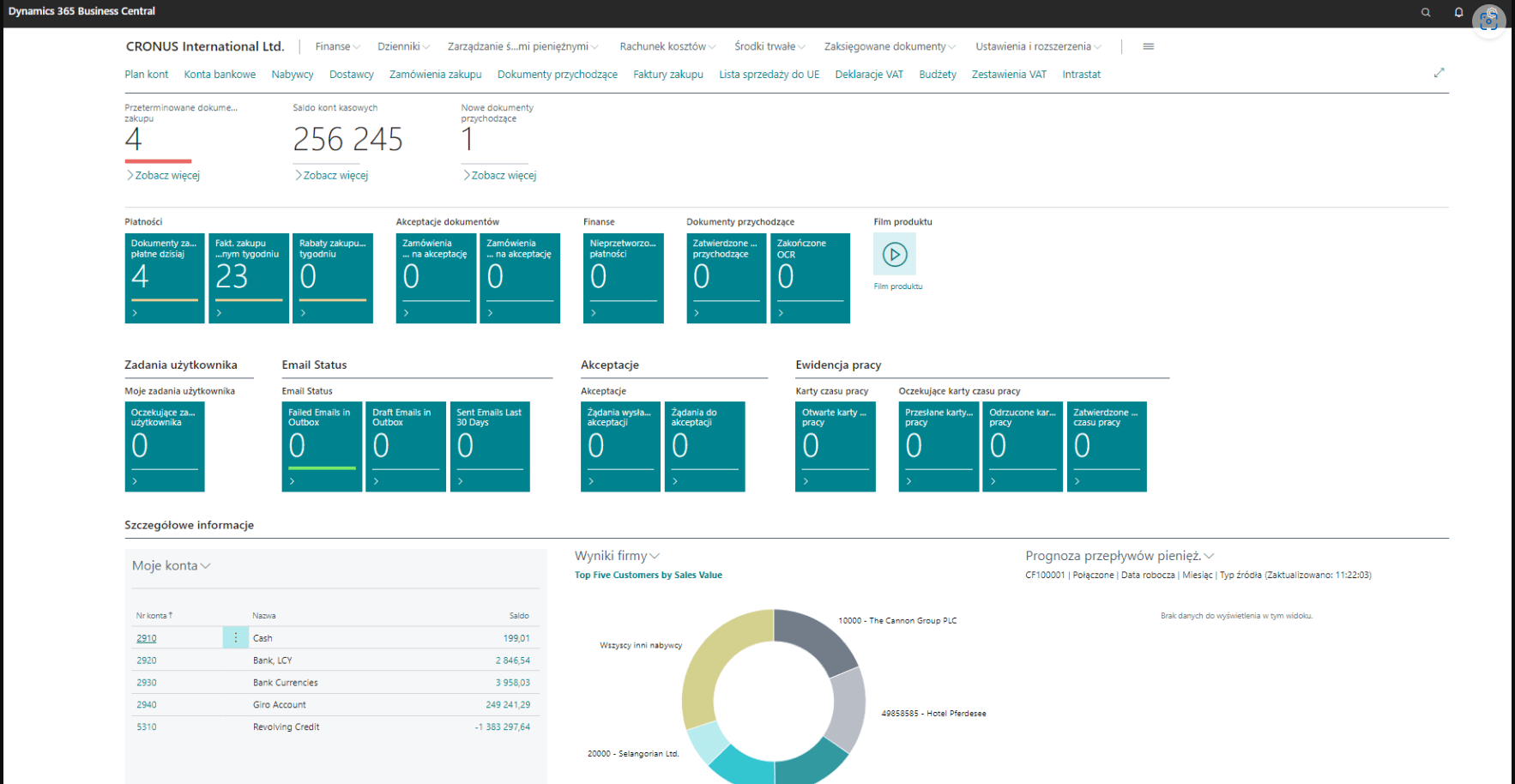

The localization package for Microsoft Dynamics 365 Business Central is a comprehensive application that extends the standard functionality of this ERP software with solutions that adapt the system to Polish legal, accounting and tax requirements.

The Polish Localization application is based on the technology and functionalities of the Microsoft Dynamics 365 Business Central system – a modern ERP solution that supports the daily management of small and medium-sized companies. Business Central enables the automation and optimization of business processes in key areas of activity, ensuring greater efficiency and better operational control. The localization was prepared with Polish users of the Dynamics 365 Business Central system and companies operating in Poland in mind, who want to operate in accordance with the legal and accounting requirements resulting from Polish regulations.

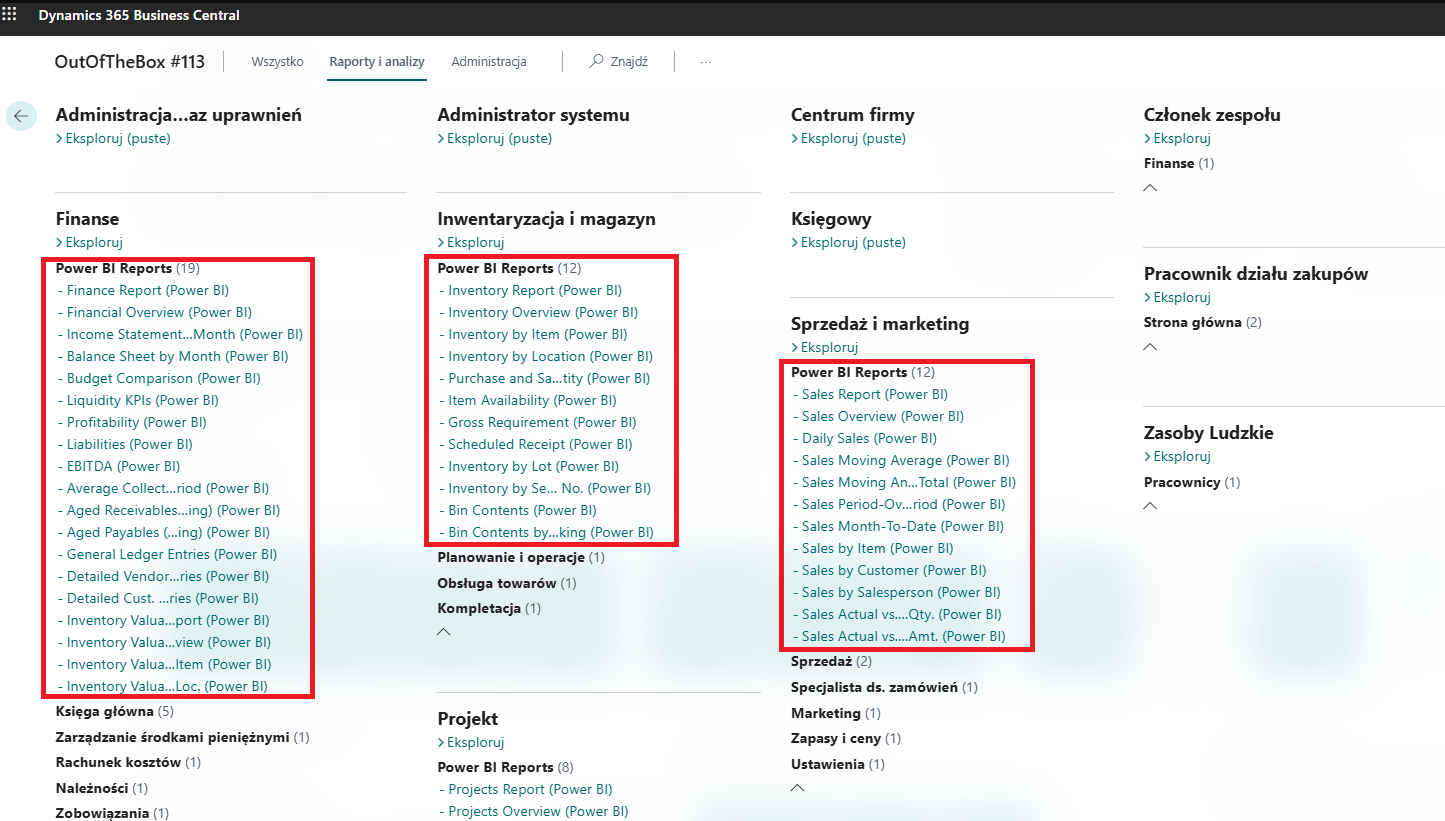

List of Polish Localization application functionalities for Microsoft Dynamics 365 Business Central

FUNCTIONALITY

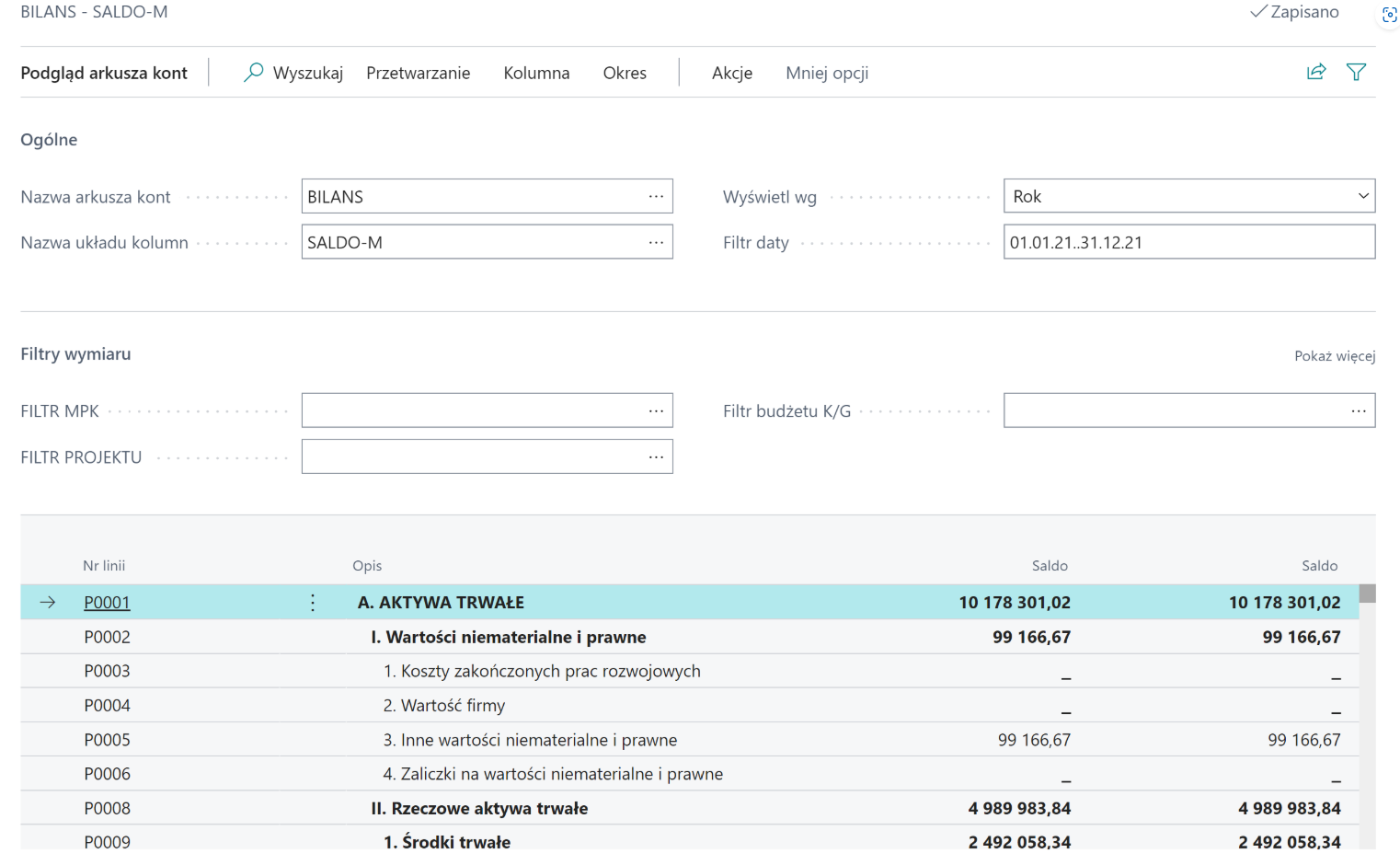

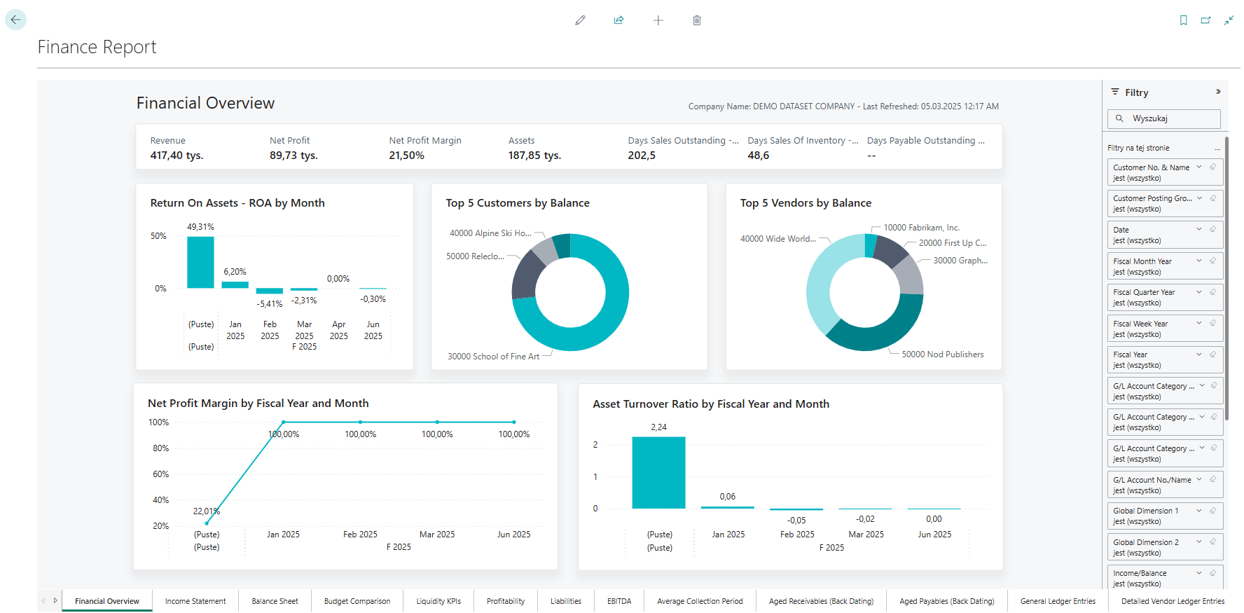

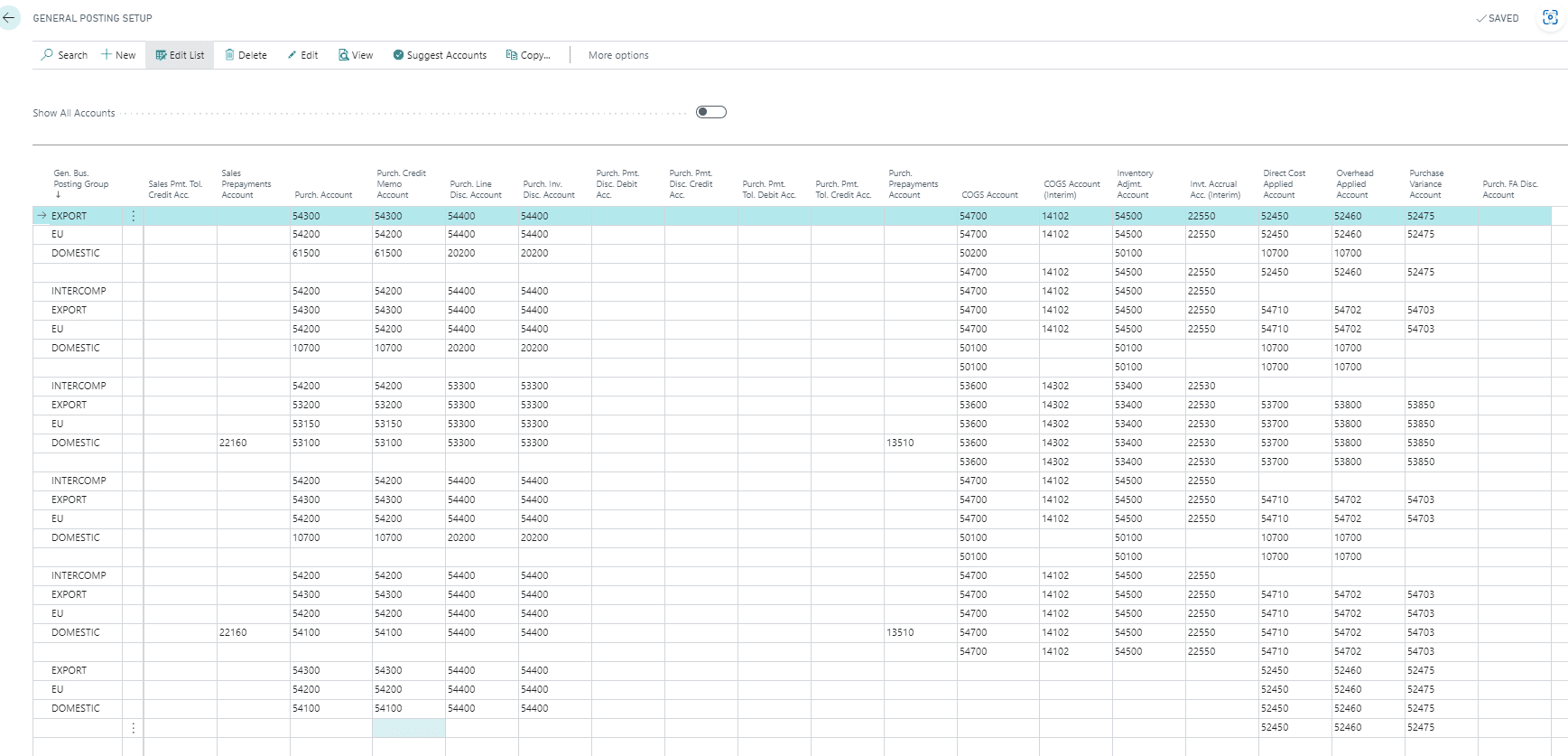

- Generating Balance Sheet and Profit and Loss Statement

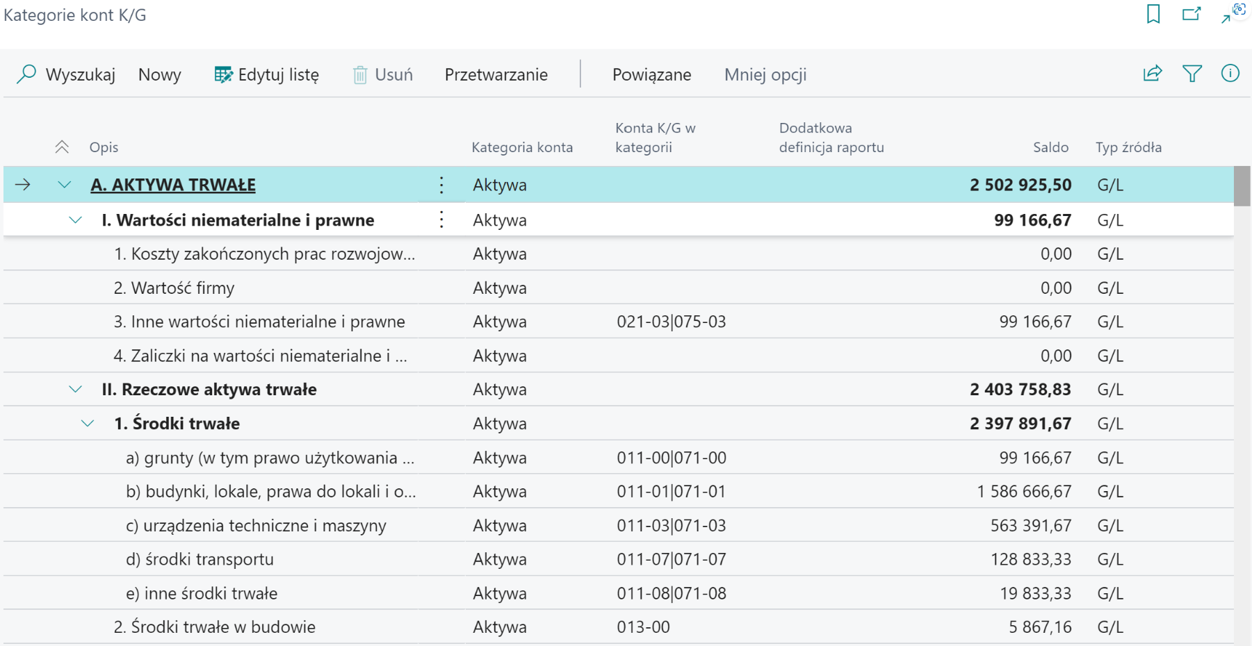

- Creating account categories

- Number Series Templates

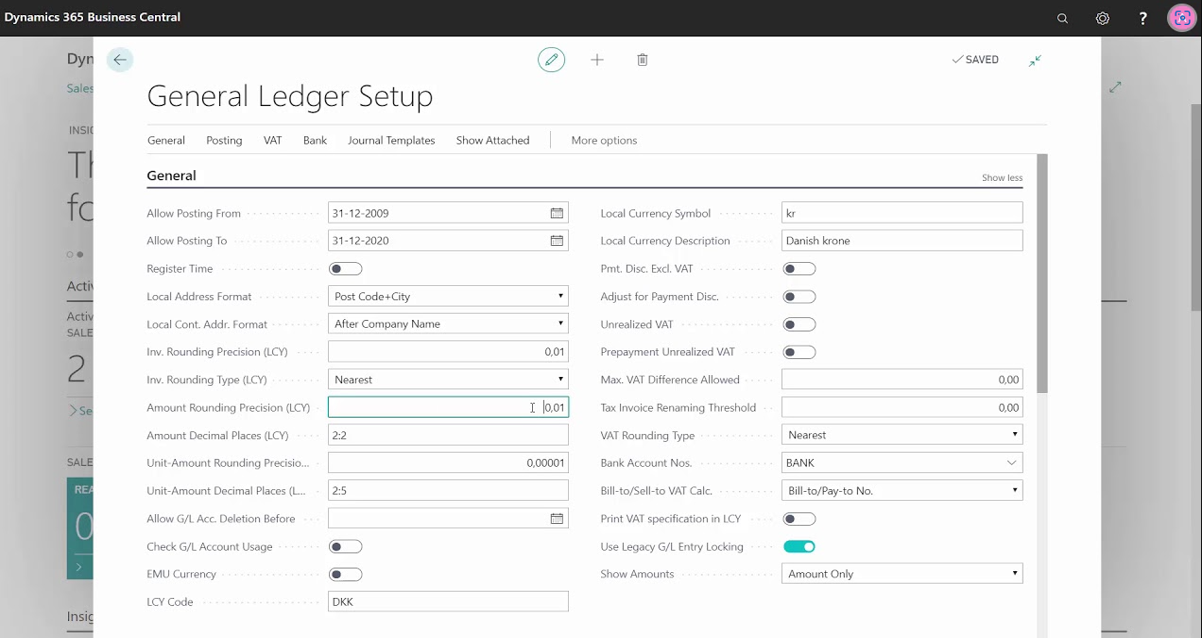

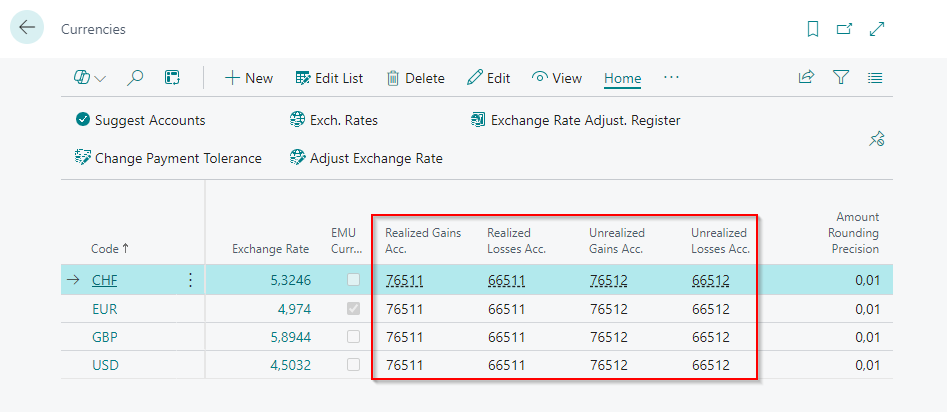

- Balance sheet valuation of exchange rate differences for bank accounts, cash, payables and receivables

- Calculation of exchange rate differences, also in test mode

- Integration with NBP exchange rates

- Correction of the record by means of a red or black storno (reversal)

FUNCTIONALITY

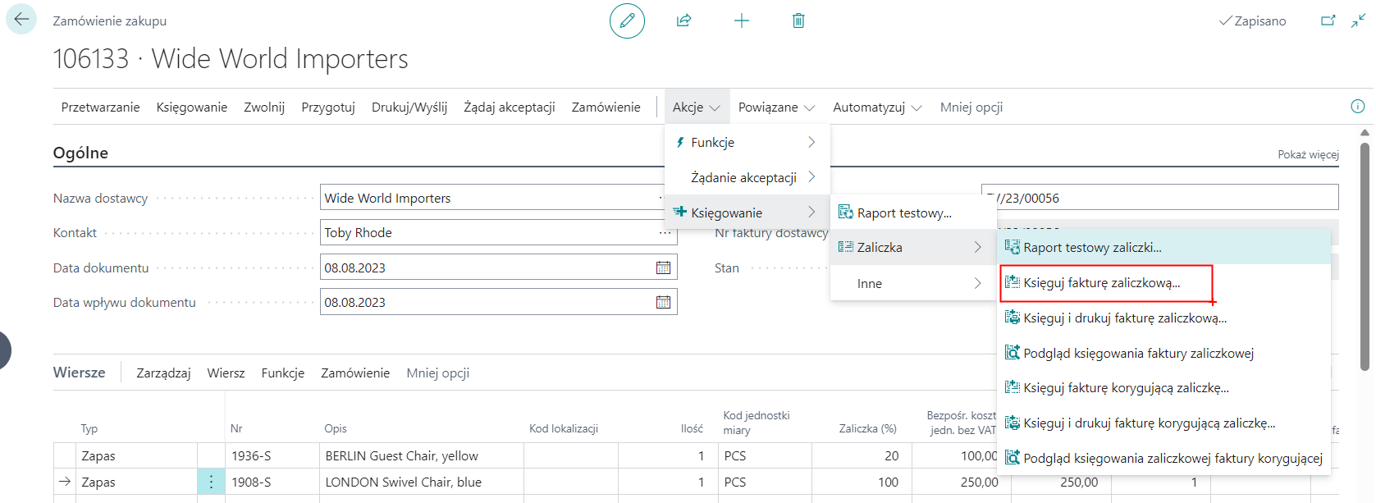

- Issuing sales invoices, sales credit memos, pro forma invoices and prepayment invoices

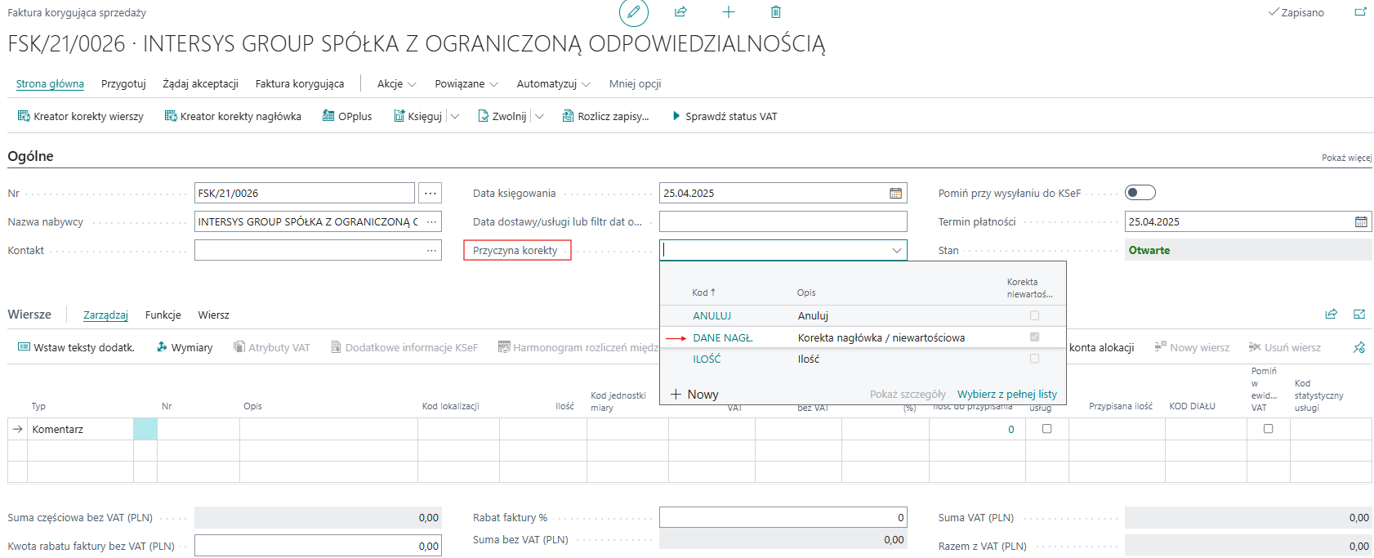

- Possibility to issue one sales credit memo for several sales invoices

- Creating Before and After lines that contain information about the sales value before and after the correction and providing the sales correction reason

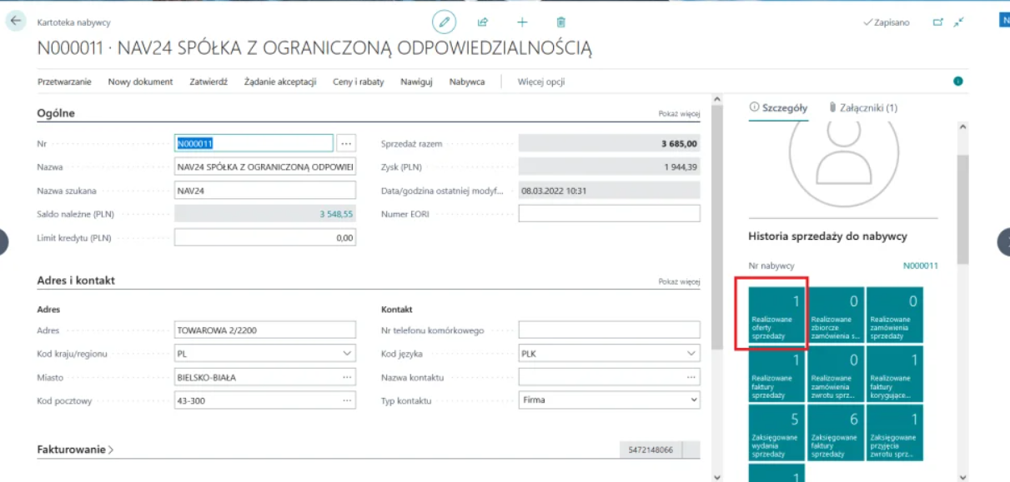

- Customer/Vendor numbering series

- Managing Customer/Vendor Balance Reconciliation

- Integration with the Regon databse

FUNCTIONALITY

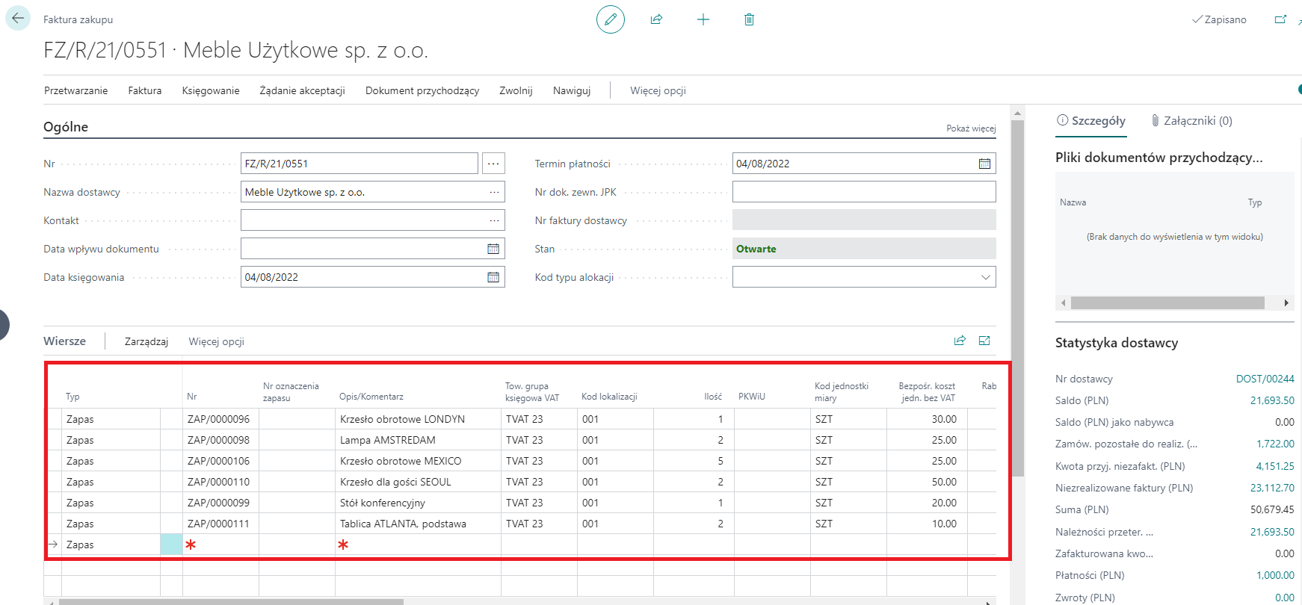

- Built-in Polish Classification of Goods and Services (PKWiU) (2016)

- Generating Intrastat reports with additional fields depending on statistical requirements and exporting the reports in xml format

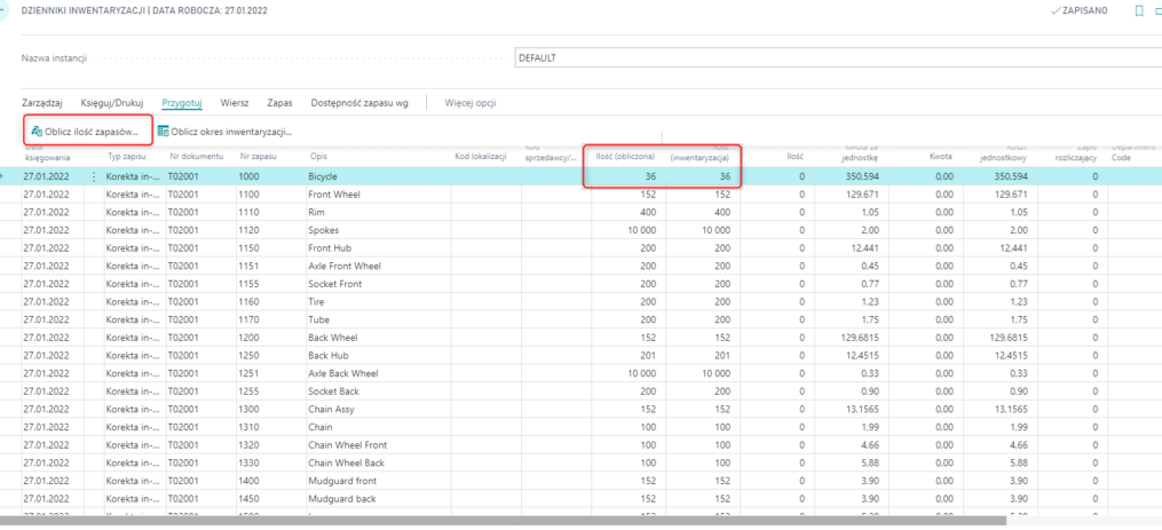

- Generating an Inventory Counting Document with the quantity and value of stocks and signatures of responsible persons as confirmation of the completion of the inventory counting process

- Setting up General Business Posting Group default codes for surpluses and shortages resulting from inventory

FUNCTIONALITY

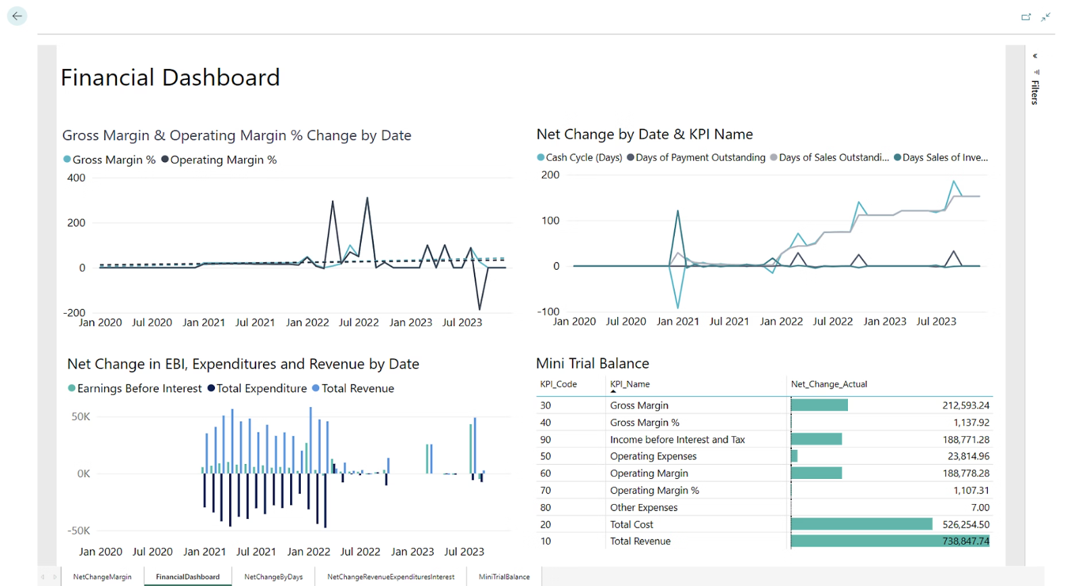

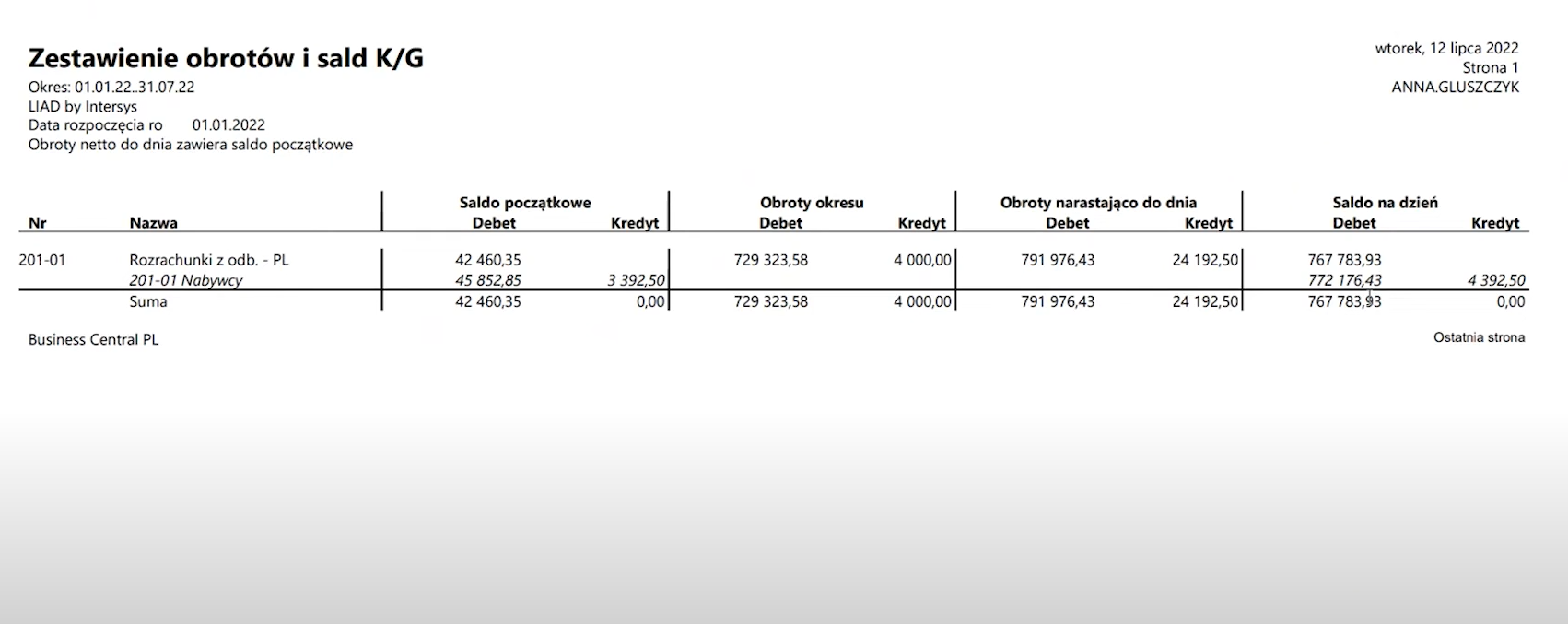

- Trial balance

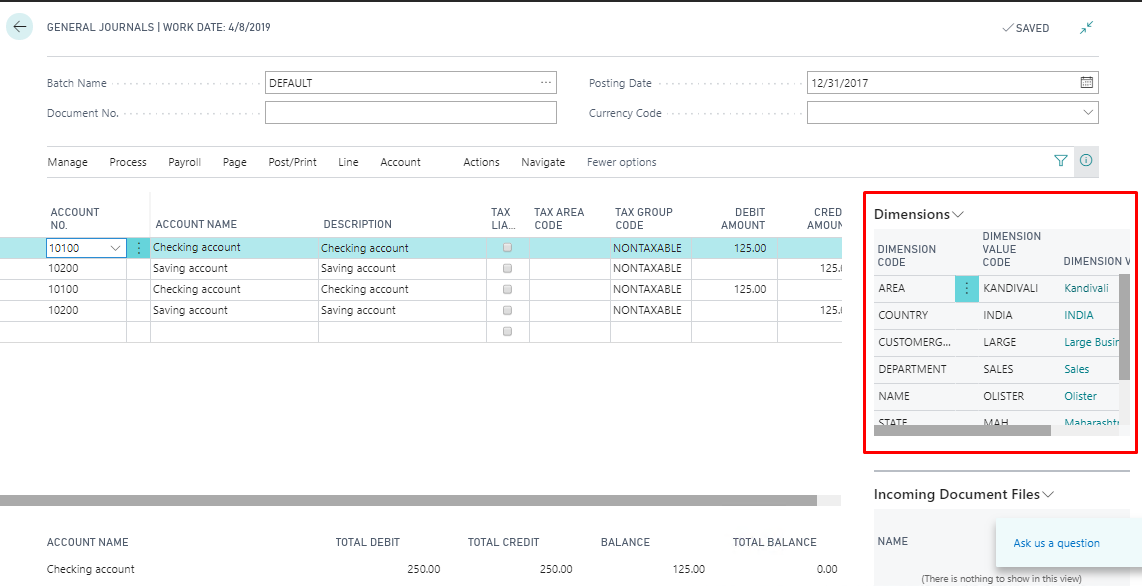

- G/L Journals, Receivables and Payables Journals – chronological list of transactions

- Analytical and synthetic G/L reports

- G/L Report – printing the G/L Register Posting Document

- G/L Purchases and Sales Report – shows posted sales/purchase transactions with detailed information

- Receivables/Payables Aging Analysis – in tabular form, with filtering option

- Inventory Aging Analysis – in terms of value and quantity in four arbitrarily selected periods

FUNCTIONALITY

- Posting cash and bank transactions in domestic and foreign currencies

- FIFO, LIFO, weighted average exchange rate service

- Export of transfer orders to the bank and import of bank statements to the system after installing the Electronic Banking application

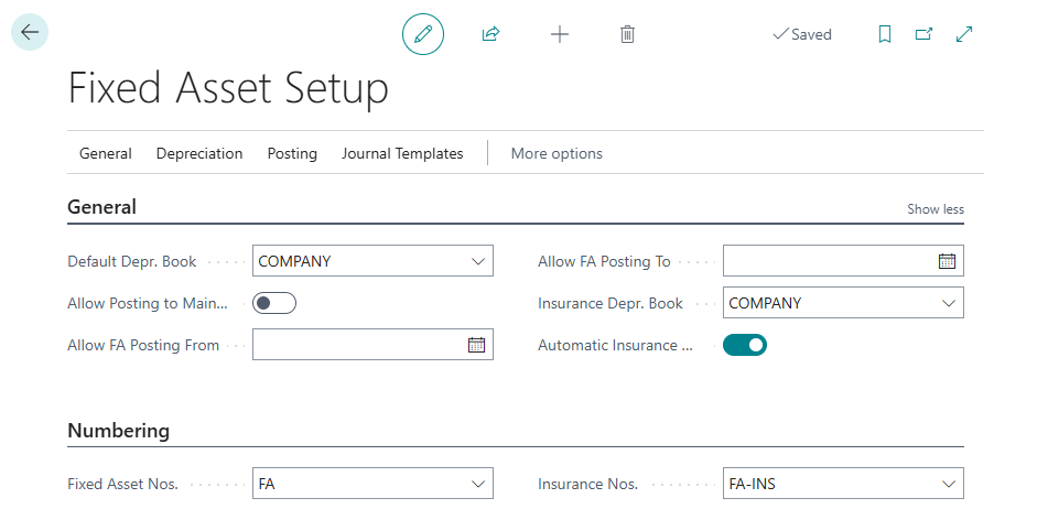

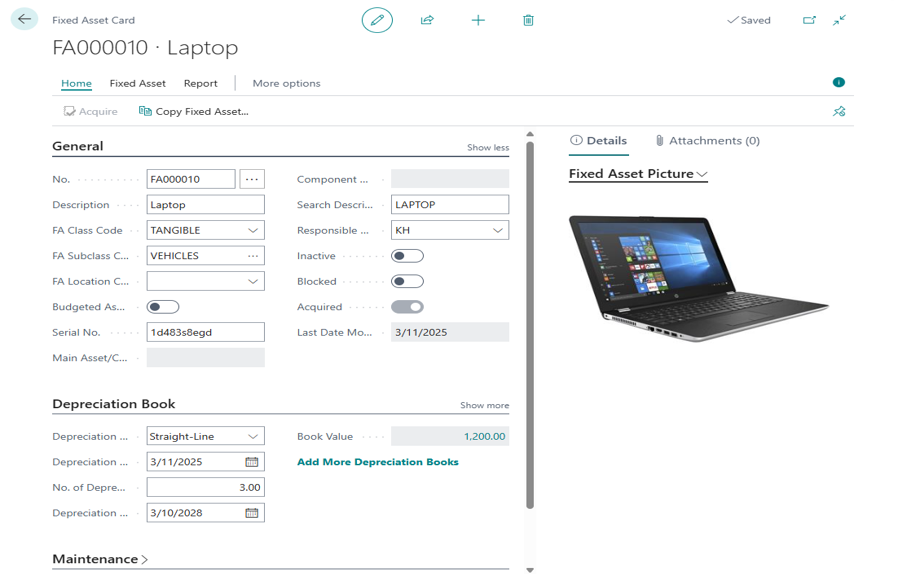

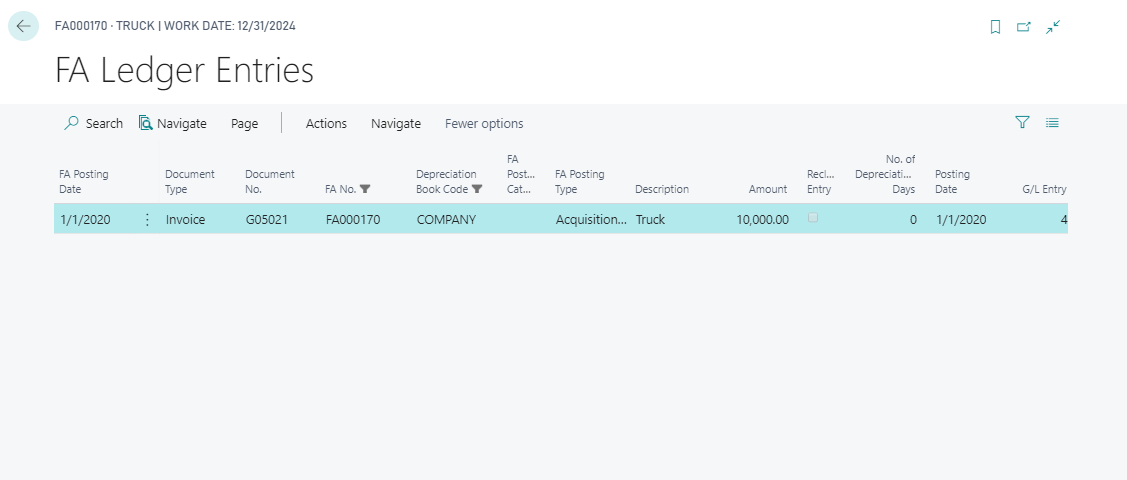

FUNCTIONALITY

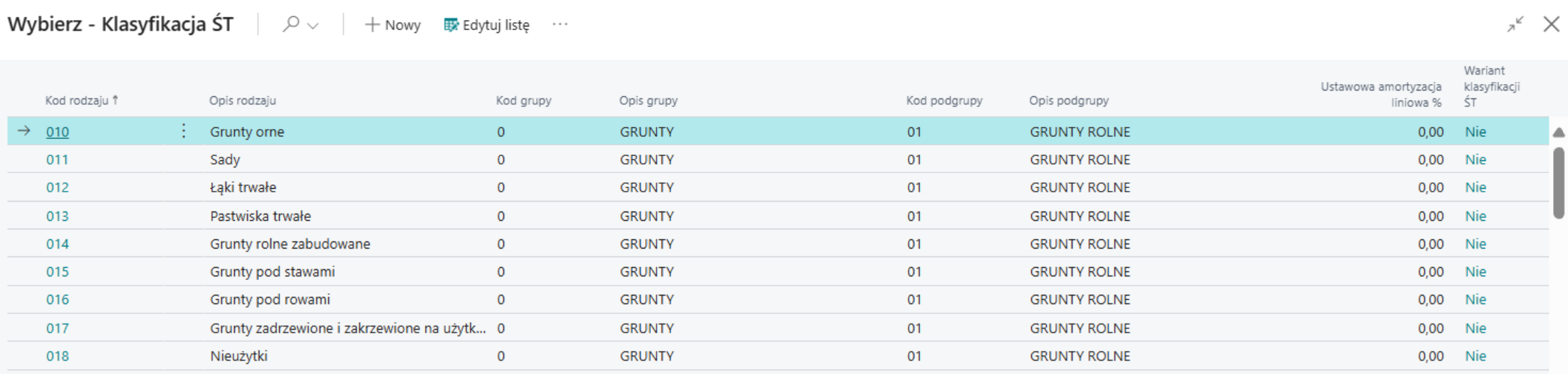

- Fixed asset reports: fixed asset records with detailed data, OT report, depreciation tables according to fixed asset groups, sold/liquidated fixed asset report, fixed asset inventory list, fixed asset valuation report for the financial statement purposes

- DNU-K/DNU-R statistical reports with statistical codes for the purpose of reporting on international trade in services

FUNCTIONALITY

- Split payment mechanism supported for purchase and sales invoices

- Service based on PKWiU codes and VAT clauses

- Possibility to define a default split payment obligation above a certain amount

- The mechanism itself divides the amount into net and VAT for sales invoices and purchase invoices (as well as corrections and orders), which are subject to split payment if the statutory conditions are met

FUNCTIONALITY

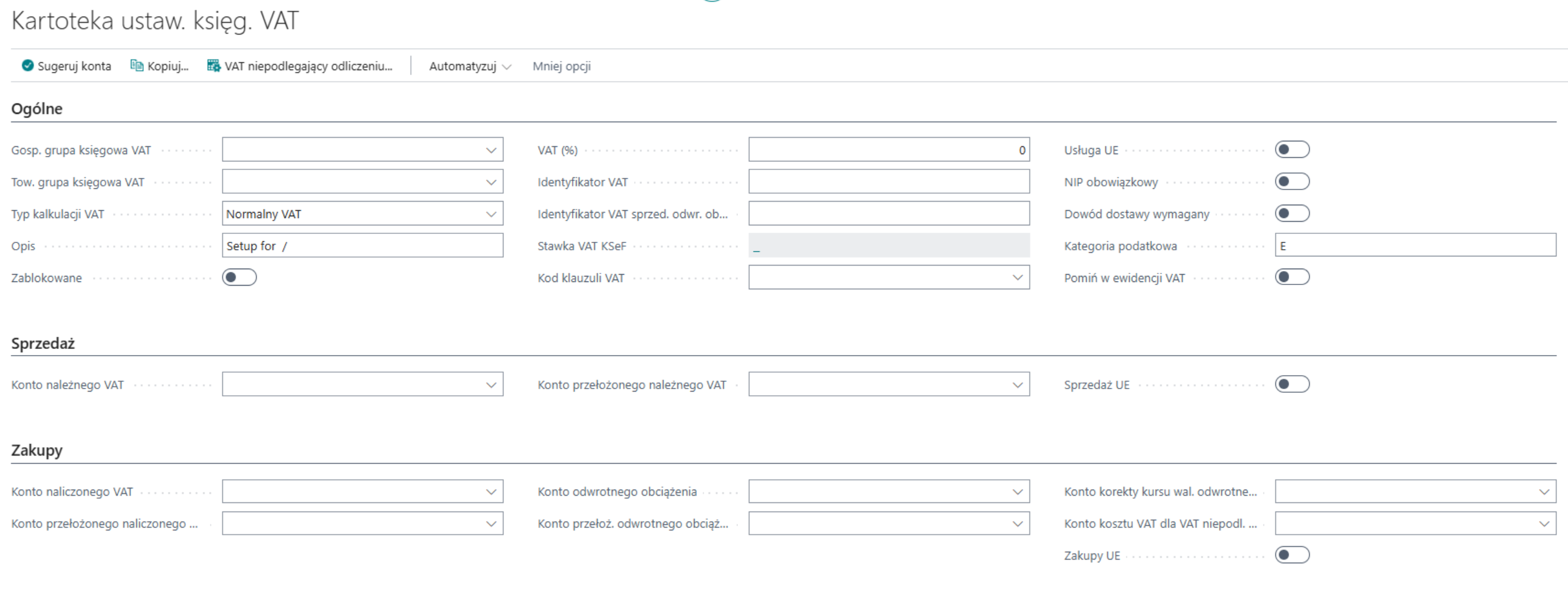

- Full suport for output and input VAT, ICA and ICS, non-deductible VAT, VAT with partial deduction, VAT with reverse charge and VAT on gratuitous transfer

- Generating VAT registers

- VAT settlement sheet, thanks to which the user has control over: postponing and paying the tax, changing the date of obligation, skipping VAT in the records, changing the rate for the reverse charge

- Complete set of VAT attributes required by the Ministry of Finance - the system allows changing VAT attributes on posted documents

- Report on transactions for which there was no right to deduct VAT in a given period

- Verification of the bank account on the white list and the VAT status of the taxpayer

- Generating VAT_UE declarations taking into account triangular transaction types and for specific VAT periods in XML format

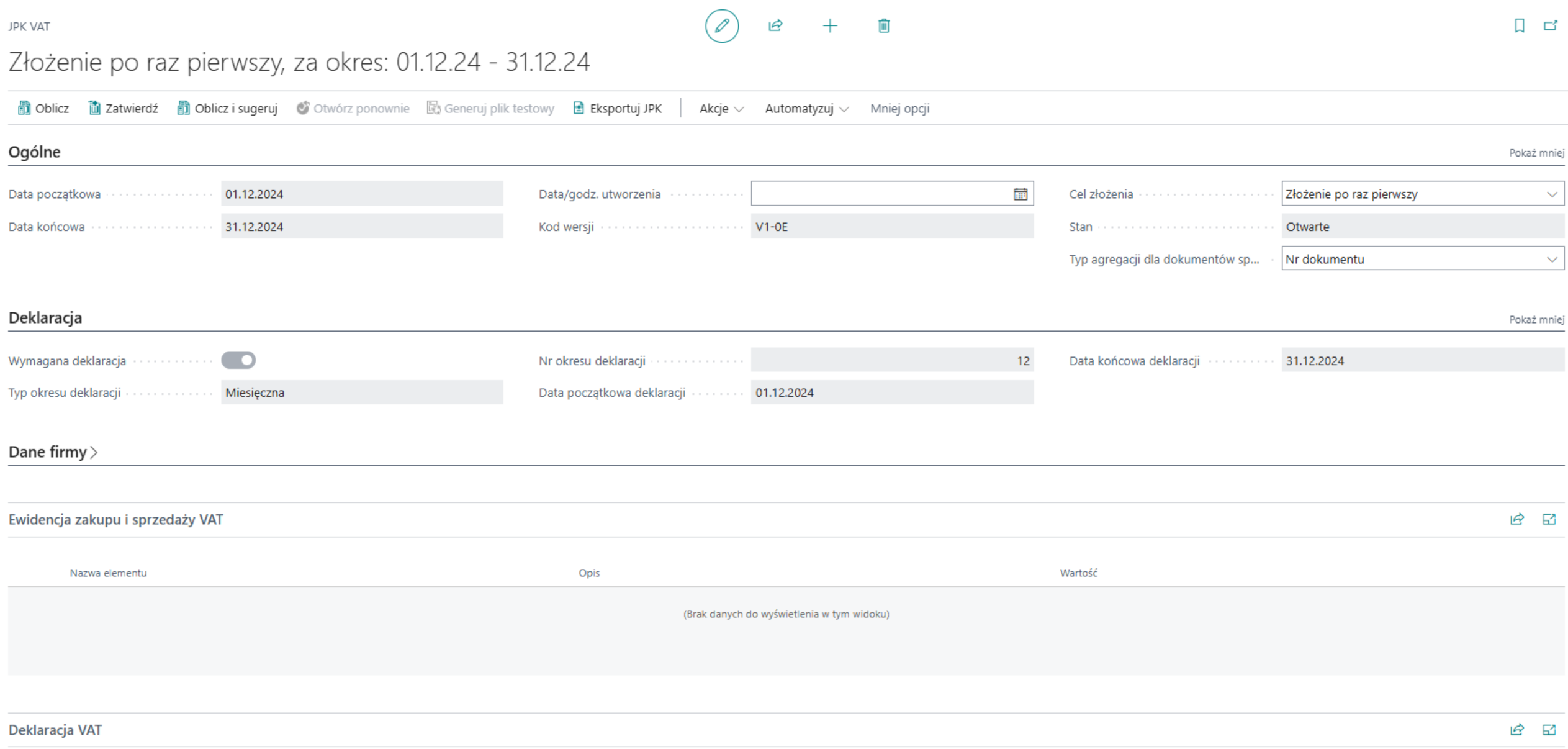

FUNCTIONALITY

- Generating reports in xml format: JPK_VAT (JPK_7M/ JPK_7K), JPK_FA, JPK_WB, JPK_KR, JPK_MAG, JPK_KR_PD, JPK_ST_KR

- Settings compliant with the guidelines of the Ministry of Finance

- Possibility to define automatic generation of JPK reports

- Possibility to mark G/L accounts with an attribute for JPK_KR_PD purposes

- Selecting the JPK version when generating a report

- Sending to the office using the application made available by the Ministry of Finance (JPK CLIENT WEB) or using another third-party program

- The system saves historical JPK_VAT with declarations and allows them to be re-sent if necessary

FUNCTIONALITY

- Handling the process of sending sales invoices and downloading purchase invoices

- Ensuring communication with the KSeF system (the National System of e-Invoices) using interactive sessions

- Authentication using a token

- Support for the current logical structure

- Possibility of manually adding optional data

- Verification of sales invoices during posting in terms of compliance of the XML file with the model logical structure of an e-Invoice in the xml format

- Possibility of skipping indicated documents or buyers

- Limitation to sending invoices posted in the system

- Import of structured purchase invoices

- Placing downloaded invoices in the import register

- Downloading and reading UPO (the Official Receipt Certificate)

Optional Apps

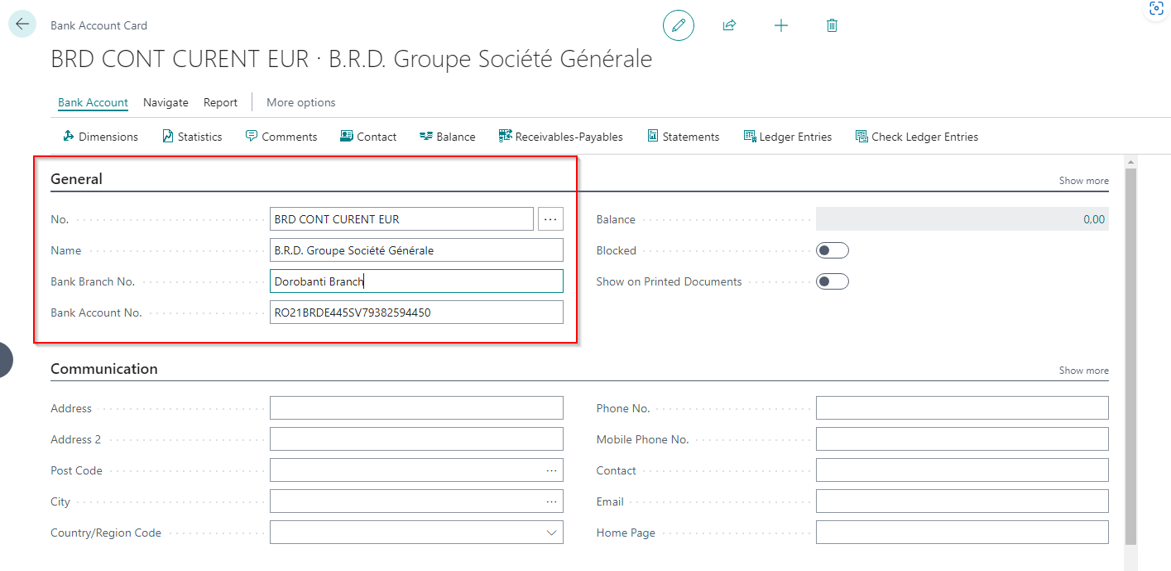

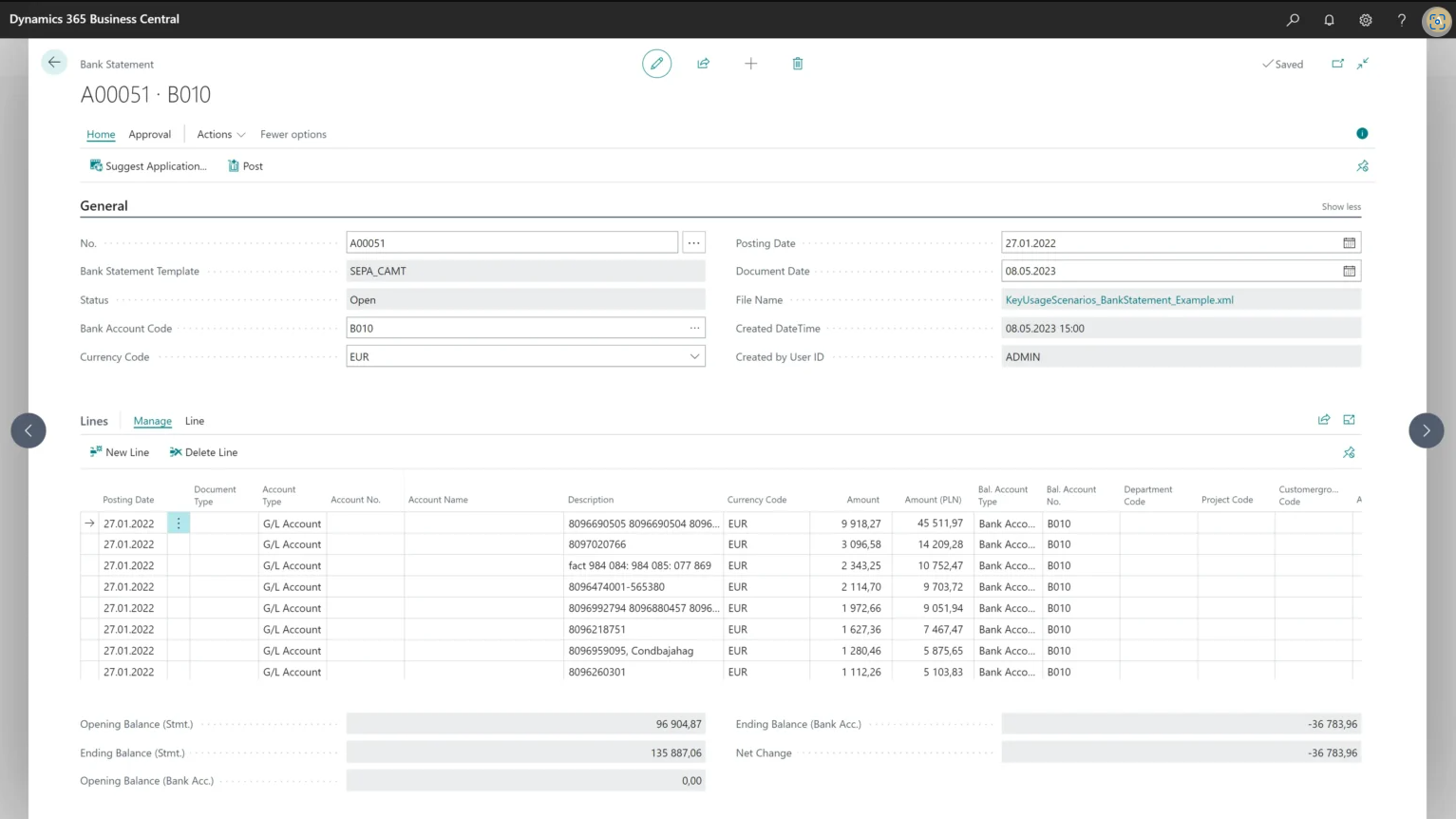

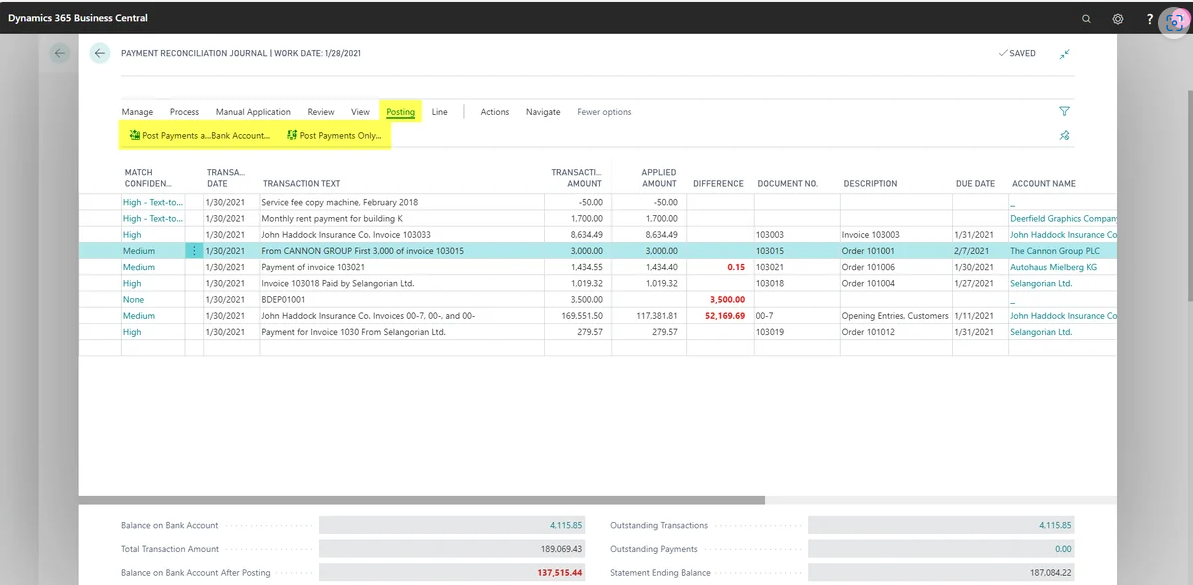

This application is an extension of the standard electronic banking functionality in the Microsoft Dynamics 365 Business Central ERP system. The module enables system integration with banks, facilitating everyday financial operations in Business Central by streamlining the handling of bank transfers and importing bank statements, as well as settling payments in Business Central.

The Electronic Banking module is dedicated to both single-country and global companies. This extension has been designed for full integration with the localization package for D365 Business Central.

The Electronic Banking application is available in two versions:

- Electronic Banking Base App – supports sending transfer orders to the bank, then downloading bank statements and mapping them in the system.

- Electronic Banking Extension – an option recommended when there is support for banks from different countries, with different interfaces, including split payment support.

Functionalities available within the Electronic Banking application:

- Support for Polish banks (MT940, SEPA)

- Working with most global banks

- Split payment support

- Validation with the list of active VAT payers

- Easy integration with Polish localization

- Support for formats: SEPA, XML, MT, CSV

- Direct communication via web services

- Direct communication with SFTP

- Simplified banking operations: export of payment proposals to the bank, import of bank statements with automatic mapping, bank transaction register, and the ability to add additional banks for processing

- Available interfaces for banks: Alior, BGK, BNP Paribas, Citi Handlowy, Credit Agricole, Danske Bank, Deutsche Bank, HSBC, ING, Millennium, mBank, Nest Bank, Pekao SA, PKO BP, Santander, SEB, Societe Generale, Bank of America, Bank Spółdzielczy Krokowa

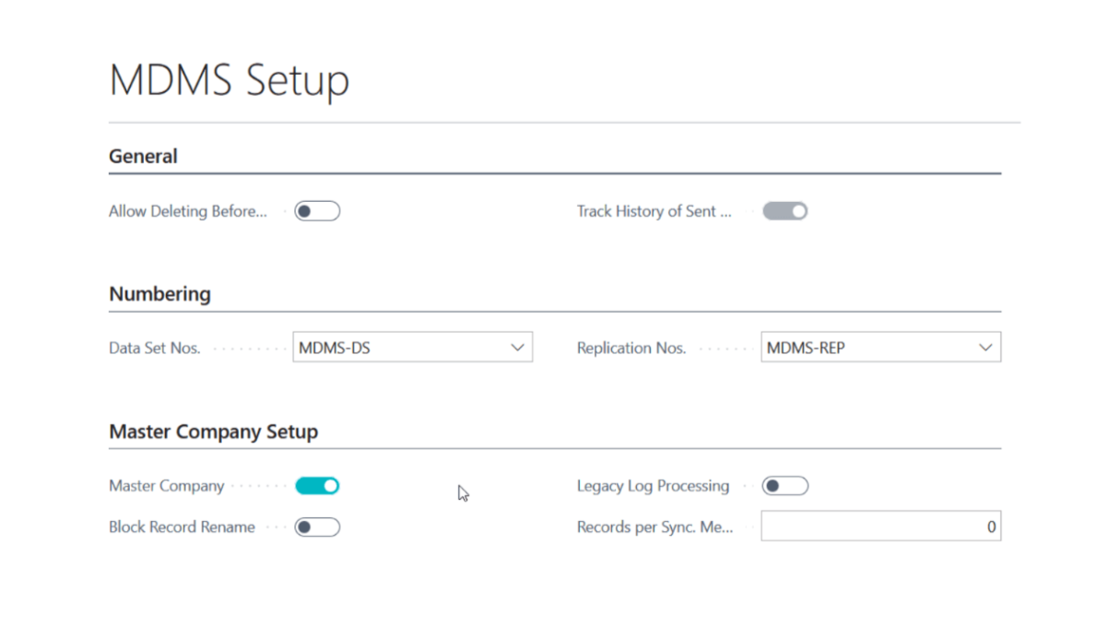

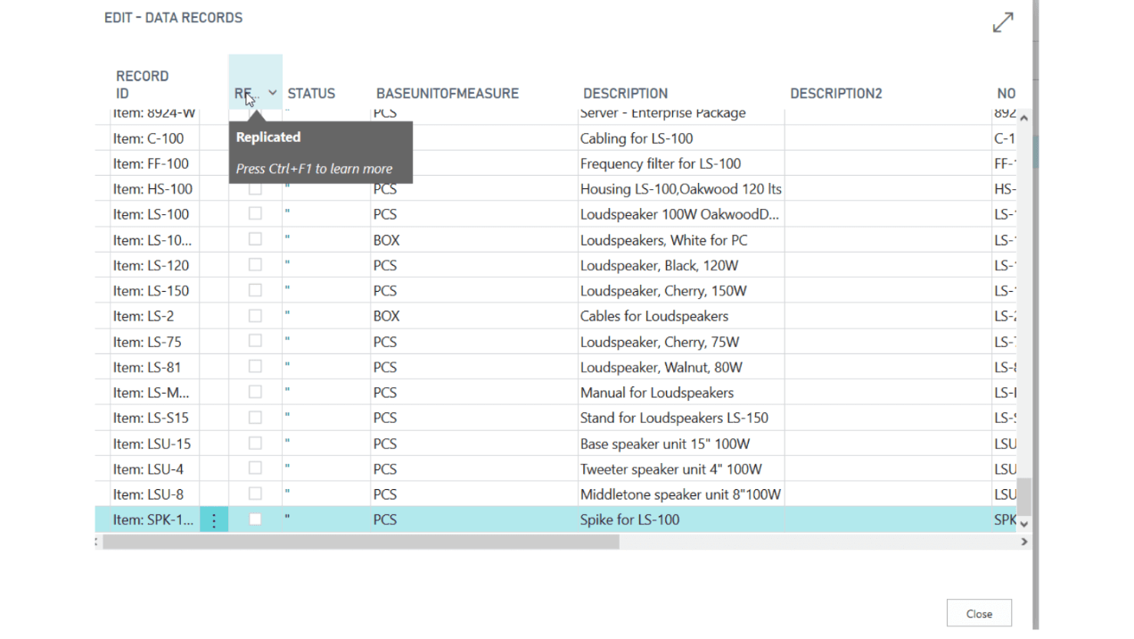

Master Data Management System is an extension for Microsoft Dynamics 365 Business Central, designed for international, multi-entity organisations. The application enables centralised management of key data and its synchronisation across subsidiaries, eliminating inconsistencies and supporting a unified operational policy. Through data standardisation, companies gain better control over processes, increased operational efficiency, and a solid foundation for further digital transformation.

Features available within the Master Data Management System application:

- Management of master data across connected entities within a single organisation

- Ease of copying vendors, customers, accounts, dimensions, and user roles between companies

- Simple setup of additional legal entities

- Improved communication between subsidiaries

- Standardisation of processes across the entire organisation

- Fast and standardised reporting across all entities

- Easy service management

- Possibility of implementing centralised purchasing

Why is RSM Poland the right choice for your company?

RSM Poland is one of the leading Microsoft Dynamics 365 Business Central partners in Poland. Our team consists of qualified specialists – certified Business Central consultants and programmers, as well as experienced tax advisors, accountants and auditors who perfectly understand the intricacies of Polish regulations.

We offer comprehensive support in implementing the localization package for Dynamics 365 Business Central and assistance after the project is completed. Our experts have already helped many companies improve key business processes and achieve their goals. We support companies from various industries and sectors, adapting our solutions to their individual needs.

Get a 100% free customized demo from a Microsoft expert at RSM Poland

Complete this form and an RSM representative will be in touch.