Assisted Compliance Assurance Programme (ACAP) encourages GST-registered companies to undertake a holistic review of the effectiveness of their internal GST control framework.

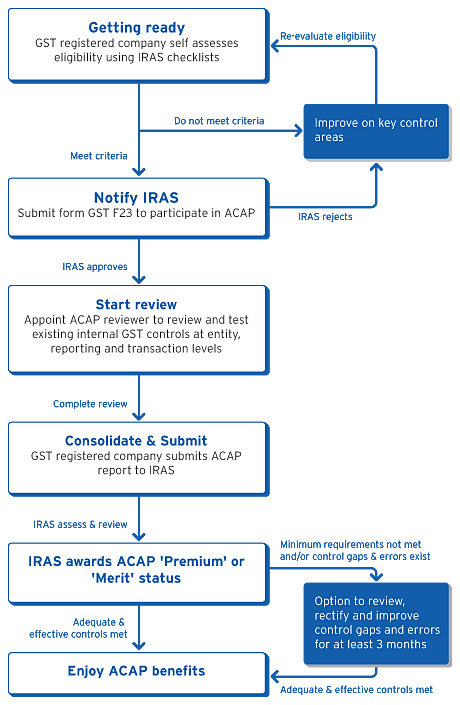

GST-registered companies must first conduct a self-assessment of their GST control framework using four review checklists provided by the IRAS, covering the Entity, Transaction and GST Reporting levels. With a minimum score of at least 60% at each level and the approval to proceed by the IRAS, the company may appoint an accredited internal or external ACAP reviewer to perform an independent verification of how its GST Control Framework operates.

The review will result in an ACAP report to the IRAS. Depending on the robustness and effectiveness of its internal control system, the IRAS will then accord an 'ACAP Premium' status for 5 years or 'ACAP Merit' status for 3 years to the company.

Benefits of ACAP

The ACAP status accorded by the IRAS implies that the GST-registered company has a good and effective internal GST control framework in place. This is beneficial to the company in the long-term with improved GST risk management.

All these translate to minimal compliance costs and peace of mind on GST matters for either 5 years (premium status) or 3 years (merit status). The GST-registered company can further enjoy the following benefits:

A - Audit of GST matters by IRAS minimised & faster GST refunds

C - Co-funding of professional fees incurred & reduction in compliance costs

A - Auto-renewal of the GST schemes (e.g. Major Exporter Scheme, Marine Fuel Trader Scheme)

P - Peace of mind & waiver of penalties for past GST errors

How we can assist

As your accredited tax advisor, we can support and work with you at every stage of the ACAP process:

- Assess whether your business is ready and suitable for ACAP

- Help you get ready for ACAP

- Assist you to bridge gaps in the internal GST control framework and rectify GST errors, if any

- Independently review or partner your internal audit team to perform the ACAP review

ACAP Review Process

Find out from our team of GST specialists on how to enhance your company’s GST compliance capability.

For assistance, please contact Richard Ong at 6594 7821 or [email protected].