A joint study by RSM, SIT and ISCA conducted prior to COVID-19 reported the low adoption rate of analytics and technology among Singapore SMEs[1]. However, when COVID-19 struck, it catalysed a wave of digital transformation among many organisations. It is not hard to see why.

In a challenging business environment, organisations constantly seek ways to increase revenue and lower operating costs to be competitive. Across a wide range of industries, analytics and technology have the potential to bring about value-added insights and help organisations identify areas to generate greater profits.

Here, we list down four of the most useful applications for your organisation.

1. Automate business processes

According to a study by the Singapore Business Federation, the use of technology “to streamline operations and automate processes” is the most important use case after digital collaboration, and 44 per cent of Singapore businesses have adopted it.

In a technique called Robotic Process Automation (“RPA”), computer software is programmed to execute standard, well-defined, and repeatable tasks typically performed by humans. For the finance function, popular applications include the automated retrieval of information from various data sources, pre-processing, validation and reconciliation of data, as well as generation of nicely formatted reports or dashboards for management reporting. The deployment of RPAs in an organisation is akin to a digital workforce that can operate around the clock and does not make mistakes.

Therefore, the use of RPAs can result in time and cost savings, thereby enhancing the sustainability of the organisation in the long term.

2. Visualise and interpret data better

One of the business challenges is the translation of voluminous data to actionable insights. Business intelligence tools can process data and display them in an interactive visualisation dashboard that allows users to analyse data from different perspectives. Such tools can also integrate information from various places, for example different retail outlets, into one single dashboard that facilitates comparative analysis.

In order to enhance the insights, organisations can also explore Artificial Intelligence (“AI”). Common applications of AI include:

- Forecast of revenue, cost, and other financial metrics of interest

- Predict and manage inventory

- Use for customer profiling and targeted advertising

- Engage customers using chatbots

Firms need to respond quickly to changing consumer demands by making quicker and more informed decisions to stay ahead of competitors. Business intelligence, coupled with AI, enhances the speed at which insights are generated, providing firms the agility to stay ahead.

3. Understand customers

The COVID-19 pandemic has pushed many companies to conduct their businesses online to mitigate the loss in revenue from their physical stores. The online retail industry has since been growing as firms seek new growth opportunities. Coupled with the prevalence of social media platforms, it is important for firms to maintain a strong and positive social media presence to attract new customers and increase sales.

For companies with online customer reviews, it is worthwhile to study the reviews using a technique called sentiment analysis. It evaluates textual data, in this case customer reviews, and converts them into scores based on whether the reviews are positive, neutral or negative. Additionally, the ability to track customer sentiments over time allows companies to identify key areas of concerns. With these insights, companies can further customise their products and services to increase sales.

Compared to a human, AI can parse through information and extract insights quicker and more accurately, especially if the number of customer reviews is large.

4. Improve business efficiency

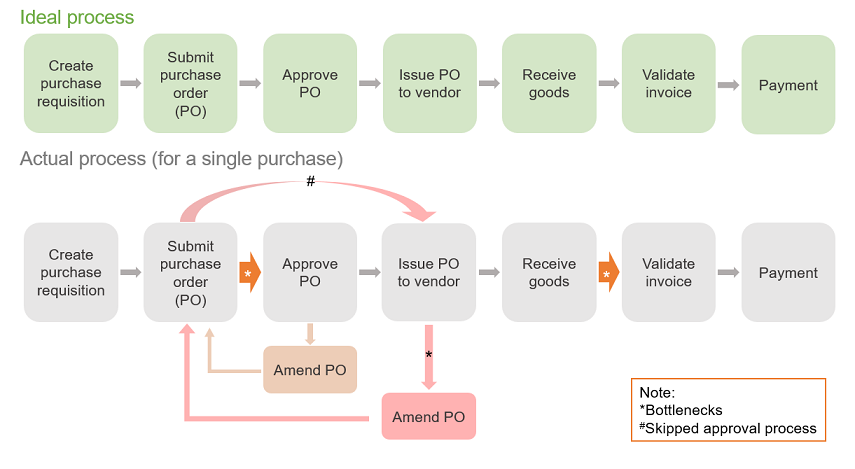

While business processes are increasingly digitalised in many organisations, not all are streamlined and optimised which could lead to process inefficiencies and increase costs. Process mining is an emerging technique that studies event logs from information systems to understand process flow, identify potential bottlenecks, and propose areas to streamline.

An example of the purchase-to-pay business cycle is as follows:

In addition to identifying potential bottlenecks in the processes, process mining can also help to identify occurrences of deviations from the ideal process or even non-compliance such as skipping of approval processes. Therefore, with process mining businesses can improve their work efficiency, reduce costs, and reduce frauds.

The potential of analytics and technology in improving business performance is limitless. In order to stay ahead of your competitors, especially in the wake of COVID-19 pandemic, it is important for companies to be aware of emerging digital trends, continue to innovate, and ensure the business can generate sustainable profits in the long term.

This article is contributed by Kimberly Neo of our Technology, Media & Telecommunications practice.

[1] Majority of SMEs Yet to Adopt Data Analytics Despite the Push for Digital Transformation | RSM Singapore