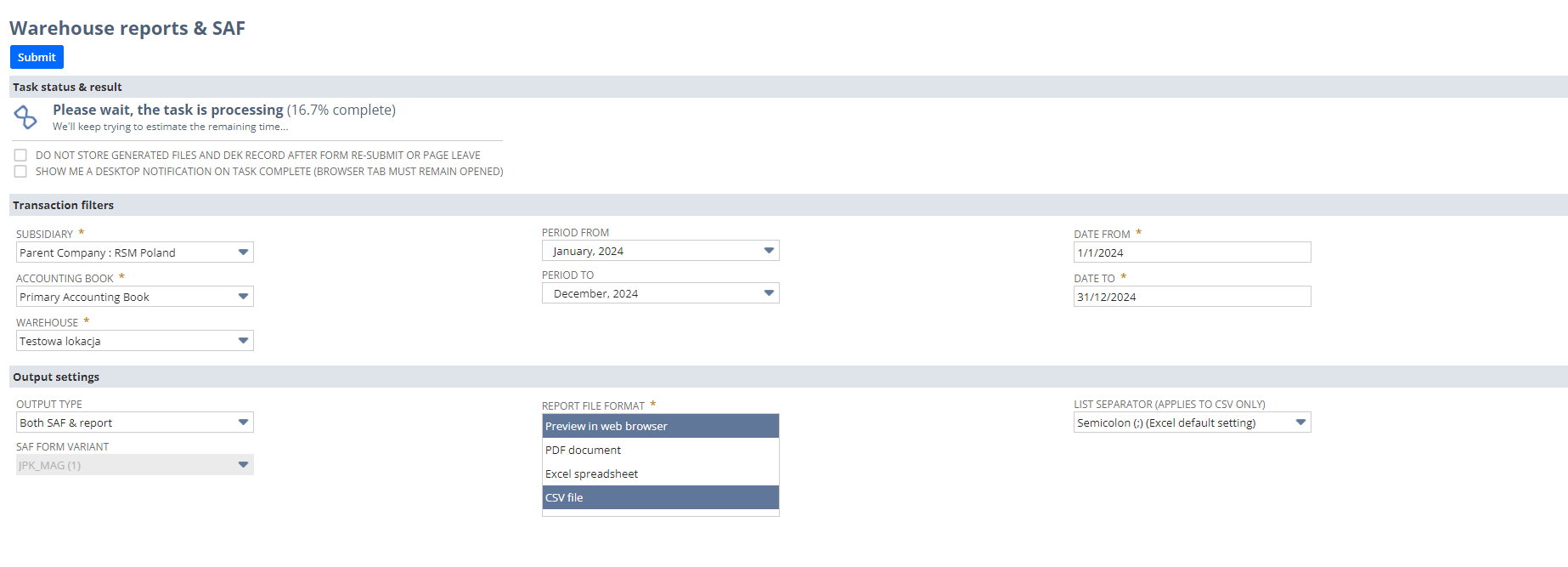

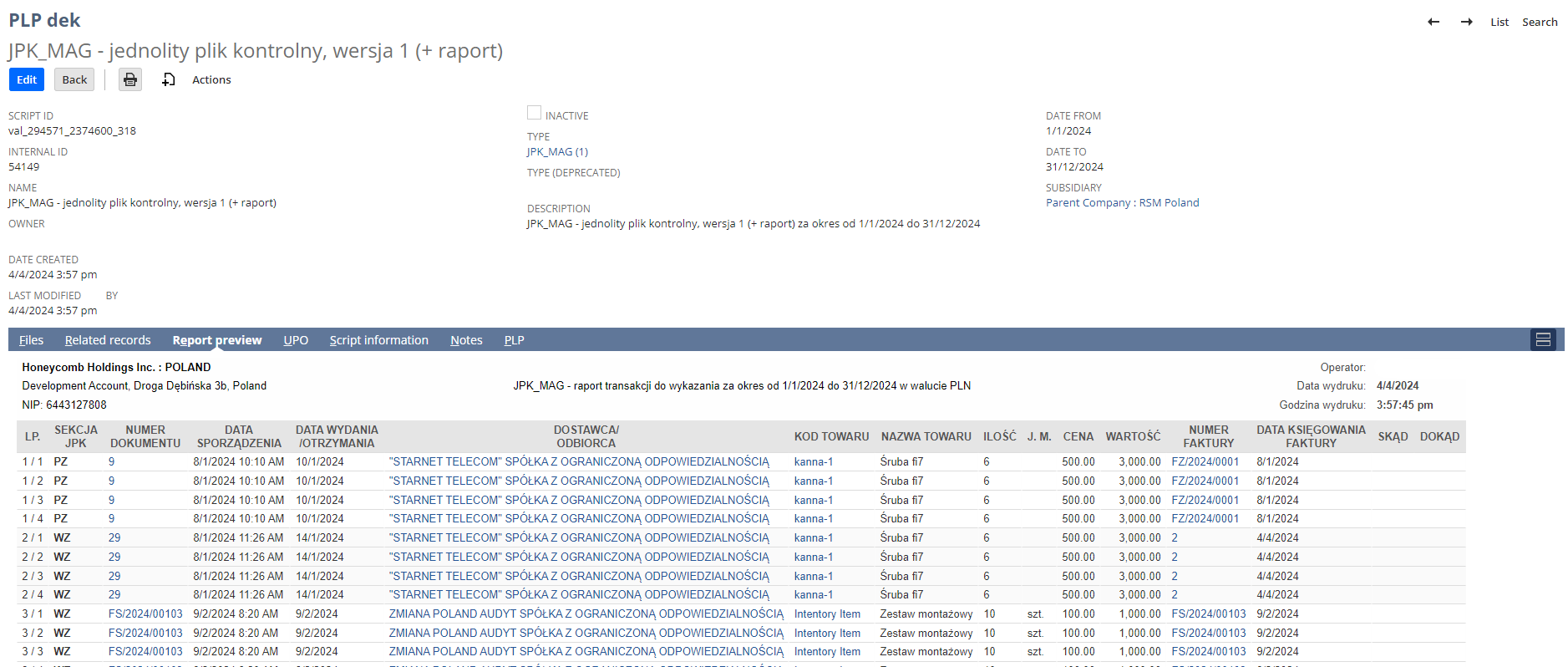

Die Führung von Aufzeichnungen über Lagerbestand an Waren und RHB-Stoffen im NetSuite-System hängt mit der Notwendigkeit zusammen, der Berichtspflicht nachzukommen, d. h. mit der Erstellung von JPK_MAG, dem Drucken von Lagerbelegen oder der Unterstützung in Form von Prozessautomatisierung. Die im JPK_MAG-Modul verfügbaren Funktionalitäten entsprechen denen, die im Abschnitt über SAF-T und Voranmeldungen beschrieben sind. Dank dieses Moduls ist es möglich, einen Bericht zu erstellen, zu speichern, zu unterzeichnen und an die zuständige Behörde zu senden. Alle Daten werden gespeichert und stehen für eine mögliche Prüfung zur Verfügung. Darüber hinaus ermöglicht das Modul das Drucken von Belegen, und die eingeführten Automatisierungen gewährleisten die Konsistenz der Daten, die sich aus diesen Umsätzen ergeben, mit Finanzdokumenten, wie z. B. Rechnungen oder Korrekturrechnungen.

VORTEILE

- Generieren des JPK_MAG-Berichts

- Möglichkeit der Überprüfung und Validierung auf Basis der gesetzlichen Vorlage

- Automatisches Dokumenten-Repository

- Unterzeichnen der erstellten Datei und ihr Versand an das Gateway des Finanzamtes, wie bei anderen Voranmeldungen und Erklärungen, z.B. JPK_VAT7

- Erstellen und Drucken von Lagerbelegen

- Automatischer Informationsfluss von Einkaufs- oder Verkaufsaufträgen über Lagerbelege bis hin zu Eingangs- oder Ausgangsrechnungen

- Unterstützung von Finanzprozessen, bei denen eine Parametrisierung auf der Ebene der Indexdefinition oder der Bestandstransaktion selbst wichtig ist

FUNKTIONALITÄT

Das Polnische Lokalisierungspaket bietet die Möglichkeit, Saldenbestätigungen oder Zahlungsaufforderungen für Lieferanten und Kunden für einen beliebigen Zeitraum mit einer Druckvorlage zu bearbeiten, die mit anderen ausgestellten Dokumenten übereinstimmt.

VORTEILE

- Ausdruck einer Saldenbestätigung für einen beliebigen Tag für Lieferanten und Kunden

- Ausdruck der Zahlungsaufforderung

- Möglichkeit, eigene Kommentare hinzuzufügen

- Konsistenz der Vorlage mit anderen versandten Dokumenten

- Mögliche Bearbeitung in mehreren Sprachen

FUNKTIONALITÄT

Das Polnische Lokalisierungspaket (PLP) Oracle NetSuite bietet Unterstützung bei der Erfassung von Umsätzen durch Journal Entry. Bei ordnungsgemäßer Eingabe der Buchung kann der Beleg in VAT-Registern, Umsatzsteuer-Voranmeldungen und JPK (SAF-T) dargestellt und an das KSeF gesendet werden. Im Falle der Eintragung eines Ausgangsumsatzes ist es möglich, analog zu Ausgangsrechnungen und Korrekturrechnungen einen PLP-Ausdruck im PDF-Format zu generieren.

VORTEILE

- Volle Unterstützung für Felder und Parameter, die bei Eingangs- und Ausgangsumsätzen auftreten.

- Bearbeitung spezifischer Fälle, die in VAT-Registern und Umsatzsteuer-Voranmeldungen erfasst werden, z. B. interne Rechnung, Steuerermäßigung wegen uneinbringlicher Forderungen.

- Unterstützung der Umsätze durch NetSuite Intercompany Journal Entry

- Möglichkeit, die Ausgangsbelege und Korrekturnoten im PLP auszudrucken.

- Möglichkeit, eine XML-Datei in KSeF zu generieren und sie zu versenden.

FUNKTIONALITÄT

Im Rahmen des Polnischen Lokalisierungspakets Oracle NetSuite steht die Unterstützung bei der Bearbeitung von Umsätzen im Zusammenhang mit der Anpassung der Umsatzsteuerbemessungsgrundlage aufgrund der sog. Steuerermäßigung wegen uneinbringlicher Forderungen zur Verfügung. Mit dem entsprechenden Journal Entry wird die Darstellung von erforderlichen Informationen in den entsprechenden Feldern der SAF-T-Voranmeldung sichergestellt. Es ist möglich, Anpassungen vorzunehmen, um die Bemessungsgrundlage in Bezug auf die zu zahlende Steuer und die Vorsteuer zu verringern und zu erhöhen.

VORTEILE

- Unterstützung aller möglichen Arten von Anpassungen der Bemessungsgrundlage und der Umsatzsteuer

- Unterstützung für notwendige Zusatzinformationen, z.B. Fälligkeitsfrist, Zahlungstag

FUNKTIONALITÄT

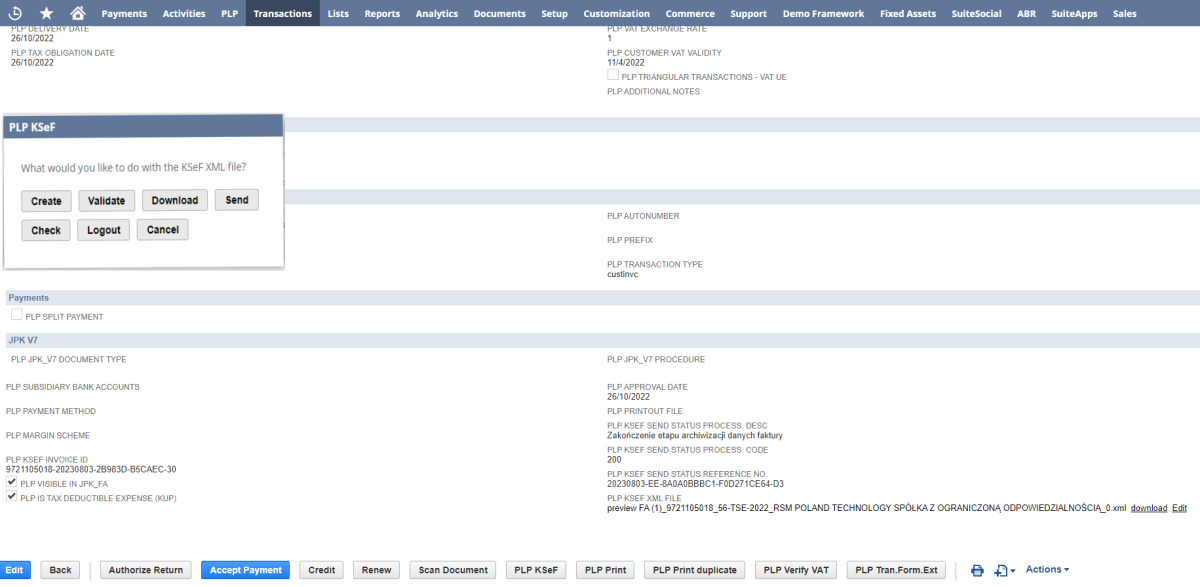

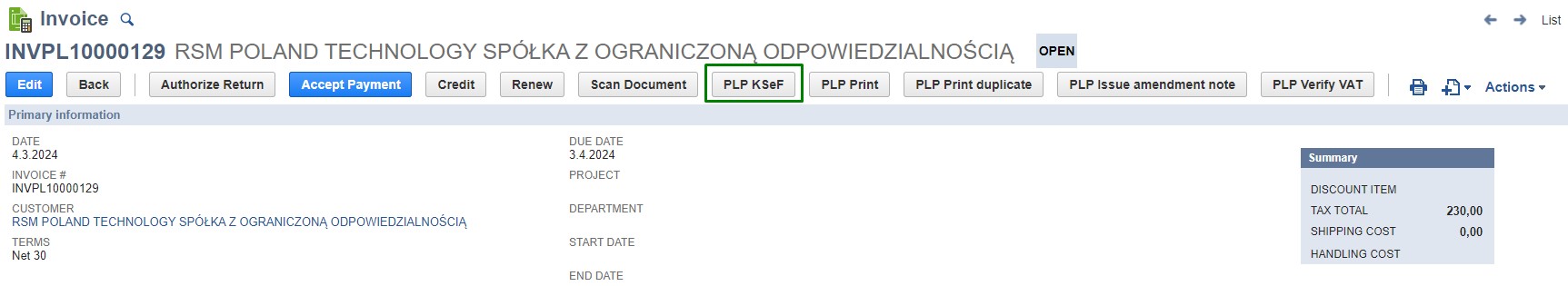

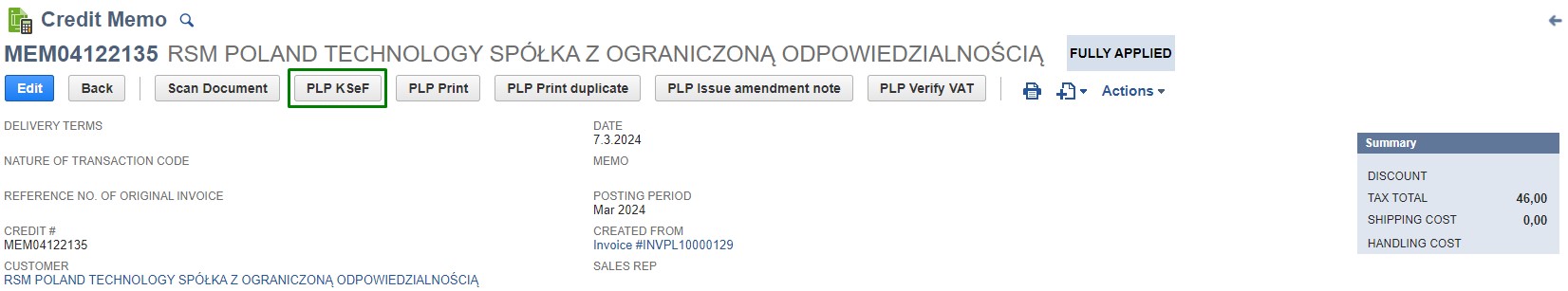

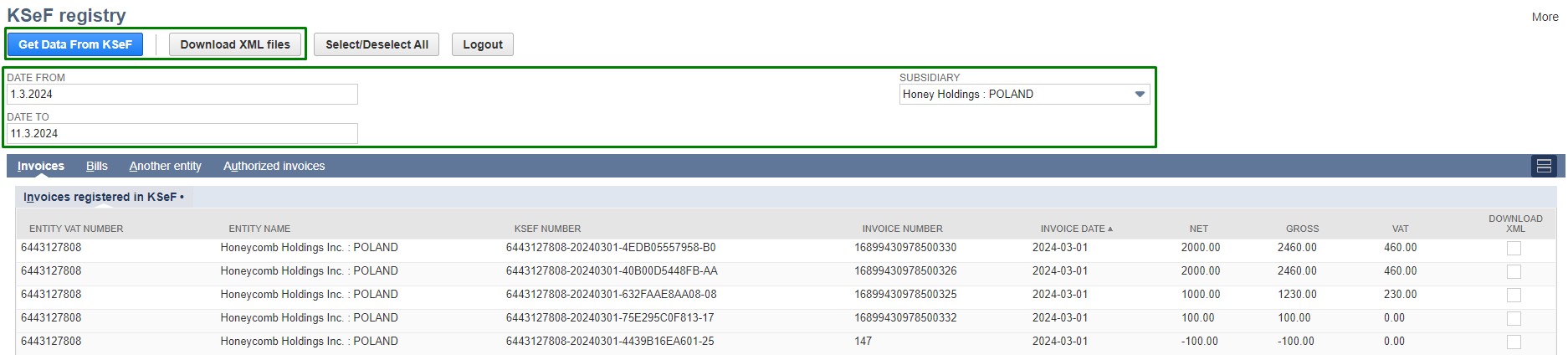

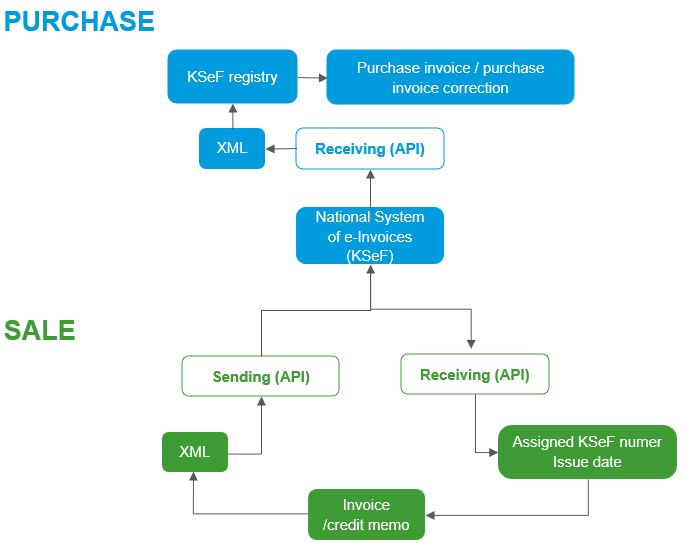

Das Landesweite E-Rechnungssystem (KSeF) ist eine Plattform für elektronische Ausstellung und Empfang von Rechnungen. Das KSeF-Modul im Polnischen Lokalisierungspaket Oracle NetSuite ist eine umfassende cloudbasierte Lösung für die Verwaltung elektronischer Belege. Diese Lösung ermöglicht eine effiziente und sichere Verbindung mit der Plattform des Finanzministeriums, das Erstellen und Versenden von Rechnungen einzeln und in einer Sammlung sowie den Empfang von Versandbestätigungen. Im KSeF-Modul wird ein Register der ein- und ausgehenden Belege erstellt und es ist möglich, automatisch einen Eingangsbeleg auf der Grundlage der von dem leistenden Unternehmer erhaltenen XML-Datei zu erstellen.

VORTEILE

- Sicheres Erstellen, Versenden und Empfangen von E-Rechnungen durch eine direkte Verbindung zur Plattform des Finanzministeriums von der Systemebene aus.

- Automatisierung des Rechnungsversands durch entsprechende Skript-Konfiguration (Schutz des Prozesses vor dem Versand der nicht genehmigten Belege, die nicht durch das KSeF abgedeckt sind bzw. vor dem zweimaligen Versand).

- Automatisierung der Überprüfung des Rechnungsstatus im KSeF (das Herunterladen aktueller Informationen über den Bearbeitungsstatus eines bestimmten Belegs im KSeF kann ohne Benutzereingriff erfolgen).

- Sichtbarkeit des KSeF-Status im VAT-Register für Ausgangsumsätze.

- Unterstützung der Sichtbarkeit von KSeF-Daten auch im VAT-Register für Eingangsumsätze in Bezug auf den Beschaffungsprozess und Unterstützung der diesbezüglichen Informationen, die durch das neue Dateiformat von JPK_VAT7 benötigt werden.

- KSeF-Registry-Funktionalität für den Beschaffungsprozess – ermöglicht das Herunterladen von Informationen über Belege, die auf der E-Rechnungsplattform für ein bestimmtes Unternehmen in einem bestimmten Zeitraum registriert sind. Diese Funktionalität ermöglicht eine umfassende Prozessunterstützung durch NetSuite, ohne dass Sie sich auf der Website der Ministerien einloggen müssen.

- Mechanismus zum Import von Eingangsbelegen im KSeF Registry-Modul, der die automatische Verknüpfung einer Rechnung mit dem entsprechenden Auftrag und die Identifizierung der Steuereinstellungen von Eingangsrechnungen ermöglicht – Unterstützung der Automatisierung von Buchhaltungsprozessen.

- Volle Transparenz über den Prozess der Verknüpfung einer Rechnung in NetSuite mit einem Datensatz, einer Sitzung und einem Status aus der KSeF-Ebene.

- Vollständige Anpassung in Bezug auf optionale Felder unter Berücksichtigung der Anforderungen und Erwartungen der Rechnungsempfänger.

- Zeilengruppierungsregeln – ein Mechanismus zur Konfiguration von Gruppierungsregeln, der die korrekte Darstellung von Verkaufslinien gewährleistet, die auf spezifische Geschäftsanforderungen zugeschnitten sind.

- Volle Unterstützung für alle Arten von Belegen, einschließlich Korrekturbelegen.

- Volle Unterstützung der Kunden in Bezug auf die hohe Systemverfügbarkeit bei einer fortschrittlicheren Architektur mit externen Systemen (Datei-Upload, Verwaltung der Dateisichtbarkeit auf der Ebene eines anderen Vertriebssystems als NetSuite).

- Volle Unterstützung des Offline-Modus auch unter Verwendung externer Systeme.

- Zusätzliche Mechanismen zur Materialisierung von Rechnungen im PDF-Format und vollständige Einhaltung von Workflows, die es Ihnen ermöglichen, den Versandprozess per E-Mail und KSeF-Gateway frei zu gestalten.

KSeF-Modul im Polnischen Lokalisierungspaket:

Versand einer KSeF-Rechnung:

Sichtbarkeit des KSeF-Status im VAT-Register für Ausgangsumsätze – die Möglichkeit, eine kollektive Überprüfung des Status der Belegverarbeitung im KSeF in der Phase des Abgleichs der VAT-Register für Ausgangsumsätze durchzuführen:

KSeF Registry:

FUNKTIONALITÄT

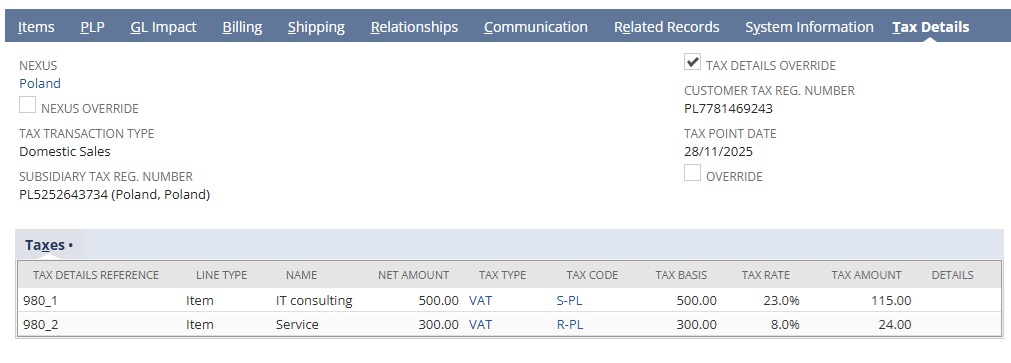

SuiteTax ist eine der Steuer-Engines, die in Oracle NetSuite verfügbar sind. Im Vergleich zur alternativen Legacy Tax Engine zeichnet sich SuiteTax durch Unterschiede in der Definition der steuerlichen Identifikationsnummern von Geschäftspartnern und der Methode zur Eintragung der Steuerdaten bei Transkationen aus.

Das Polnische Lokalisierungspaket verwendet neue SuiteTax-Felder und -Mechanismen sowie bietet Unterstützung und Richtigkeit der bei den folgenden Abläufen verwendeten und dargestellten Daten:

- Herunterladen von Geschäftspartnerdaten und ihre Überprüfung in Systemen des Hauptstatis-tikamtes (GUS) und VIES

- Ausdruck von Ausgangsbelegen

- Eintragung von Steuerdaten in Ausgangsbelegen, Eingangsbelegen, sonstigen Buchungsbele-gen

- Erstellung von VAT-Registern, Umsatzsteuer-Voranmeldungen und SAF-T

- Generieren von Zahlungsdateien im Bank Payments Modul des Polnischen Lokalisierungspa-kets

- Versand der Verkaufsdaten an KSeF

Vorgänge unterstützt durch das Polnische Oracle NetSuite-Lokalisierungspaket

- Profromarechnungen

- Einkaufs- oder Verkaufsaufträge

- Lagerbelege

- Ausgangsrechnungen und Korrekturen von Ausgangsrechnungen (in plus und in minus)

- Lastschiften und Gutschriften

- Eingangsrechnungen und Korrekturen von Eingangsrechnungen

- Korrekturnoten für Einkauf und Verkauf

- Anzahlungsrechnungen, Abrechnungsrechnungen und ihre Korrekturen

- Buchungsaufträge und automatische Stornierung

- Spezifische Vorgänge – Umbuchungen, Abrechnungen, automatische Vorgänge

- Konsolidierungsvorgänge – unternehmensübergreifende Umbuchungen

Steuergebiete unterstützt durch das Polnische Oracle NetSuite-Lokalisierungspaket

Das Polnische Oracle NetSuite-Lokalisierungspaket bietet umfassende Tools für den Umgang mit der Körperschaftsteuer und Umsatzsteuer, die eine sichere und rechtskonforme Buchführung und Abrechnung von Transaktionen mit dem Finanzamt ermöglichen. Die Funktionalitäten des Pakets werden regelmäßig erweitert und an sich ändernde gesetzliche Anforderungen angepasst. Die Implementierung des Polnischen Oracle NetSuite-Lokalisierungspakets garantiert die vollständige Einhaltung der polnischen steuerrechtlichen Vorschriften und bietet gleichzeitig kontinuierlichen Support und Updates als Reaktion auf sich dynamisch ändernde Anforderungen.

Das Polnische Oracle NetSuite-Lokalisierungspaket ermöglicht u.a.:

- Bearbeitung von igE/igL;

- Einfuhr/Ausfuhr von Waren und Dienstleistungen;

- Bearbeitung von Dreieckgeschäften;

- Bearbeitung von Transaktionen, die in einem anderen Staat steuerpflichtig sind;

- Unterstützung bei der Anwendung des OSS-Verfahrens;

- Umgang mit allen Codes, Ausdrucken und Verfahren für Umsatzsteuerabrechnung;

- Berechnung der Umsatzsteuer und Buchung der Differenz zwischen dem Wechselkurs für die Körperschaftsteuer und Umsatzsteuer;

- Prüfung der Rechtmäßigkeit des Vorsteuerabzugs auf der Grundlage von Daten aus dem VAT-Register und VIES;

- Volle Bearbeitung der Steuerermäßigung wegen uneinbringlicher Forderungen;

- Bearbeitung von automatisierten internen Belege für Umsatzsteuerzwecke;

- Bearbeitung von Anzahlungen und ihre Abrechnung;

- Berechnung der Abrechnung von Fahrzeugkosten und anderen Teilabzügen unter Berücksichtigung der Einkommensteuer und Umsatzsteuer;

- Einkommensteuerliche und umsatzsteuerliche Abrechnung der Leistungen an Arbeitnehmer;

- Unterstützung der Pro-rata-Abrechnung;

- Bearbeitung der Umsätze mit Differenzbesteuerung;

- Bearbeitung aller Arten von jährlichen Korrekturen für die Zwecke der Voranmeldungen;

- Unterstützung im Falle der Besteuerung nach vereinnahmten Entgelten

- Zugriff auf umfangreiche Funktionen, mit denen das Verkaufsdatum in jeder Zeile des Vorgangs in PLN und Fremdwährung im Rahmen eines Verkaufsbelegs bestimmt werden kann;

- Zugang zu erweiterter Logik, die das Einstellen des Zeitpunkts des Entstehens der Steuerpflicht für Eingangsrechnungen unterstützt;

- Bearbeitung von Korrekturen aller Arten von Daten und Lasten, die Korrekturbelege erfordern – der Rechnungen und Noten;

- Automatisierung von Wechselkursen für Umsatzsteuerzwecke bei Korrekturbelegen;

- Automatisierung zur Unterstützung der Konsistenz der Daten auf den Endbelegen in Verbindung mit den Lagerbelegen (korrekte Bestimmung der Steuerpflicht);

- Zugang zu erweiterter Logik, die den Benutzer bei der Bestimmung des Zeitpunkts des Entstehens der Steuerpflicht unterstützt;

- Multibook-Service mit verschiedenen Währungen für die o.g. Vorgänge;

- Unterstützung der Berechnung der Körperschaftsteuer (Steuerklassifikatoren und Drucken von Körperschaftsteuerberichten);

- Vollständige Integration aller oben genannten steuerlichen Vorgänge in das KSeF;

- Unterstützung des Benutzers beim Abgleich der Umsatzsteuerwerte und im Falle der Notwendigkeit, eine Korrektur vorzunehmen;

- Zugriff auf die Steuerlogik, die die korrekte Bestimmung der Steuerparameter für eine Eingangsrechnung auf der Grundlage der im KSeF erhaltenen Rechnung ermöglicht;

- Automatische Darstellung aller o.g. Berechnungen im SAF-T.

Warum ist die Wahl der richtigen Oracle NetSuite-Lokalisierung für Ihr Unternehmen von entscheidender Bedeutung?

Gewährleistet die Einhaltung der polnischen Steuer- und Rechtsvorschriften

Minimiert das Risiko von Fehlern und Strafen bei Nichteinhaltung der Vorschriften

Unterstützt das Wachstum des Unternehmens durch die effiziente Verwaltung von Transaktionen in verschiedenen Währungen, grenzüberschreitenden Vorgängen und Expansion in neue Märkte

Verbessert Prozesse und Abläufe durch direkte Integration von lokalen-Anforderungen in die NetSuite-Umgebung

Senkt Betriebskosten, indem der Aufwand für manuelle Fehlerkorrekturen entfällt und das Risiko von Strafen für Rechtsverstöße minimiert wird

Warum ist RSM Poland die richtige Wahl für Ihr Unternehmen?

RSM Poland ist der größte offizielle Oracle NetSuite-Partner in Polen. Unser Team besteht aus qualifizierten Experten, einschließlich zertifizierter NetSuite-Entwickler und -Berater sowie Steuerberater, Buchhalter und Wirtschaftsprüfer, die die Herausforderungen im Zusammenhang mit den komplexen polnischen Vorschriften perfekt verstehen.

Wir bieten umfassende Unterstützung sowohl während der Implementierung des Polnischen Lokalisierungspakets als auch danach. Wir gewährleisten laufende Unterstützung und regelmäßige Updates des Systems, um es an sich ändernde Steuer- und Rechtsvorschriften anzupassen.

Unsere Consultants haben bereits vielen unseren Kunden geholfen, ihre Geschäftsprozesse zu optimieren und ihre strategischen Ziele zu erreichen. Gerne unterstützen wir Unternehmen aller Größen und Branchen und passen unsere Dienstleistungen an die individuellen Bedürfnisse unserer Kunden an.

Oracle NetSuite in Polen – häufig gestellte Fragen und Antworten (FAQ)

Definitiv nicht. NetSuite ist auch eine ausgezeichnete Software für kleinere, wachsende Unternehmen sowie Start-ups. Sie wurde als zu 100 % cloudbasiertes System entwickelt, wodurch man sich keine Sorgen um Serverinfrastruktur oder den Kauf sehr teurer Lizenzen machen muss. Die Lösung steht in einem Abo-Modell zur Verfügung – die monatliche Gebühr für den Zugang hängt von der Anzahl der Nutzer und den ausgewählten Modulen ab. Die Einstiegshürde ist daher relativ niedrig. Sie können mit der Implementierung wichtiger Module (meistens des Finanzmoduls) beginnen und dann, wenn Ihr Unternehmen wächst, die Funktionalitäten des ERP-Systems schrittweise um andere Bereiche wie Lagerverwaltung oder Produktionsmanagement erweitern.

NetSuite ist eine hochgradig konfigurierbare Lösung. Das bedeutet, dass wir die Funktionalitäten an die spezifischen Bedürfnisse fast jedes Unternehmens anpassen können, unabhängig von seiner Größe oder Branche. Bei RSM Poland unterstützen wir Kunden aus vielen Sektoren und wir wissen aus Erfahrung, dass dieses System hervorragend in den Branchen wie Software, Fintech, HiTech, Professional Services und Healthcare funktioniert. Dennoch ist diese Liste nicht vollständig – NetSuite unterstützt erfolgreich Unternehmen aus verschiedenen Geschäftsbereichen.

Na klar! Das Expertenteam von RSM Poland hat eine umfassende Erweiterung der Funktionalitäten von Oracle NetSuite – das Polnische Lokalisierungspaket – entwickelt. Die Software wurde so angepasst, dass sie die Anforderungen des polnischen Rechnungslegungsgesetzes vollständig erfüllt. Das Paket richtet sich sowohl an polnische Kunden als auch an multinationale Unternehmen mit polnischen Tochtergesellschaften (polish subsidiaries), die in NetSuite zusammenarbeiten und polnische gesetzliche Anforderungen in ihrem Buchhaltungssystem erfüllen müssen. Eine ausführliche Beschreibung der Module des Polnischen Lokalisierungspakets finden Sie auf unserer Website. Das IT-Consulting-Team von RSM Poland aktualisiert kontinuierlich das Polnische Lokalisierungspaket und passt es an die sich ändernden steuerrechtlichen Vorschriften, Regelungen und Rechnungslegungspraktiken in Polen an. Wir informieren unsere Kunden über neue Funktionalitäten und Verbesserungen in den Fachbeiträgen von Release Notes und in unserem IT Insights Newsletter.

Natürlich – unser Team hat eine All-in-One-Cloud-Lösung zur Verwaltung elektronischer Belege entwickelt. Das KSeF-Modul im Polnischen Oracle NetSuite-Lokalisierungspaket ist eine fertige, funktionsfähige All-in-One-Cloud-Lösung zur Verwaltung elektronischer Belege. Diese Lösung ermöglicht eine effiziente und sichere Verbindung mit der Plattform des Finanzministeriums. Wenn Sie mehr über die Funktionalitäten und Konfigurationsmöglichkeiten des KSeF-Moduls im Polnischen Lokalisierungspaket möchten, lesen Sie spezielle Broschüre zu diesem Thema.

Natürlich! Unsere Zusammenarbeit endet nicht mit der Implementierung und Konfiguration des Systems. Wir bieten fortlaufenden Support unseres Helpdesk-Teams, der NetSuite-Nutzer bei ihrer täglichen Arbeit unterstützt. Unsere Unterstützung kann unter anderem die Beseitigung von Systemfehlern, die Unterstützung bei Problemen beim Abschluss von Abrechnungsperioden und Personalisierung von Funktionen oder die Unterstützung laufender administrativer Aufgaben wie Verwaltung von Rollen, des Dashboards, Wahrung der Kontosicherheit und Verwaltung von Benutzerberechtigungen umfassen. Wir bieten drei Support-Stufen für Anwendungsmanagement, die unterschiedlichen Budgets und Erwartungen entsprechen.

Ja, wir sind uns voll bewusst, dass der Übergang zum neuen System eine große Herausforderung für die gesamte Organisation darstellt. Wir sind in der Lage, maßgeschneiderte Bedienungsschulungen zu organisieren, die auf die spezifischen Bedürfnisse unserer Kunden zugeschnitten sind. Sie stehen in zwei Varianten zur Verfügung: Einerseits organisieren wir Schulungen, die von unseren zertifizierten NetSuite-Beratern durchgeführt werden und eine breite Palette von Funktionalitäten des Polnischen Lokalisierungspakets und anderer Oracle NetSuite-Module abdecken. Da RSM auch ein Team erfahrener Buchhalter ist, das mit NetSuite arbeitet, bieten wir andererseits spezielle Schulungen für Buchhaltungsteams an. Diese Schulungen behandeln praktische Aspekte der Verwendung des Systems gemäß den polnischen Steuer- und Rechnungslegungsvorschriften sowie Verwendung der Funktionen, die im Polnischen Lokalisierungspaket verfügbar sind. Die Teilnehmer erwerben dabei das notwendige Wissen, wodurch sie selbstständig die Bücher in NetSuite führen können – von der täglichen Aufzeichnungen über die Bearbeitung von Rechnungen bis hin zur Erstellung von Berichten, Voranmeldungen und Steuererklärungen. Der Umfang und der Zeitplan der Schulungen werden immer an die Erfahrungen der Teilnehmer und die Besonderheiten der Geschäftstätigkeit des jeweiligen Unternehmens angepasst.

Die Implementierungszeit hängt von der Komplexität des Projekts ab. Einfache Implementierungen, die nicht viele Anpassungen erfordern, um spezifische Kundenanforderungen zu erfüllen, können etwa 3-4 Monate dauern. Komplexere Projekte können bis zu 6 Monate dauern.

Das BPO-Programm eignet sich für Unternehmen, die mit der Arbeit auf einer Enterprise-Class-Plattform schnell beginnen und zugleich die Flexibilität und die Fähigkeit bewahren möchten, in Zukunft reibungslos auf ihre eigene NetSuite-Instanz zu wechseln, wenn ihr Geschäft wächst. Es ist ideal für Start-ups sowie schnell wachsende kleine und mittlere Unternehmen, die eine skalierbare cloudbasierte Lösung suchen und bevorzugen, kleine interne Teams zu halten. Ein großer Vorteil besteht darin, dass Kunden jederzeit problemlos von einer BPO-Umgebung zu einer internen NetSuite-Instanz wechseln können, ohne komplexe Datenmigration zwischen Systemen zu benötigen.

Es ist jedoch zu betonen, dass RSM Poland auch NetSuite BPO-Partner ist, dank dem wir unseren Kunden Zugang zur vollen Systemfunktionalität bieten können, ohne dass sie die Kosten einer vollständigen und komplexen ERP-Implementierung von Anfang an tragen müssen. In diesem Modell erhält der Kunde innerhalb weniger Tage nach Vertragsunterzeichnung Zugriff auf das System.

Ja – wir bieten sowohl eine umfassende Unterstützung der Buchhaltung in diesem System als auch Buchhaltungsaufsicht. Das Outsourcing der vollständigen Buchhaltung bieten wir denjenigen Kunden, die sich auf ihre grundlegenden Geschäftsziele konzentrieren möchten, indem sie mit allen anderen Aufgaben die externen Fachdienstleister beauftragen. Dagegen richtet sich die Buchhaltungsaufsicht an Unternehmen, die zwar ihre Bücher alleine in ERP NetSuite führen, aber eine professionelle, sachbezogene Unterstützung bei der Buchführung erwarten. Im Rahmen der Buchhaltungsaufsicht in NetSuite führen wir die Tätigkeiten aus, für die die Personen verantwortlich sind, die als selbstständiger Buchhalter und Hauptbuchhalter beschäftigt sind. In Notfällen bieten wir eine Vertretung für abwesende Mitarbeiter der Finanzabteilung an, die mit Oracle NetSuite arbeiten. Der Umfang unserer Unterstützung der Buchhaltung ist stets auf die Erwartungen spezifischer Kunden zugeschnitten.

RSM Poland ist Ihre Garantie für Erfolg bei der Implementierung und dem Betrieb von NetSuite in Polen. Wir sind der größte offizielle Oracle NetSuite-Partner in Polen. Unser Team besteht aus qualifizierten Experten, einschließlich zertifizierter NetSuite-Entwickler und -Berater sowie Steuerberater, Buchhalter und Wirtschaftsprüfer, die die komplexen polnischen Vorschriften gut verstehen. Wir unterstützen unsere Kunden nicht nur bei der Implementierung und Konfiguration von Oracle NetSuite und dem Polnischen Lokalisierungspaket, sondern bieten ihnen auch eine Reihe von Dienstleistungen zur Unterstützung der laufenden Arbeit mit dieser Software an.