Przemysław POWIERZA

Tax Partner at RSM Poland

The split payment is a very broad subject. I could go on and on about it. Below you will find another chunk of questions and answers that crop up in connection with using this system of settlements. I cannot give you a 100 percent guarantee that once you have read our earlier posts (part 1, part 2, part 3), the split payment mechanism will have no secrets for you. However, knowing the rules and principles of using the SPM will make it easier for you to run your business and avoid tax traps.

Is it possible to pay invoices without VAT under the SPM?

In the explanations, the Ministry of Finance has clearly indicated that it is not possible to pay only the net amount under the SPM. We are talking here for example about invoices that do not include the amount of tax (reverse charge, actions exempt from tax, procedure of the VAT margin scheme). Such action fails to meet the assumptions behind the introduction of the split payment mechanism. In the bank transfer template, you must at all times provide the amount corresponding to the gross sale value, either in its entirety or in part, and the corresponding VAT amount, either in its entirety or in part.

Is it possible to pay for the intra-community purchase of motor fuels under the SPM?

Yes, it is possible to apply the SPM for any payment of VAT amounts on the intra-community purchase of motor fuels to the VAT account of the payer. How do one complete the transfer template correctly in such a case? The entrepreneur shall enter the amount of tax that is supposed to be paid using the SPM both in the field dedicated for the amount corresponding to the total or part of the amount of tax indicated in the invoice that is supposed to be paid in the SPM and in the field dedicated for the amount corresponding to the total or part of the gross sale value. In the invoice reference number field, the entrepreneur shall provide the reference number of the document connected with the payment and issued by the payer. In the field dedicated for the supplier’s or service provider’s VAT number, the entrepreneur must provide the VAT number of the tax payer on the intra-community purchase of motor fuel.

What are the incentives for applying the split payment?

The Ministry of Finance strongly encourages the use of split payment; therefore, the VAT Act provides for a package of incentives for taxpayers who apply this form of settlements, namely:

No joint and several liability

If the SPM is used for making a payment for an invoice for purchased sensitive goods (e.g. fuels, digital cameras or SSDs), the purchaser shall not be jointly and severally liable with the supplier for the supplier’s tax arrears concerning any unsettled output tax on the supply of goods made to this taxpayer. This exemption shall apply up to the amount corresponding to the amount of tax resulting from the received invoice.

No additional tax liability

Should the tax authority challenge the right to deduct VAT from invoices paid with the SPM, they shall not determine any additional tax liability on the amount of tax paid under the SPM.

No 150% default interest rate

In the event of VAT arrears for a period for which the taxpayer has accounted in his tax return, for an amount of input tax of which at least 95% results from invoices received by the taxpayer and paid using the SPM, the provisions on the increased default interest rate shall not apply. However, if the tax arrears exceed the amount of the input tax twofold, the increased rates shall apply.

The aforementioned benefits shall inevitably not apply to an entrepreneur who knew that the invoice paid using the SPM:

- has been issued by an entity that does not exist;

- asserts actions that have not been performed;

- provides amounts inconsistent with the facts;

- confirms legal actions that are either in breach of the Act or aimed at evading the Act, legal actions breaching the rules of social conduct, as well as actions, for which a declaration of will was made to the other party upon its consent for the sake of appearances.

Bonus for early payment

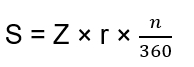

The entrepreneur who pays the tax in its entirety from his VAT account before the payment deadline shall be entitled to a reduction of this liability in the amount calculated according to the following formula:

where:

S – amount of reduction;

Z – tax amount provided in the tax return;

r – NBP reference rate valid on 2 working days prior to the tax payment date;

n – number of days before the payment date (excluding the date of debiting the account).

In most cases, this ‘bonus’ is going to actually be symbolic. Thus, we may immediately ask about the point of offering this incentive. Since it is symbolic, it is not motivating on the whole. Please note that applying the bonus does not generate any revenue for taxation purposes in this respect.

Not that much into finance and taxes but overwhelmed by documents you’re not sure how to read?

FIND OUT MORE

Expedited VAT refund within 25 days

If the entrepreneur makes a request in his tax return to have the tax refund deposited to his VAT account, i.e. ticks a relevant box in the VAT-7 or VAT-7K return form (under item 68) and provides the amount he wishes to be transferred to his VAT account (under item 58), the tax office shall be under obligation to make such a refund within 25 days. This deadline cannot be extended, even if there are any reservations as to the eligibility of the refund.

Is the SPM connected with due diligence?

If you use the split payment mechanism to make a payment for goods, the tax authority may apply preferential treatment to the purchaser, under the assumption that the taxpayer has observed due diligence. One must remember, however, that making a payment under the SPM constitutes only one prerequisite of due diligence, yet it does not replace it. You can read more about this in the post available here: LINK.

Can the bank grant a credit or a loan secured against the funds on the Vat account?

No, the funds on the VAT account cannot serve as collateral for any loan or credit.

How to close a business account with a linked VAT account?

The entrepreneur who has a single business account in a given bank, with only one VAT account linked to it, must file a request with the head of the tax office to have the funds transferred to a VAT account in another bank. In the case where the entrepreneur has several business accounts in a given bank and wants to close only one of them, the funds from the VAT account that is being closed shall be transferred to another VAT account that has been established in this bank.

The Ministry of Finance assures that they are aware of the entrepreneurs’ demands, and are considering a certain amendment of the rules and principles behind the split payment mechanism. The Ministry is considering the introduction of an option of paying other public liabilities, e.g. social insurance or PIT, from the VAT account. What is more, they are also planning to extend the scope of the split payment application, e.g. to transactions paid with a payment card. This problem occurs, among others, when refuelling a company car. The payment made with a card is debited from the bank account; hence it is identical with a bank transfer. What is more, the transfer recipient is known in advance. Therefore, the receipt of an invoice shall allow for the settling of such a transaction in the SPM. The Ministry has also noticed other obstacles, including the limitations of applying the SPM to settlements in foreign currencies. They are considering an extension of the SPM scope to include payments made to foreign currency accounts.

I would like to draw your attention to the fact that even though using the split payment scheme is indeed voluntary, probably each and every one of us will be forced to use the SPM sooner or later. If a couple of your business partners use the SPM to pay you for a supply or service, and you do not use the split payment scheme to pay your purchase invoices, the balance of funds accumulated on the VAT account will keep growing. In order to avoid problems with your financial liquidity, you will most probably decide to use these funds and make a payment using the SPM. It can be compared to the domino effect.

Moreover, when analysing the current ‘aggressive’ policy of the Ministry of Finance, primarily aimed at making the VAT system more efficient, one may assume that with time the choice of the SPM will cease to be voluntary. The Ministry of Finance is still awaiting the decision of the European Commission approving the introduction of an obligatory SPM in certain industries, e.g. fuel, construction or electronics. The decision of the European Commission will most probably be issued in December. Clearly, the Commission’s approval is not going to mean that the obligatory SPM will be introduced in certain industries as early as of the beginning of 2019. The taxpayer must have the time to analyse the regulations and prepare for changes in taxation.

Summing up, I think that for the time being I have discussed most doubts that have so far appeared in the wake of the introduction of a new system of settlements, namely the split payment mechanism. Nevertheless, I am not closing the topic of split payment once and for all. If any changes are introduced to the rules and principles behind the SPM, they will surely be discussed by our experts, I therefore wholeheartedly encourage you to follow our website.

Subscribe to RSM Poland Newsletter to stay up-to-date on all legal, financial and tax matters. Benefit from the expertise of our professionals.

Subscribe