Climate change stands at the forefront of Environmental, Social and Governance (“ESG”) considerations by governments and sustainability conscious companies. In 2015, the Paris Agreement, a legally binding international treaty on climate change, was adopted by 196 parties. It aims to hold the temperature rise to “well below 2 °C” while “pursuing efforts to limit the temperature increase to 1.5 °C.” Since then, governments have begun to align their national agendas with the aim of the Paris Agreement. Singapore has targeted to halve its peak greenhouse gas emissions as of 2030 by 2050, and to achieve net zero emissions "as soon as viable."

The urgency of the global climate commitment is not to be understated. If the Paris Agreement commitments are not met, the prospect of a world warmer by more than 2 °C would become a reality, decimating vulnerable natural biomes with disruptive consequences to global supply chains. To date, the world has fallen short of meeting its major Paris Agreement milestone according to climate scenarios modelled by the International Energy Agency (“IEA”).

Evaluate impacts, risks and opportunities

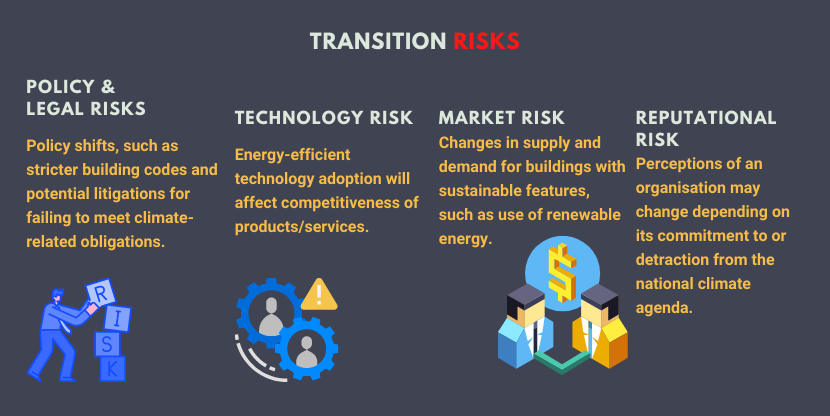

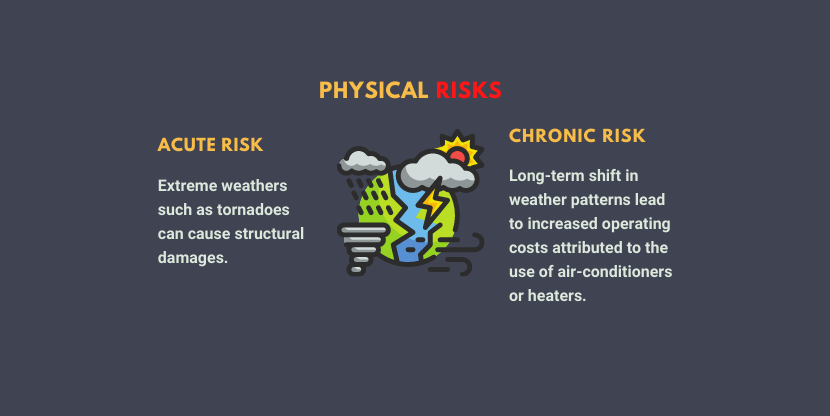

Regardless of the contributions from different countries to the commitment, moving towards a low-carbon future is inevitable. Companies in emission-intensive sectors are already being held accountable for their climate-related impacts. Singapore’s Carbon Tax, currently at a rate of S$5 per tonne of greenhouse gas emissions, is expected to increase substantially by 2023 in order to reduce emissions. Climate-related impacts are pertinent to the real estate sector as this sector holds the biggest electricity and district heating consumers; accounting for more than half of the total final energy demand in 2016 (IEA, 2016). The Real Estate Investment Trust (“REIT”) managers will encounter two overarching types of climate-related risks (transition and physical risks) while managing climate-related impacts.

As the real estate sector restructures itself to accommodate a sustainable and low-carbon future, opportunities may surface. Hence, a commitment to sustainability should not be regarded as just a compliance exercise.

Here are five opportunities companies can ride on to develop their competitive, sustainability edge:

Implement effective reporting

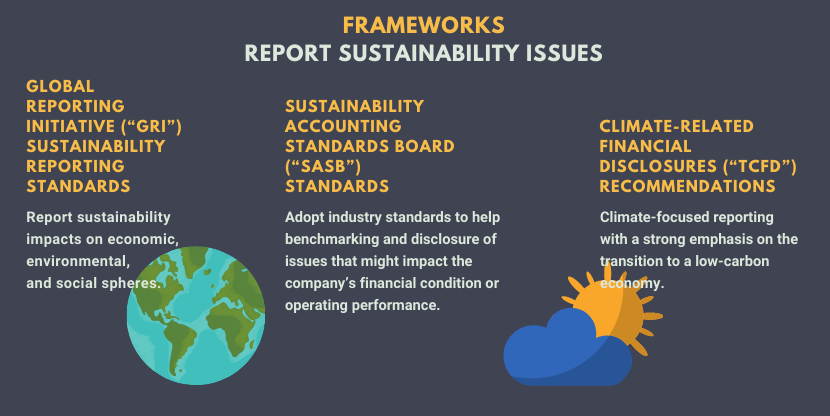

REIT managers that are working toward achieving a sustainable business model can communicate their sustainability targets and objectives with their stakeholders through effective reporting. The reports should focus on key ESG areas that are aligned with the organisation’s business objectives. Engagement with stakeholders during the reporting process should include the entire supply chain, upstream and downstream suppliers, and business partners. Targets in the short-, medium- and long-term timeframes should be set and evaluated regularly. Here are some useful frameworks that may help organisations to report their sustainability issues:

Policies and processes should be designed to facilitate effective implementation of ESG practices in conjunction with reporting. Information systems should also be developed for continual monitoring of the organisation’s sustainability performance.

Integrate ESG into investment decision making

In order to limit temperature rise within 2 °C, investments into increasing the supply of renewable energy and reducing the demand for energy-sapping products through investment into energy efficient equipment and machinery are necessary. Asset managers on top of the investment chain play a role in influencing organisations or assets which they invest in. The Monetary Authority of Singapore (“MAS”) has published guidelines on environmental risk management, holding asset managers accountable for the resilience of their customers’ assets against environmental risks.

Consideration of environmental risks that include both physical and transition risks should be considered throughout the investment process; from governance and strategy, research and portfolio construction, portfolio risk management to investment stewardship.

In the MAS guidelines, REIT managers are expected to consider energy, water, and waste management in their asset enhancement initiatives.

Perform benchmarking

REIT managers can also look at industry benchmarks to make data-driven decisions regarding the sustainability performance of their portfolios. The availability of comparative data for the real estate sector has increased with the proliferation of benchmarking initiatives, such as the SASB standards and the Global Real Estate Sustainability Benchmark (“GRESB”). Benchmarking enables managers to answer questions such as:

- How is my portfolio performing against peers?

- How and which areas can be improved?

- Are we on track to meet sustainability goals?

The risks and opportunities inherent in the asset portfolio can subsequently be assessed and acted upon. Organisations which provide quantitative and qualitative clarity on their ESG performance will also enjoy better access to capital from the growing ESG investing market, which is becoming increasingly data driven.

To effectively combat climate change, reliance on current or prospective governmental policies and regulations to drive momentum is no longer sufficient. Spontaneous and immediate efforts by real estate companies are required given that technology and tools for meeting the 2 °C goal are readily available. REITs that are keen to earn their place in a sustainable future should take action now.