From this article, you will learn:

- Why is ESG important?

- How to prepare company for ESG reporting?

- What do you need to know about the CSRD Directive?

ESG – or Environmental Social Corporate Governance – is the management of an organisation in a socially responsible and sustainability-oriented manner. But what exactly does this mean? What are the sustainability objectives, and how do you implement the necessary rules and regulations within your company to meet the standards and objectives of crucial directives?

The Report of the World Commission on Environment and Development of 1987 states that sustainable development is a development that meets the present without compromising the ability of future generations to meet their own needs.

Due to the risks associated with significant social and political changes as well as climate changes together with greater awareness of these issues, organizations devote more attention to the issue of sustainable development. Nevertheless, it is necessary to take coherent system actions.

As a response to various threats, international organizations and individual states take relevant actions. The most important include:

- The Paris Agreement;

- The European Green Deal;

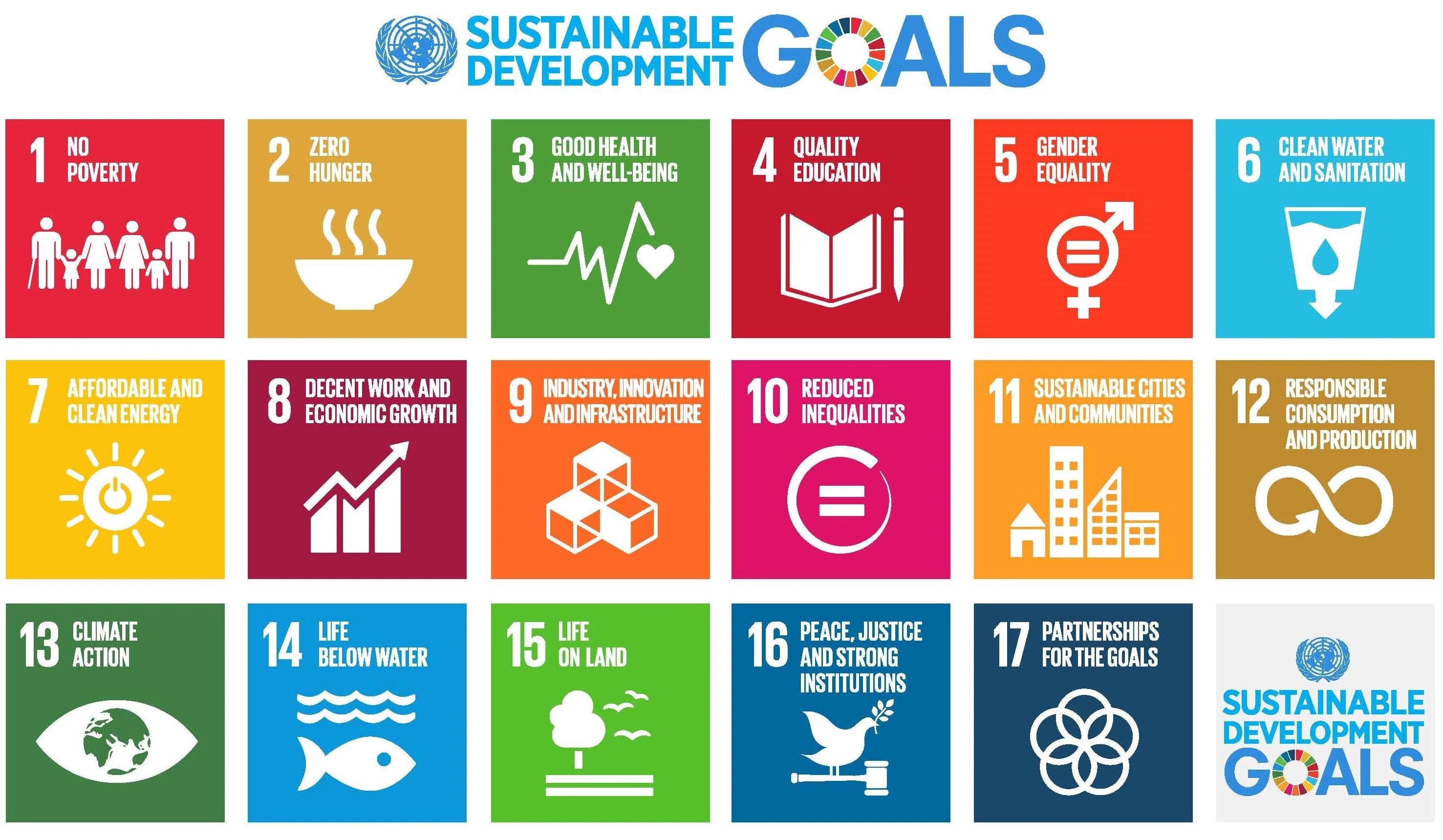

- The UN Sustainable Development Goals.

CSRD Directive

The Corporate Sustainability Reporting Directive (CSRD) took effect on 5 January 2023. The time limit for its implementation falls on 6 July 2024.

With respect to the Polish legal system, it will be implemented in the Polish Accounting Act and in the Statutory Auditors, Audit Firms and Public Supervision Act. The directive defines the necessary elements of sustainability reporting, the details of which can be found in the common European Sustainability Reporting Standards (ESRS).

The scope of sustainability reporting includes corporate governance, strategy, influence, risks, opportunities (IRO), and targets and metrics.

The structure of ESRSs

The structure of ESRSs

ESRSs are comprised of cross-cutting standards: ESRS 1 and ESRS 2. ESRS 1 contains the description of the reporting process and the principles governing it. ESRS 2 deals with obligatory metrics and the necessity to conduct an analysis of double materiality. The subsequent standards concern factors to report within the framework of the E, S and G areas.

Environment

- ESRS E1 – Climate change;

- ESRS E2 – Pollution;

- ESRS E3 – Water and marine resources;

- ESRS E4 – Biodiversity;

- ESRS E5 – Circular economy.

Social, including employment

- ESRS S1 – Employment;

- ESRS S2 – Workers in the value chain;

- ESRS S3 – Local communities;

- ESRS S4 – Consumers and end-users.

Corporate governance/organization

- ESRS G1 – Business practices.

Who will the reporting obligation apply to?

Entities having the reporting obligation in accordance with CSRD are:

- From 1 January 2024 – undertakings currently subject to the Non-Financial Reporting Directive (NFRD) (reporting in 2025 for the 2024 data);

- From 1 January 2025 – large undertakings which are not currently subject to NFRD fulfilling 2 out of the 3 following criteria: more than 250 employees, annual revenues of EUR 50 million, and balance sheet total of EUR 25 million (reporting in 2026 for the 2025 data);

- From 1 January 2026 – SMEs listed on the Warsaw Stock Exchange as well as small and non-complex credit institutions and captive insurance undertakings (reporting in 2027 for the 2026 data).

ESG – what to start with, and what should you know?

The company can implement the ESG strategy by introducing the necessary rules and regulations in the following areas:

- environment (E),

- social (S),

- and governance (G).

One of the initial activities in the reporting preparation process of the organization is to identify the stakeholders, i.e. persons or undertakings that have an impact on or that are impacted by the organization.

Stakeholders may be both internal and external. Stakeholder groups included in the regulations are:

- Society;

- Investors;

- Clients;

- Employees;

- Business partners;

- Organization.

Analysis of double materiality

By the analysis of materiality, which is for example dialogue with stakeholders, the organization assesses the impact it exerts on people and climate in the entire value chain.

This analysis will indicate the areas in which the sustainable development strategy must be implemented and which data the organization will be obliged to report, therefore, in which areas it should implement the tools necessary to collect these data.

Double materiality is the total of impact materiality and financial materiality.

Disclosure types

- Mandatory disclosures for each obliged organization;

- Disclosures resulting from the analysis of double materiality (impact, risks, short-, mid-, and long-term opportunities);

- Relevant topics:

- Material – disclosure of policies, actions and targets;

- Not material – short explanation.

- Disclosure requirements:

- Material – disclosure resulting from specific standards;

- Not material – the organization can decide not to disclose information arising out of specific standards.

- Relevant topics:

Attestation of sustainability reports

An important fact is that sustainability reports will be subject to attestation by statutory auditors.

Greenwashing

It is crucial from the point of view of the organization's reputation that the information provided is not treated as greenwashing, i.e. information which is false, inaccurate or irreleveant from the point of view of the organization's operations in the environment and social areas.

Taxonomy

Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088 set out the criteria for establishing whether an economic activity qualifies as environmentally sustainable and to determine the degree of environmental sustainability of a particular investment.

According to the European Commission, in order to achieve the sustainability goals, it is necessary to shift capital flow towards sustainable investment. That is why clear assessment criteria of a particular activity and disclosure requirements have been laid down.

Entities having the disclosure obligation in accordance with EU taxonomy

The entities included in the EU taxonomy are:

- entities implementing the measures adopted by member states or the Union laying down the requirements for financial market participants or issuers with respect to financial products or corporate bonds which are made available as environmentally sustainable;

- financial market participants which make financial products available;

- enterprises which are subject to the obligation to publish a statement on non-financial information or a consolidated statement on non-financial information).

It is not only reporting!

Sustainable development issues are becoming increasingly more important for investors in their decision-making processes. They are considered by banks while providing financing, insurance companies while providing insurance coverage for investment, or customers in their purchasing decisions.

Organizations must be aware that in spite of the lack of reporting obligations, they may be requested by their business partners to take certain actions, because such actions are in line with their value chain.

Sustainability actions may help organizations to gain competitive advantage.