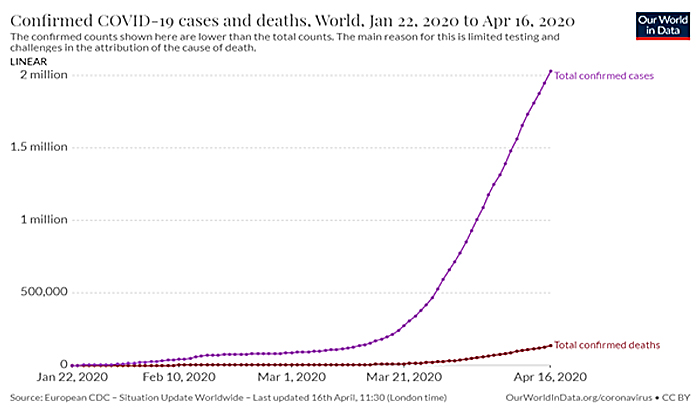

On 11 March 2020, the World Health Organization (WHO) declared COVID-19 a pandemic. To date, the total confirmed cases and total deaths globally sits at 2,158,033 and 144,221 respectively.

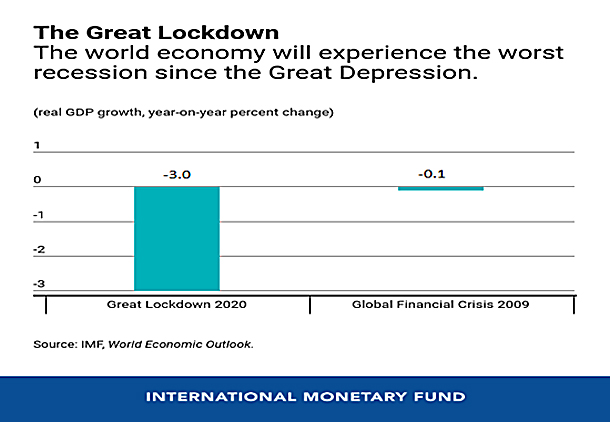

On 15 April 2020, IMF forecasted that the global economy is expected to contract sharply by 3% in 2020 due to The Great Lockdown arising from COVID-19 pandemic.

Fears surrounding the pandemic’s impact on the global economy has caused significant drop in stock prices for major markets. The drop in global economic activity has also resulted in oil prices plunging to an all-time low of $19.87 per barrel on 15 April 2020.

For some wealthy family businesses, the COVID-19 pandemic may have presented them with an easier opportunity to pass wealth to the next generation. In Korea where succession planning can be costly because of high inheritance tax rates, members of some family-run conglomerates are taking advantage of lower stock prices to snap up shares and increase their ownership stakes. Similarly, low interest rates and falling stock prices are helping wealthy Americans avoid estate and gift taxes by lending assets to their children through the set up a Grantor Retained Annuity Trust, or GRAT.

Equally, there are also many family businesses that are not prepared for the effect of COVID-19 pandemic on their businesses and wealth. We believe it is timely now to start the preparation and planning for succession planning during this COVID-19 pandemic.

Considerations for Family Businesses Amidst the COVID-19 Pandemic

"What will happen to me? Will I see my wife again?" One of the survivors of the COVID-19 shared the first thoughts that went through his mind when doctors confirmed that he was tested positive for the COVID-19 infection.

Across the globe, we are seeing an increase in deaths of COVID-19 patients and the death toll is expected to continue to rise. The uncertainty and chaos from the pandemic has reminded us of the fragility of life and that there are limits to our power and what we can control. For many Asian families, the topic of life after death has always been a taboo. However, families should take this opportunity to sit together to devise a strategy that can help build family cohesion and at the same time preserve wealth through generations after the passing of the patriarch.

In today’s world, there has been an increasing number of real-life cases of family members falling apart after the death of the patriarch. The patriarch of Lotte Group recently passed on at the age of 97 without establishing a will. Even though he has always involved his children in the family business, he has never established a clear heir for succession. This has resulted in the jostling of power between the two sons after his death.

It is clear that succession planning does not just end after establishing a will. It takes years of planning to develop and execute it properly without invoking the emotions of family members in a negative way. Such examples have made it much more apparent to these wealthy business owners on the necessity to speak about life after death for their family members and family business. With the global slowdown in economic activity during the COVID-19 outbreak, it is the perfect time to reflect and ask themselves difficult questions and start planning for the future.

- What is the legacy you would like to leave behind for your children and grandchildren?

- What are the family values that drives cohesion within the family members?

- What are the governance structures that are put in place to clearly identify the roles and responsibilities of each family member?

- Does the family members or family business comes first?

- What are the training and educational programmes that are in place to groom my successor?

- How do I pick my successor? By seniority, by gender or by capabilities?

- How do I divide my assets and wealth amongst my children? In equal portions, by gender or do I apportion them based on capabilities?

- Are my children interested in running the business after I pass or should I think of exit strategies now in preparation for the future?

It is also important to note that this pandemic has significantly changed the way we work. Many companies have implemented the work-from-home arrangements for most employees as part of their Business Continuity Plans. Prolonged self-isolation often bring about anxieties which can in turn lead to arguments within the family when the individual becomes aggravated more easily. In difficult times like this, families should first address the emotional and mental well-being of themselves and their family members.

The increased stress from firefighting to keep the family business intact coupled with the impending need to innovate and keep up with automation and digitization might also bring to light latent leadership qualities of family members.

Conclusions

As the saying goes, “there is an opportunity in every crisis and the deeper the crisis, the better the opportunity can be”. While we wait for the pandemic to flame out and the recovery of the global economy, it is time to reflect on the trajectories of our lives where small changes can lead to huge differences in the outcome.

To find out more and how our private client service team can help you, please contact our specialists:

Tay Woon Teck

Partner and Industry Lead, Private Client Services

T+65 6594 7803

wttay@RSMSingapore.sg

Yvonne Tang

Associate Director & Deputy Industry Lead, Private Client Services

T+65 6594 7668

yvonnetang@RSMSingapore.sg