The blockchain is a distributed ledger technology that underlies cryptocurrencies like Bitcoin. However, our perception of blockchain is dominated by Bitcoin, one of its earliest applications. So, what are the other applications of blockchain beyond Bitcoin?

To answer this question, this article discusses how blockchain technology is impacting financial services, trading services, and intermediation services. The long-term implications of blockchain technology for businesses in these sectors are potentially revolutionary. In this context, “long-term” may mean as soon as five years.

Blockchain - a brief recap

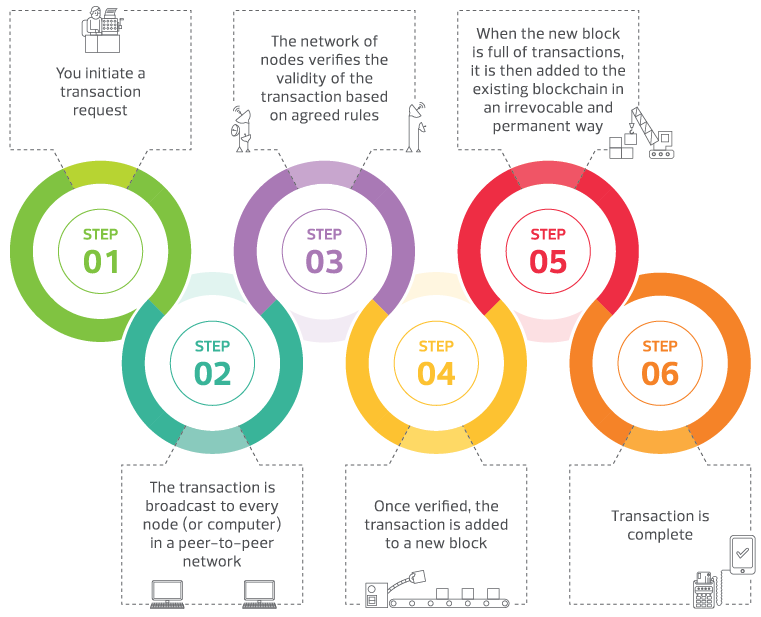

Before diving into blockchain impact, let's do a quick recap so that we share a common understanding of this technology and the hurdles it faces. Blockchains are large, distributed databases that have a mechanism for replicating transactional data in real time while employing cryptography to guard against unauthorised tampering. In addition, blockchains are transparent—all parties to a given blockchain see all the transactions recorded therein. For a closer look at blockchain technology, our team has put together the infographic below:

To emphasise, our team believes that the most important blockchain features are decentralisation and openness which can enhance data incorruptibility, transparency and security. This combination holds great opportunities for creative applications of blockchain by both large companies and start-ups.

Potential blockchain threats & opportunities: financial services, trading services, intermediation

As mentioned at the start of this article, we will go beyond bitcoin and discuss potential threats and opportunities for these three sectors as blockchain technology cuts both ways. Next, we will discuss specific case studies of successful applications to provide inspiration for businesses that seek to leverage blockchain technology:

| Business Sector | Impact | |

Financial Services |

Potential Threat: Traditional banks and other remittance agencies. Potential Opportunity: Add greater transaction security and efficiency as well as reduce compliance costs. | |

| Trading Services |

Current trade financing processes are often time-consuming and prone to errors. Blockchain digitalises contracts and documents, helping to provide real-time visibility as well as authentication. This allows shipping customers to check the status of their shipments by themselves rather than wait for email replies. Potential Threat: Trade and supply chain finance. | |

Intermediation Services |

Potential Threat: Traditional intermediaries, e.g. recruitment agencies that do background checks of participants. |

Financial services case study

Traditionally, when a person wants to remit money across borders, the money flows through multiple banks and intermediaries. The whole process usually takes at least one working day and the remittance fee is a significant cost (7.09% global average1).

However, sending money through a blockchain-based remittance company is much cheaper and faster. For example, in the Philippines where there is a large community of citizens working overseas and remitting money home, cryptocurrency transactions within the country reached a monthly average of over US$6 million in 2017, three times the volume seen in the previous year. Local start-ups that are exploiting the potential of blockchain include Coins.ph and Salarium.

Trading services case study

Cross-border trade currently leaves an enormous trail of paperwork (e.g. sales contract, letter of credit and certificates) among many stakeholders such as shippers, freight forwarders, ocean carriers, ports and customs authorities.

In Jan 2018, the first fully-fledged agricultural trade (a cargo of soy beans) conducted using blockchain was successfully fulfilled among Louis Dreyfus Company and Shandong Bohi Industry, and banks ING, Societe Generale, and ABN Amro2.

Robert Serpollet, global head of trade operations at Louis Dreyfus, claimed that the time spent on processing documents and data had been reduced five-fold with blockchain. But how exactly has blockchain facilitated this enhanced efficiency? There are two features that helped:

- Real-time visibility: Different parties on the blockchain have real-time visibility into what parts of the contract have been executed on and can hence execute payments quicker and with more assurance.

- Automated authentication: The ownership of receivables (e.g. purchase orders or payables) can be distributed on a blockchain. With blockchain, the automation of payment to the supplier can be triggered by pre-programmed conditions.

Intermediation services case study

The blockchain is a highly effective and trusted framework for participants to directly interact with each other and enhance trust. This is particularly helpful for the healthcare industry where an estimated 5-10% of healthcare costs are fraudulent. In the United States alone, medicare fraud, e.g. excessive billing, caused around $30 million in losses in 20163.

For example, when an insurance company receives a claim request from a healthcare insurance policy holder, their system will verify his/her medical records and other information in the blockchain. Thereafter, the claim will be approved automatically provided the requirements are met (smart contracts). This simplifies the whole process and reduces fraud as well as manpower cost.

Time to prepare

While these changes sound rather revolutionary, it's important to remember that blockchain technology is in its infancy. In our opinion, the biggest issue with blockchains is to work out how to better balance the need for transparency versus anonymity. Blockchains associate all transactions with users identified by a blockchain address. As pointed out by Mr. David Bartlett, RSM’s economic advisor, full commercial exploitation of blockchain hinges on the resolution of certain regulatory issues, such as configuring distributed ledgers to comply with the “Right to Be Forgotten” provisions of the European Union’s upcoming General Data Protection Regulations.

Businesses from the financial services, trading services, and intermediation services should track the ongoing blockchain developments and act now if they don’t want to be left behind. In terms of immediate next steps, these businesses may wish to consider:

- Identify: List down the aspects of blockchain technology, e.g. smart contracts, hyperledger, where blockchain may profoundly impact your existing business

- Seek out alliance partners: It is true that your business is likely to face a steep blockchain learning curve. Therefore, you may wish to start working with vendors, suppliers, competitors, and customers who share a mutual interest in blockchain technology, to build up these capabilities. For example, let’s look at MoneyGram, the second largest provider of remittances in the world. In Jan 2018, MoneyGram announced a partnership with blockchain firm Ripple to test out payment flows of XRP, Ripple’s native cryptocurrency, to speed up remittances.

- Leverage rather than compete against blockchain: As mentioned earlier, blockchain technology is in its infancy and you may choose to shape this technology. For example, OCBC, HSBC, and Mitsubishi UFJ Financial Group are jointly building a customer identification and verification system in Singapore using blockchain technology. This initiative was announced in Oct 2017, potentially lowering compliance costs as lenders step up efforts to combat money laundering and terrorism financing.

Though the above strategy sounds counter-intuitive, it is clear that businesses generally respond head-on to challenges associated with emerging blockchain technologies. Your business has deep expertise in your industry and it is no surprise that you should look to leverage this amidst potential blockchain disruption. Good luck!

1 Remittances Prices Worldwide, The World Bank, Dec 2017. https://remittanceprices.worldbank.org/sites/default/files/rpw_report_december2017.pdf

2 U.S. soy cargo to China traded using blockchain, Reuters, 22 Jan 2018, https://www.reuters.com/article/grains-blockchain/u-s-soy-cargo-to-china-traded-using-blockchain-idUSL8N1PG0VJ

3 Does Blockchain Have A Place in Healthcare?, Forbes, 08 May 2017, https://www.forbes.com/sites/reenitadas/2017/05/08/does-blockchain-have-a-place-in-healthcare