With the current COVID-19 outbreak and its impact on businesses, Budget 2020 supports companies, workers and households with an immediate release of a $5.6 billion package to help them tide over this difficult time. Nevertheless, the emphasis on economic transformation and growth still remain strong, with an $8.3 billion budget allocation as announced by the Deputy Prime Minister and Finance Minister Mr. Heng Swee Keat during his Budget 2020’s speech on 18 February 2020. A further $1 billion has also been set aside to build up the Government’s capabilities in cyber and data security over the next three years, in line with Singapore’s Smart Nation and Digital Economy ambitions.

Some of the initiatives that may be relevant to technology companies are listed below:

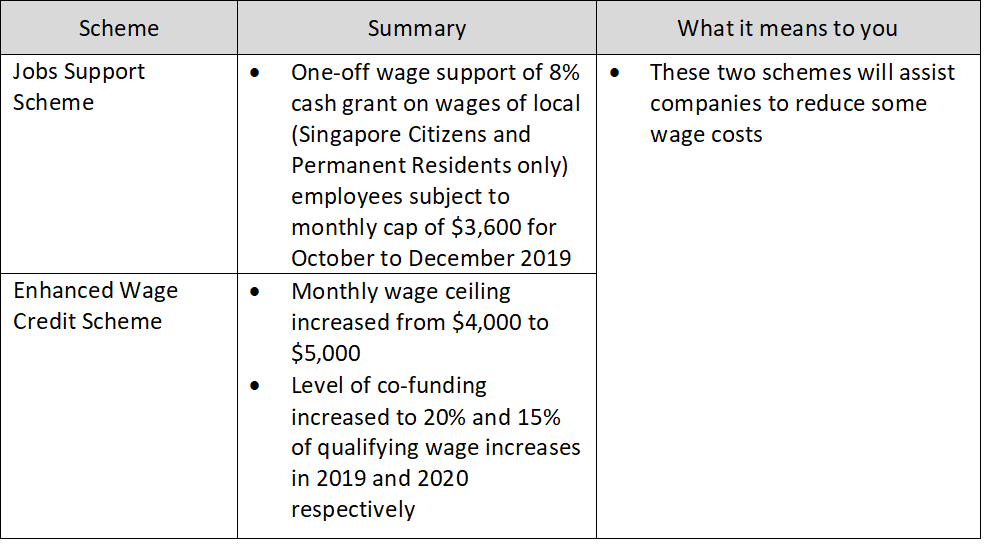

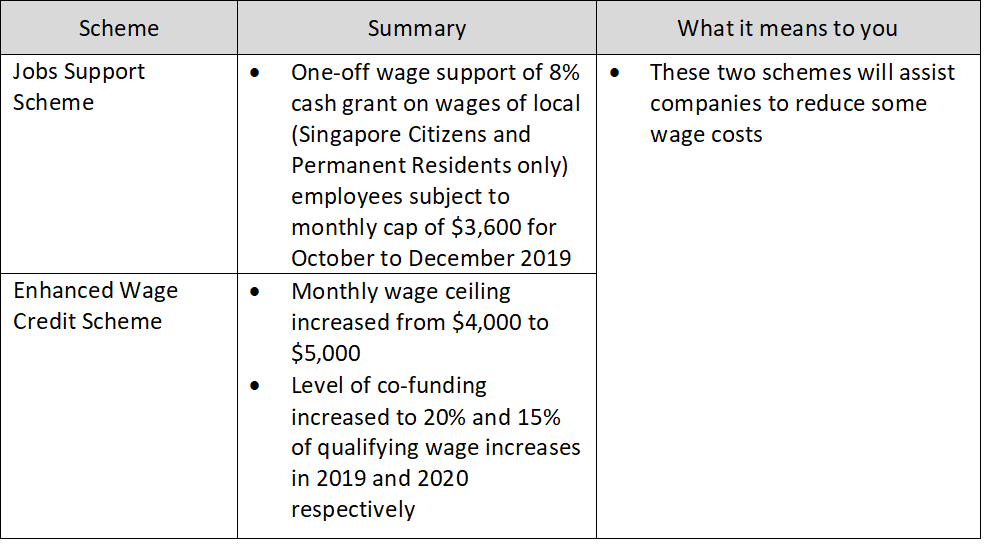

Wage Support

Financing Support

| Scheme | Summary | What it means to you |

Enhancements to Enterprise Financing Scheme's Working Capital Loan

| - Loan quantum increased to $600,000 until March 2021

- Government's share of risk increased to 80% for SMEs borrowing from participating financial institutions

| - SMEs that require funding for working capital needs may consider tapping into this programme

|

| Enhancement to Start-Up SG Equity | - Additional $300 million financing for early stage deep-tech start-ups

| - Eligible deep-tech start-ups able to gain access to capital for their funding needs, and in the process gain expertise and industry networking opportunities

|

Advisory Support

| Scheme | Summary | What it means to you |

| GoBusiness, including e-Adviser | - Central platform for companies to transact with the Government e-Adviser enables businesses to access the suite of schemes available and recommend the most suitable scheme based on input from individual companies via GoBusiness platform

| - It is now easier for companies to locate support schemes via a central platform, which benefits them

|

| Enhancement of SME Centres | - Implementation of pilot initiative for promising micro and small enterprises

- Enhancement of support from business advisors at SME Centres to qualified enterprises

|

| Enterprise Leadership for Transformation ("ELT") | - Support promising SME business leaders in their expansion journey by strengthening leadership and management capabilities

| - Leaders can now receive guidance and training to prepare for next stage of growth and gain access to network for collaboration opportunities

|

Digital Planning

| Scheme | Summary | What it means to you |

| Expansion of SMEs Go Digital | - Help SMEs build digital capabilities which includes expansion of Industry Digital Plans ("IDPs") to additional sectors and expanding the list of pre-approved digital solutions

| - Technology companies providing Al-infused solutions and cybersecurity solutions can now consider getting their digital solutions pre-approved to gain bigger market share

- Technology companies with experience in applying their solutions to new sectors, such as healthcare, food manufacturing, and adult and early childhood education, should collaborate with Info-communications Media Development Authority ("IMDA") to get their solutions incorporated into the IDPs

|

| SkillsFuture Enterprise Credit | - $10,000 per firm to defray 90% of out-of-pocket costs of business transformation, job redesigning, and skills training

| - Technology companies may use this credit to invest in their staff or serve as solution providers to businesses in other sectors in their business transformation journey

|

| Open Innovation Platform Sector-wide Challenges | - Various initiative by IMDA to promote transformation and co-innovation for businesses includes:

- Providing 70% со-funding of prize monies for companies to develop good digital solutions that will benefit the whole sector

- Lowering barrier to entry to innovate with IMDA paying 30% of prize monies to shortlisted technology firms at prototype development phase

| - Technology companies with experience and ideas of digital solutions that can help to tackle issues in various sectors may consider taking part in this programme to develop a prototype, with funding assistance from IMDA

|

Expand Beyond Home Market

| Scheme | Summary | What it means to you |

| Grow Digital (part of SMEs Go Digital programme) | - Enable SMEs to access global markets via B2B and B2C digital channels

| - Technology companies with plans to expand into region and international market may consider tapping into these programmes for advice, guidance and connection for their expansion plan

- Technology companies with digital solutions supporting businesses on their internationalisation journey may also consider collaborations in this space

|

| Enhancement to Market Readiness Assistance ("MRA") | - Accelerate SME's internationalisation efforts by:

- Expanding scope of support activities

- Increasing grant cap to $100,000 per new market per year over enhancement period from FY2020 to FY2022

- Extending 70% support level for another three years until 31 March 2023

|

| GlobalConnect@SBF | - Assist Singapore enterprises looking to internationalise for the first time or expanding and deepening their presence in key Southeast Asian and emerging markets

- Team of market advisors to assist SMEs via face-to-face market advisory services

|

Tax Support

| Scheme | Summary | What it means to you |

| Double Tax Deduction for Internationalisation Scheme Enhancement with Extension until 31 December 2025 | - Qualifying expenses have been widened to cover third party consultancy costs related to new overseas business development to identify suitable talent and build up business network; new categories of expenses will be included

| - Technology companies can benefit from this scheme if they are looking to expand internationally and need external professionals assistance

|

| Writing Down Allowance ("WDA") scheme for acquisition of an indefeasible right to use an international submarine cable system ("IRU") under Section 19D of the ITA | - The WDA scheme under Section 19D of the ITA will be extended until 31 December 2025

| - Technology companies that incur capital expenditure on the purchase of an IRU will be tax incentivised for additional five years, subject to conditions. Businesses are advised to consult tax advisers, prior to acquisitions, to secure full benefits of this incentive

|

Budget 2020 addresses the current needs and Singapore’s Smart Nation and Digital Economy ambition. It puts together various initiatives to help businesses expand their capabilities and upskill their people.

This article is contributed by Clarrie Tay and Chiang Jun Chin of our Technology, Media & Telecommunications practice.