Treasury management forms an essential part of a company’s business operations. It includes efficient cash management, deployment of onshore or offshore cash within a group of entities, foreign exchange and interest rates management.

Treasury management is more crucial than ever today, amidst the ever-increasing cost of funding.

Treasury management can be complex, especially when it involves the deployment of funds across different countries for purposes of working capital, reinvestment or a return to shareholders. This article discusses the key considerations from a tax perspective for a group wishing to setup a treasury centre.

Key Considerations:

1. Implications for intercompany loans

Cash pooling via Intercompany loans is a centralised cash management technique that is used by group companies (“Group”). It helps the Group optimise the cash balances of all its entities efficiently, resulting in a more effective usage of its cash balances.

Cash sweeping (transfers) between Group entities will result in intercompany loans. Interest on these intercompany loans will have to comply with the transfer pricing (“TP”) rules and regulations; and they may attract withholding tax in the borrower’s country and corporate income tax in the lender’s country.

In some countries, the interest payments may be subject to thin capitalisation and/or earnings stripping rules which restrict the tax deduction of the interest payments.

2. Transfer pricing - Finance and treasury management services

The key function of the treasury centre is to better manage a Group’s liquidity and funding needs through the centralisation of treasury activities. This includes managing bank relationships (arranging bank facilities for Group entities, etc.), managing liquidity and working capital needs for the Group, and setting the treasury policies, among other responsibilities. In return, the treasury centre must be remunerated at an arm’s length fee commensurate with its functions, assets, and risk profile.

The Group will have to consider whether a benchmarking analysis is required to determine that the arm’s length fees are charged.

3. Treasury centre location and favourable tax regime

The treasury centre should ideally be based in a country that possesses an efficient financial regulatory framework, a deep pool of financial talents, strong banking facilities and a favourable tax regime.

Singapore is a popular location in Asia for setting up a global/regional treasury centre and has continued to gain strong interest from many multinational corporations due to its political stability, robust legal framework and financial capabilities, and favourable tax regime, among others.

Below is a summary of the salient tax features offered by Singapore: -

| Features | |

| Corporate income tax rate | 17% |

| Tax incentive | Finance & Treasury Centre (FTC) Incentive

|

| Withholding tax ("WHT") on interest payment to non-residents |

|

| Interest deductibility |

|

| Double Taxation Agreements |

|

| TP Rules and Regulations |

|

| Goods and Services Tax (GST) |

|

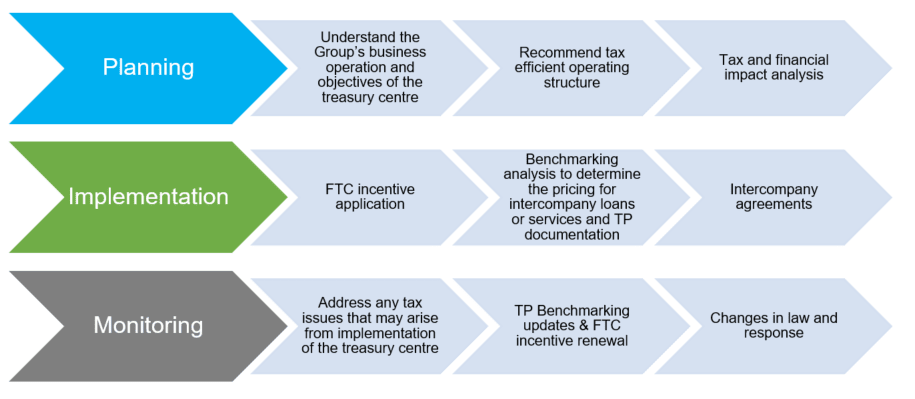

How RSM Singapore Can Help?

At RSM Singapore, we have a team of experienced tax professionals ready to offer integrated tax solutions to our clients.