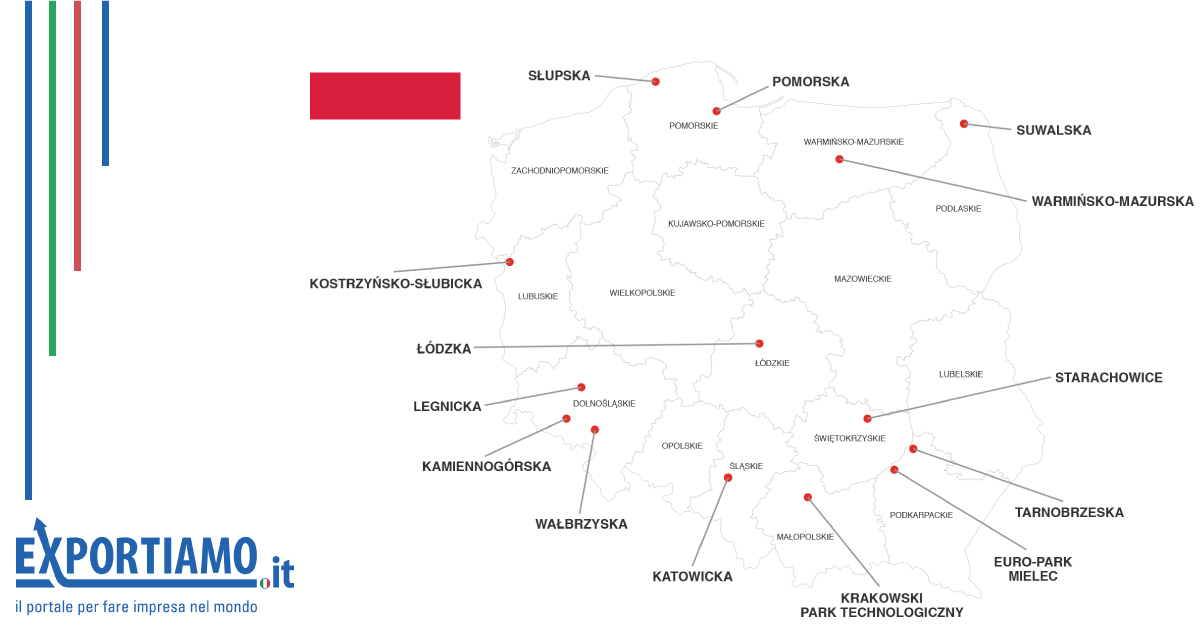

At present, the Polish Special Economic Zones incorporate 18,687 hectares, investments worth EUR 25.5 million, nearly 296,000 newly created jobs and growing interest from entrepreneurs and potential employees.

By the decision of the Polish government, the operation of the Special Economic Zones (hereinafter referred to as SEZ) in Poland was extended until the year 2026. Due to the positive experience of previous years and the undoubted attractiveness of these investment areas it is expected that over the next ten years Polish SEZ will attract subsequent, mainly small and medium-sized enterprises.

The SEZ areas are constantly expanded through the creation of new sub-zones and by integrating them into the already operating zones. The new sub-zones are usually areas located in the vicinity of large metropolitan areas, highways or expressways, including those still in progress. One example could be the new sub-zone incorporated into the Lednicki SEZ (Lower Silesia province): it incorporates approximately 422 ha of investment areas in the immediate vicinity of the national road No 3 and S3 expressway, which is still under construction.

The primary purpose of such action is the intention to make use of newly established infrastructures and to make Poland even more attractive to new investors. In the context of the development of SEZ one should also bear in mind the numerous projects for restructuring and modernization of infrastructure planned for the years 2015-2020, when Poland is to receive the last tranche of EU funds amounting to total value of 82.5 billion euros.

According to the data from September 2015, the SEZ included areas located in 162 cities and 232 municipalities, occupying a total area of over 18,500 hectares, which increased threefold since 2004. In 2014, 436 permits to conduct business activity in the SEZ were issued, which constitute nearly 21.2% of the total number of valid permits. Compared to 2013, the number of authorizations granted was higher by 72.3%.

Most permits were issued in the zones: Wałbrzych (64), Katowice (58), Kraków (44) Mielec (42) and Tarnobrzeg (39). In contrast, most new jobs were created in the zone of Kostrzyn-Słubica (over 5500), Wałbrzych (over 3900) and Łódź (over 3300).

What are the benefits of the investments in the SEZ?

Investors in the SEZ may above all expect tax exemption (CIT or PIT). Some municipalities also offer exemptions from the property tax. Moreover, the parcels located in the SEZ are fully prepared for investments and available at competitive prices. The managements of the zones also offer free assistance in dealing with formalities related to the investment.

The amount of public assistance for the investors varies depending on the region, the size and the cost of investment as well as the number of newly created jobs. When planning operations in the SEZ, it is worth taking into account that the minimum amount of new investment costs entitling to make use of public assistance amounts to EUR 100 thousand.

The eligible costs, that is the costs entitling to apply for public assistance, comprise all expenses associated with the new investment within the SEZ, incurred in the course the authorization, which include:

- expenditures on the purchase, own fabrication of fixed assets or repayment of the value specified in the lease agreement or other agreement of similar nature;

- expenses for the expansion or modernization of existing fixed assets;

- costs of intangible assets (while meeting additional conditions);

- expenses included in the initial value of the fixed assets or the intangible assets, actually incurred after the date of authorization.

The costs of the employment of new employees, which can be qualified to the eligible costs, is the product of maximum aid intensity and two-year gross wage costs of newly employed workers increased by all obligatory payments related to their employment.

As was previously mentioned, the amount of public assistance varies depending on the region in which the investment is planned. In four provinces (Lubelskie, Podkarpackie, Podlasie and Warmia-Mazury) one may, for example, benefit from public assistance amounting to 50%. In Warsaw, however, this aid is at the lowest rate - currently stands at 15%, and from 2018 it will be equal to 10%.

The success of Polish SEZ is confirmed by FDI Business Financial Times ranking, in which the Katowice SEZ has been awarded as the best economic zone of Europe in 2015.

The Katowice SEZ is one of the most important and influential investment areas among all the zones, generating an investment of EUR 5.5 billion, creating 58,000 new jobs and attracting 260 investors. Apart from the biggest investment of General Motors group, the Katowice SEZ has attracted many Italian companies, which include Fiat, Ferroli, Brembo, Magneti Marelli, Mapei and Avio Aero.

The benefits of the investments in the SEZ are a big challenge for local authorities from other areas, which are also trying to encourage foreign investors with their own efforts, helping them to develop new projects and investments.

Source: Exportiamo, Agata Sikora, RSM Poland, [email protected]

https://www.exportiamo.it/aree-tematiche/12562/alla-scoperta-delle-zone-...