Financial modelling and advice

RSM’s Financial Modelling team understands the complexities businesses encounter when making strategic decisions without adequate analytical tools.

We empower clients to make well-informed choices through our comprehensive services. Financial models are integral to the decision-making process, enabling organisations to confidently assess the financial impact of commercial decisions.

Pre-built templates to save time

RSM partners with your organisation to design and develop tailored models that meet your specific modelling needs. Our models are built to facilitate timely decisions across daily operations, budgeting and forecasting, strategic planning, and complex transactions.

Custom-built models to fit your needs

RSM conducts thorough cell-by-cell formula review in combination with a commercial review of model outputs, ensuring your models operate as intended without error and instil you with confidence in the outputs driving business decision making.

Model diagnostic and review to give confidence

RSM's off-the-shelf solutions provide a cost-effective and efficient means for organisations to gain insights that support informed decision-making. These tools are developed with scalability and simplicity as key priorities, allowing for swift implementation and easy customisation to deliver immediate value aligned to your requirements.

What stage are your Financial Models at?

Offering and solutions

RSM supports your business by using financial modelling to pinpoint value drivers and identify critical variables. Clear input and output structures make it easy to adjust models and run dependable sensitivity analyses.

Our development process prioritises collaboration, allowing you direct involvement throughout each stage.

By engaging closely with your subject matter experts, we ensure the model accurately reflects your business operations, resulting in a solution tailored to your specific needs. Stakeholder engagement is central to this process, facilitated by a combination of in-person and virtual workshops and regular project updates during development.

RSM utilises advanced third-party renewable energy modelling software for detailed simulation and asset valuation of energy projects.

Using Gridcog, we analyse generation from renewable sources such as solar PV and wind, battery storage operations, fuel-powered generation, flexible loads, and grid interactions.

The extensive data produced is incorporated into a bespoke Excel-based financial model, which summarises scenarios and manages complexity for usability. This delivers project-specific profit and loss, balance sheet, and cash flow forecasts reflecting comprehensive scenario analysis and network optimisation, enabling effective communication of financials to stakeholders.

The Cash Pulse Model is a ready-to-use cashflow solution designed for construction businesses seeking transparency over cash positions across all projects.

It consolidates weekly and monthly cashflows, incorporates overheads, and provides comprehensive forecasts and dashboard overviews of:

- Net Cash Movement

- Closing Cash

- Gross Margin

- EBITDA

The Core Forecast Model offers users a robust three-statement template, enabling rapid deployment and easy customisation to align with your unique business structure and key drivers.

It’s transparent logic and clear outputs empower confident decision-making, making it an ideal solution for organisations seeking a low-cost, low-maintenance, and straightforward three-statement forecast model.

This dynamic, Excel-powered tool is specifically designed to support financial planning and reporting needs for finance teams and advisors.

It establishes a solid foundation for constructing flexible forecasts, allowing users to adjust assumptions in response to both microeconomic and macroeconomic factors impacting their business. The model is built with transparency and intuitive functionality at its core, ensuring it is actionable and easy to use for ongoing financial management.

Our model validation methodology is structured to assure confidence in model integrity using analytical software and meticulous human formula inspection.

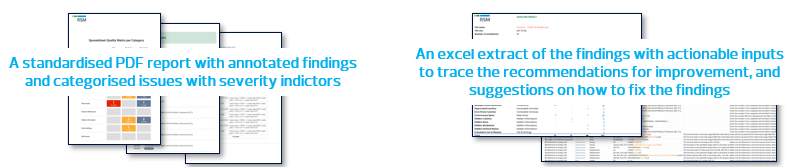

We employ an iterative approach: initial comprehensive reviews are followed by targeted examinations of new or amended functionality. Each iteration presents a consolidated issues log and, where applicable, suggestions for enhancement or simplification.

We apply specialised analysis tools to evaluate your model and generate a diagnostic report highlighting risks, structural weaknesses, and improvement opportunities.

This diagnostic includes:

- Formula-level inspection to identify hardcoded values, reference issues, complexity, and hidden information.

- Visual audit overlays flagging problematic calculations, formulas, and unused or obscured components

The diagnostic report facilitates assessment of model health without requiring a full review, providing flexibility for early-stage evaluations, internal validations, or pre-diligence preparation.

KEY CONTACTS

![]()

Frequently asked questions about Financial Modelling

Our approach to financial modelling enables the identification of key value drivers and the assessment of key input variables.

Clearly defined input variables provide users with flexibility which, together with clearly defined outputs, ensure that you are able to undertake 'what if' or sensitivity analysis with confidence.

RSM Australia develops and tailors a comprehensive range of financial models to support informed strategic decision-making, including:

- Discounted Cash Flow (DCF) models for valuation purposes

- Mergers & Acquisitions (M&A) and Leveraged Buyout (LBO) models

- Cash flow forecasting and budget planning tools

- Models designed for IPOs, refinancing, equity raising, project finance, and acquisition roll-up initiatives

Custom financial models are meticulously crafted to address the distinct needs of your business.

By aligning with your specific objectives and circumstances, these models provide targeted insights that enable informed decision-making. Whether you're evaluating the viability of a new project, analysing potential risks, or managing investment strategies, bespoke financial modelling empowers you to make choices supported by robust, dependable information.

RSM’s flexible models empower organisations to effectively manage uncertainty through comprehensive scenario analysis.

Designed for transparency, these models facilitate straightforward comprehension of model logic and highlight critical variables, enabling businesses to thoroughly assess potential risks and opportunities across varied circumstances.

Clear, well-documented, and logical models foster confidence among investors, clients, and regulators.

RSM is committed to transparency, strengthening trust and credibility throughout the modelling process.

Spreadsheet models are vulnerable to mistakes, especially under time pressure—with many containing errors by default. To manage risk, best practices include:

- Thoughtful initial structuring

- Consistent documentation and logic flows

- Health checks and peer reviews to catch issues early

Cash flow offers an objective view of financial health, unlike profit, which may reflect subjective accounting choices.

A well-structured cash flow model using direct or indirect approaches clarifies liquidity and solvency, supporting informed capital decisions.

Financial models are highly valuable for small businesses and startups.

For new companies, RSM recommends adopting models that are simple, focused, and flexible. By prioritising essential financial metrics, such as cash flow forecasts, businesses can establish a solid foundation that adapts as their operations grow.

Beginning with straightforward cash flow projections provides clarity on liquidity and solvency, allowing business owners to make informed capital decisions. As the business evolves, these initial models can be adjusted and expanded to reflect changing needs, supporting long-term financial stability and growth.

Building expertise in financial modelling requires consistent practice and a willingness to learn from both successes and setbacks. Developing these skills is an iterative process, relying on hands-on experience to deepen understanding and proficiency.

Support from experienced mentors plays a key role in accelerating the learning curve. Skilled mentors can offer valuable insights, provide constructive feedback, and help navigate complex modelling challenges, ultimately guiding professionals towards best practices.

Certifications, such as those provided by the Financial Modelling Institute, also offer substantial benefits. These credentials serve as formal recognition of competency and commitment to the discipline, enhancing credibility and professional development within the field.

RSM emphasises the importance of keeping financial models straightforward and easy for users to work with.

As these models naturally grow more complex, RSM recommends systematically reviewing and simplifying their core logic. This approach makes it easier to spot unnecessary complications or features that could impact how effectively the model can be used.

Wherever possible, RSM recommends simplifying models, ensuring that essential functions remain intact and no critical features are lost. By prioritising clarity and ease of use, these practices support better decision-making and enable professionals to work more effectively with financial models.