Most industries are not spared by the outbreak of COVID-19 that has increased market volatility since the first quarter of 2020. This has raised concerns revolving around the fair value of companies and various asset classes.

Jointly organised by RSM and Twin Pillars, the “Valuation & Impairment Assessment in the New Normal” webinar (held on 27 October 2020) provided perspectives on valuation assessment in the new normal on preparing and auditing year-end financial statements.

Terence Ang, Partner of Advisory of RSM, in his opening address, highlighted the varying impacts of COVID-19 on various industries in Singapore throughout 2020, and identified key uncertainties related to valuation i.e. cash flow forecasts businesses face during this period.

Business Valuation Fundamentals

Business valuations are undertaken for financial reporting, IPO/RTO, litigation, and transactions. Valuations for financial reporting—the main focus of this webinar—are governed by FRS36 (Impairment of Assets), FRS102 (Share-based Payments), FRS103 (Business Combinations), and FRS109 (Financial Instruments).

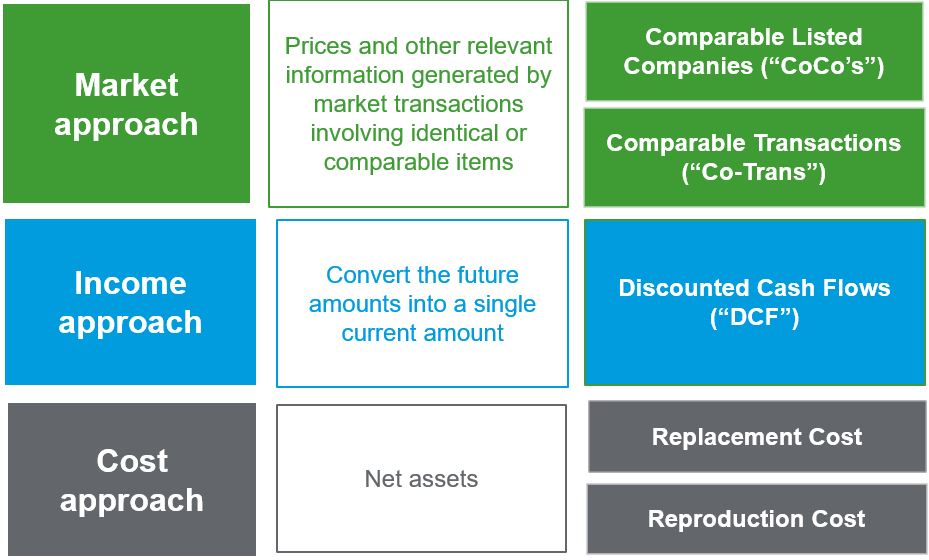

Business valuation exercise encompasses understanding financial (i.e. financial statements) as well as non-financial aspects (i.e. corporate strategy, business sustainability, corporate governance, etc.) of a business. The three approaches to business valuations are (1) Market Approach; (2) Income Approach; and (3) Cost Approach.

Adopting the DCF model, the key emphases of valuation professionals are the terminal growth rates, discount rates (i.e. cost of capital), and the forecasted Free Cash Flow to Firm (“FCFF”) – cash flow that is available to debt and equity holders of a company. All of which are subject to the heightened uncertainties during this period of time.

Navigating the New Normal

A. Value ≠ Price

Value and price are often perceived as the same concept. However, value and price often diverge for a number of reasons. During this webinar, Terence discussed the key differences between the value and price of a business.

In valuation, it is important to triangulate the perspectives of sellers, buyers, and the market as a whole to bridge the gap between value and price.

B. Cash Flow is Key, a More Rigorous Review of Cash Flow is Required

The main determinant of the value of a business is its cash flow (i.e. FCFF). In such a time of uncertainties, Terence highlighted several considerations when preparing and/or assessing a company’s cash flow:

- short-, medium- long-term impacts of COVID-19 on a company’s cash flow include, but are not limited to, one-off government grants or rental rebates, a recovery period of the company, change in social or business norms, and consumer behaviour;

- the financial health of a company, in terms of working capital requirements, availability of credit facilities, and tightening of suppliers’ credit terms; and

- the impact on day-to-day business operations (i.e. supply chain disruptions, government directives, and foreign workers supply).

Cash flow projections now require a higher level of scrutiny to ensure valuations are supported by business plans and/or management’s targets moving forward. The projections should be prepared from a bottom-up approach on a more granular basis to support key components of the financials.

C. COVID-19 Impacts Discount Rates

There are four parameters of the discount rate that have been impacted by COVID-19:

- Cost of Borrowing: Possibly warrants a higher cost of borrowing due to increased operational risks and, hence, higher credit default spreads

- Risk Premiums: Fluctuations of equity risk premiums throughout 2020

- Interest Rates: Artificially low-interest rates globally due to (1) introduction of quantitative easing measures; and (2) increase in bond prices that push the yield rates down

- Additional Risk Premiums: Consider to factor in an additional premium to account for the uncertainty during this period

Care should be taken to avoid any double-counting of risks, for instance, additional risk premiums are not required for factors that have already been addressed in the cash flow or included in the market inputs. With the increased uncertainty in the market imposed by COVID-19, valuation professionals may find it useful to consider alternative scenarios and derive a probability-weighted value rather than just one outcome.

D. Be Cautious With Market Data

This is particularly relevant when adopting the Market Approach. Terence quoted the IPEV Valuation Guidelines: “It may no longer be appropriate for recent transaction prices, especially those from before the expansion of the pandemic to receive significant, if any, weight in determining fair value.” Multiples for transactions that were completed prior to the COVID-19 pandemic would not have incorporated the impact of COVID-19. In such circumstances, an appropriate adjustment (be it on financials or multiple) should be factored in when adopting the Market Approach. One should understand the economics in the deal price and assess whether it is reflective of the current market condition.

E. What Auditors are Looking for

Auditors will be more skeptical about the assumptions adopted that include understanding and evaluating controls surrounding the forecasting and budgeting processes, comparing past performances against past forecast and budgets for reliability, understanding your assumptions and the basis of such assumptions, and corroborating assumptions used in the forecast with supporting evidence.

Terence concluded his presentation by stating that the projections need to be realistic, supportable, and can withstand challenges – the story drives the numbers and not vice versa. Rigour is more important than ever in understanding the key value drivers and risks of your business.

During his segment, Milton Tan, Founder and Managing Director of Twin Pillars, briefly covered topics such as the definition of plant and machinery, differences between Market Value and Fair Value, purposes of valuation, valuation methodologies and approaches, impairment testing, and insights into the challenges during COVID-19.

It is necessary to adapt to the market volatility during this COVID-19 pandemic. Under such market and economic uncertainty, it is difficult to determine whether the impact by COVID-19 is short- or long-term. Hence, it is recommended that valuation be kept under more frequent reviews than usual.

To find out more and how our Advisory team can assist you, please consult our specialists.

Terence Ang

Partner & Head of Advisory

T: +65 6594 7862

[email protected]

Daniel Low

Director

T: +65 6594 7622

[email protected]

Qiu Wenqi

Director

T: +65 6715 1399

[email protected]